Benefits of RPA in banking and finance

Role of RPA in banking: how it transforms accounting and auditing

RPA use cases in banking and finance

Report generation

RPA can help banks and financial institutions save time and resources by automating tedious tasks, minimizing mistakes and boosting productivity. It can generate compliance reports with detailed info about a company’s adherence to regulations; finance statements such as balance sheets, income and cash flow for insight into the business’ financial wellbeing; account statements, transaction histories and credit reports to keep customers informed of their money matters; plus internal audit assessments to evaluate controls, spot risks and advise on existing processes.Accounts payable

When it comes to accounts payable, robotic process automation can increase accuracy and efficiency. Some examples of RPA use cases in accounts payable include invoice processing, payment processing, and vendor management. RPA can extract data from invoices, validate information, match invoices with purchase orders, and update accounting systems. Automating these tasks can help financial institutions reduce errors, increase processing speed, and improve efficiency. RPA can also assist with vendor management by automating onboarding processes and monitoring vendor compliance. Overall, implementing RPA in accounts payable can result in significant cost savings and improve financial operations.Accounts receivable

Automating accounts receivable processes is a common and valuable use case for RPA in the banking and finance industry. RPA tools offer increased speed and accuracy in tasks such as invoicing, client onboarding, and collections by digitizing workflows and gathering data from multiple sources. Bots can also send automated payment reminders, detect account arrears, and enter supplier data into an accounts receivable system. Furthermore, bots can generate reports containing crucial information such as customer invoices, order payments, and missed discounts, enabling insights into payment patterns and facilitating adjustments in strategy. The potential cost reductions of up to 25% on operations related to accounts receivable have made this technological transformation an attractive prospect for banks and financial services firms.Mortgage processing

Mortgage processing is another area where RPA can be utilized in banking and finance. RPA can help automate various mortgage processing tasks, such as gathering and verifying borrower information, checking credit scores, and verifying employment and income. RPA can also assist in verifying property information, calculating interest rates, and generating documents. By automating these processes, RPA can help financial institutions reduce errors, improve speed and accuracy, and enhance customer satisfaction. Additionally, RPA can assist with compliance and regulatory requirements by ensuring that all necessary documentation is collected and processed accurately. Overall, implementing RPA in mortgage processing can lead to significant improvements in efficiency and cost savings.Know your customer (KYC)

Robotic process automation (RPA) is becoming an increasingly popular tool for banks and financial institutions to automate the costly and labor-intensive process of customer onboarding, also known as ‘Know Your Customer’ (KYC). RPA can quickly check large amounts of records for compliance-related requirements, errors, and anomalies, tasks that would otherwise have to be performed manually by staff. This results in significant cost reductions while ensuring accuracy and reliability. By implementing RPA in KYC, financial institutions can streamline their operations, reduce risks, and improve customer experience. Furthermore, RPA can free up time for staff to focus on higher-value tasks, such as risk management and customer engagement. Overall, RPA is an essential tool for financial institutions to improve efficiency and compliance in KYC processes.Fraud detection

RPA is an increasingly popular tool for fraud detection in the banking and finance industry. By automating the analysis of vast amounts of data from multiple sources, RPA can identify patterns and flag potential fraud cases in real-time. It can also automate routine tasks such as data collection, verification, and reporting. By automating fraud detection processes, financial institutions can reduce the risk of fraud and minimize losses while improving the accuracy and speed of detection. Additionally, RPA can help banks comply with regulations and improve customer trust by preventing fraudulent activities. With advanced predictive analytics capabilities, RPA can identify patterns of fraudulent behavior early and allow financial institutions to take prompt action to prevent further damage, reducing labor costs and potential losses from fraudulent activities.Client onboarding

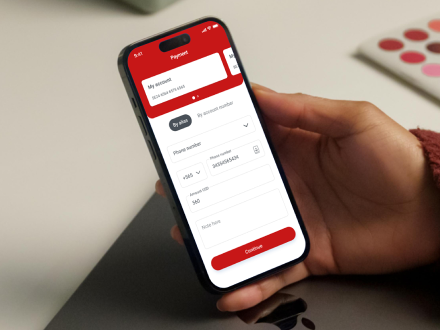

Client onboarding is another critical area where RPA is being used extensively in banking and finance. By automating onboarding processes, RPA can significantly reduce the time and effort required for manual data entry, verification, and documentation. RPA bots can extract and verify customer information from multiple sources, conduct background checks, and automatically update customer records. Additionally, RPA can facilitate the integration of customer data into internal systems, reducing errors and improving accuracy. By automating client onboarding processes, banks and financial institutions can improve customer experience, reduce operational costs, and enhance compliance with regulatory requirements.Financial statements and financial close

Robotic process automation in the banking industry can be used with remarkable success across myriad activities, such as organizing financial statements and completing financial closes. By automating tasks such as data entry, reconciliation, and reporting, RPA can reduce the time and effort required to complete these processes. RPA can also improve accuracy and consistency by eliminating manual errors and ensuring that all relevant data is captured and recorded correctly. Additionally, RPA can help financial institutions comply with regulatory requirements by ensuring that all financial statements are prepared and reported accurately and on time. Overall, RPA in financial statement preparation and financial close processes is a valuable use case for banks and financial institutions to improve efficiency and accuracy in their operations.Financial planning and forecasting

RPA has been particularly beneficial for daily business functions such as financial planning and forecasting, allowing financial analysts to make more accurate predictions based on the quick processing of large datasets. RPA enhances the employee experience with efficient data management tasks, and customers benefit from faster access to services due to improved operational efficiency. With features such as audit trail functions that allow detailed logging of events and machine learning algorithms that offer predictive analytics, robotic process automation can help improve accuracy and reduce the risk of errors. The benefits of using RPA for financial planning and forecasting are manifold – but most importantly companies can make sound investment decisions knowing they have reliable data.Travel and expense processing

RPA is becoming increasingly popular in travel and expense processing, which requires vast amounts of data entered into specific enterprise systems. RPA automates parts, or even whole processes, that relate to an employee’s expense claim journey from submission to final payment – these include checking accuracy of financial claims, allocation of costs to the correct cost centers and performing complex calculations that relate to the expenses. This improves detail accuracy levels and minimizes costs associated with manual efforts. Consequently, companies can generate quick insight and more efficient management at scale – something almost impossible without RPA-driven automation.Account reconciliations

Account reconciliations are a crucial task in banking and finance to ensure accuracy and compliance with regulations. RPA can automate the process of reconciling bank statements with internal financial records, such as general ledger accounts, and flag discrepancies for review. RPA can also identify and match transactions, verify balances, and reconcile exceptions. By automating account reconciliations, banks and financial institutions can reduce manual labor, improve accuracy, and enhance compliance. This leads to faster reconciliation cycles and better visibility into financial information. Overall, RPA is an effective tool for banks and financial institutions to streamline the account reconciliation process, reduce risks, and improve operational efficiency.Data management

A regular and accurate data flow is essential for the banking and finance industry. Robotic process automation provides a sophisticated solution to optimize data processing and data management procedures. By automating routine tasks such as validating, cleansing, merging, and consolidating databases, which can lead to inefficiencies when done manually, RPA ensures accurate results. Additionally, this technology allows necessary information to be collected from different databases into one unitary platform and makes the update of information easier, ensuring that reliable data is available for decision-making in a timely manner. In this way, businesses in financial services can benefit from an efficient system that supports a wide range of activities with increased accuracy.How to implement RPA for your bank?