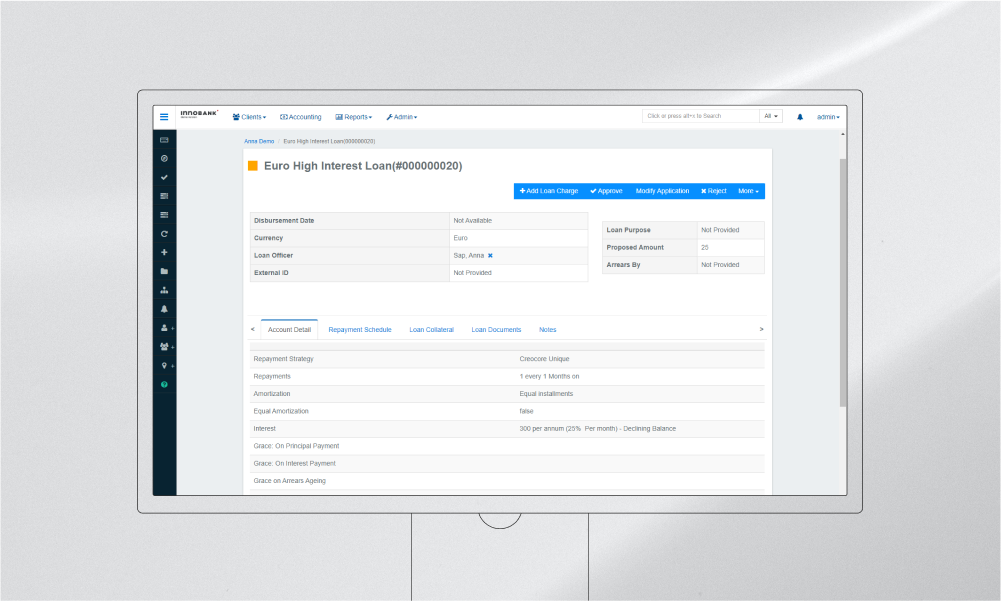

Online fintech lending offers individuals and business users an alternative avenue for providing loans entirely over the Internet, contributing to enhanced financial convenience and accessibility. Typically, these solutions use automated processes for underwriting and credit assessment, providing a more efficient, accessible, and affordable means of obtaining credit, be it personal loans, debt consolidation, or small business financing. Particularly, in the realm of P2P lending, fintech companies serve as intermediaries, connecting individuals or businesses seeking loans with willing investors for a nominal fee. As for the buy now, pay later (BNPL) scheme, it presents a form of short-term loan that empowers consumers to acquire items and settle payments over time, typically without incurring any interest. Concerning business loans, fintech lending companies also play a crucial role in assisting small businesses to access essential capital for growth since securing credit from traditional institutions can be challenging due to perceived risks.

A digital wallet is an online payment tool or software application that functions as a virtual counterpart to a physical wallet, allowing users to store digital representations of various payment methods securely. Using credit and debit cards, gift cards, cryptocurrency, as well as boarding passes, event tickets, passwords, and coupons, individuals can make purchases and pay bills on the go by tapping their smartphone or smartwatch over the contactless payment terminal. For instance, through quick response (QR) codes that encode information in a black-and-white pattern, users initiate a payment with a smartphone camera or their digital wallet’s scanning system. Near field communication (NFC), in turn, is a wireless data transfer technology that employs electromagnetic signals for devices like smartphones, tablets, and laptops to share and transfer data nearby, typically within an inch and a half, to establish a connection.

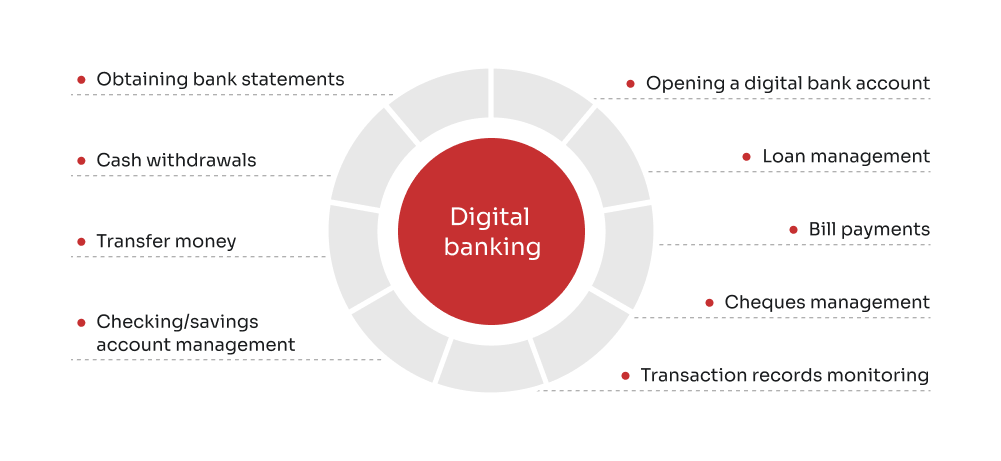

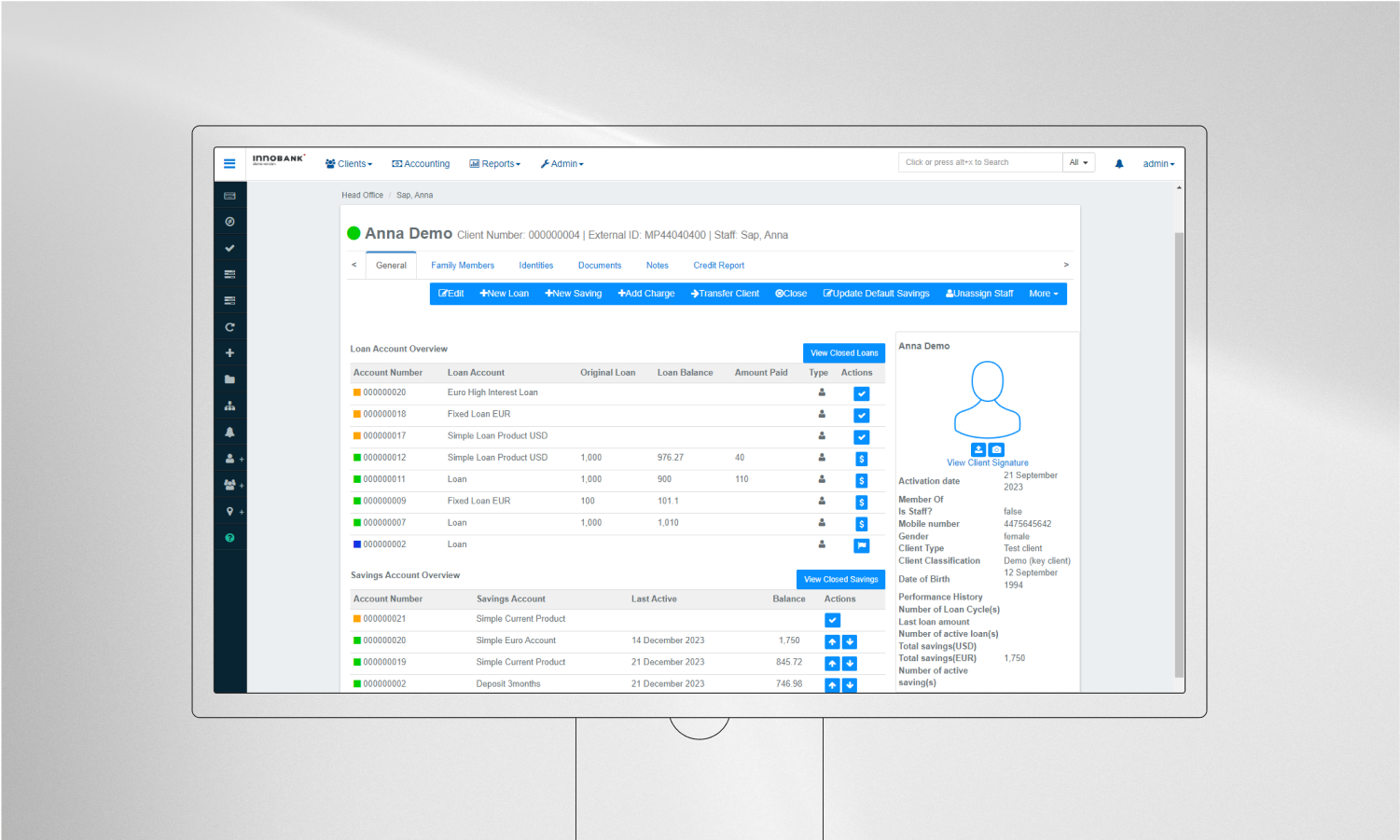

With no waiting times and fixed working hours, neobanks are devoid of any physical branches, existing exclusively in the digital realm. These entities aim to streamline the banking process by delivering financial services in a customer-centric, digital-only format, focusing mainly on core banking systems, with modules on accounts, payments, money transfers, lending, and more. While many neobanks are not obliged to have a banking license, enjoying slightly more autonomy than traditional banking institutions, they frequently partner with licensed banks to offer their financial services rather than operate independently. Boasting impeccable accessibility, fewer restrictions, and incredible ease of use, neobanks simultaneously provide lower fees and higher interest rates, released from the chains of spending money on rent, electricity, infrastructure, and other expenses that eat away significant sums at a traditional bank’s bottom line.