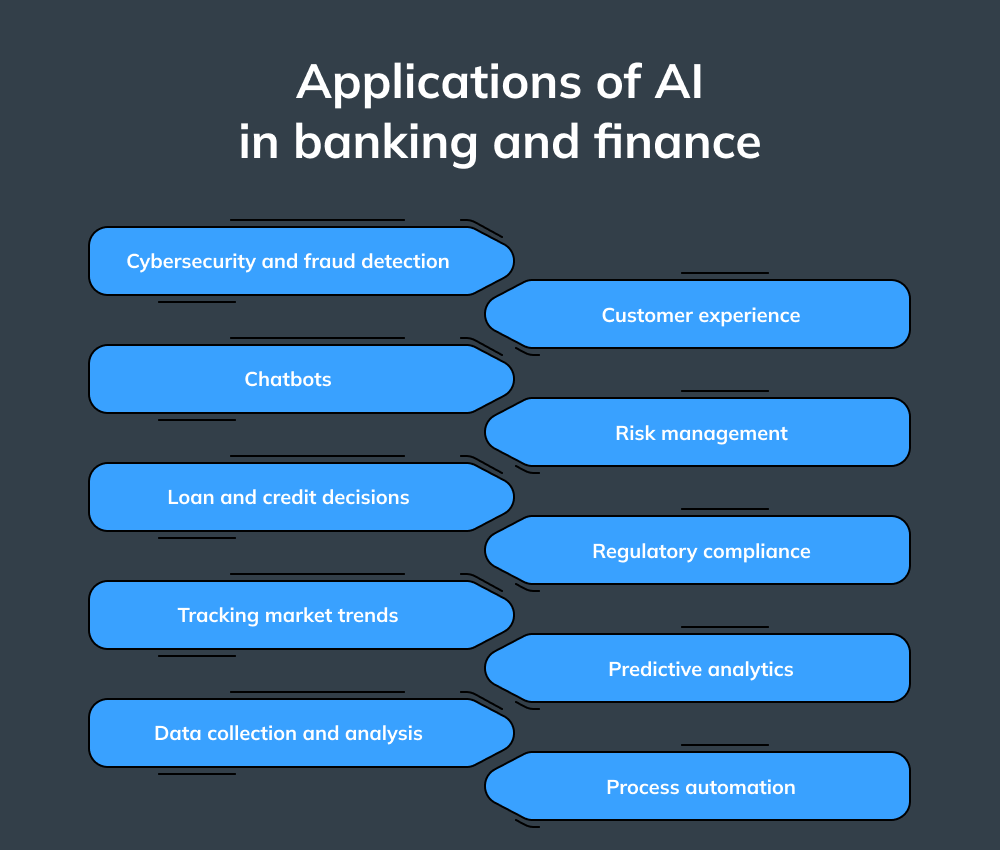

Anwendungen von AI im Bank- und Finanzwesen

KI hat sich in unser tägliches Leben eingewoben und verändert Branchen auf eine Art und Weise, die wir uns noch vor wenigen Jahren nicht vorstellen konnten. Ihre Bedeutung zu leugnen, wäre kurzsichtig: Insbesondere der Banken- und Finanzsektor hat sich dank der FinTech-Innovationen stark verändert und bietet sowohl den Akteuren als auch den Kunden eine Vielzahl von Vorteilen.

Cybersecurity und Betrugserkennung

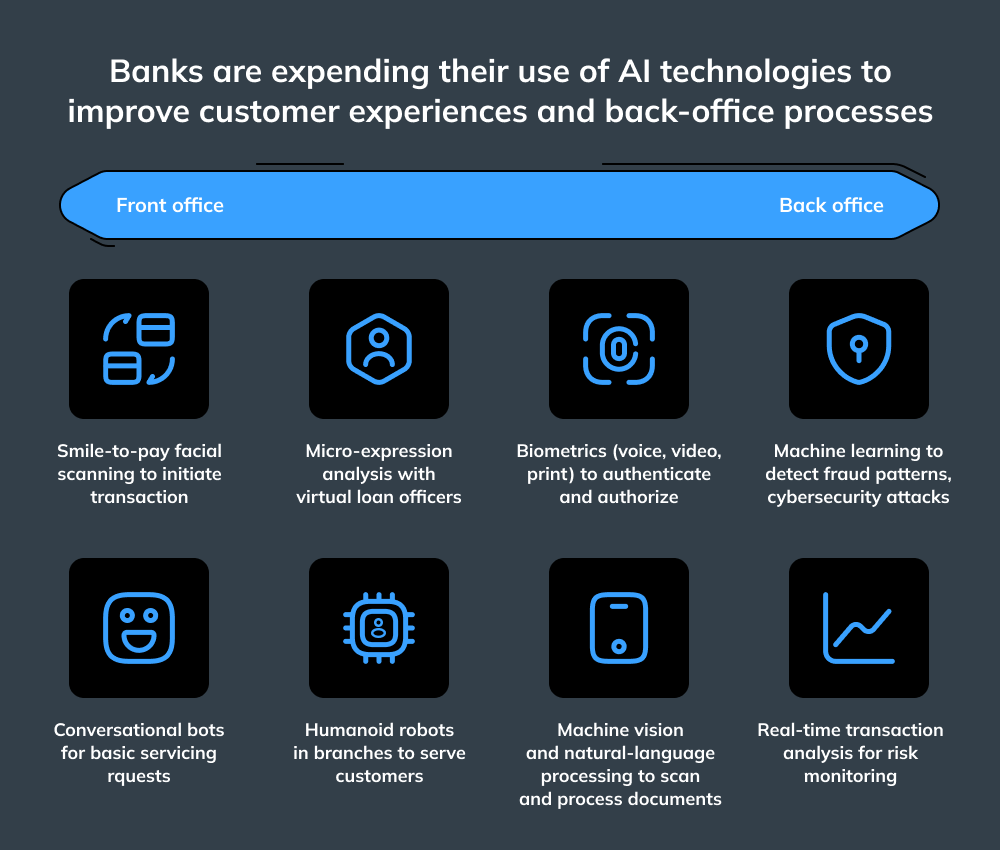

Jeden Tag fließen Millionen von Transaktionen durch das Bankensystem: Menschen bezahlen Rechnungen, zahlen Geld ein, heben Geld ab, lösen Schecks ein und vieles mehr. Hinter den Kulissen befinden sich die Banken in einem ständigen Wettlauf, um Cyberkriminellen einen Schritt voraus zu sein. Sie verstärken ihre Sicherheitsanstrengungen, um den Betrieb und die Vermögenswerte zu schützen und betrügerische Aktivitäten zu unterbinden, bevor sie überhaupt eine Chance haben, stattfinden zu können.Die künstliche Intelligenz ist jetzt ein wichtiger Akteur in diesem Spiel mit hohen Einsätzen. Banken können das Potenzial der künstlichen Intelligenz nutzen, um den digitalen Zahlungsverkehr zu verbessern, Software-Schwachstellen zu erkennen, verdächtiges Kundenverhalten zu identifizieren und gleichzeitig das Betrugsrisiko zu verringern. Maschinelles Lernen - ein Teilbereich der KI - hilft, illegale Handlungen wie E-Mail-Phishing, Kreditkarten- und Mobilfunkbetrug, Identitätsdiebstahl und gefälschte Versicherungsansprüche zu erkennen und zu verhindern.Ein Beispiel ist die dänische Danske Bank, die kürzlich ihre veraltete Betrugserkennungssoftware mit modernen KI-Algorithmen aktualisiert hat. Dank der Fähigkeit von ML, frühere Transaktionen zu analysieren (z. B. persönliche Informationen, Daten, IP-Adresse, Standort usw.), konnte die Bank die Betrugserkennungsgenauigkeit um 50% steigern und die Zahl der Fehlalarme um 60% senken. Da Banken ein Hauptziel für Hacker sind, ist die breite Einführung von ML und KI von entscheidender Bedeutung. Diese Technologien helfen Finanzunternehmen, schnell auf digitale Bedrohungen zu reagieren und ihre Abwehr gegen Cyberangriffe zu stärken, bevor sie interne Systeme, Mitarbeiter oder Kunden gefährden.Chatbots

Der Einsatz von Chatbots im Bankwesen ist eines der einfachsten Beispiele für die Implementierung von KI. Sobald sie eingesetzt werden, stehen sie rund um die Uhr zur Verfügung, im Gegensatz zu menschlichen Mitarbeitern mit festen Zeitplänen und der Notwendigkeit von regelmäßigen Pausen. Chatbots antworten nicht nur mit pauschalen Antworten auf Anfragen: Sie lernen aus den Interaktionen mit den Kunden und bauen einen Wissensschatz auf, der es ihnen ermöglicht, die Bedürfnisse der Nutzer vorherzusagen und ihre Antworten entsprechend anzupassen. Durch die Integration von KI-gesteuerten Chatbots in Banking-Apps können Manager sicher sein, dass ihre Kunden rund um die Uhr personalisierten Kundensupport erhalten, mit Produkten und Dienstleistungen, die auf die individuellen Bedürfnisse zugeschnitten sind.Ein Beispiel für einen erfolgreichen Chatbot ist Erica: ein KI-gestützter virtueller Assistent der Bank of America. Seit 2019 hat Erica über 50 Millionen Kundenanfragen bearbeitet - von der Unterstützung beim Abbau von Kreditkartenschulden bis hin zur Aktualisierung der Kartensicherheit.Darlehens- und Kreditentscheidungen

Banken setzen heute eine breite Palette intelligenter Tools ein, um die Genauigkeit, Präzision und Rentabilität ihrer Darlehens- und Kreditentscheidungen zu verbessern. Herkömmliche Bankensoftware ist oft unzureichend, da sie mit Fehlern, Ungenauigkeiten in der Transaktionshistorie und falschen Klassifizierungen von Gläubigern behaftet ist. Finanzinstitute müssen bei der Kreditvergabe und der Bewertung der Zahlungsfähigkeit von Einzelpersonen oder Unternehmen die Kredithistorie und Kundenreferenzen genau überwachen. KI-basierte Systeme analysieren die Verhaltensmuster der Kunden, um datengestützte Entscheidungen über die Kreditwürdigkeit zu treffen und die Banken umgehend auf verdächtige oder riskante Aktivitäten aufmerksam zu machen.Kundenerfahrung

Die Kunden erwarten bei der Verwaltung ihrer Banking-Apps ein intuitives, unkompliziertes Benutzererlebnis. Vorbei sind die Zeiten, in denen man für einfache Transaktionen wie Einzahlungen und Abhebungen eine Bankfiliale aufsuchen musste - dank der Bequemlichkeit von Geldautomaten.Heutzutage - mit einer immer technikaffineren Bevölkerung - müssen Banken kontinuierlich Innovationen entwickeln, um schnelle und sichere digitale Zahlungslösungen anzubieten. KI trägt dazu bei, den Zeitaufwand für die Erfassung von KYC-Informationen zu reduzieren und Fehler zu beseitigen, die Markteinführung von Produkten zu beschleunigen und Probleme vor der Markteinführung proaktiv anzugehen, bevor sie entstehen.Als ob das nicht genug wäre, war die Beantragung eines Privatkredits noch nie so einfach. Die Kunden müssen sich nicht mehr mit der mühsamen manuellen Beantragung herumschlagen: KI und ML im FinTech-Bereich verkürzen die Genehmigungszeiten und erfassen präzise und fehlerfreie Daten zu den Kundenkonten.Risikomanagement

Währungsschwankungen, politische Umwälzungen, Naturkatastrophen und bewaffnete Konflikte können Schockwellen durch das Finanz- und Bankensystem schicken. In turbulenten Zeiten ist es entscheidend, kluge Investitionsentscheidungen zu treffen, um sich über Wasser zu halten und finanzielle Verluste zu vermeiden. Hier kommt die künstliche Intelligenz ins Spiel: Indem sie einen nützlichen Überblick über aktuelle Ereignisse bietet, künftige Trends vorhersagt und die Zukunft voraussagt, hilft sie den Anlegern, mit Zuversicht durch unsichere Gewässer zu navigieren. KI kann auch dabei helfen, festzustellen, ob ein Kunde in der Lage sein wird, einen Kredit zurückzuzahlen, indem Verhaltensmuster, die Kreditgeschichte und verfügbare persönliche Daten analysiert werden.Einhaltung gesetzlicher Vorschriften

FinTech ist einer der am stärksten regulierten Sektoren der Weltwirtschaft. Die Regierungen spielen eine wichtige Rolle als primäre Wachhunde - sie überwachen und beaufsichtigen die Banken, um Finanzverbrechen, Geldwäsche und Steuerhinterziehung zu verhindern.Rechtliche Anforderungen und Standards ändern sich häufig - das bedeutet, dass Banken gut informierte, flexible Abteilungen unterhalten müssen, die sich mit der Erforschung und Umsetzung der sich ständig ändernden Finanzgesetzgebung befassen. Wenn dieser Prozess manuell durchgeführt wird, ist er sowohl zeitaufwändig als auch kostspielig. Hier kommt KI ins Spiel: Mithilfe von Deep Learning und NLP) können KI-Systeme neue Vorschriften schnell analysieren und die Compliance-Anforderungen bewerten, um sicherzustellen, dass Unternehmen alle externen Gesetze und internen Richtlinien einhalten. KI ist zwar kein Ersatz für einen qualifizierten menschlichen Compliance-Analysten, aber sie kann kritische oder unklare Aspekte von Vorschriften aufzeigen und das Unternehmen vor gesetzlichen Risiken schützen.Prädiktive Analytik

Der Einsatz von KI für prädiktive Analysen ist ein wenig wie ein hochintuitiver Assistent, der Trends und Korrelationen aufspüren kann, die Menschen oder herkömmliche Technik oft übersehen. KI wird in der Analyse natürlicher Sprache und in der Allzwecksemantik dank ihrer Fähigkeit, spezifische Muster und Datenkorrelationen schnell zu erkennen, häufig eingesetzt. Für den Bankensektor ist dies ein Wendepunkt: Prädiktive Analysen helfen Finanzinstituten, ungenutzte Absatzchancen zu definieren, datengestützte Kennzahlen zu liefern und branchenspezifische Erkenntnisse zu gewinnen, die den Umsatz erheblich steigern können.Warum sollte sich der Bankensektor mit KI befassen?

Die Bankenwelt entwickelt sich rasch in Richtung kundenorientierter Modelle, die darauf abzielen, die Wünsche, Bedürfnisse und Erwartungen jedes Kunden zu erfüllen. Die Kunden von heute wollen, dass ihre Bank rund um die Uhr erreichbar ist und innovative Tools und Funktionen anbietet, die ihnen ein problemloses Bankerlebnis ermöglichen. Um diese Erwartungen zu erfüllen, müssen die Banken zunächst interne Herausforderungen bewältigen, wie z. B. veraltete Softwaresysteme, fragmentierte Datensilos, begrenzte Budgets und eine minderwertige Qualität der Vermögenswerte. Sobald diese Hindernisse überwunden sind, sind Banken einen Schritt näher dran, KI für ihre alltäglichen Probleme zu nutzen.KI sorgt nicht nur für unübertroffene Cybersicherheit, sondern macht Finanzdienstleistungen auch bequemer und zeitsparender für Kunden und Mitarbeiter.

Herausforderungen bei einer breiteren KI-Einführung im Finanz- und Bankwesen

Es versteht sich von selbst, dass KI unzählige Vorteile mit sich bringt - aber ihre breite Einführung wird durch verschiedene Probleme wie Glaubwürdigkeitslücken und Sicherheitsrisiken behindert, die sehr groß sind. Eine ganzheitliche Strategie und ein umfassender Ansatz für KI und maschinelles Lernen im Finanzbereich können diese Risiken deutlich verringern und die Wahrscheinlichkeit eines Erfolgs und der damit verbundenen finanziellen Gewinne erhöhen. Auf dem Weg in die aufregende Welt der KI im Finanzbereich können Entscheidungsträger auf eine Reihe von Hindernissen stoßen, die im Folgenden beschrieben werden.

Datensicherheit

KI sammelt, speichert und verarbeitet riesige Mengen sensibler personenbezogener Daten - das bedeutet, dass Finanzinstitute unbedingt Schutzmaßnahmen ergreifen müssen, um Datenschutzverletzungen und unbefugten Zugriff zu verhindern. Banken sollten beim Umgang mit großen Mengen an KI-bezogenen Informationen auf eiserne Datenschutzsysteme setzen, um jegliche Risiken auszuschließen und vertrauliche Informationen zu schützen.Mangel an Qualitätsdaten

Unzureichende Datenqualität stellt eine große Herausforderung für FinTech-Unternehmen dar. Ohne gut organisierte Daten ist die Anwendung von Erkenntnissen auf reale Situationen nahezu unmöglich, wenn sie nicht den aktuellen Gegebenheiten entsprechen. Darüber hinaus können Daten, die vom maschinenlesbaren Format abweichen, zu unvorhersehbarem Verhalten in KI-Modellen führen. Banken, die künstliche Intelligenz einsetzen möchten, sollten ihre Datenrichtlinien ändern - und wenn nötig überarbeiten - und mehr Ordnung in den Datenfluss bringen.Fragen der Erklärbarkeit

Da KI-gestützte Software Fehler ausmerzt und Zeit spart, wird sie häufig bei Entscheidungsverfahren eingesetzt. Leider können sie aufgrund früherer menschlicher Beurteilungsfehler Voreingenommenheit aufweisen. Dies kann bedeuten, dass der Ruf der Bank gefährdet ist, wenn kleine Unstimmigkeiten in der KI eskalieren und zu großen Problemen führen. Alle Daten, die in KI-Szenarien involviert sind, sollten klar und transparent sein und keinen Raum für mögliche Unstimmigkeiten lassen.Wie Innowise Ihre KI-Reise beschleunigen kann