Your message has been sent.

We’ll process your request and contact you back as soon as possible.

The form has been successfully submitted.

Please find further information in your mailbox.

In the last few years, fintech has decidedly moved from an “emerging” trend to something very much in the here and now. And if you operate in the industry, you’ve probably felt that shift firsthand. What used to be cutting-edge is now table stakes. According to Market.us, the global fintech market is expected to hit $1.38 trillion by 2034. That’s nearly 20% growth every year for the next decade.

So, what does 2026 look like for fintech companies? In short: it’s a make-or-break moment. The market’s evolving fast, and standing still isn’t an option. You’ve got to stay sharp, stay adaptable, and stay ahead of what’s coming.

That’s exactly why I pulled together this list. These are the real trends that are shaping the next phase of financial technology. Think of it as your cheat sheet to what matters, what’s changing, and where the biggest opportunities lie.

Let’s get into it.

| Trend | Description |

|---|---|

| AI agents & autonomous finance | Intelligent AI systems are now handling entire workflows autonomously, including decisions, actions, and compliance. |

| Embedded finance evolves into ecosystems | Financial services like lending, insurance, and savings are embedded into non-financial platforms via orchestrated, composable architectures. |

| Agentic commerce enters the mainstream | AI agents are now making real purchases online, and Visa and Mastercard are building the protocols to verify them and enable secure, bot-free payments. |

| Open finance & data ownership | Open finance expands beyond banking to include full-spectrum data like payroll, pensions, and tax, enabling real-time, behavior-driven financial products. |

| Real-time payments as core infrastructure | Instant settlement systems are reshaping product strategies with liquidity automation, event-based pricing, and fraud detection in milliseconds. |

| Core banking modernization | Fintechs are replacing legacy systems with modular, cloud-native cores to support faster releases, real-time data, and regulatory resilience. |

| Super-apps mature into financial operating systems | Super-apps are becoming unified hubs where people can handle payments, banking, insurance, shopping, and more in one seamless experience. |

| AI-powered RegTech | Compliance is now continuous and embedded, with real-time risk engines, explainable models, and policy-as-code architectures driving resilience. |

| Continuous identity & behavioral biometrics | Identity verification now spans the full user session using behavior, biometrics, and risk-based triggers to counter deepfakes and synthetic fraud. |

| Digital currencies & tokenization | CBDCs and tokenized real-world assets are becoming standard financial rails, requiring secure custody, smart contracts, and compliance-ready logic. |

| Next-gen decentralized banks | Financial institutions are moving on-chain with deobanks that fuse blockchain transparency, smart contracts, and compliance-ready design. |

| Hyper-personalization as UX standard | Real-time personalization driven by behavioral data and AI is redefining product interactions by tailoring credit, savings, and interfaces to the individual. |

| Smarter green finance & ESG | ESG is evolving from reporting to infrastructure, with AI-auditable data, emissions-aware pricing, and climate-positive product design becoming mandatory. |

| Financial inclusion through edge innovation | Voice-first, multilingual fintech tools are extending financial services to underserved users via low-bandwidth, mobile-native, and screenless experiences. |

Fintech is entering a new era in 2026, shaped by the growing impact of agentic AI, decentralization, and tokenized banking products. At Innowise, we see this as an opportunity to rethink how financial platforms operate. We’re staying close to the trends, but even closer to what our clients really need, delivering practical, future-ready solutions that work in the real world.

FinTech Expert & Head of Competence Center

AI in fintech is starting to think for itself. In 2026, we’re entering the age of agentic AI: intelligent systems that not only interpret data but make decisions, trigger actions, and handle entire workflows without a human in the loop.

Think of it like this: instead of dashboards waiting for input, AI agents are proactively approving loans, reconciling transactions, flagging compliance risks, or even negotiating contract terms. They’re part of multi-agent systems that collaborate across your infrastructure, connected through frameworks like LangChain and powered by vector databases like Pinecone for real-time context recall.

This leap didn’t happen overnight. Three forces brought us here:

But here’s what often gets missed: the best AI agents in finance aren’t just smart – they’re empathetic too. According to recent research from Deloitte, emotionally intelligent AI is already influencing customer satisfaction and loyalty, which is particularly important in high-stress interactions like fraud disputes or declined transactions.

What this means for fintech leaders:

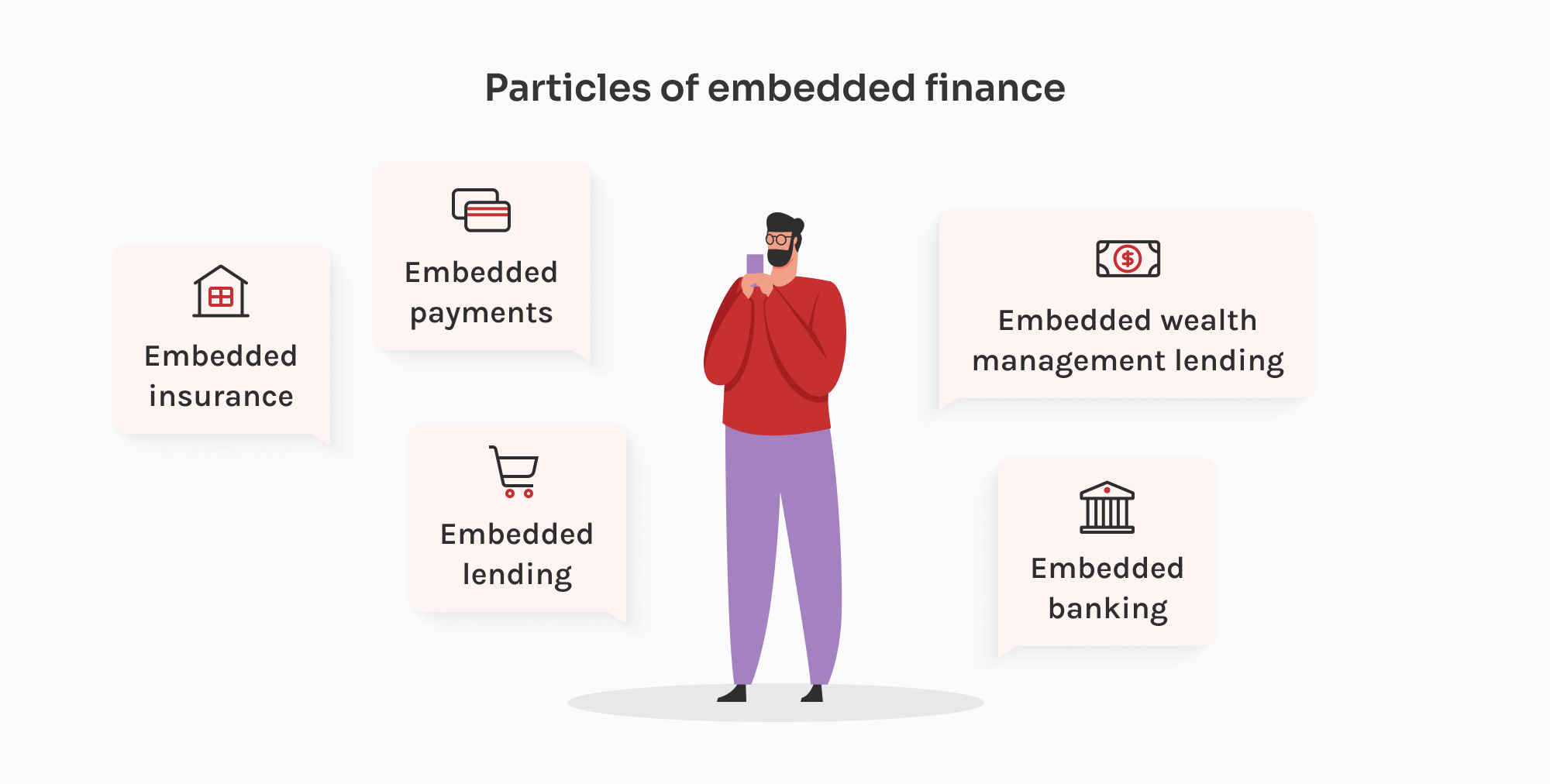

In 2026, embedded finance is no longer about dropping a payment API into an app. The conversation has turned from features to flows.

Today’s embedded finance integrates financial capabilities such as lending, insurance, savings, payroll, and even wealth management directly into user experiences across platforms that are not traditional financial institutions.

To power this, fintechs are moving from all-in-one BaaS platforms to orchestrated ecosystems. They’re layering services across providers: one for onboarding (e.g., Alloy), another for KYC (e.g., Persona), a third for account creation (e.g., Griffin), and their own logic for compliance fallback and reporting. It’s composable, but only if you own the glue.

And regulators are catching up. In the US, the OCC and FDIC are scrutinizing sponsor bank relationships. In the EU, platforms embedding finance are being asked to prove control over customer data, flow of funds, and risk logic. Gone are the days of “just plug in and launch.” If your BaaS provider fails an audit, so do you.

So, what’s changed? Embedded finance in 2026 is a product strategy. It requires the same investment in observability, compliance, and fault tolerance as any regulated financial stack.

What this means for fintech leaders:

2026 marks the rise of agentic commerce, where autonomous systems browse, select, and transact across e-commerce platforms in real time. And now, the payments industry is racing to meet them.

Both Visa and Mastercard launched frameworks to support AI-driven transactions. Their goal is to enable merchants to confidently verify AI agents, reduce friction at checkout, and process payments that may happen without a human ever clicking “buy.”

Visa’s Trusted Agent Protocol, already live on GitHub and backed by partners like Microsoft, Stripe, Nuvei, and Worldpay, enables verified agents to signal purchase intent, identify the consumer behind the session, and transmit payment credentials securely. Mastercard, meanwhile, introduced the Agent Pay Merchant Acceptance Framework. It focuses on scale: allowing merchants to authenticate AI agents before the transaction, with built-in transparency and interoperability across platforms.

These moves reflect growing urgency. Adobe Insights reported a 4,700% YoY spike in generative AI-driven retail traffic by mid-2025, with AI agents now influencing and completing entire customer journeys, often without the shopper’s real-time involvement.

What’s powering this shift?

What this means for fintech leaders:

Open banking cracked the door open. Open finance kicks it wide.

By 2026, we’ll have moved well beyond basic account aggregation. Now it’s about full-spectrum access: pensions, insurance, mortgages, payroll, tax data, even crypto wallets, all flowing through a unified API layer. Full control, portability, and ownership.

Regulations like PSD3 and the Payment Services Regulation (PSR) in the EU are pushing the shift even further. TPPs (third-party providers) are being held to higher standards for token lifecycle management, secure redirect flows, and real-time consent revocation. In return, fintechs get clearer frameworks to build on and more reliable access to customer data.

But here’s where it gets interesting: the most forward-thinking fintechs are turning it into product fuel.

But none of that works without orchestration. Data still arrives in dozens of formats with inconsistent quality. That’s why API gateways like Gravitee and Kong, and normalization engines like Flinks or Railz, are becoming core parts of the fintech stack.

What this means for fintech leaders:

In 2026, real-time payments (RTP) have become a foundational capability. Systems like FedNow in the US, SEPA Instant in Europe, UPI in India, and PIX in Brazil are enabling 24/7 settlements across retail, treasury, and B2B flows, and expectations have shifted accordingly.

Where speed was the core motivation of the past, flexibility is the name of the future game. The real advantage lies in how payments trigger downstream actions: real-time liquidity repositioning, instant refunds, embedded payouts, just-in-time lending, and event-based pricing. These are the new baselines for competitive fintech products.

The transition is also shaped by ISO 20022, the data-rich messaging standard that underpins modern payment infrastructure. Banks and fintechs that adopt it gain better fraud prevention, reconciliation, and compliance, which makes payment data faster and smarter.

But speed comes with pressure. Real-time payments shrink the fraud detection window to seconds. Compliance ops can’t wait for batch reports. That’s why modern RTP stacks are built around event-driven architecture, streaming analytics, and automated risk engines.

Providers like Volante, Moov, and Dwolla are enabling fintechs to move from slow, file-based systems to API-first RTP infrastructure that integrates directly with ERPs, mobile apps, and global banking rails.

What this means for fintech leaders:

Most fintech innovation lives at the edge: UX layers, APIs, analytics. But in 2026, the core is finally catching up. Legacy banking systems are being replaced with modular, cloud-native cores that allow fintechs and digital banks to build faster, safer, and more scalable products.

Platforms like Mambu, Thought Machine, and 10x Banking are leading the charge. Their core systems are built to be API-first, event-driven, and flexible enough to support everything from real-time deposits to dynamic credit products.

What’s driving this shift? A mix of necessity and opportunity.

“Modernization” doesn’t simply mean to demolish the old systems, though.. The smart move in 2026 is progressive modernization: moving key functions (e.g., lending, onboarding, KYC, payments) to composable services, while gradually phasing out legacy dependencies.

What this means for fintech leaders:

In 2026, fintech super-apps are emerging as multi-vertical financial ecosystems. These are platforms that combine payments, banking, insurance, investments, commerce, and even non-financial services into a single, deeply personalized environment.

Originating in Asia with players like WeChat, Alipay, and Paytm, the super-app model is now being reinterpreted in Western markets. Rather than one mega-app, we’re seeing the rise of modular financial hubs: platforms that integrate critical services through composable APIs, white-label banking, and embedded infrastructure. Think of them less as apps and more as financial operating systems.

What’s driving the shift in 2026?

But there’s nuance. In the US and EU, regulatory scrutiny is limiting the bundling of services in a single walled-garden app. Instead, we’re seeing federated super-app architectures, where fintechs partner through shared KYC rails, open APIs, and co-branded experiences.

On the enterprise side, B2B super-apps are also gaining traction, combining invoicing, treasury, expense management, lending, and procurement in unified interfaces for SMEs.

What this means for fintech leaders:

In 2026, compliance is deeply integrated into product design and user experience. The regulatory environment is pushing fintechs to be faster, clearer, and more accountable in how decisions are made and risks are managed.

The EU’s DORA went into effect in 2025, but many fintechs are still scaling up implementation: real-time incident detection, vendor audits, and traceability across infrastructure. Meanwhile, the EU AI Act is raising the stakes further and requires high-risk systems (like credit scoring or fraud detection) to prove explainability, bias mitigation, and model transparency.

That’s why RegTech has matured from a point solution into a real architecture layer. We’re seeing:

Global regulators are converging on the same expectation: if your platform uses AI to make a decision, you need to explain and defend it. That’s not just an EU thing. The FCA, MAS, and US OCC are all leaning hard into this.

What this means for fintech leaders:

Back in 2023 or 2024, continuous authentication was more of an experiment — promising, but not yet standard. Fast forward to 2026, and it’s now a baseline expectation in fintech platforms that deal with high-risk flows like instant payouts, open banking APIs, and real-time payments.

What’s changed?

For one, attackers have leveled up. Deepfakes, AI-generated phishing, and synthetic identities are more sophisticated and more scalable than ever. Static credentials and device checks aren’t enough. Fintechs are under pressure to prove, not just guess, that the person behind the session is who they say they are.

Today’s advanced fintech stacks blend:

If a session behaves abnormally, like unusual typing patterns or a sudden IP/OS switch, the system flags risk in real time. It can then silently escalate: block the transaction, request biometric re-auth, or route the user through a high-friction flow. Without human intervention or hardcoded rules.

Importantly, these security measures are now privacy-aware by design: GDPR-compliant, data-minimizing, and explainable to auditors.

What this means for fintech leaders:

Cyber resilience in 2026 requires systems that learn and adapt. Fintechs should embed risk-based scoring, dynamic verification, and AI-driven threat simulations into everyday operations. True security isn’t static; it evolves with every session, every signal, and every emerging risk. With the right cybersecurity partners like Innowise by your side, you’ll build resilience that only grows stronger with every challenge.

Head of Global Development

In 2026, CBDCs, tokenized assets, and programmable money are foundational rails being actively built into both public and private fintech ecosystems.

Let’s start with CBDCs (Central Bank Digital Currencies). More than 130 countries are exploring or piloting them, and a growing number have launched retail and wholesale programs. In the EU, the Digital Euro has entered live testing with select payment providers. The Bank of England is laying the groundwork for a digital pound, and the US is exploring institutional pilots focused on interbank settlement.

Meanwhile, tokenization of real-world assets (RWAs) has hit a tipping point. Funds, bonds, and real estate are now being natively issued on blockchain rails. Platforms like Franklin Templeton, BlackRock, and UBS are already offering tokenized share classes or launching digital fund wrappers.

In this environment, fintechs need more than a “crypto” feature. They need:

What this means for fintech leaders:

By 2026, decentralized banking will no longer be an experiment but a viable operating model. Early deobanks are emerging: fully regulated financial platforms built on blockchain rails, combining the transparency of DeFi with the usability and compliance of traditional finance.

Where neobanks digitized the front end, deobanks re-engineer the core. Smart contracts now handle deposits, lending, liquidity, and rewards autonomously, while programmable compliance ensures every action remains audit-ready. This shift moves finance from “apps on rails” to native on-chain ecosystems, which are open, composable, and permissionless by design.

Why it matters in 2026

What this means for fintech leaders

The decentralized banking model is the next evolution of digital finance. With token rewards, on-chain referral validation, and seamless wallet integration, these platforms deliver a truly Web3-native experience. What makes deobanks stand out is how they blend DeFi transparency and automation with the compliance and usability of traditional finance. In 2026, they’re redefining what it means to be a bank.

Alexandr Bondarenko

Delivery manager, deobanking

In 2026, customers expect platforms to anticipate their needs, not just respond to them. That’s why hyper-personalization is moving from a luxury to a core capability.

We’ve gone from basic audience segmentation to real-time behavioral tailoring. Product recommendations, credit offers, and savings nudges are all being personalized based on how users interact, what they ignore, and even their transaction rhythms.

AI plays a central role here, but the real differentiator is how you orchestrate them. Leading platforms are using:

This creates a lending app that adjusts repayment offers based on real-time affordability, or a neobank that adapts its UI layout based on how each customer engages. Even UX flows, such as onboarding or re-auth, can now adjust per user.

What is more, 2026 brings a sharper focus on personalization ethics. Regulators are asking: Is that hyper-targeted credit offer helpful or predatory? Fintechs need not just relevance, but transparency and user control.

What this means for fintech leaders:

Sustainability in fintech isn’t new, but in 2026, it’s getting a serious upgrade. Moving beyond carbon calculators and ESG badges buried in a dashboard. This year, climate fintech is becoming smarter, more regulated, and finally, scalable.

Let’s start with the data. Fintechs are now plugging AI into their ESG engines. We’re seeing models fine-tuned to sift through corporate disclosures, spot greenwashing, and extract real insights from oceans of unstructured reports. Tools like ESG Book and Greenomy are stepping up with cleaner, audit-ready APIs. This means not just showing a carbon score anymore, but proving it, on demand, in a format regulators can read.

And speaking of regulation, that’s heating up too. The EU’s CSRD is forcing large companies (and by extension, fintechs serving them) to disclose structured ESG data. In parallel, new rules are standardizing how ESG ratings are defined and used. This means fintechs can’t just rely on third-party labels. They need traceability, model explainability, and clean handoffs to clients who are under the microscope.

On the product side, green finance is finally scaling. We’re seeing micro-investment platforms that channel spare change into climate-positive portfolios, credit products with emissions-based pricing, and SME tools that automate ESG reporting.

What this means for fintech leaders:

Financial inclusion used to be treated like a CSR checkbox. But in 2026, it’s fast becoming a fintech growth strategy. And what’s powering this shift is innovation happening at the edges of infrastructure.

We’re talking about tools that let you onboard a new user in 30 seconds via voice, in their native language, on a $50 Android phone, with patchy data. Platforms are rolling out AI-driven agents that work without a screen, leveraging speech recognition and local language models. Digital ID systems like India’s Aadhaar or Nigeria’s NIN are being integrated directly into fintech onboarding. And micro-services are being spun up to deliver loans, insurance, and savings to segments that traditional banks ignored because the margins didn’t make sense.

Edge innovation isn’t just rural anymore, either. In urban centers, fintechs are using behavioral data to underwrite credit for gig workers with no pay slips. Embedded finance models are showing up in last-mile logistics platforms, informal trade apps, and diaspora remittance flows.

What this means for fintech leaders:

Now that you’ve seen the fintech trends shaping 2026, the path forward is clearer, but insight alone won’t keep you ahead. Action will.

At Innowise, we don’t just track trends, we turn them into real strategies, tailored to your business. Whether you’re rethinking your roadmap or building from scratch, we’re here to ask the right questions, challenge outdated thinking, and help you move with confidence.

Let’s shape what’s next together.

Senior Technical Delivery Manager in Healthcare and MedTech

Siarhei leads our FinTech direction with deep industry knowledge and a clear view of where digital finance is heading. He helps clients navigate complex regulations and technical choices, shaping solutions that are not just secure — but built for growth.

Your message has been sent.

We’ll process your request and contact you back as soon as possible.

By signing up you agree to our Privacy Policy, including the use of cookies and transfer of your personal information.