Your message has been sent.

We’ll process your request and contact you back as soon as possible.

The form has been successfully submitted.

Please find further information in your mailbox.

The real estate industry has traditionally been associated with high entry barriers, illiquidity, and limited accessibility for small-scale investors. However, with the advent of blockchain technology, a new concept called “tokenization” is revolutionizing the way property assets are bought, sold, and traded. This article explores the tokenization of real estate and its potential as the future of real estate asset management.

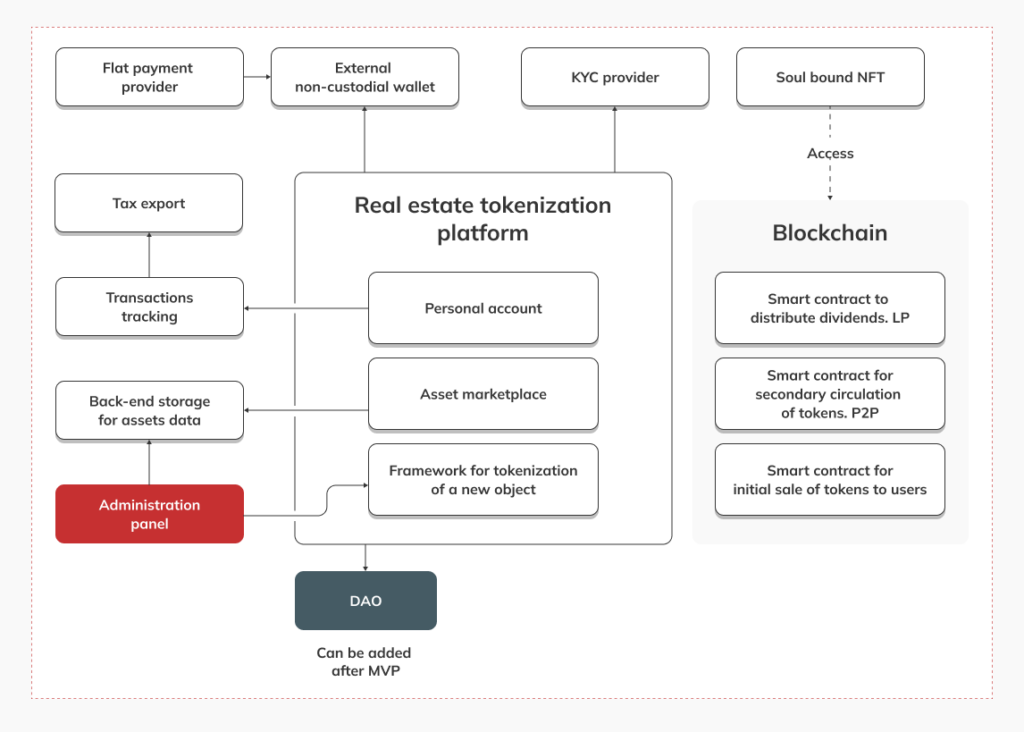

Property tokenization involves several key steps. First, a property undergoes due diligence and valuation by experts to determine its market value. Next, a special purpose vehicle (SPV) is created to hold the property, ensuring legal compliance and protecting token holders. The property is then divided into fractional ownership units, represented as real estate crypto tokens on a blockchain platform.

Investors can then purchase these tokens, which provide them with proportional ownership rights, including rental income, capital appreciation, and the ability to trade their tokens on secondary markets. Smart contracts, programmed on the blockchain, automate and enforce the terms of the investment, ensuring transparency and security.

Real estate is a tough market for new investors.

The tokenization of real estate lowers the entry barrier and democratizes investments in assets.

The tokenization of property has introduced a groundbreaking approach that is transforming the conventional landscape of property ownership and investment. This innovative concept, although relatively new, has already witnessed notable success stories in the realm of digital real estate. Here are a few examples of digital real estate.

The future of tokenized real estate assets holds great promise for transforming the industry and revolutionizing investment opportunities. As technology continues to advance and regulatory frameworks adapt, we can anticipate a widespread adoption of tokenized real estate on a global scale. This shift will likely be accompanied by the emergence of specialized platforms and tokenized real estate marketplaces dedicated to trading real estate tokens, which will enhance liquidity and expand investment options.

Tokenization offers a convenient and cost-effective method for investing in real estate assets. However, due to its novelty, there is still a lack of consistent regulatory frameworks governing real estate tokenization. The application of securities laws varies depending on the nature of the tokenized asset, and this lack of clarity can pose challenges for market participants.

Despite these challenges, tokenization has the potential to revolutionize real estate investment by increasing liquidity in an otherwise illiquid asset class, reducing barriers to entry for retail investors, and lowering transaction costs. However, it is crucial to address key issues such as establishing clear market regulations, reconciling tokenized assets with land title registries, and implementing centralized reporting of transactions.

For investors and real property owners looking to capitalize on the opportunities presented by real estate tokenization, seeking advice from experts is essential. By navigating these complexities and working together, stakeholders can unlock the full potential of tokenized real estate and shape a future where investing in property is more accessible and efficient than ever before.

Rate this article:

4.8/5 (45 reviews)

Your message has been sent.

We’ll process your request and contact you back as soon as possible.

By signing up you agree to our Privacy Policy, including the use of cookies and transfer of your personal information.