Your message has been sent.

We’ll process your request and contact you back as soon as possible.

The form has been successfully submitted.

Please find further information in your mailbox.

I read something recently that made me stop cold.

New York’s Department of Financial Services just fined 37 auto insurers. Big ones. The total hit? Twenty million dollars. Not for fraud. Not for mishandling customer data. Just for failing to report new and canceled policies on time. That’s it. Slow, manual reporting.

And in 2026, that’s all it takes to land in regulatory hot water. DFS was clear: insurers are responsible for accurate, timely reporting, even if the state’s systems are outdated and still offline. Saying “our process isn’t built for that” doesn’t hold up anymore. And really, it shouldn’t.

But that’s just the start. These outdated processes don’t just put you at risk with regulators; they slow down everything, from underwriting and claims to customer service. And when speed, accuracy, and trust are the currency of your brand, that’s a real problem.

So this feels like the right moment to talk about RPA and provide a straight-up look at how it’s actively solving problems that have been slowing insurance teams down for years.

Let me show you what works, what doesn’t, what insurers are finally doing differently in 2026, and most importantly, what you can do now to move forward.

Insurers seeing real ROI from RPA are not just automating repetitive tasks. They are targeting high-impact processes, aligning automation with strategic objectives, and establishing strong governance from the outset. That’s the difference between short-term efficiency gains and long-term operational transformation.

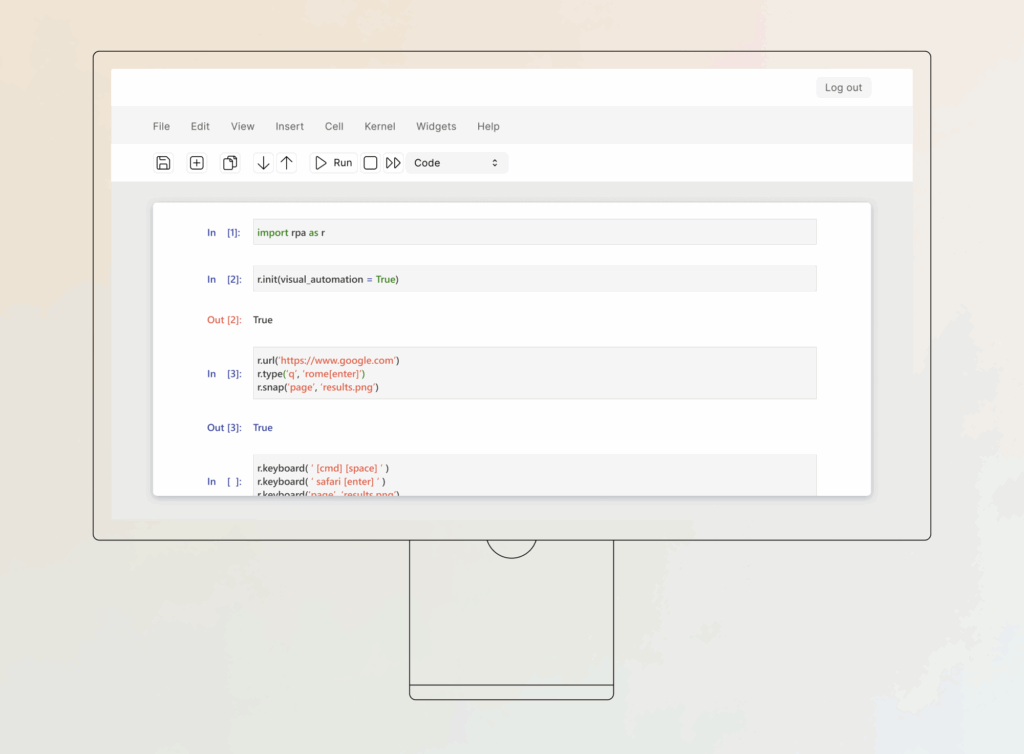

Robotic process automation, or RPA, is basically software that handles the repetitive stuff your team deals with every day. It logs into systems, moves data around, runs checks, and fills out forms. The kind of work that eats time and drains focus.

In insurance, that kind of work never stops. And most teams are still doing it manually. Or halfway manually. Or manually with three screens open. Claims, policies, compliance, billing — all of it depends on speed, accuracy, and doing the same task the same way, thousands of times over.

That’s why insurance is such a perfect match for RPA.

According to Verified Market Reports, the RPA market in insurance was worth 5.27 billion dollars in 2024. It’s projected to reach 18.12 billion by 2033, with steady growth expected from 2026 onward.

And the return is real. Some financial services firms saw up to 200% ROI in year one. Not just cost savings, but faster processing, fewer errors, and less time lost fighting slow systems.

RPA isn’t here to replace your people. It’s here to take the grunt work off their plate, so they can focus on the things that require human judgment.

RPA delivers value on two levels, and both matter. At the top, it gives insurers the flexibility to move faster, serve smarter, and scale without chaos. On the ground, it clears the clutter so teams can actually get things done.

So instead of lumping everything together, I’m splitting it. First, the strategic wins. Then, the operational ones. Let’s start at the top.

Growth shouldn’t be limited by manual processes. But for most insurers, that’s the reality. Every new product or pricing tweak runs into the same wall: too many handoffs, too much manual work. RPA clears the path. It frees up your team and lets you scale without stacking headcount. That’s how insurers are iterating faster and testing new ideas without the usual bottlenecks.

RPA is here to make your service team faster. Think of the first notice of loss (FNOL). With RPA in place, claims can be triaged automatically, data can be verified instantly, and status updates can be sent out without a rep lifting a finger. No more “we’ll get back to you” delays. Just quicker responses, smoother interactions at every touchpoint, and customers who feel taken care of.

Insurers don’t lack data. It’s just buried in unwieldy legacy systems or scattered across platforms. RPA pulls it together and makes it usable. When bots pull data from underwriting tools, CRMs, and policy systems automatically, insights land in hours, not days, amplifying what data analytics can deliver.

Launching a new insurance product is stalled by a painful chain of steps: filings, approvals, system updates, testing, and training. Most of it follows the same patterns every time. RPA speeds it up by handling the repeatable setup and config work behind the scenes. You get to market faster without overwhelming your ops or IT teams.

Claims, underwriting, and policy changes depend on speed and precision. RPA handles repetitive steps like document intake, data checks, and system updates. This means processes that used to take days can now be completed in hours. And you don’t need to change your core systems — just add RPA on top.

You know how it goes. Someone copies a name from one form to another and misses a digit. Or pastes the wrong policy number into the CRM. Multiply that by thousands of transactions, and you’re looking at real exposure. RPA removes that risk. Once you train the bot on accurate data, it does the job the same way, every time.

When people talk about cost savings, they often miss what really drives it. It’s not just fewer hours worked. It’s less friction. When a process runs end-to-end without human involvement, you avoid the back-and-forth, the rework, and the escalations. That’s how RPA helps lower the true cost-to-serve without compromising quality.

Here’s the hidden win. When you remove the boring stuff, people get better at the work that matters. Your underwriters have more time for edge cases. Your adjusters can focus on complex claims. Your customer service teams spend less time re-routing customers to FAQs or policy pages and more time solving complex cases. And that kind of work? It’s what drives performance, retention, and customer trust.

So now that we’ve looked at how RPA delivers both strategic and operational value in insurance, let’s get into what actually makes it tick. What does it automate? Where does it plug in? Which tools bring it to life?

Here’s a clear, use-case-by-use-case breakdown of how RPA works in real insurance operations.

| Use case | What RPA does | Tech stack/systems |

|---|---|---|

| Claims processing | Captures FNOL data via OCR, auto-validates policyholder info, pushes data to core systems, and triggers adjudication rules. | OCR tools (ABBYY, Hyperscience), core admin systems (Guidewire, Duck Creek), BPM platforms (Pega). |

| Policy underwriting | Aggregates data from disjointed systems, both internal and external, scores risk profiles using predefined logic, and populates underwriting platforms. | Data lakes, third-party risk engines (LexisNexis), underwriting tools (RiskMatch, Applied Rater). |

| Customer service automation | Routes tickets based on content, escalates exceptions, and integrates with CRM to update case statuses automatically. | CRM (Salesforce, Zendesk), NLP tools (Azure AI, Google Dialogflow), ticketing platforms (ServiceNow). |

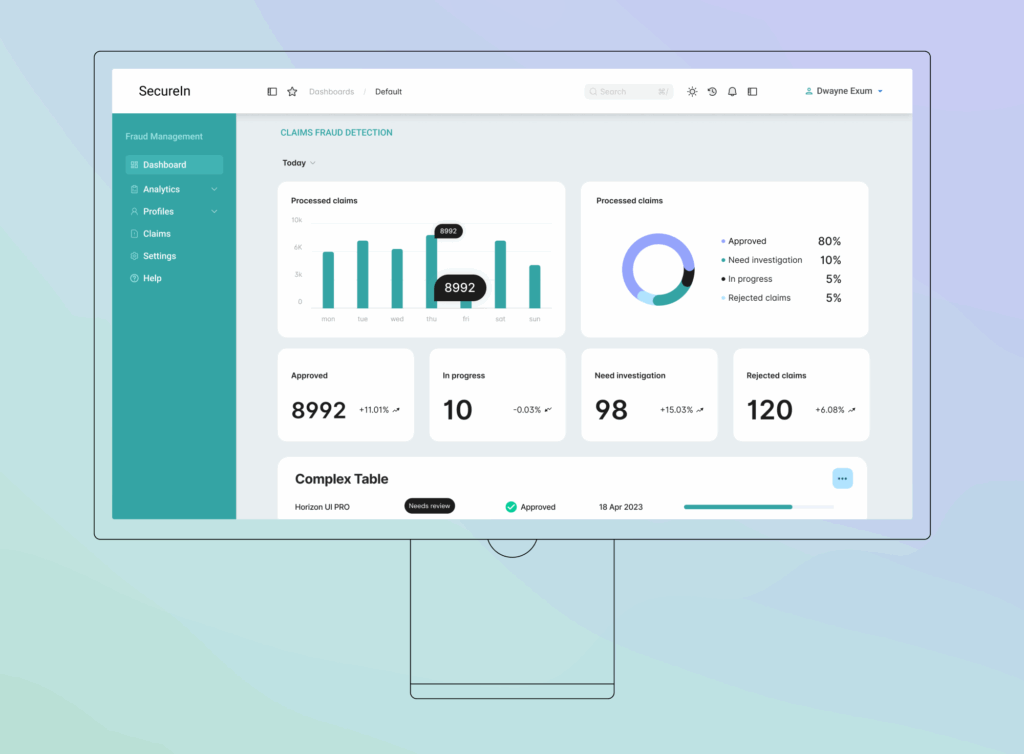

| Fraud detection | Scans incoming data for outliers, flags anomalies based on predefined thresholds, and supports AI-based pattern matching. | RPA with AI modules (UiPath AI Center, Automation Anywhere IQ Bot), analytics layers (Power BI, Tableau). |

| Regulatory reporting | Auto-generates compliance reports, pulls structured/unstructured data from systems, and builds auditable records. | RegTech tools (Clausematch, ComplyAdvantage), reporting systems, document repositories (SharePoint, Box). |

| Routine task automation | Extracts data from emails/docs, pushes updates to CRM and policy systems, logs activity for traceability. | Email parsers, CRM systems, policy admin (Sapiens, Majesco), automation tools (UiPath, Blue Prism). |

| Premium reconciliation | Compares payment and policy records, identifies mismatches, and updates financial ledgers in real time. | ERP (SAP, Oracle), policy admin, RPA bots for reconciliation and reporting. |

| Broker onboarding | Automates data collection from brokers, validates credentials, and updates CRM and compliance systems. | CRM (Salesforce, HubSpot), KYC/AML APIs, compliance dashboards, onboarding platforms. |

| Renewal notifications | Triggers policy renewal alerts based on customer segment and terms, logs customer interactions automatically. | CRM, campaign tools (Marketo, ActiveCampaign), policy admin, notification engines. |

| Reinsurance data exchange | Extracts treaty and claims data, formats and transfers it to reinsurer portals, and ensures completeness. | Reinsurance modules, core insurance platforms, secure data transfer protocols, RPA orchestration. |

| Data migration | Transfers data from legacy platforms to modern systems with field-level validation and error handling. | Legacy systems, cloud storage (AWS, Azure), ETL tools, automation platforms (UiPath, Power Automate). |

| Agent commission processing | Calculates broker commissions, generates payment instructions, logs reports for audit and compliance. | Commission engines, payroll systems, Excel macros, financial software, RPA workflows. |

RPA is great at following rules. But once you layer in AI, it starts making decisions too. That’s when automation moves from helpful to truly intelligent. Let’s break down how that works in real insurance workflows.

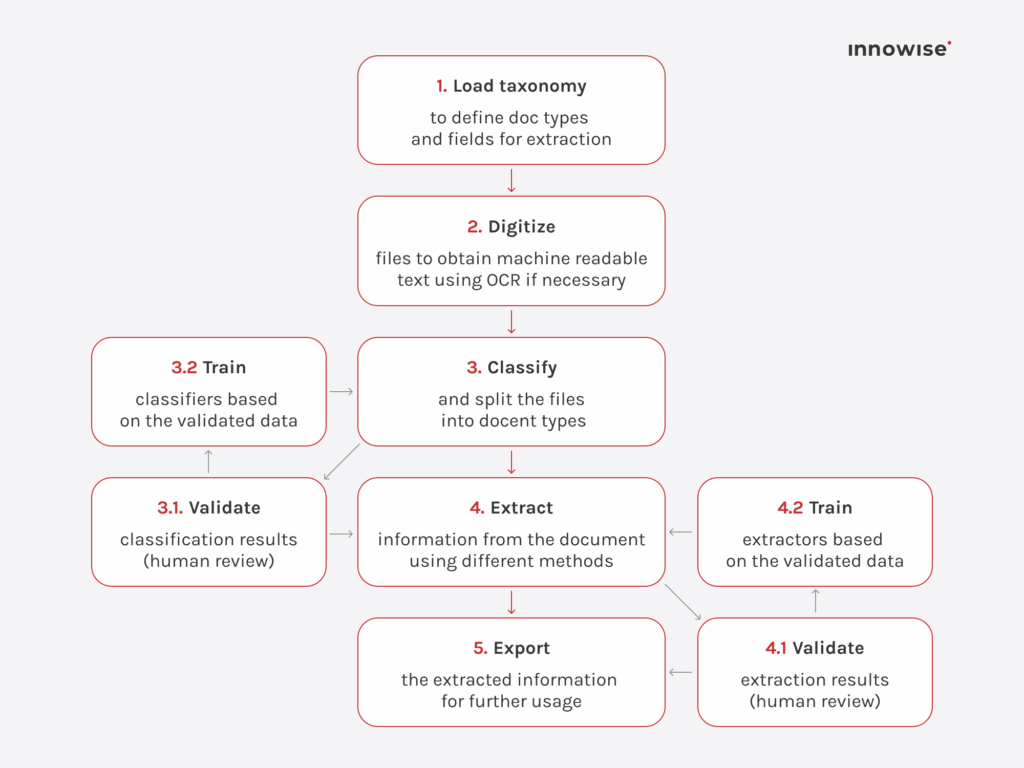

Think about how much insurance still runs on paperwork: scanned forms, handwritten notes, PDFs buried in emails. Intelligent document processing (IDP) lets bots actually understand and extract the relevant data from all of that. Not just pulling numbers from neat tables, but interpreting real-world documents with missing fields, odd formats, and even handwriting. Suddenly, that claims packet doesn’t need a full manual review. The bot reads it, validates it, and pushes it into the system, and people only step in if there’s a flag.

That kind of intelligence doesn’t come from off-the-shelf models. At Innowise, we train IDP systems on your actual claims, policies, and forms. This means the bots learn to work with your real-world mess, not just lab conditions. The result: fewer exceptions, cleaner data, and faster processing from day one.

Now apply that intelligence to communication. AI can read incoming emails, support tickets, and CRM notes, and actually understand what’s being said. It picks up on urgency, intent, and sentiment. So instead of your team manually sorting through messages, AI classifies and summarizes them, and RPA takes it from there, routing tickets, updating records, or escalating an issue before it slips through the cracks.

But there’s one thing I always highlight: don’t just drop in a generic model and call it done. A good RPA partner will train the AI on your actual messages and workflows, so the system learns your tone, your terminology, and your priorities. That’s the only way it truly understands how your customers speak and what really matters to your team.

And this is where it gets really interesting. With enough data, AI can start spotting patterns your team might miss. A renewal that looks like it’s about to churn. A claim that shows signs of fraud. A policyholder whose risk profile is changing. Instead of just alerting someone, RPA can reroute the workflow, flag a case, or trigger a proactive outreach. It’s automation that adapts to the situation in real time.

At Innowise, we bring this to life by integrating predictive models with your core systems, whether that’s your policy admin platform, CRM, claims engine, or BI tools. So when the data suggests a risk shift or behavioral pattern, the system acts immediately, reprioritizing queues, kicking off rule-based actions, or syncing updates across channels. Everything stays in flow, and nothing gets missed in the handoff.

I’d love to say RPA is all upside, but that wouldn’t be honest. There are real challenges, and skipping over them helps no one. Some processes just don’t play well with bots. Some systems fight back. And if your team isn’t ready, even the best automation can stall. These are the things I always tell clients to look at early. Get ahead of them, and the payoff comes faster.

Most insurers still rely on systems built long before RPA was even a concept. That’s not a dealbreaker, but it does mean your bots need to work with green-screen UIs, terminal emulators, or outdated databases. Success here depends on how well you map out processes, plan your exceptions, and avoid relying on surface-level automations alone.

Bots don’t make mistakes, but without guardrails, they might keep collecting or moving data they shouldn’t. That’s a big deal when they’re handling PII, claim details, or financial records. That’s why you need access control to set boundaries, encryption to protect the data they touch, and logging to monitor every step. And yes, this includes third-party RPA platforms that run in the cloud.

RPA doesn’t just change how tasks get done. It changes who does them, who owns the process, and what success looks like. That’s why projects fail when you treat them like IT-only initiatives. You need buy-in from business users, hands-on training, and ongoing governance. Start small. Show value early. Scale with a plan.

The first few bots are usually easy. It’s the next fifty that get messy. Who owns them? Who updates them when your policy admin system changes? How do you handle exceptions, logging, or rollback? If you don’t plan for lifecycle management, you’ll end up with zombie bots and brittle automation that quietly breaks in the background.

Automation isn’t magic. Some processes just aren’t ready. Maybe they’re too unstructured. Maybe they’re full of workarounds. That’s why your biggest ROI wins often come after you clean things up first. Map your processes. Eliminate noise. Then automate. That’s how you get results that actually scale.

You can build ten bots in a pilot and see real value. But scaling that to enterprise-wide automation? That’s a different game. You’ll need orchestration, monitoring, alerting, version control, and a team that knows how to keep it all running. Otherwise, automation becomes just another operational burden.

This isn’t just about hiring an RPA developer. You’ll need people who understand how to translate insurance workflows into automation logic. If you don’t have those skills in-house, plan for training or a long-term partner who does.

In regulated markets, every action matters. Your bots need to log what they did, when, and why. That means building audit trails into the automation from day one, not as an afterthought. And yes, auditors will ask to see it.

Let’s cut to the chase. Below, you’ll see how we’ve used RPA and AI to drive real results in insurance. And because automation delivers value in any industry, I’m also throwing in two quick wins from banking and manufacturing. Different domains, same playbook. If it worked there, there’s a good chance it can work for you too.

A European multi-line insurer came to us with a familiar pain point: too many claims, too much paperwork, and not enough automation to handle the load. Their teams were buried in emails, PDFs, and fragmented tools. Claims were taking days to process. Underwriters were working with outdated or incomplete data. And compliance reviews? Entirely manual.

Here’s how we turned that around with a full-scale RPA solution, combining automation with machine learning:

This wasn’t just an efficiency play. It gave their teams time back, reduced risk, and laid the groundwork for smarter, data-driven growth.

While the case above shows what RPA can do specifically for insurers, let me zoom out for a second to show just how versatile and powerful this technology really is.

A major US bank was bogged down by SOX and ITGC compliance tasks, as it heavily relied on manual data entry and spreadsheet-driven control checks. We built an RPA solution powered by OCR and custom Workfusion scripts to extract data from audit documents, auto-execute control validations, and generate compliance logs. The impact: 64 hours of manual effort cut weekly, and audit readiness improved across the board.

A leading EU appliance manufacturer had a fractured procurement process — PDFs, email orders, manual invoice approvals, and shipment tracking scattered across systems. We implemented UiPath-based bots with OCR and API integrations to auto-read orders, validate quantities and pricing, and sync them all with the CRM. We also added real-time shipment tracking via web scraping and API calls. This resulted in a 27% increase in procurement speed and 6 FTEs reallocated to higher-value work.

Sure, these examples aren’t from insurance, but the patterns absolutely apply. If you’re drowning in claims paperwork, slow renewals, or risk checks that take days, there’s a good chance these same automation blueprints can unlock huge gains for you too. Same tech just tailored to your workflows — and same results.

Before we wrap up, I want to leave you with a big-picture checklist for getting RPA off the ground. This isn’t a technical deep dive, more like a set of key things to focus on as you start planning. If you’re serious about making automation stick, these are the boxes worth ticking.

Start by auditing your operations to find tasks that are:

Tip: Use process mining tools or engage a partner like Innowise to speed up this discovery phase.

Once you have a list, evaluate each workflow based on:

Tip: Start with low-complexity, high-impact processes, as they give you quick wins and internal buy-in.

Select a tool that supports your current and future needs. Consider:

Tip: Innowise works with leading platforms like UiPath, Automation Anywhere, and Power Automate, so we can help match you with the best fit.

Develop a small-scale RPA solution for one high-priority process. Make sure to:

Tip: A good pilot should deliver measurable results within 4–6 weeks.

After a successful pilot, expand to other use cases, but don’t lose control.

Tip: Innowise doesn’t just build bots. We offer ongoing support, bot health monitoring, and CoE enablement if needed.

Here’s the thing: RPA is a strategic lever. The insurers getting ahead aren’t the ones doing more of the same faster. By letting automation handle the routine, your people can focus on strategic value delivery: cutting fraud investigation time in half, gaining sharper insights from legacy workflows, and staying agile while competitors stall.

A solid plan matters, but it’s only a tool. The real impact comes from the partner behind it. If you’re ready to turn your roadmap into real results, Innowise brings hands-on RPA expertise across claims, underwriting, and customer service. We’ve done it, and we know what works.

FinTech Expert

Siarhei leads our FinTech direction with deep industry knowledge and a clear view of where digital finance is heading. He helps clients navigate complex regulations and technical choices, shaping solutions that are not just secure — but built for growth.

Your message has been sent.

We’ll process your request and contact you back as soon as possible.

By signing up you agree to our Privacy Policy, including the use of cookies and transfer of your personal information.