Your message has been sent.

We’ll process your request and contact you back as soon as possible.

The form has been successfully submitted.

Please find further information in your mailbox.

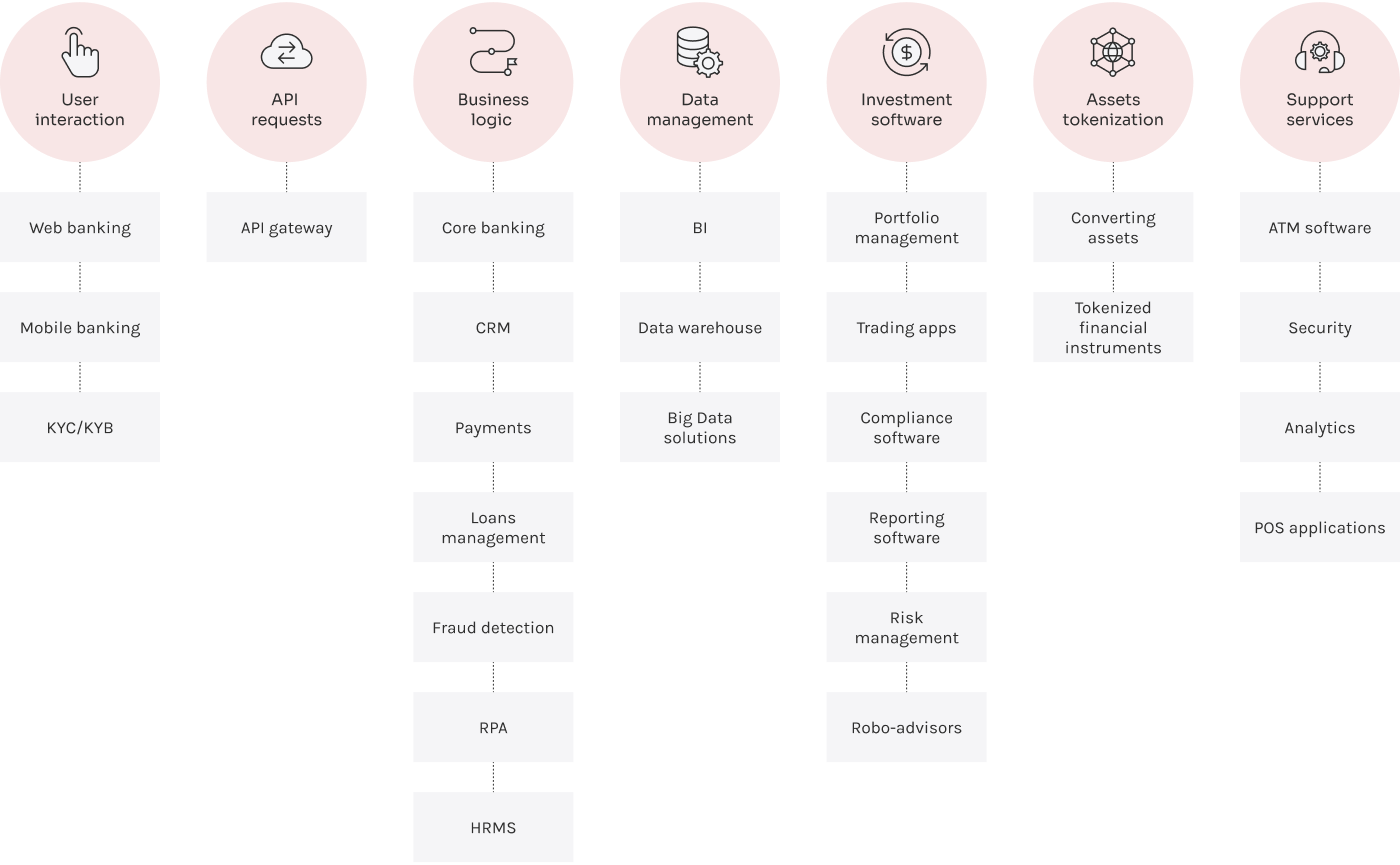

Banking software development services are all about creating the digital solutions that keep modern banking running — think core systems, payment processing, and fintech apps. It helps banks grow their online presence, improve financial services reach, increase customer retention rates by 5-10%, and protect sensitive info. Basically, it's what makes sure everything in the digital banking world works smoothly and securely.

Digital software is the backbone of the banking industry. Make the most of ground-breaking technologies to grow exponentially.

Custom software development helps banks remain competitive and provide their customers with the best possible service. By creating custom software, banks can make sure that their systems are secure, efficient, and up-to-date. As a result, they can offer more features and faster processing times, enabling customers to get the most out of their experience.

Having unmatched success in software development digital banking, our company provides cutting-edge solutions that help banks stay ahead of the curve.

Innowise builds complex solutions that assist clients in monitoring payments, identifying delays, recalculating loan interest, and changing credit conditions.

To facilitate acquiring processes and enhance the safety of funds, our engineers build banking applications that provide confidence while processing digital transactions.

Through open APIs, we ensure stable and secure communication between banks and third parties and drive seamless data interactions across different devices, platforms, and services.

We design personalized web resources that give customers many options to tackle their financial issues through a single point of access to relevant and up-to-date information.

With deep expertise in CRM systems, Innowise improves performance management, optimizes workflow, and introduces order in client relationships.

Besides custom software development, our vetted teams offer core banking services such as floating new accounts, approving loans, calculating interests, and processing deposits/withdrawals.

Our finance software development company covers a wide array of technological tools perfectly fitted for FinTech. Powered by a vast network of mid-to-senior level specialists, we develop innovative solutions that boost operational efficiency and accelerate business growth. While building software for processing enormous volumes of payments, transactions, and other details, Innowise ensures accuracy, convenience, and security by utilizing the best in-house and global practices.

With banking solutions becoming increasingly complex, Innowise takes advantage of pioneering technologies and keeps up with innovative advancements. We adopt blockchain, AI/ML, IoT, and many other technologies, especially our big data development services, to ensure seamless automation and digitalization.

With our innovative tools, banks can enjoy more efficient and reliable operations. Our solutions let financial organizations follow up with the latest trends in the industry, giving them a competitive edge.

As the financial industry relies on structured data to make decisions, our skilled software engineers create BI solutions to collect, analyze, and process data and turn it into actionable insights.

Innowise aids banks in replacing or augmenting human efforts with automatic algorithms and robotic capacities to facilitate repetitive manual processes and reduce employee errors.

Financial organizations benefit from our top-tier developers’ ability to consolidate information from various sources and store it in flexible data warehouses.

With no censorship and control over external authorities, Innowise takes full advantage of decentralized databases, ensuring safe payments and currency exchanges.

Through IoT capabilities, we guarantee enhanced security, fraud detection, advanced insurance strategies, and many more to meet customers’ expectations and address their pain points.

We develop solutions that enable banks and other financial organizations to issue plastic cards, provide loan and mortgage services, and other services within one ecosystem.

As a artificial intelligence development company, we believe that artificial intelligence and machine learning technologies can revolutionize the banking industry. We strive to use these innovative solutions to strengthen existing financial systems and offer unprecedented growth opportunities for our customers. Our mission is to utilize AI in banking and finance to bring about positive change in the world, creating an improved environment for people everywhere. With our cutting-edge tools, we enable our clients to maximize their efficiency while providing superior user experiences.

Cybersecurity and fraud detection

Smart chatbots

Loan and credit decisions

Tracking market trends

Risk management

Regulatory compliance

Predictive analytics

Anti-money laundering

Process automation

Does your business struggle to keep up with innovations?

Innowise knows how to unleash the potential of digital technologies and thrive

Developing a turnkey product doesn’t come with a fixed price. Before signing an agreement, we discuss specialists’ hourly rates and approve project budgets. We advise clients on choosing the best-suited pricing model given their requirements, project scope, and allocated resources. Overall, the final cost is determined by the factors as follows:

Founded in 2007, Innowise has never wavered from its commitment to clean code and constant improvement. We create solutions tailored to each customer’s exact needs, regardless of their complexity. Our experienced team evaluates each organization’s needs carefully before crafting a solution that meets their specific goals. With Innowise, you can rest assured knowing our experts have the knowledge, language proficiency, and European mindset needed for success. We are committed to staying in sync with your team to ensure the perfect result every time.

Vast talent pool

Quick project kick-off

Sustainable product quality

Reasonable costs

Flexible cooperation models

Efficient project delivery

Compliance with customer requirements and quality standards

Nowadays, banking domain is unimaginable without decent automation and digitization. Besides eliminating bureaucratic hurdles, it allows for managing online payments, ensuring financial control, and simplifying many manual procedures. To stay ahead of the curve, banks should understand that digital transformation is no longer a whim but a necessity to withstand competition and gain market advantages.

Dmitry Nazarevich

CTO at Innowise

While building bespoke solutions, we go through SDLC stages, attaining intermediate outcomes and ensuring regular feedback. Our agile e-banking software development methodology ensures flawless quality and allows us to adapt to project scope changes.

Compromising on quality is shortsighted

Build trust and reliability across your products with Innowise Contact usInnowise is one of the best partners the client works with. They always fulfill our requests by providing developers that meet the client’s specific language and experience-level requirements.

Innowise has built an amazing application from scratch in an amazingly short time of just about 3 weeks. Their seniority and in-depth experience in this field make them valuable partners.

Innowise is a reliable tech partner, working as a part of our team. They are hard- working professionals, bringing strong expertise and dedication to everything they develop.

There are no defined timeframes for a custom software project. According to our experience, developing a full-fledged solution usually takes between four and twelve months.

Banking software should provide account management, advanced security, deposit/withdrawal functionality, and loan management capabilities.

Every banking solution should employ encryption algorithms that convert data into code only certain banks can access.

Software robotics in banking allows for the comprehensive automation of manual operations in the financial sector.

Your message has been sent.

We’ll process your request and contact you back as soon as possible.