Votre message a été envoyé.

Nous traiterons votre demande et vous contacterons dès que possible.

Le formulaire a été soumis avec succès.

Vous trouverez de plus amples informations dans votre boîte aux lettres.

Sélection de la langue

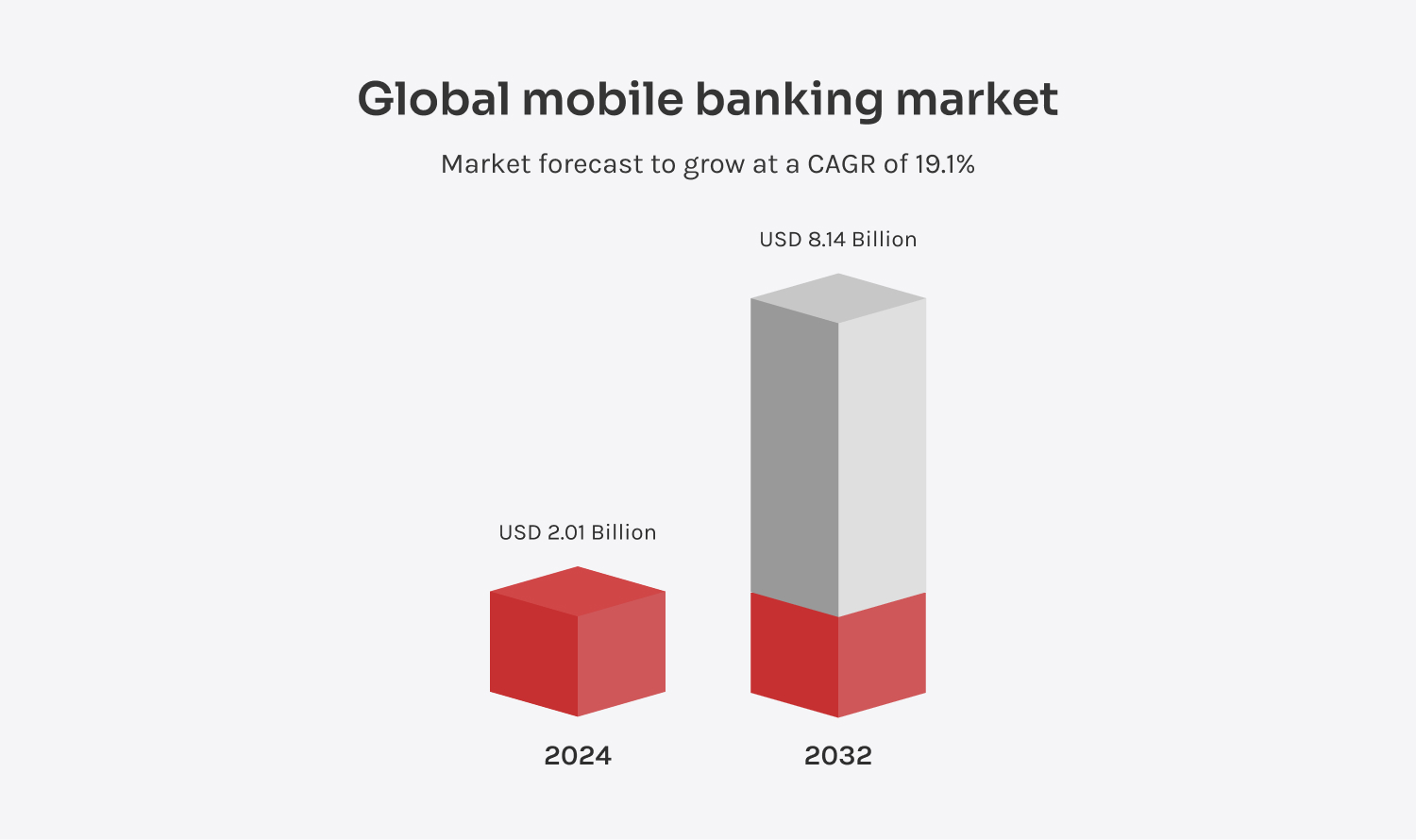

Les applications bancaires mobiles sont aujourd'hui au cœur de notre vie. Besoin de vérifier votre solde ? Payer une facture ? Faire une demande de prêt ? Il existe une application pour cela. Le marché de la banque mobile n'est pas seulement en croissance, il est en plein essor. D'ici à 2032, il devrait passer de $2,01 milliards en 2024 à $8,14 milliards avec un taux de croissance annuel de 19,10%. Cela fait beaucoup de gens qui s'attendent à ce que leurs applications fonctionnent parfaitement à chaque fois qu'ils appuient sur leur écran.

Mais le hic, c'est que les banques sont dans une situation délicate. Elles doivent se tenir au courant des dernières tendances technologiques, mais elles ne peuvent pas prendre le risque d'une seule panne ou d'un seul pépin. Un seul accroc et c'en est fini de la confiance des clients.

Comment les banques font-elles pour que leurs applications soient à la fois innovantes et fiables ? Le secret réside dans les tests d'applications bancaires mobiles - le héros des coulisses qui veille à ce que tout fonctionne parfaitement. Vous êtes curieux de savoir comment tout cela s'articule ? Plongeons dans le vif du sujet !

Siarhei Sukhadolski

FinTech Expert & Head of Competence Center

Chez Innowise, nous comprenons que votre application bancaire mobile est le visage de votre marque et la clé pour conquérir davantage d'utilisateurs. Des vérifications détaillées aux évaluations approfondies, nous nous assurons que votre application fonctionne parfaitement et laisse une impression durable.

Les tests fonctionnels permettent de s'assurer que votre application bancaire fonctionne comme prévu, qu'il s'agisse d'effectuer des transactions, de traiter des paiements ou de gérer des comptes. Nous testons des scénarios réels pour détecter et corriger tout problème, afin que votre application offre une expérience fiable.

Votre application bancaire est en constante évolution - les bogues sont corrigés, les mises à jour sont déployées et les performances sont améliorées. Nos tests de régression permettent de s'assurer que ces changements ne perturbent pas ce qui fonctionne déjà, afin que votre application soit toujours stable et prête à être utilisée par les utilisateurs.

Avec les tests de sécurité des applications bancaires, nous renforçons votre application contre les menaces potentielles en repérant les vulnérabilités grâce à des tests de pénétration, en évaluant les normes de cryptage et en validant des méthodes d'authentification sécurisées.

Notre équipe effectue des tests de stress et de charge pour repérer les goulets d'étranglement, augmenter la vitesse et s'assurer que votre application bancaire mobile reste rapide, gère un trafic élevé, traite les transactions rapidement et fonctionne sans heurts, même en cas de charge élevée.

Les tests de conformité permettent de s'assurer que votre application bancaire respecte toutes les règles et normes du secteur, telles que GDPR, PCI DSS ou les lois bancaires locales. C'est la clé pour éviter les amendes, assurer la sécurité des données des utilisateurs et gagner la confiance des clients.

Les tests d'automatisation vous évitent de vérifier votre application bancaire en exécutant des tests préétablis pour des éléments tels que la régression, la fonctionnalité et la performance. Ils permettent de réduire le travail manuel, d'accélérer les tests et d'assurer la cohérence de l'ensemble.

Notre équipe teste rigoureusement les API - les moteurs qui sous-tendent les fonctionnalités de base de votre application bancaire - afin de vérifier que chaque API fonctionne comme prévu. L'accent est mis sur le test de la fonctionnalité et de la fiabilité de l'API elle-même, indépendamment des autres composants.

Dans une application bancaire, l'exactitude et la fiabilité des données sont essentielles, qu'il s'agisse des détails de l'utilisateur, des enregistrements de transactions ou des soldes de comptes. Notre équipe vérifie soigneusement les entrées, les opérations de base de données et les sorties afin d'éviter les erreurs et de maintenir l'intégrité.

Les tests d'intégration permettent de s'assurer que tous les éléments de votre application bancaire fonctionnent parfaitement ensemble. Il s'agit de repérer les problèmes lorsque les éléments se connectent, comme une API de paiement qui ne met pas à jour les soldes ou n'envoie pas de notifications.

Notre équipe teste votre application sur toutes sortes d'appareils, de plateformes, de tailles d'écran et de configurations pour détecter les bogues de mise en page, les ralentissements ou les fonctionnalités défectueuses, afin de s'assurer qu'elle est belle et qu'elle fonctionne parfaitement, quel que soit l'endroit où elle est utilisée.

Nous vérifions les fonctionnalités telles que les lecteurs d'écran, la navigation au clavier, le contraste des couleurs et le redimensionnement du texte par rapport aux normes d'accessibilité telles que WCAG, afin de nous assurer que votre application est inclusive et facile à utiliser pour tout le monde.

Les tests de convivialité portent sur la facilité et l'intuitivité d'utilisation de votre application bancaire mobile. Il évalue la navigation, les flux de travail et la conception générale afin d'identifier les points problématiques tels que les mises en page confuses ou les fonctionnalités difficiles à trouver.

L'UAT est le dernier contrôle avant le lancement, au cours duquel de vrais utilisateurs testent votre application bancaire pour confirmer qu'elle répond à leurs attentes et aux exigences de l'entreprise. L'objectif est de confirmer que l'application est prête à être déployée, tant sur le plan technique que du point de vue de l'utilisateur.

30+

experts en services bancaires et financiers

27+

clients des services bancaires aux entreprises

35+

des ingénieurs qualifiés en assurance qualité

105+

des projets d'essais réussis dans le secteur bancaire

Notre statut de partenaire Gold de l'ISTQB confirme notre engagement à respecter des normes de test de logiciels de classe mondiale à l'échelle de l'entreprise, en soutenant à la fois les environnements à forte réglementation et les environnements agiles.

Nous en sommes arrivés là en développant une expertise polyvalente en matière d'assurance qualité - de la gestion des tests à l'automatisation - et nous avons donc veillé à ce que vous soyez pleinement couvert.

Le test d'une application bancaire mobile est un processus complet dont chaque étape est importante. C'est un peu comme assembler un puzzle : chaque pièce compte pour que l'ensemble s'emboîte et fonctionne sans accroc. Examinons donc de plus près comment le processus se déroule généralement.

Les plateformes de banque en ligne permettent aux utilisateurs de vérifier leurs comptes, d'envoyer de l'argent et de s'occuper de leurs finances à tout moment. Nous testons la sécurité des connexions, les mises à jour en temps réel, la fluidité des transactions et la compatibilité entre les appareils afin que tout fonctionne parfaitement.

Les applications bancaires mobiles mettent les services financiers dans la poche des utilisateurs, en mettant l'accent sur l'accessibilité et la facilité d'utilisation. Nos tests garantissent des fonctionnalités essentielles telles que les connexions biométriques et les notifications push, ainsi que des facteurs spécifiques à la téléphonie mobile tels que la fluidité de la navigation et la rapidité de chargement.

Les portefeuilles électroniques permettent d'envoyer facilement de l'argent, d'effectuer des paiements sans contact ou de partager des factures avec des amis. Lorsque nous testons les portefeuilles électroniques, nous nous intéressons à tout ce qui les rend sûrs et conviviaux, comme le cryptage fort, la protection contre la fraude et la synchronisation entre les appareils.

Conçues spécifiquement pour les entreprises, les applications bancaires pour entreprises simplifient les tâches telles que la paie, les paiements en masse et la gestion des hiérarchies de comptes. Nous nous attachons à tester leur capacité à gérer de lourdes charges de transaction, à prendre en charge un accès multi-utilisateurs sécurisé et à s'adapter à la croissance de votre entreprise.

Ces applications fonctionnent exclusivement sur des plateformes numériques, ce qui nécessite plus que des tests de base. Nous nous concentrons sur la création de comptes en toute simplicité, sur des protocoles de sécurité robustes, sur une intégration sans faille avec des API tierces et sur un traitement précis des transactions en temps réel.

Les applications d'investissement mettent la puissance de la négociation et de la gestion de portefeuille au bout des doigts des utilisateurs. Pour garantir la performance de ces applications, nous nous attachons à tester l'exactitude des données, l'intégration avec les API de négociation et la stabilité face au trafic intense qui accompagne les hauts et les bas du marché.

Les applications P2P permettent d'envoyer de l'argent en quelques clics. Nos tests portent sur l'exactitude des transactions, l'authentification sécurisée des utilisateurs, la validation de la fluidité des transferts transfrontaliers et la conformité aux réglementations en matière de paiement.

Andrew Artyukhovsky

Responsable de l'assurance qualité chez Innowise

Les applications bancaires mobiles évoluent rapidement et les tests doivent répondre aux exigences croissantes en matière de rapidité, de sécurité et de fiabilité. Au fur et à mesure que la technologie progresse, la façon dont nous testons ces applications va changer radicalement, sous l'effet de certains facteurs. des tendances passionnantes qui façonnent l'avenir des services bancaires mobiles.

L'IA et la ML changent la donne pour les tests d'applications bancaires mobiles. La création automatisée de tests, les scripts d'auto-réparation et la hiérarchisation plus intelligente des tests soulageront les équipes d'assurance qualité du travail répétitif. Cela signifie plus de temps pour s'attaquer aux cas limites et résoudre les problèmes délicats. La ML permettra également de détecter plus facilement les problèmes les plus importants, tels que les erreurs de paiement, les risques de sécurité et les problèmes de connexion, afin que les applications soient toujours en parfait état.

Les applications bancaires mobiles gérant plus de données sensibles que jamais, les tests de sécurité seront au cœur des préoccupations. Qu'il s'agisse de cryptage, d'API sécurisées ou de détection des vulnérabilités avant les pirates, la sécurité des applications sera une priorité absolue. Tests de pénétration et les contrôles de sécurité en temps réel aideront les applications à garder une longueur d'avance sur les menaces et à préserver la confiance des utilisateurs.

Les tests d'applications bancaires mobiles ont pour but d'instaurer la confiance, d'assurer la sécurité et de veiller à ce que tout se déroule sans heurts. Les vérifications intelligentes sont cruciales pour chaque partie de l'application. Il s'agit de répondre aux attentes élevées des utilisateurs et des régulateurs, tout en s'assurant que l'intégrité financière est maintenue et que la conformité est respectée - le tout pour offrir une expérience transparente et fiable aux utilisateurs.

Les tests sont indispensables pour les applications bancaires mobiles, car elles traitent des informations sensibles et de l'argent réel - un seul petit bogue pourrait tout gâcher. Ils permettent de s'assurer que l'application est sécurisée, qu'elle fonctionne sans heurts et que les utilisateurs sont satisfaits et ne subissent pas de stress.

La difficulté des tests d'applications bancaires mobiles est de trouver le juste équilibre entre une sécurité renforcée, des transactions sans faille, une compatibilité multi-appareils et une conformité stricte, tout en rendant l'application simple et agréable pour les utilisateurs.

Nous nous assurons que l'application fonctionne à la fois sur Android et iOS en utilisant des outils de test multiplateforme, en effectuant des tests sur des appareils réels et des émulateurs, et en validant les fonctionnalités, les performances et la compatibilité spécifiques à chaque système d'exploitation.

La durée du test d'une application bancaire mobile dépend de la complexité de l'application, de ses caractéristiques et de ses exigences. En moyenne, elle peut aller de quelques semaines pour les applications simples à plusieurs mois pour les applications complexes dotées de fonctionnalités avancées et répondant à des exigences strictes en matière de conformité.

Votre message a été envoyé.

Nous traiterons votre demande et vous contacterons dès que possible.

En vous inscrivant, vous acceptez notre Politique de confidentialitéy compris l'utilisation de cookies et le transfert de vos informations personnelles.