Votre message a été envoyé.

Nous traiterons votre demande et vous contacterons dès que possible.

Le formulaire a été soumis avec succès.

Vous trouverez de plus amples informations dans votre boîte aux lettres.

Sélection de la langue

Le meilleur CRM pour l'assurance dépend de vos besoins : Salesforce pour les grandes équipes, Zoho pour les plus petites, et HubSpot pour les agences axées sur le marketing - mais de nombreux CRM ne répondent tout simplement pas aux exigences du secteur.

Ils n'ont pas été conçus pour les courtiers qui jonglent avec les délais de mise en conformité. Ou pour les agents qui suivent les renouvellements de polices sur dix lignes de produits. Ou encore pour les agences de taille moyenne qui tentent de se développer sans perdre en qualité de service.

Et pourtant, chaque année, je vois des équipes qui essaient de forcer des CRM génériques à s'adapter à des flux de travail pour lesquels ils n'ont jamais été conçus.

L'assurance a besoin de plus. Des devis automatisés. Pipelines de sinistres. Logique de souscription intégrée. Routage intelligent des prospects. Des intégrations en temps réel avec les systèmes des assureurs. Pas seulement des listes de contacts et des rappels de tâches.

Nous avons mis en place des systèmes de gestion de la relation client à partir de zéro pour les fournisseurs d'assurance vie, santé et IARD. Nous avons vu ce qui fonctionne. Et ce qui fait perdre du temps, du chiffre d'affaires et de la fidélisation.

Voici donc mon avis. Les meilleurs CRM pour les courtiers, agents et agences d'assurance en 2025.

| CRM | Caractéristiques principales | Meilleur pour | Prix (approx.) |

|---|---|---|---|

| Salesforce | Flux de travail personnalisés, outils de devis, services financiers Cloud, intégrations profondes | Grandes agences, sociétés de courtage, équipes d'entreprises | De $25/utilisateur/mois à $100+. |

| Zoho CRM | Automatisation des flux de travail, modules personnalisés, communications intégrées, extensions tierces | Petites agences ou courtiers indépendants | Niveau gratuit ; plans payants $16-$60/utilisateur/mois |

| Lundi CRM | Pipelines visuels, générateur d'automatisation, prise en charge des prospects par formulaire, mise en place rapide | Les agences de petite et moyenne taille qui ont besoin d'un déploiement rapide | $14–$32/utilisateur/mois |

| Odoo | Système modulaire, intégration complète, suivi des polices, comptabilité + CRM combo | Moyennes et grandes entreprises souhaitant le contrôle et la personnalisation | $0 (open source) ; nuage de $14/utilisateur |

| HubSpot | Automatisation du marketing, segmentation des contacts, flux d'e-mails, interface utilisateur claire | Agences dirigées par le marketing avec une forte génération de leads | CRM de base gratuit ; suite complète à partir de $103 |

| SAP CRM | Intégration ERP, flux de travail d'entreprise, outils de conformité prêts pour l'audit | Les assureurs mondiaux utilisent SAP | $1,476.00/utilisateur/année |

| Microsoft Dynamics | Power BI analyse, intégration des équipes, évaluation des risques, personnalisation des modules de police | Grandes entreprises sur la pile Microsoft | $65–$150/utilisateur/mois |

| Insureio | Devis intégrés, suivi des polices et des dossiers, marketing spécifique à l'assurance, outils de conformité | Les agents vie et santé ont besoin d'un outil tout-en-un | $25–$75/utilisateur/mois |

Voici comment je juge si un CRM pour l'assurance vaut vraiment la peine d'être utilisé, et pas seulement d'être testé.

Je commence par gestion des politiques. S'il ne peut pas gérer les configurations multi-lignes, les couvertures superposées, les cycles de renouvellement et les champs spécifiques à l'assureur sans créer de chaos, il est éliminé. Il en va de même pour les demandes d'indemnisation. Je ne me contente pas d'un "statut du sinistre" caché dans un obscur onglet. Je veux des mises à jour en temps réel, des vues chronologiques et des alertes intelligentes. Si un client appelle pour demander des informations sur son sinistre et que l'agent doit lui répondre, "Laissez-moi vérifier avec les opérations". que le CRM a déjà échoué.

Souscription est le suivant. Les bons outils vous aident à normaliser la logique du risque et à l'appliquer à tous les niveaux. Les mauvaises ? Ils vous obligent à retaper les mêmes données cinq fois, de cinq façons différentes. J'ai vu des équipes perdre des jours à cause de ce genre d'inefficacité.

Puis j'ai creusé dans analyses de données. Vous seriez surpris de voir le nombre de systèmes qui collectent tout et ne remontent rien à la surface. Je cherche des signaux de désabonnement, des modèles de vente croisée, des incohérences dans les commissions, et je veux les visualiser. Des tableaux de bord, pas des téléchargements.

Données centralisées n'est pas négociable. Si je trouve trois versions du même dossier client, des notes éparses ou des points de contact manquants, je le signale. Le rôle d'un CRM est de créer de la clarté, pas du désordre.

Suivi des commissions est un autre facteur décisif. Les agents doivent savoir exactement ce qu'ils ont gagné. Les responsables doivent être en mesure de réconcilier les paiements sans avoir recours à une thérapie par tableur. Si ce n'est pas le cas, il ne faut pas s'attendre à ce que l'adoption se poursuive.

Outils de communication sont souvent négligés jusqu'à ce qu'ils vous coûtent de l'argent. Je veux voir les textos, les courriels et même les appels intégrés. Tout est enregistré. Tout peut être déclenché. La police d'assurance d'un client doit être renouvelée ? Le CRM doit le savoir et agir en conséquence.

Automatisation du marketing doivent être intégrées, et non pas collées. Campagnes au goutte-à-goutte. Les incitations au renouvellement. L'accueil des nouveaux clients. C'est la différence entre des équipes qui chassent manuellement les clients potentiels et celles qui les gardent à l'esprit automatiquement.

Idem pour devis et demandes. Les clients ne devraient pas avoir à changer d'onglet ou à remplir des PDF. L'ensemble du processus (demande de devis, remplissage du formulaire, soumission) doit se dérouler en un seul flux.

Acheminement intelligent des pistes n'est pas facultative. Que ce soit par zone géographique, par licence, par langue ou par ligne de produits, si votre CRM ne peut pas attribuer automatiquement des pistes, vous perdez des heures et risquez de perdre des marchés.

Catalogues de produits ont plus d'importance qu'on ne le pense. Des modèles intelligents, des offres groupées et des messages de vente croisée réduisent les erreurs de devis et accélèrent la conclusion des contrats.

Les flux de travail ? Automatisez-les. Les suivis, la création de tâches et les changements de statut, s'ils peuvent être répétés, doivent être automatisés. Tout ce qui n'est pas automatisé ne fait qu'alourdir la charge de travail.

Intégrations en est une importante. Si votre CRM ne communique pas avec DocuSign, par exemple, votre logiciel de comptabilité, vos outils de devis, votre équipe se retrouve à faire de la double saisie, ou pire, à ne pas en faire du tout. Les meilleurs CRM sont compatibles avec les autres.

Et enfin, mobile. Si vos agents de terrain ne peuvent pas charger la police d'un client, mettre à jour une note ou envoyer un suivi à partir de leur téléphone sur placevous vous exposez à une perte d'informations et à un ralentissement des ventes.

Chez Innowise, nous avons testé, mis en œuvre ou supprimé plus de CRM que je ne peux en compter. Et lorsqu'il s'agit d'assurance, seuls quelques-uns sont vraiment à la hauteur. Voici un aperçu de ceux qui se distinguent en 2025.

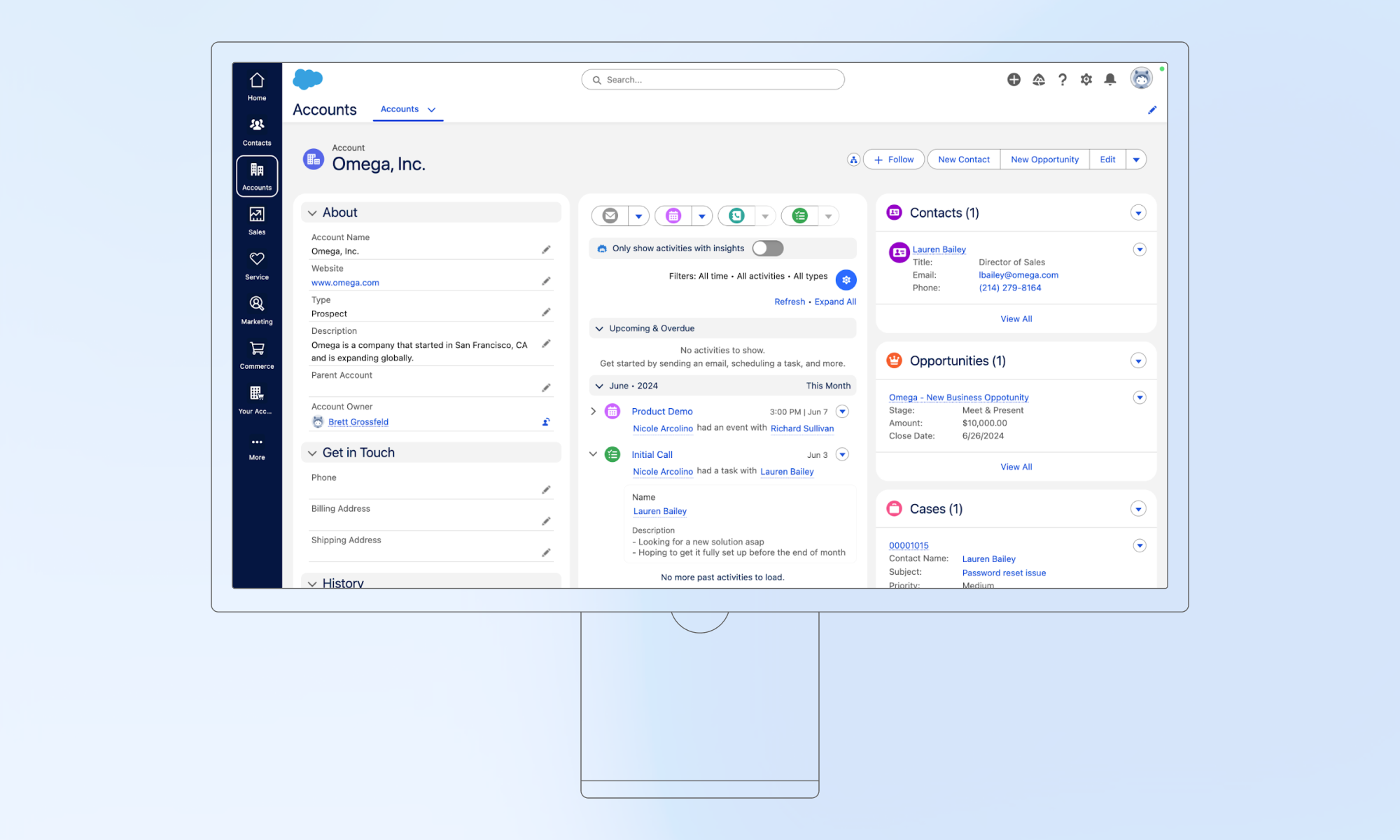

Salesforce est un poids lourd. Il n'est pas conçu pour l'assurance dès le départ. Mais avec la bonne configuration ou avec Salesforce Financial Services Cloud, il devient une véritable centrale.

La courbe d'apprentissage est réelle. Et oui, c'est une solution excessive pour les petites équipes. Mais pour les grands courtiers, les AGM ou les agences à succursales multiples qui ont besoin d'une personnalisation approfondie, d'un suivi de la conformité et d'une automatisation intelligente entre les départements ? Il est difficile de faire mieux.

Commence autour de $25/utilisateur/mois pour la Starter Suite de base, mais la plupart des équipes d'assurance auront besoin de constructions personnalisées, souvent $100+/utilisateur/mois en fonction de l'étendue. Essai gratuit disponible.

Agences d'entreprise, grandes sociétés de courtage ou compagnies d'assurance multirisques disposant d'équipes informatiques internes ou d'un budget pour des consultants Salesforce externes.

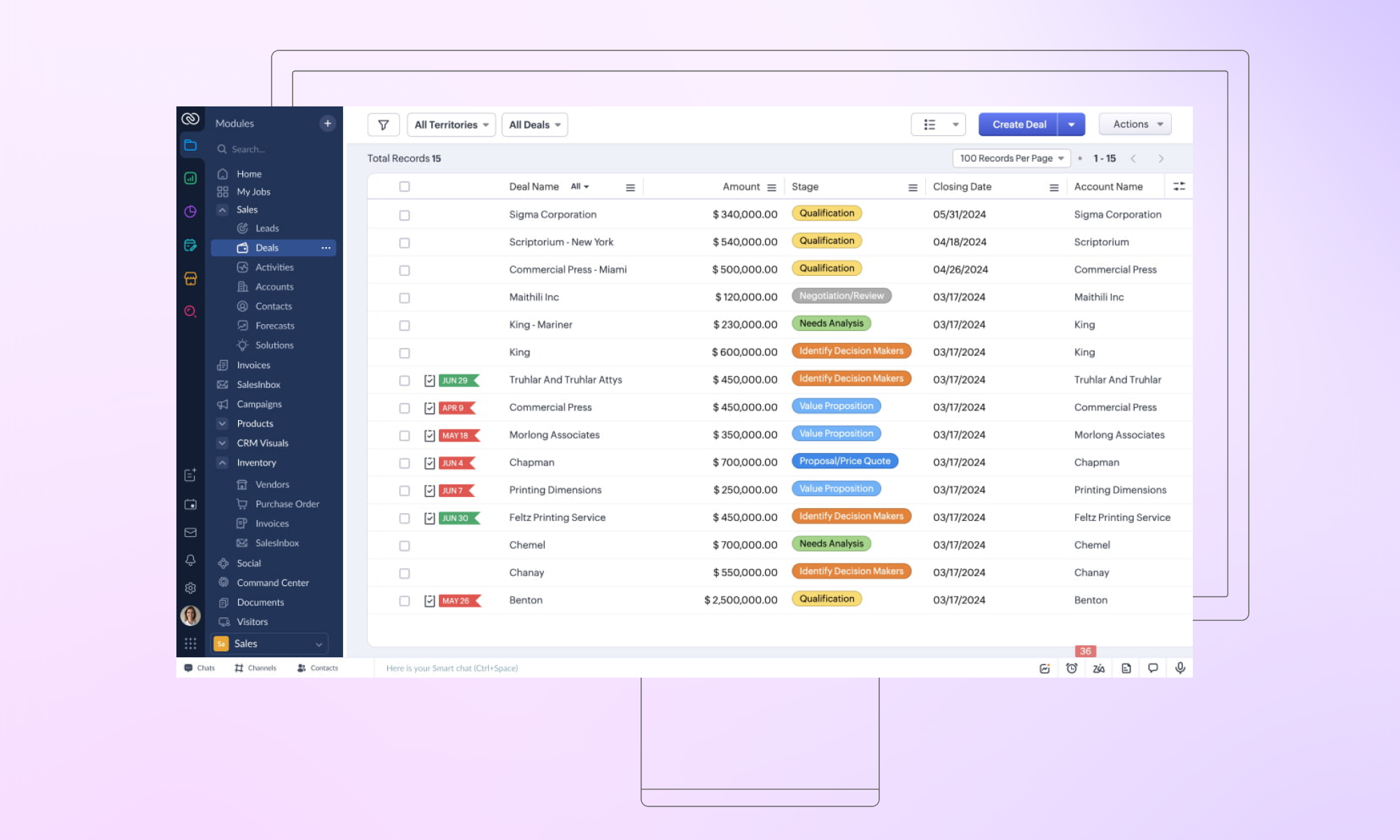

Zoho m'a surpris. Il est souvent considéré comme un "CRM économique", mais avec la bonne configuration, il est bien plus performant, en particulier pour les petites agences d'assurance qui n'ont pas besoin d'une personnalisation poussée mais qui souhaitent tout de même une véritable automatisation, des rappels et un suivi des devis.

Il n'est pas préchargé avec des modules d'assurance, mais il est suffisamment flexible pour s'adapter. De plus, son prix le rend accessible aux agences en pleine croissance qui ne peuvent pas dépenser l'argent de Salesforce.

La version gratuite permet d'utiliser jusqu'à 3 utilisateurs. Les forfaits payants commencent à 14 €/utilisateur/mois (~$16), la plupart des équipes d'assurance se situant entre 23 et 52 € (~$26-$60). Essai gratuit disponible.

Les petites agences, les courtiers en solo ou les entreprises régionales qui veulent un CRM abordable et flexible qui peut évoluer avec eux sans avoir besoin d'une équipe de développement pour le maintenir.

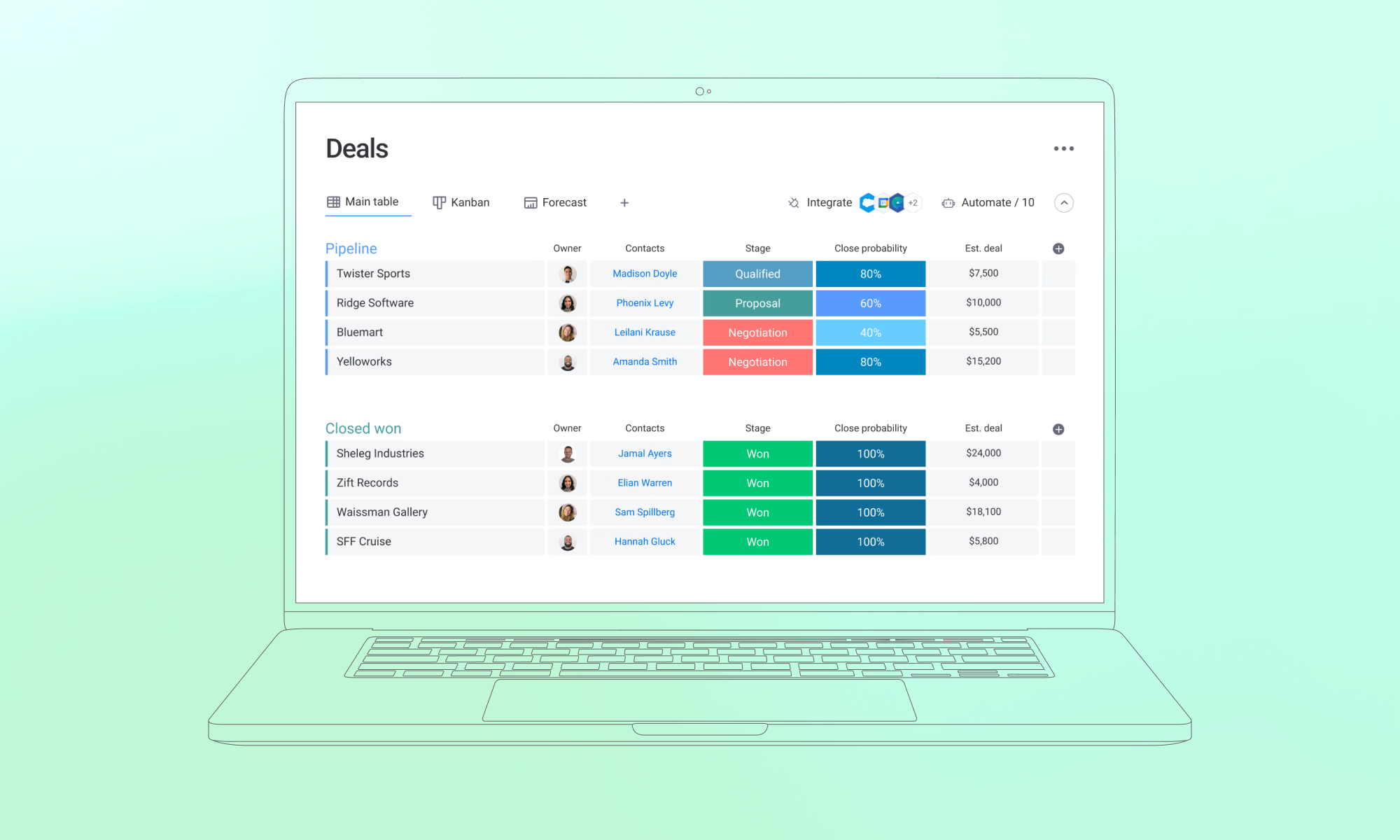

Monday n'est pas un CRM d'assurance par défaut, mais c'est l'une des plateformes les plus faciles à adapter. Si votre équipe aime les visuels, les pipelines par glisser-déposer, et ne veut pas s'embarrasser de code ou d'interfaces encombrantes, Monday est un concurrent de poids.

J'ai vu des agences de petite et moyenne taille utiliser Monday pour tout gérer, de l'accueil des clients à la gestion des renouvellements et des réclamations. Il ne s'agit pas de cas d'utilisation ultra-complexes, mais il couvre l'essentiel sans submerger votre équipe.

Le CRM de base commence à 12 €/utilisateur/mois (~$14). La plupart des équipes d'assurance voudront les niveaux Standard ou Pro pour environ €17-€28/utilisateur/mois (~$20-$32). Essai gratuit et modèles disponibles.

Les petites et moyennes agences ou sociétés de courtage qui veulent des gains rapides, des flux de travail visuels et de la flexibilité sans s'enliser dans la complexité de la gestion de la relation client (CRM).

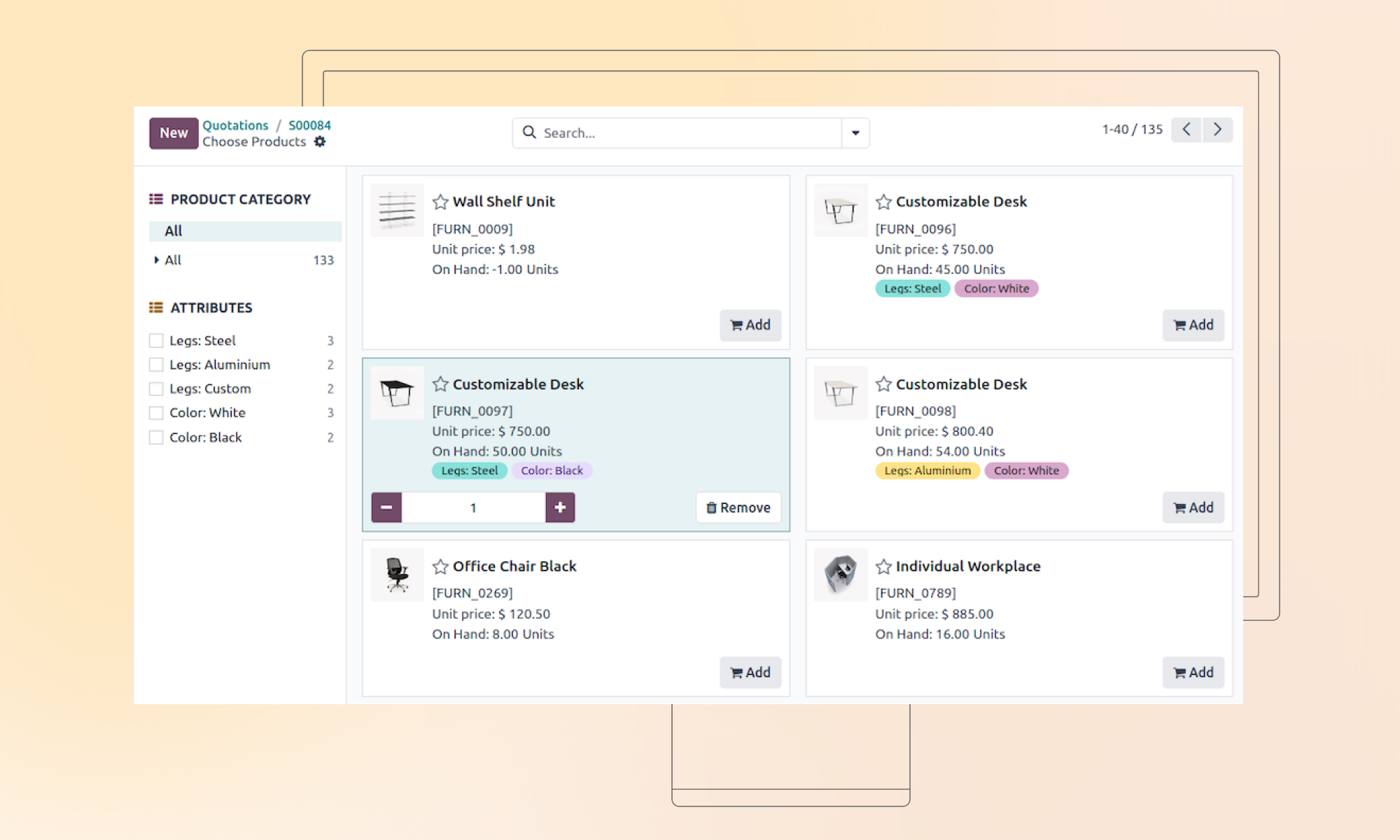

Odoo est une bête modulaire. Et c'est une bonne chose si vous voulez plus qu'un simple CRM. Odoo n'est pas spécifique à l'assurance, mais si vous êtes prêt à investir dans l'installation (ou si vous avez un partenaire technique qui sait ce qu'il fait), il devient une plateforme puissante qui relie les ventes, la gestion des polices, la comptabilité, le service d'assistance et même les ressources humaines.

Je l'ai vu briller dans des agences qui avaient dépassé les CRM de base et qui avaient besoin de plus de structure, d'appropriation et de visibilité sur l'ensemble de leurs activités. Il est particulièrement utile lorsque vous souhaitez que votre système de gestion des relations avec les assureurs communique directement avec la facturation ou les demandes d'indemnisation, sans passer par des tiers.

Démarrage à 0 € pour la version communautaire open-source (nécessite l'auto-hébergement). La version cloud payante commence à 11,90 €/utilisateur/mois (~$14), avec des frais supplémentaires pour les modules additionnels. Les prix peuvent varier en fonction du modèle de déploiement.

Les agences de taille moyenne à grande qui souhaitent un système profondément intégré et entièrement personnalisable et qui disposent des ressources techniques (ou du budget) nécessaires pour le supporter.

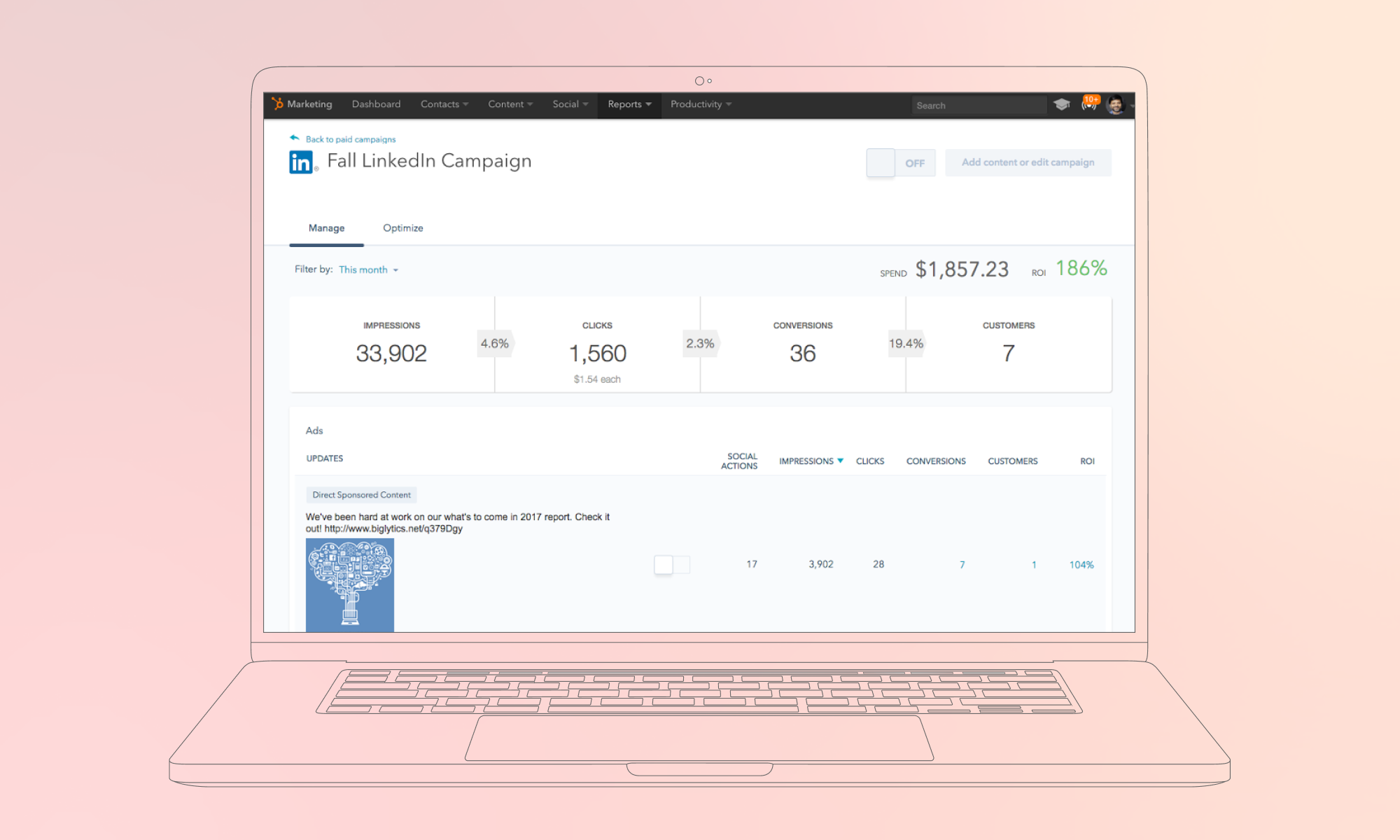

HubSpot n'est pas un assureur. Et il ne prétend pas l'être. Mais ce qu'il fait offer est l'un des meilleurs moteurs de marketing entrant sur le marché. Si votre agence fonctionne sur la génération de leads, le contenu ou les références et a besoin d'automatiser les suivis, les séquences d'emails et l'engagement des clients ? HubSpot s'en charge.

J'ai travaillé avec des agences qui utilisaient HubSpot pour tout automatiser, depuis les demandes de devis jusqu'à la relance des renouvellements. Il n'est pas aussi flexible que Salesforce ou Odoo, mais pour la visibilité du haut du tunnel et l'engagement des clients, il est difficile de faire mieux.

La version gratuite comprend les fonctions CRM de base. Les plans payants commencent à €90/mois/utilisateur (~$103) pour Sales Hub Professional.

Les agences de petite et moyenne taille qui se concentrent sur le marketing, la fidélisation des clients et l'automatisation du haut du tunnel, en particulier celles qui n'ont pas de flux de travail internes lourds en matière d'exploitation ou de souscription.

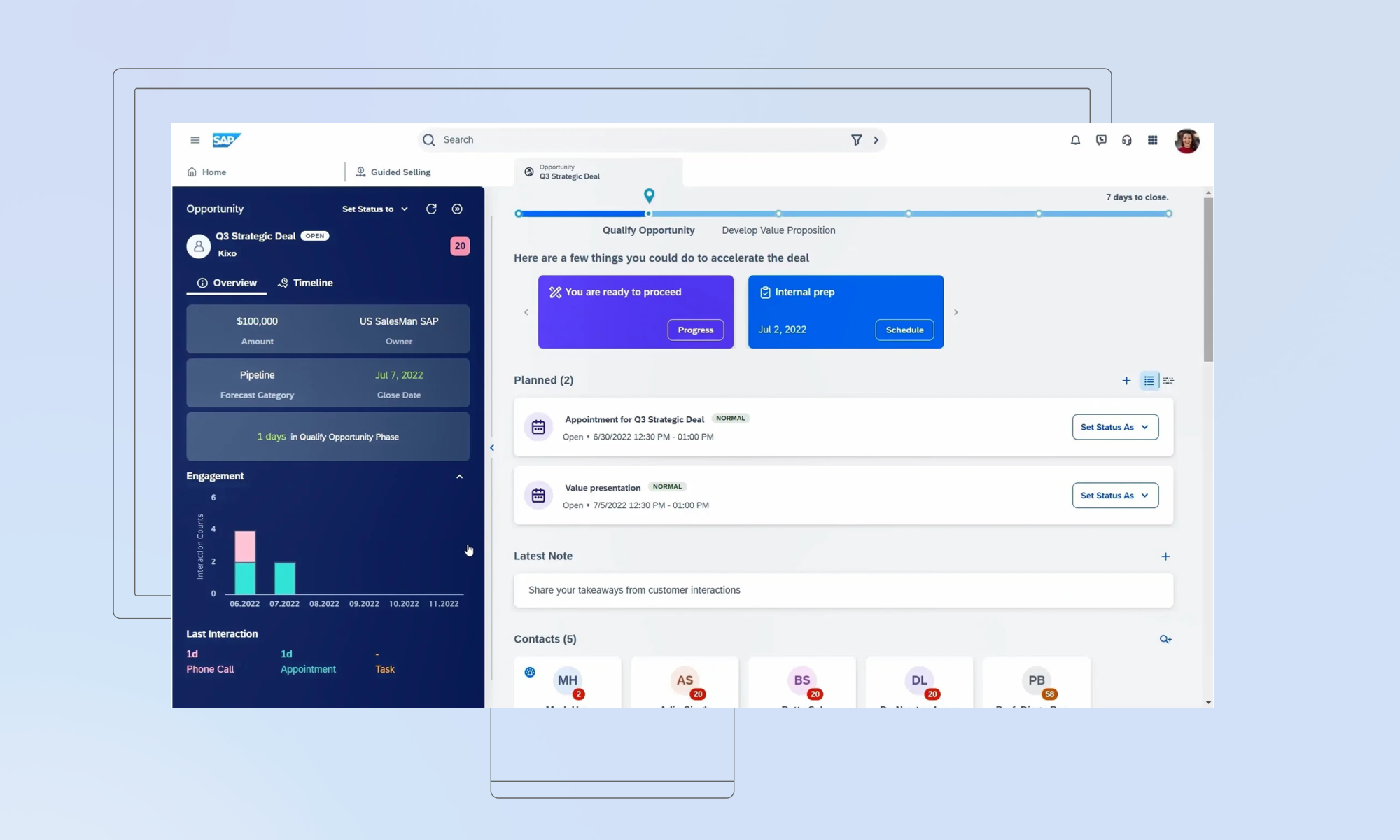

SAP CRM, qui fait désormais partie de SAP Sales Cloud, est conçu pour les organisations massives et multidépartementales qui ont besoin d'une gouvernance des données rigoureuse, d'une conformité globale et d'un alignement CRM-ERP. Il n'est pas léger. Il n'est pas prêt à l'emploi. Mais pour les transporteurs multinationaux ou les sociétés de portefeuille avec des structures de produits complexes, il peut apporter une cohérence et un contrôle sérieux.

L'avantage ? Vous bénéficiez d'une vision unifiée des politiques, de la facturation, du service client et des ventes, surtout si vous utilisez déjà SAP ERP. L'inconvénient ? Il faut du temps, de l'argent et de l'expertise pour que tout se passe bien.

SAP Sales Cloud coûte $1.476,00 par blocs de 1 utilisateur par an. Vous pouvez demander un devis personnalisé.

Assureurs d'entreprise avec plusieurs unités commerciales, des opérations mondiales et une infrastructure SAP existante.

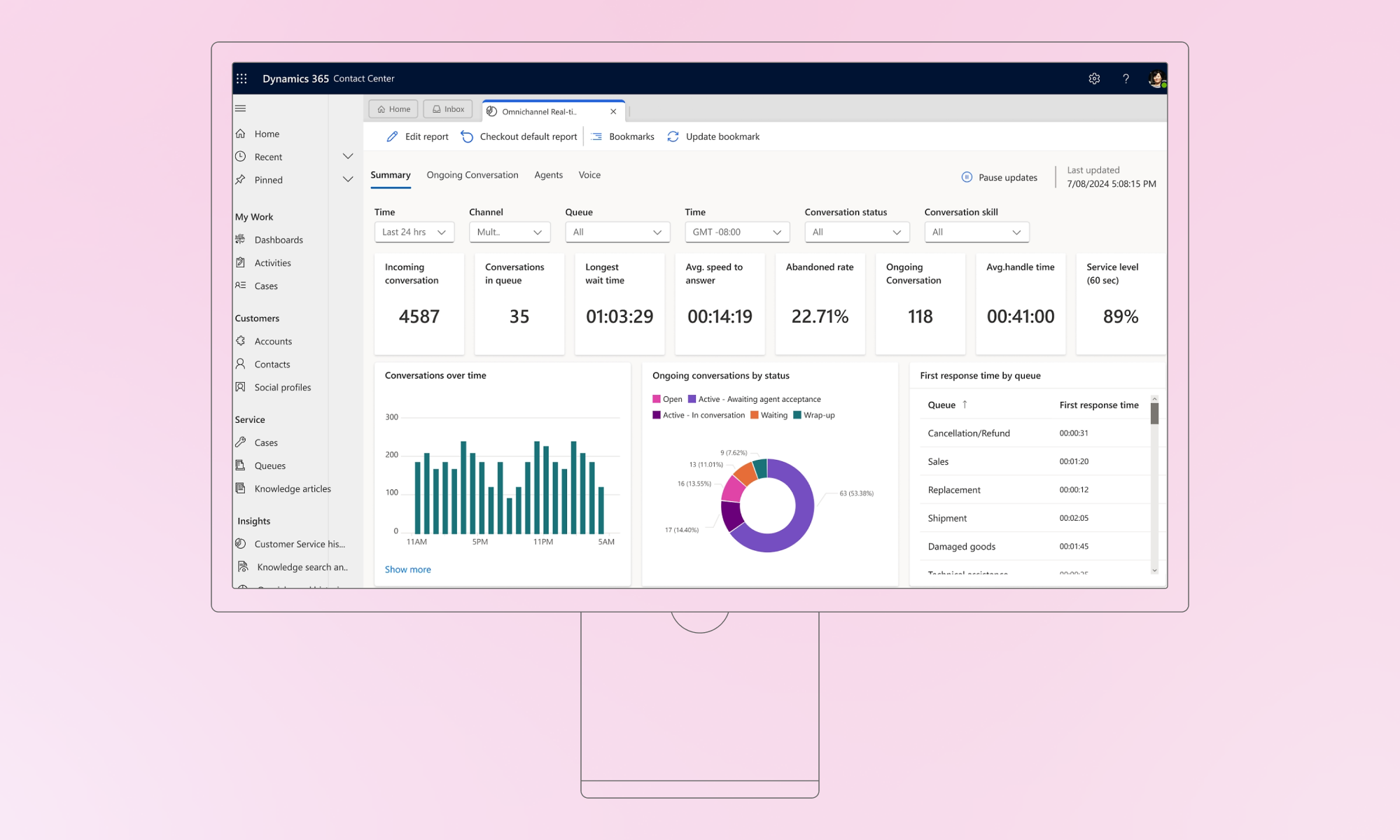

Dynamics est puissant. Mais comme pour Salesforce, la vraie question est : avez-vous l'équipe ou le partenaire nécessaire pour le façonner ? En effet, il n'est pas prêt pour l'assurance. Ce qu'il estEn revanche, il convient parfaitement aux grands assureurs qui utilisent déjà Microsoft - Azure, Office 365, Power BI, Teams.

Ce qui distingue Dynamics, c'est son intégration étroite dans l'ensemble de la pile Microsoft et sa modularité. Si vous êtes déjà intégré dans cet écosystème, cela peut vous permettre de gagner en efficacité. Mais si vous démarrez à froid, attendez-vous à une courbe d'apprentissage et à une longue période d'installation.

A partir de $65/utilisateur/mois pour Sales Professional. La plupart des configurations d'assurance nécessitent la suite Customer Engagement ($105-$150/utilisateur/mois). Tarifs personnalisés pour les déploiements en entreprise.

Les grands assureurs ou réseaux de courtiers qui utilisent déjà des outils Microsoft et qui disposent du budget et de l'équipe nécessaires au déploiement et à la configuration complets.

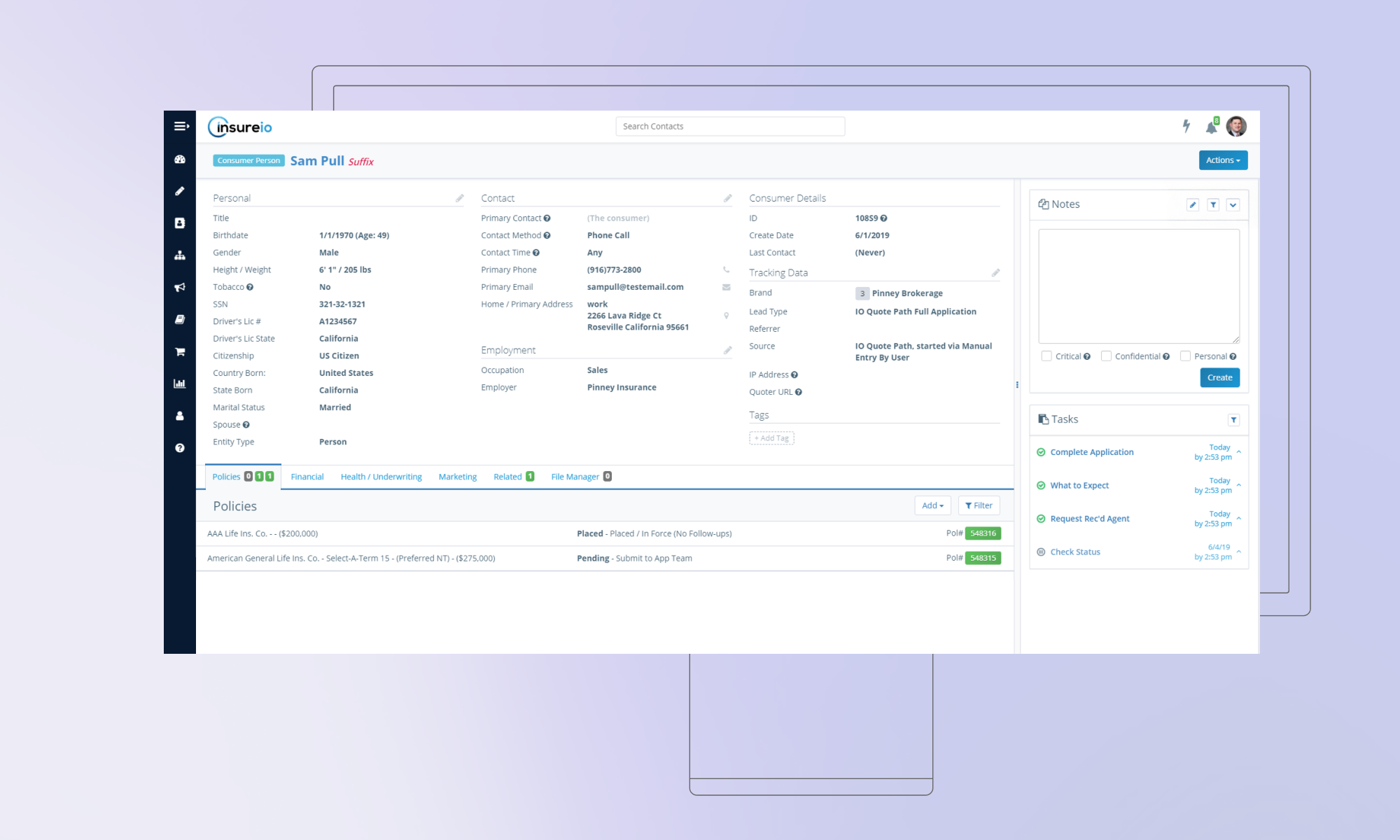

La plupart des CRM peut être configuré pour l'assurance. Insureio évite les conjectures et commence par là.

Il est conçu dès le départ pour les flux de travail de l'assurance vie et de l'assurance maladie, y compris l'établissement de devis, le suivi des demandes, la prospection de prospects et l'enregistrement de la conformité. Vous n'avez pas besoin de le faire fonctionner. Il fonctionne tout simplement parce qu'il est conçu pour votre secteur d'activité.

L'aspect le plus intéressant de cette solution est la façon dont elle relie de manière transparente le marketing, les devis et la gestion des dossiers. Vous pouvez lancer des campagnes d'e-mailing, générer des devis multi-transporteurs, suivre les approbations et même gérer le service après-vente à partir du même tableau de bord.

A partir de $25/mois pour le CRM de base. Les plans Marketing+CRM vont de $50 à $75/mois par utilisateur. Tarifs échelonnés en fonction de la taille de l'équipe et des fonctionnalités. Démonstration gratuite disponible.

Les agents d'assurance vie et santé, les courtiers et les petites agences à la recherche d'un CRM de bout en bout qui couvre les devis, la communication et la conformité en un seul endroit.

Je ne voulais pas que cette liste soit une fois de plus un tour d'horizon basé sur des discours marketing ou des démonstrations superficielles. J'ai donc demandé à mon équipe de développeurs, de consultants CRM et de spécialistes de la mise en œuvre avec lesquels j'ai travaillé sur des projets d'assurance de m'aider à creuser la question.

Nous avons créé des systèmes de gestion de la relation client de A à Z pour des courtiers, des compagnies d'assurance et des agences multirisques. Nous avons également été appelés à remplacer des systèmes qui n'étaient pas à la hauteur. Ainsi, lorsque nous examinons les CRM, nous ne nous intéressons pas à l'élégance de l'interface utilisateur, mais nous nous demandons si le système peut réellement prendre en charge les besoins des clients. Nous nous demandons s'il peut réellement prendre en charge les flux de travail désordonnés, multicanaux et à fort enjeu auxquels les équipes d'assurance sont confrontées chaque jour.

Voici ce que nous avons examiné :

Nous avons procédé à des essais en direct. Nous avons recueilli les commentaires des agences clientes. Et oui, nous avons passé beaucoup trop d'heures à lire les commentaires des utilisateurs sur G2, Capterra et Reddit.

Cette liste n'est pas exhaustive, mais elle est honnête. Et elle se concentre 100% sur les cas d'utilisation de l'assurance. C'est ce qui compte.

Toutes les agences ne correspondent pas à un modèle.

Vous avez peut-être un flux de devis personnalisé. Ou d'anciens outils qui ne sont pas compatibles avec les systèmes modernes de gestion de la relation client. Peut-être que vos équipes de vente et de service ont besoin d'interfaces totalement différentes. J'ai vu cela plus d'une fois.

Si vous avez lu jusqu'ici et que vous ne vous sentez toujours pas en mesure de choisir le meilleur logiciel de gestion de la relation client pour les agents d'assurance, il ne s'agit pas d'un signal d'alarme. C'est normal. Choisir la bonne plateforme n'est pas seulement une question de fonctionnalités, c'est aussi une question d'adéquation. Et l'intégrer à vos systèmes existants ? C'est là que les choses se compliquent.

C'est là que mon équipe intervient.

Nous aidons les compagnies d'assurance (courtiers, MGA, transporteurs) à évaluer, configurer et intégrer des CRM qui fonctionnent réellement. Qu'il s'agisse de créer une solution personnalisée ou d'adapter une plateforme standard, nous l'avons déjà fait. Et nous vous dirons si quelque chose est exagéré, sous-puissant ou n'en vaut tout simplement pas la peine.

Si vous souhaitez une deuxième paire d'yeux ou un partenaire de mise en œuvre complet, voici par où commencer.

L'assurance est une affaire de relations. Mais c'est aussi une affaire de données. Et lorsque votre CRM n'est pas conçu pour les deux, les choses se gâtent.

Les bonnes solutions CRM pour l'assurance aident les agents à garder le contrôle sur les renouvellements, à conclure davantage de contrats, à automatiser les tâches répétitives et à accorder à chaque client l'attention nécessaire pour instaurer une confiance à long terme. La mauvaise solution ? Elle se transforme en un outil de plus que personne n'utilise.

Si vous recherchez la vitesse, l'automatisation et une faible hauteur de levage, HubSpot et Zoho sont des choix solides. Si vous avez besoin d'une personnalisation poussée, de fonctionnalités d'entreprise ou d'une intégration complète, Salesforce ou Odoo est votre meilleur atout. Et si vous vivez et respirez la santé ou l'assurance vie ? Insureio a été conçu pour vous.

J'ai vu ces plateformes réussir, et j'ai vu où elles s'effondraient. Si vous ne savez pas par où commencer ou si vous avez besoin d'aide pour transformer un CRM en une véritable solution pour votre agence, nous pouvons vous aider.

Notre équipe à Innowise a construit et déployé des CRM complexes pour de grandes compagnies d'assurance. Nous n'imposons pas de solution unique. Nous mettons en œuvre ce qui vous convient.

La différence entre un CRM à usage général et un CRM pour l'assurance est qu'un CRM général suit les pistes, les contacts et les affaires, tandis qu'un CRM pour l'assurance va plus loin : il gère les polices, les sinistres, les renouvellements, les données de souscription, la conformité et le suivi des commissions. Il est adapté aux flux de travail complexes et délicats auxquels les agents d'assurance sont confrontés quotidiennement, et pas seulement aux pipelines de vente. Il s'agit de fidéliser et de réglementer, et pas seulement de convertir des clients.

Pour choisir le bon système de gestion de la relation client, commencez par examiner votre flux de travail. Avez-vous besoin d'intégrations pour les devis ? D'un suivi des réclamations ? D'une automatisation du marketing ? Examinez ensuite la taille de votre équipe, vos compétences techniques internes et votre budget. Le "meilleur" CRM n'est pas celui qui possède le plus grand nombre de fonctionnalités. C'est celui que votre équipe utilisera réellement. Ne sous-estimez pas non plus l'intégration et l'assistance.

Les avantages commerciaux des systèmes de gestion de la relation client pour l'assurance sont les suivants :

Qu'il s'agisse de relances automatiques avant l'expiration des renouvellements, de dossiers clients centralisés ou d'une meilleure visibilité sur les ventes croisées, le meilleur CRM pour les agents d'assurance maladie transforme le chaos en structure. Il aide les agents à se concentrer sur les personnes, et non sur la paperasse, et stimule la croissance sans épuiser votre équipe.

Les CRM modernes s'intègrent aux moteurs de devis, aux outils de signature électronique comme DocuSign, aux systèmes VoIP, aux outils de tarification des polices, aux plateformes de marketing, aux logiciels de comptabilité et aux API des assureurs. Les meilleurs CRM pour les agents d'assurance-vie ne fonctionnent pas en silos, ils relient les points de votre stack, de sorte que les données circulent au lieu de rester bloquées dans des outils déconnectés.

Directeur, chef de Java, solutions ERP

Michael connaît l'ERP de fond en comble - du choix du bon système à la façon dont il fonctionnera avec le reste de votre pile technologique. C'est vers lui que les gens se tournent lorsqu'ils ont besoin d'un ERP pour résoudre des problèmes opérationnels réels, et non pour en créer de nouveaux.

Votre message a été envoyé.

Nous traiterons votre demande et vous contacterons dès que possible.

En vous inscrivant, vous acceptez notre Politique de confidentialitéy compris l'utilisation de cookies et le transfert de vos informations personnelles.