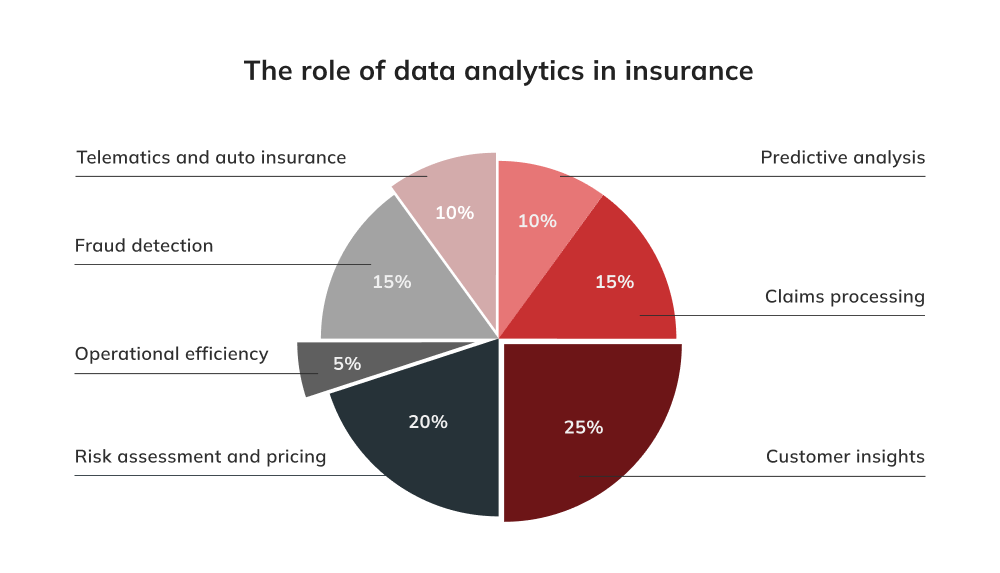

En exploitant les données en temps réel collectées à partir d'appareils connectés, tels que les smartphones équipés d'un GPS et les capteurs embarqués, les assureurs acquièrent une connaissance approfondie du comportement du conducteur et des performances du véhicule, en tenant compte de la vitesse, du kilométrage, de l'accélération, du freinage et d'autres facteurs. Grâce à cette approche fondée sur les données, ils adaptent les primes d'assurance en conséquence et fournissent des informations précises et opportunes sur les circonstances de l'accident. Les agences d'assurance peuvent ainsi régler les sinistres plus rapidement, réduire les fraudes et éviter les litiges, ce qui contribue à un comportement de conduite plus sûr.

Plutôt que de traiter la clientèle comme une entité monolithique, les assureurs la classent en fonction de l'âge, du revenu, du mode de vie, de l'appétence pour le risque et d'autres caractéristiques afin d'offrir des services centrés sur le client et de favoriser la fidélisation de la clientèle. Par exemple, un jeune professionnel célibataire vivant en milieu urbain pourrait privilégier une assurance automobile ou une assurance de location offrant certaines commodités numériques. En revanche, une personne qui vit en banlieue et qui s'occupe de sa famille sera peut-être plus intéressée par une assurance maladie ou une assurance vie complète. Grâce à la segmentation, les compagnies d'assurance peuvent également optimiser leurs stratégies de marketing afin de s'assurer qu'elles envoient le bon message à la bonne personne, réduisant ainsi l'inefficacité des approches générales.

Par le passé, le processus d'indemnisation était manuel, exigeait beaucoup de papier et souffrait de retards, ce qui laissait place à des erreurs et à des incohérences. De nombreuses évaluations préliminaires des sinistres peuvent être effectuées presque instantanément à l'aide de logiciels et d'algorithmes sophistiqués, afin d'évaluer la validité et de quantifier le montant approprié du règlement. En outre, les outils d'automatisation peuvent instantanément croiser les données du sinistre avec les détails de la police, en signalant les divergences ou les activités frauduleuses potentielles. Cela accélère la résolution des sinistres simples, permettant aux assureurs de se concentrer sur les cas plus complexes.

Au lieu de tableaux statiques et de données historiques, les tarificateurs modernes utilisent l'analytique pour obtenir une compréhension plus nuancée du risque. Des algorithmes avancés analysent de vastes quantités de données, qu'il s'agisse de sources conventionnelles comme les dossiers médicaux dans l'assurance maladie ou de sources plus contemporaines comme la télématique dans l'assurance automobile. Cela permet de comprendre les schémas, de prédire les risques futurs et d'évaluer la valeur réelle d'une police. Désormais, l'assureur peut adapter les primes en fonction du mode de vie, des habitudes d'exercice ou même des prédispositions génétiques, plutôt que de proposer une police générique basée sur l'âge et les données de santé primaires.

Dans un secteur historiquement considéré comme impersonnel et transactionnel, l'infusion de l'analyse des données dans l'assurance a permis aux compagnies de comprendre et de répondre de manière proactive aux besoins individuels des assurés. En analysant les schémas de renouvellement des polices, les demandes d'indemnisation et les interactions, les assureurs acquièrent des connaissances sur les préférences, les comportements et les points faibles de leurs clients. Cette compréhension approfondie permet une communication sur mesure, des offres de service opportunes et des recommandations de produits personnalisées. L'assureur peut, par exemple, suggérer une assurance habitation lors de l'achat d'une nouvelle propriété ou une couverture médicale complète lorsque la famille s'agrandit, en analysant les étapes de la vie du client.

Au fond, l'analyse prédictive exploite les données historiques pour prévoir les résultats futurs. Pour les assureurs, cela signifie anticiper les besoins, les comportements et les défis potentiels des clients avant qu'ils ne se manifestent. En modélisant divers points de données - tels que les interactions avec les assurés, l'historique des sinistres et les changements de mode de vie - les assureurs peuvent prédire quand un client est sur le point de vivre un événement important de sa vie, comme l'achat d'une nouvelle maison ou la fondation d'une famille. Cela leur permet de proposer de manière proactive des produits ou des conseils pertinents, transformant ainsi des points de douleur potentiels en transitions harmonieuses. En outre, l'analyse prédictive peut améliorer le processus de gestion des sinistres, en prévoyant la probabilité qu'un sinistre devienne controversé ou se prolonge, et en permettant aux assureurs d'intervenir rapidement en proposant des solutions ou un soutien personnalisé.

La modélisation des catastrophes cherche à anticiper et à quantifier les répercussions financières d'événements imprévisibles à grande échelle, qu'il s'agisse de catastrophes naturelles comme les ouragans ou de crises d'origine humaine. Plutôt que de s'appuyer uniquement sur des données historiques, dont la portée peut être limitée, l'analyse des données dans le domaine de l'assurance intègre divers flux de données, y compris des observations environnementales en temps réel, des tendances climatiques et même des dynamiques sociopolitiques. Par exemple, si les modèles d'ouragans passés donnent quelques indications, l'intégration de données de température océanique en temps réel ou de taux de déforestation peut fournir une évaluation plus précise de l'intensité future des cyclones ou des risques d'inondation. En analysant les schémas de développement urbain, les assureurs peuvent prédire les concentrations potentielles de pertes de biens dans les zones nouvellement développées et susceptibles de subir des catastrophes naturelles.

En exploitant la puissance des données, les compagnies d'assurance peuvent adapter leurs offres pour mieux servir les particuliers et les entreprises, en proposant des recommandations personnalisées aux assurés et en encourageant des choix et des comportements plus sains. Par exemple, des employés en meilleure santé sont souvent plus productifs, ont moins de jours de maladie et réduisent les coûts de santé à long terme. En analysant les données générées par les programmes de santé et de bien-être, les compagnies d'assurance peuvent affiner leurs modèles d'évaluation des risques et leurs structures de tarification, ce qui se traduit par une souscription plus précise et des primes potentiellement moins élevées pour les entreprises. En outre, l'analyse des données permet aux assureurs d'identifier les tendances et les opportunités en matière de soins préventifs et d'intervention précoce, ce qui réduit en fin de compte les demandes d'indemnisation et les dépenses de santé globales.

L'analyse des données dans le règlement des sinistres aide les entreprises à accélérer le traitement des sinistres légitimes. L'évaluation automatisée des sinistres et les modèles prédictifs permettent aux compagnies d'assurance d'identifier les sinistres valables et de les régler plus efficacement, ce qui réduit la pression financière sur les entreprises et leur permet de reprendre leurs activités dès que possible. Cette efficacité peut favoriser la confiance entre les assureurs, les assurés et les entreprises et améliorer la satisfaction globale des clients. En outre, l'analyse des données dans le secteur de l'assurance contribue à l'optimisation des provisions pour sinistres, ce qui permet aux entreprises de mettre de côté le montant approprié de fonds pour les sinistres futurs anticipés avec précision. Cette optimisation permet aux entreprises de ne pas payer trop cher leurs primes d'assurance et de conserver les ressources financières nécessaires à leurs activités.

L'une des principales façons dont l'analyse des données aide les assureurs en matière de cybersécurité est l'analyse des données historiques et en temps réel. En examinant de vastes ensembles de données, les assureurs identifient des schémas et des anomalies indiquant des cybermenaces ou des vulnérabilités, ce qui leur permet de traiter les problèmes potentiels avant qu'ils ne se transforment en brèches majeures. Par exemple, les assureurs peuvent détecter des tentatives de connexion ou des schémas d'accès aux données inhabituels, qui peuvent indiquer des tentatives d'accès non autorisé, et prendre des mesures immédiates pour contrecarrer les cyberattaques. En outre, en analysant des facteurs tels que le secteur d'activité, la taille, l'infrastructure de cybersécurité et les données historiques d'une entreprise, les agences d'assurance peuvent évaluer avec précision le niveau de risque que présente un client. Elles peuvent ensuite adapter les polices d'assurance et les tarifs aux profils de risque spécifiques de leurs clients, en veillant à ce qu'ils bénéficient d'une couverture adéquate sans payer trop cher.

En analysant de vastes ensembles de données contenant des informations sur les demandes de soins de santé, les antécédents des patients et les pratiques de facturation, les compagnies d'assurance peuvent repérer les irrégularités et les schémas indiquant une fraude potentielle. L'analyse des données permet de repérer les cas où un prestataire facture des services qui n'ont pas été rendus ou lorsqu'un patient reçoit un volume inhabituellement élevé de services dans un court laps de temps. Ces anomalies déclenchent des enquêtes, ce qui permet aux assureurs d'intervenir rapidement et de prévenir d'autres activités frauduleuses. Cela permet non seulement d'éviter aux assureurs des pertes financières substantielles, mais aussi de préserver l'intégrité du système de santé, car les activités frauduleuses dans le secteur de la santé impliquent souvent plusieurs parties qui s'entendent pour maximiser les gains mal acquis.

L'analyse de vastes ensembles de données comprenant des informations sur les attributs des biens, leur emplacement, les données historiques sur les sinistres et les tendances du marché est l'un des principaux moyens par lesquels l'analyse des données peut contribuer à l'évaluation des biens. Cela permet non seulement de réduire la probabilité de sous-assurance ou de sur-assurance, mais aussi de garantir que les entreprises paient des primes qui correspondent à la valeur réelle des biens. L'analyse des données permet aux agences d'assurance de disposer d'informations en temps réel sur les biens, car les conditions du marché et la valeur des biens peuvent fluctuer rapidement, ce qui complique la mise à jour de la couverture d'assurance. En outre, l'analyse des données leur permet de suivre l'évolution de la valeur des biens et de la dynamique du marché, ce qui garantit que les polices restent pertinentes et que les entreprises sont correctement protégées.

L'une des principales façons dont l'analyse des données dans le secteur de l'assurance contribue au développement des produits consiste à exploiter de vastes ensembles de données pour en tirer des enseignements, les assureurs recueillant des données sur le comportement des clients, l'historique des sinistres, les tendances du marché et les risques émergents. En analysant cette mine d'informations, ils acquièrent une meilleure compréhension des besoins, des préférences et des comportements des clients. Cela leur permet de développer et d'adapter les produits d'assurance à des données démographiques et à des segments de clientèle spécifiques, en veillant à ce que les entreprises bénéficient d'une couverture conforme à leur profil de risque unique. L'analyse des données permet aux assureurs d'identifier les lacunes du marché et de développer des offres d'assurance innovantes en conséquence. En analysant les tendances du marché et les risques émergents, les assureurs peuvent repérer les opportunités de lancer de nouveaux produits qui répondent à des besoins urgents et évolutifs.