Votre message a été envoyé.

Nous traiterons votre demande et vous contacterons dès que possible.

Le formulaire a été soumis avec succès.

Vous trouverez de plus amples informations dans votre boîte aux lettres.

Sélection de la langue

Les responsables financiers se demandent souvent si le CSRD est vraiment important. Ma réponse : Absolument, elle est plus importante que jamais. La directive sur les rapports de durabilité des entreprises a remplacé les brochures volontaires sur la CSR par un règlement contraignant sur la divulgation des informations relatives à la durabilité dans l'ensemble de l'Union européenne.

La directive couvre déjà l'exercice 2024 pour la première vague de sociétés entrant dans le champ d'application, et leurs premiers rapports CSRD doivent être publiés en 2025. Les régulateurs estiment qu'environ 50 000 organisations relèveront du CSRD. Ce chiffre inclut désormais les multinationales non européennes dès lors qu'elles atteignent le seuil de 150 millions d'euros de chiffre d'affaires.

Dans ce guide étape par étape, je vous ferai découvrir les origines de la CSRD, l'étude a pour but de présenter les principales exigences de la directive ESG et de préciser qui doit s'y conformer et à quel moment. Vous obtiendrez une feuille de route pratique pour la préparation et le reporting, une vue d'ensemble des changements réglementaires à venir, des idées sur l'adoption de AI pour les informations ESG, et des stratégies pour transformer la conformité en avantage stratégique.

CSRD est l'acronyme de Corporate Sustainability Reporting Directive (directive sur les rapports de durabilité des entreprises). Elle fait de la publication d'informations sur le développement durable une obligation légale dans toute l'Union européenne. Si votre organisation atteint deux des trois seuils suivants : 250 employés, 50 millions d'euros de chiffre d'affaires ou 25 millions d'euros d'actifs, vous entrez dans le champ d'application de la directive. La directive s'applique également aux petites et moyennes entreprises cotées en bourse, aux banques, aux assureurs et à tout groupe non européen réalisant un chiffre d'affaires supérieur à 150 millions d'euros dans l'UE.

L'établissement des rapports se fait en quatre étapes :

Le CSRD exige des informations sérieuses. Les entreprises doivent utiliser les normes européennes de rapport sur le développement durable (ESRS). Les 12 normes ESRS (2 transversales, 5 environnementales, 4 sociales, 1 de gouvernance) requièrent des centaines de points de données spécifiques, tels que les émissions des champs d'application 1, 2 et 3 dans le cadre de la norme ESRS E1 pour le climat, adaptés à votre évaluation de l'importance relative. Les rapports doivent être marqués numériquement au format ESEF, ce qui signifie qu'ils doivent être lisibles par machine avec des balises XBRL dans un fichier XHTML. En outre, une assurance limitée est requise pour les rapports de l'exercice 2024, et une assurance raisonnable pour l'exercice 2028.

Le CSRD est juridiquement contraignant. Le non-respect des règles peut entraîner des amendes et, pire encore, éroder la confiance des investisseurs plus rapidement que n'importe quelle pénalité. Commencez donc dès maintenant à mettre en place des pistes d'audit solides pour vous préparer.

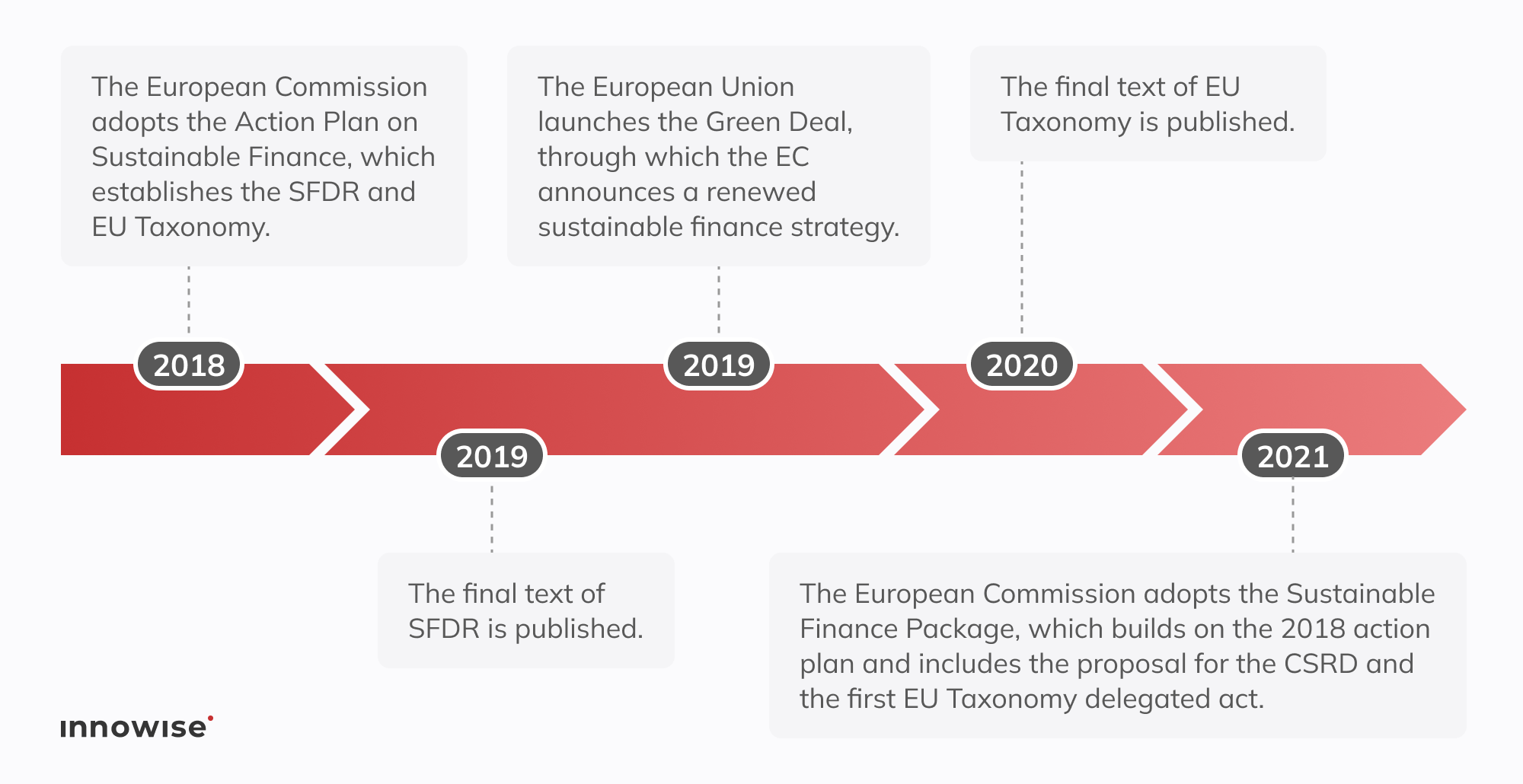

Retour en 2014, la directive sur l'information non financière (NFRD) couvrait environ 11 700 entités d'intérêt public. L'intention était bonne, mais les règles permettaient aux entreprises de choisir leurs propres formats, d'omettre des données et d'ignorer toute forme d'assurance. Le résultat était incohérent et difficilement comparable.

Les législateurs ont dû faire face à des exigences accrues de la part des investisseurs, aux objectifs du Green Deal de l'UE et à une vague de scandales liés à l'écoblanchiment. Par exemple, en 2015, le Le scandale de la tricherie sur les émissions du Dieselgate chez Volkswagen a montré comment des déclarations environnementales exagérées peuvent masquer de graves malversations. Fin 2022, ils ont remplacé le NFRD par le CSRD, qui rattache les informations sur le développement durable aux objectifs climatiques et sociaux plus larges de l'UE.

Le CSRD reprend les fondements du NFRD et les renforce de trois manières principales :

Après ce petit rappel historique, venons-en directement aux objectifs et principes clés qui sous-tendent le CSRD.

La directive sur la responsabilité sociale des entreprises (CSRD) définit ce qui constitue un bon rapport ESG si vous souhaitez opérer dans l'UE sans complications. Au fond, cette directive fixe des objectifs clairs et quelques règles de base que chaque entreprise doit respecter. Voici ce qui compte vraiment.

Le CSRD est la centrale de données sur le développement durable de l'UE. Il n'est pas isolé. Les chiffres que vous divulguez dans le cadre du CSRD sont intégrés dans la taxonomie de l'UE, qui exige des rapports sur la proportion des activités alignées sur la taxonomie (par exemple, les recettes, les dépenses d'investissement, les dépenses d'exploitation, conformément à l'article 8 du règlement relatif à la taxonomie).

Ces mêmes chiffres alimentent ensuite les informations de la SFDR et étayent la conformité à la directive sur les services de dépôt de documents (CSDD). En d'autres termes, si vous êtes dans le champ d'application du CSRD, vous travaillez automatiquement en fonction des règles de la taxonomie, et votre rapport CSRD devient la principale source de données que les gestionnaires d'actifs intègrent dans leurs modèles SFDR.

Les investisseurs sont avides de données ESG auxquelles ils peuvent se fier. Près de neuf investisseurs institutionnels sur dix déclarent s'appuyer davantage sur les informations ESG. Pourtant, quatre entreprises sur cinq trouvent encore les données inégales en termes de matérialité et de cohérence.

Le CSRD va bien au-delà du petit groupe d'entreprises couvertes par l'ancienne directive. Elle couvre désormais des dizaines de milliers d'entités. Que vous soyez dans l'UE ou en dehors, votre taille et vos revenus dans l'UE déterminent si vous devez faire une déclaration. Vous trouverez ci-dessous une liste de contrôle pratique qui vous permettra de déterminer si votre entreprise entre dans le champ d'application de la directive.

Une entreprise de l'UE est soumise au CSRD si elle coche au moins deux de ces cases à deux dates de bilan consécutives.

employés en moyenne

du chiffre d'affaires net

total des actifs

Si vous répondez à l'une de ces deux conditions, vous devez faire une déclaration. Par exemple, une société d'ingénierie employant 300 personnes et disposant de 28 millions d'euros d'actifs, mais dont le chiffre d'affaires n'est que de 40 millions d'euros, doit tout de même se conformer à la législation. En effet, elle remplit les critères relatifs au nombre d'employés et aux actifs.

Les PME cotées sur un marché réglementé de l'UE entrent également dans le champ d'application, à l'exception des micro-entreprises (moins de 10 salariés, 0,7 million d'euros de chiffre d'affaires ou 0,35 million d'euros d'actifs), qui en sont exemptées en vertu de l'article 19 bis de la directive comptable.

Si votre entreprise est basée dans l'UE et qu'elle franchit les seuils de taille, le CSRD s'applique automatiquement. Pas de conditions particulières, pas de solutions de contournement. Vous êtes dans le champ d'application.

C'est là que de nombreuses entreprises se trompent : Le CSRD dépasse largement les frontières de l'UE. Si vous dirigez une société mère non européenne, deux contrôles déterminent si vous êtes pris :

Par exemple, une entreprise canadienne de logiciels réalise 200 millions d'euros de ventes dans l'UE par l'intermédiaire d'une succursale à Dublin, dont le chiffre d'affaires s'élève à 45 millions d'euros. Il se peut qu'elle n'ait jamais pensé à l'établissement de rapports sur l'UE auparavant. Mais en vertu de la directive CSRD, elle doit désormais produire un rapport complet sur le développement durable pour ses activités dans l'UE.

Enfin, un dernier problème se pose. L'UE pourrait un jour accepter comme équivalentes des normes de durabilité non européennes, mais ce n'est pas encore le cas. Par conséquent, si vous êtes couvert, les normes ESRS sont votre point de départ. Pas de raccourci pour l'instant.

Le CSRD ne s'applique pas à tout le monde du jour au lendemain. Le déploiement s'étend de 2024 à 2029, principalement en fonction du fait que vous étiez déjà couvert par l'ancienne directive sur l'information non financière ou de la taille de votre entreprise.

Voici comment je l'explique à mes clients qui veulent savoir quand leur premier rapport arrive sur le bureau du directeur financier :

Si vous étiez déjà soumis au NFRD (entreprises cotées en bourse dans l'UE comptant plus de 500 employés), vous déposerez votre premier rapport CSRD l'année prochaine. Il n'y a pas de changement.

Celle-ci était prévue pour les PME cotées en bourse, mais elle a été reportée à l'exercice 2028 (rapports en 2029). Vous pouvez toujours opter pour un report facultatif, qui vous ferait passer à l'exercice 2029.

Celle-ci s'adresse aux sociétés mères non européennes réalisant un chiffre d'affaires de plus de 150 millions d'euros dans l'UE et disposant d'une filiale ou d'une succursale remplissant les conditions requises. Le coup d'envoi sera donné au cours de l'exercice 2028 (rapports attendus en 2029). Ce calendrier reste inchangé par rapport aux règles actuelles.

| Vague | Qui rapporte | Année de dépôt initiale | Nouvelle année de dépôt |

| Vague 1 (exercice 24) | Entités du NFRD (500+ employés) | 2025 | 2025 |

| Vague 2 (exercice 25) | Grandes entreprises de l'UE | 2026 | 2028 |

| Vague 3 (exercice 26) | PME cotées en bourse (opt-out pour retarder davantage) | 2027 | 2029 |

| Vague 4 (exercice 28) | Sociétés mères hors UE dans le champ de l'enquête | 2029 | 2029 |

Lorsque les échéances changent, il est tentant de repousser la préparation. Ainsi, si vous n'entrez pas dans le champ d'application initial du CNRD, votre calendrier vient d'être décalé, mais le travail de préparation ne disparaît pas pour autant. Je suggère toujours à mes clients d'utiliser ce temps supplémentaire à bon escient. Comblez vos lacunes en matière de données dès maintenant, testez votre processus d'assurance au plus tôt et évitez de paniquer à la dernière minute lorsque votre nouvelle échéance se présentera.

Les exigences en matière de rapports CSRD sont détaillées, spécifiques et conçues pour résister au microscope d'un auditeur. Vous devrez déclarer des points de données exacts couvrant les facteurs environnementaux, sociaux et de gouvernance et les étayer par des preuves susceptibles de passer l'épreuve d'une assurance indépendante. En outre, chaque donnée doit être étiquetée numériquement pour que les régulateurs et les investisseurs puissent l'intégrer directement dans leurs systèmes.

Dans les sections ci-dessous, je vais détailler ce que vous devez couvrir dans le cadre de chaque pilier : environnemental, social et de gouvernance.

Dans le cadre du CSRD, vous suivez les normes ESRS regroupées en 3 piliers. Considérez-les comme votre liste de contrôle pour une conformité totale.

N'attendez pas la dernière minute pour y remédier. La plupart des lacunes que je vois dans les rapports proviennent de données manquantes sur les fournisseurs, d'une cartographie imprécise de la chaîne de valeur ou d'une documentation insuffisante sur les objectifs climatiques. Si cette liste vous semble décourageante, il est judicieux de faire appel à une équipe de consultants en ERP ou en développement durable qui a vécu plusieurs cycles de reporting.

Le CSRD exige une double matérialité. Vous devez montrer à la fois comment votre entreprise affecte les personnes et la planète et comment les questions de développement durable influencent les flux de trésorerie et la valeur de l'entreprise.

Vous détaillez l'empreinte que vous laissez derrière vous. Cela signifie des chiffres précis sur les émissions de carbone, l'utilisation de l'eau, la diversité de la main-d'œuvre, la diligence raisonnable en matière de droits de l'homme, etc. Par exemple, si vous exploitez une usine dans une région où l'eau est rare, vous devez indiquer les volumes prélevés, partager les résultats des consultations communautaires et mettre en évidence les investissements réalisés dans les systèmes de recyclage de l'eau. Ces chiffres montrent aux régulateurs et aux habitants de la région comment vos activités influent sur leur vie.

Vous cartographiez la manière dont les facteurs de durabilité influencent vos résultats. Pensez aux risques de la chaîne d'approvisionnement liés au climat, aux coûts des conditions météorologiques extrêmes, aux changements de réglementation ou à l'évolution des exigences des investisseurs. Par exemple, un détaillant qui s'approvisionne auprès de fournisseurs situés dans des zones inondables quantifiera les retards d'expédition potentiels, modélisera les coûts logistiques supplémentaires et expliquera comment la diversification des fournisseurs préserve les flux de trésorerie futurs.

D'après mon expérience, les rapports CSRD les plus solides commencent par une double évaluation structurée de la matérialité. Interrogez les principales parties prenantes, cartographiez les risques sur une carte thermique, obtenez l'approbation du conseil d'administration et vous saurez ce qui doit figurer dans le rapport final et ce qui doit rester sur le tableau de bord interne.

Considérez CSRD comme votre manuel de référence pour les rapports de développement durable de l'UE considérez CSRD comme votre manuel de référence ESG de l'UE qui rassemble les meilleures normes mondiales afin que vous ne fassiez qu'un seul rapport.

Vous obtenez une liste claire d'indicateurs, des invites narratives et une taxonomie XBRL. Dès votre premier rapport, vous produisez un fichier XHTML avec des balises XBRL en ligne pour que les machines puissent accéder à vos données.

La GRI se concentre sur l'impact des parties prenantes et sur l'aspect extérieur de la double matérialité. Le CSRD reflète cette approche lorsque vous montrez comment vos activités affectent les personnes et la planète.

Les normes IFRS S1 et S2 fournissent une taxonomie pour les informations sur les risques. Vous insérez ces scénarios directement dans la section "matérialité financière" du CSRD.

Sous l'égide de l'ISSB, la SASB propose désormais ces ICP sectoriels. Ils sont directement liés aux thèmes de l'ESRS, ce qui permet d'éviter les doubles emplois. Voici comment ils s'articulent :

| Cadre de travail | Mandat | Principaux points d'attention | Comment il s'intègre dans le CSRD |

| ESRS | Obligatoire UE | Mesures détaillées | Taxonomie complète et étiquetage XBRL pour toutes les divulgations CSRD |

| GRI | Volontaire | Impacts sur les parties prenantes | Guide votre impact du côté de la double matérialité |

| IFRS-ISSB | Finalisé | Risque pour l'investisseur | Aligne la taxonomie des risques sur les besoins en matière de matérialité financière |

| SASB | Volontaire | ICP de l'industrie | Correspondance directe avec les thèmes de l'ESRS pour rationaliser les rapports |

En rédigeant d'abord votre rapport CSRD, puis en étiquetant chaque point de données par rapport à d'autres cadres, vous pouvez potentiellement réduire la duplication du travail d'environ 40%, en fonction de votre configuration.

Vous apprendrez rapidement que la conformité au CSRD exige un budget important, du temps et un travail d'équipe dans les domaines de la finance, du développement durable, de l'informatique et de l'approvisionnement. Si vous manquez une étape, votre calendrier s'effondre, ce qui a pour effet de frustrer les auditeurs, les régulateurs et les investisseurs. Voici quatre obstacles auxquels vous serez confronté et comment vous pouvez les surmonter.

Vos chiffres sur les émissions se trouvent dans le système financier. Vos statistiques sur la diversité se trouvent dans les RH. Les risques liés aux fournisseurs se cachent dans les feuilles de calcul des achats. Tant que vous n'aurez pas regroupé tout cela en un seul endroit, vous aurez du mal à étiqueter les données pour XBRL et à satisfaire les auditeurs. Mettez en place un lac de données ESG central qui se connecte via des API à vos plateformes ERP, SIRH et fournisseurs. Ajoutez des règles de validation pour que votre équipe repère les chiffres manquants ou bizarres bien avant le jour de l'audit.

Les licences de logiciels spécialisés, les services de conversion XBRL, les frais d'assurance et les analystes supplémentaires peuvent grever votre budget. Procédez à un déploiement progressif en classant les unités opérationnelles en fonction de l'importance relative et du risque, puis étalez la mise en œuvre sur deux exercices financiers. Cela permet d'équilibrer les sorties de fonds et donne aux équipes la marge de manœuvre nécessaire pour apprendre chaque étape sans avoir à payer d'avance une facture astronomique.

Vous menez peut-être déjà des projets solides en matière de développement durable, mais s'ils ne correspondent pas aux points de données de l'ESRS, les auditeurs signaleront immédiatement les lacunes. Organisez un atelier de deux jours avec vos responsables du développement durable, des finances, des affaires juridiques et de l'informatique. Ensemble, vous élaborez une matrice d'alignement CSRD qui relie chaque objectif stratégique à son exigence ESRS et désigne clairement le propriétaire des données. Cette matrice sert également de plan de projet et de liste de contrôle pour les audits.

Le CSRD n'est pas facultatif. Si vous vous relâchez en matière de rapports sur le développement durable, vous risquez de lourdes amendes, des poursuites judiciaires, des interdictions d'exercer et une atteinte durable à votre réputation. De nombreuses équipes considèrent cela comme un crédit supplémentaire et finissent par le payer plus tard. Voyons ce qu'il en est et comment éviter les ennuis.

J'ai établi une petite liste de contrôle pour transformer les rapports de CSRD en une routine régulière. Abordez chaque étape dans l'ordre et vous passerez de la panique de dernière minute à des progrès prévisibles. Les auditeurs ne trouveront pas de surprises, les régulateurs ne s'en mêleront pas et les investisseurs constateront une dynamique constante.

Chaque État membre de l'UE a ses propres règles. Passez rapidement en revue les règles locales dès maintenant afin de ne pas vous heurter à des exigences cachées plus tard. Cette vérification précoce vous permettra de respecter votre budget et votre calendrier.

Discutez avec les parties prenantes, représentez les risques sur une carte thermique et reliez chacun d'entre eux à sa norme ESRS. Cette approche permet au rapport d'être allégé et de se concentrer sur les questions qui comptent vraiment.

Rédigez directement dans le format électronique unique européen (XHTML avec balises XBRL en ligne). Laissez un logiciel intelligent baliser vos données au fur et à mesure. Pas de reformatage fastidieux par la suite.

L'assurance limitée entre en vigueur pour l'exercice 2024 et l'assurance raisonnable pour l'exercice 2028. Créez dès maintenant des pistes de preuves et renforcez les contrôles pendant que la charge de travail est encore gérable.

Les échéances du CSRD ne doivent pas être perçues comme des bombes à retardement. Chez Innowise, nous avons mis au point un processus allégé et reproductible qui fait de la conformité au CSRD un moteur stratégique. Notre approche suit les directives de l'ESRS (European Financial Reporting Advisory Group), y compris les dernières mises à jour des questions-réponses, afin que vous puissiez respecter chaque norme en toute confiance.

Notre feuille de route en cinq étapes pose des jalons clairs et vous fournit des données fiables à chaque étape. Nous remplaçons les suppositions par une structure et nous vous donnons des informations que vous pouvez utiliser pour stimuler la croissance. Passez de l'incertitude à la confiance, un pas après l'autre.

Trop d'entreprises ne découvrent leurs lacunes en matière de CSRD qu'à l'approche de la date limite de dépôt. C'est à ce moment-là que les coûts augmentent et que des erreurs se glissent. Il est plus judicieux de procéder d'emblée à une vérification de l'état de préparation et de transformer les surprises en un plan réalisable.

C'est exactement ce que fait notre sprint de diagnostic. Nous commençons par une analyse approfondie de vos politiques et de vos dossiers de développement durable. Ensuite, nous organisons des ateliers avec les parties prenantes afin de déterminer ce qui préoccupe le plus vos investisseurs, vos employés, vos clients et les autorités de réglementation. Au cœur de cette démarche se trouve l'évaluation Double Materiality (indispensable dans le cadre de l'ESRS 1), qui met en évidence l'impact de votre entreprise sur le développement durable et l'impact de ces questions sur vos résultats.

Lorsque nous aurons terminé, vous repartirez avec trois choses que vous pourrez mettre en œuvre immédiatement :

Lorsque vous disposez d'une carte claire, vous protégez les budgets, vous fixez des priorités et vous maîtrisez votre cycle d'établissement de rapports.

Un bon rapport CSRD vit et meurt grâce à des données solides. La recherche manuelle de chiffres dans des feuilles de calcul ou la chasse aux courriels des fournisseurs ne suffisent pas. Vos informations doivent résister à un examen minutieux au niveau de l'audit.

Nos experts y remédient en mettant en place un lac de données ESG basé sur le cloud : un seul endroit pour tout. Nous extrayons des données en direct de vos systèmes ERP, HRIS et IoT. Émissions, consommation d'énergie, sécurité du personnel, etc. Les connexions API maintiennent ce flux en temps réel et précis. Des règles de validation intelligentes vérifient vos données à la recherche de lacunes ou de drapeaux rouges au fur et à mesure qu'elles arrivent, ce qui vous permet de résoudre les problèmes avant qu'ils ne prennent de l'ampleur.

Un mappeur XBRL intégré étiquette chaque numéro pour l'archivage numérique. Cette approche permet de gagner du temps, de réduire les erreurs manuelles et de soutenir le passage du CSRD d'une assurance limitée à une assurance raisonnable dans les années à venir. De plus, chaque entrée laisse une piste d'audit dont votre équipe financière vous remerciera lorsque les auditeurs externes viendront frapper à la porte.

Maintenant que vos données et votre moteur de validation tournent à plein régime, il est temps d'intégrer les informations du CSRD dans vos principaux plans d'affaires.

Tout d'abord, nous établissons une correspondance entre vos objectifs ESG ou GRI existants et les exigences de l'ESRS afin que vous vous appuyiez sur ce que vous avez déjà commencé et que vous ne réinventiez pas la roue. Ensuite, notre équipe intègre ces objectifs dans vos OKR et, le cas échéant, les associe aux primes d'encouragement des cadres.

Enfin, nous avons conçu un tableau de bord commun qui présente les données financières et ESG côte à côte. Vous disposez ainsi d'une vue unique permettant aux dirigeants d'orienter la stratégie, de gérer les risques et de s'adresser au marché en connaissance de cause.

Maintenant que le CSRD est intégré à votre stratégie de base, votre premier rapport devient la rampe de lancement. Les réglementations évolueront, les attentes des parties prenantes changeront et vos données devront rester à jour. Voici comment notre équipe veille au bon fonctionnement de votre moteur de reporting :

La conformité ne s'applique que lorsque vos collaborateurs comprennent ce qui change et pourquoi c'est important. C'est pourquoi nous investissons dans vos équipes internes dès le départ. Notre formation couvre tout, des exigences de divulgation ESRS au marquage XBRL, en passant par les pistes d'audit et les processus d'assurance numérique. Nous accompagnons vos équipes financières, de développement durable et informatiques à travers des démonstrations en direct, des exercices pratiques et des sessions de questions-réponses sur mesure, afin qu'elles sachent exactement comment gérer chaque cycle de reporting.

Grâce à une formation adaptée, vos collaborateurs acquièrent les compétences nécessaires pour gérer la conformité en toute confiance, année après année, et ne pas se contenter de se précipiter à la date butoir. Les équipes travaillent plus rapidement, les erreurs diminuent et les connaissances ne disparaissent pas lorsqu'une personne part.

En traitant le CSRD comme un processus vivant plutôt que comme un projet ponctuel, vous protégez votre réputation, vous gardez la confiance des investisseurs et vous transformez la conformité en valeur stratégique permanente.

"Le CSRD exige de la précision, et cela commence par les données. Chez Innowise, nous transformons chaque mesure en un aperçu commercial, de sorte que nos rapports constituent un véritable atout pour les dirigeants et les investisseurs."

La poussière est retombée sur la simplification du CSRD. Le 26 février 2025, le paquet Omnibus I de l'UE a réduit le champ d'application, prolongé les délais et reporté indéfiniment les normes ESRS sectorielles. Les entreprises devraient utiliser des normes volontaires telles que les guides sectoriels du SASB ou de la GRI pour établir des rapports sectoriels jusqu'à ce que les mises à jour de l'ESRS soient publiées. Ce qui n'a pas changé, c'est l'attente que les grandes entreprises encore dans le champ d'application fournissent des données propres et vérifiables.

Cette réalité vous laisse deux possibilités. Vous pouvez faire une pause et attendre que les choses s'arrangent, pour vous démener plus tard si les délais ne sont pas respectés. Ou bien vous pouvez aller de l'avant, développer vos données et votre gouvernance dès maintenant, et gagner rapidement de la crédibilité auprès des investisseurs en fixant le prix de la performance ESG.

Je propose la deuxième approche. Chez Innowise, nous combinons des mises à jour réglementaires en temps réel avec une architecture de données flexible. De cette façon, vous restez conforme aujourd'hui et vous pivotez facilement lorsque Bruxelles fait son prochain mouvement.

Si vous devez concilier les délais de la CSRD et les contraintes budgétaires, la Le nouveau paquet Omnibus I de l'UE vous offre simplement une certaine marge de manœuvre et des réductions de coûts intelligentes si vous savez comment les utiliser. Ce paquet vise à réduire les formalités administratives tout en maintenant intacts les objectifs du Green Deal. Il remanie le CSRD, le CSDDD, certaines parties de la taxonomie européenne, le CBAM et les règles InvestEU, avec la promesse de réduire les charges administratives d'au moins 25 % pour les grandes entreprises et de 35 % pour les PME, en bref : plus d'attention là où c'est important, moins de paperasserie qui fait perdre du temps.

Voyons maintenant ce que cela signifie pour votre équipe et comment vous pouvez utiliser ces changements à votre avantage.

Les entreprises de la "vague 2" et de la "vague 3" bénéficient de deux années supplémentaires. Si vous deviez déposer votre rapport CSRD en 2026 ou 2027, cette fenêtre passe à 2028 ou 2029. La date de début de la CSDDD est également repoussée à juillet 2028. Le champ d'application se resserre également : seules les grandes entreprises employant plus de 1 000 personnes et réalisant un chiffre d'affaires d'au moins 50 millions d'euros (ou un bilan d'au moins 25 millions d'euros) restent dans le champ d'application.

Vous avez maintenant besoin de 70% points de données en moins. Si moins de 10% de vos activités remplissent les conditions requises, vous pouvez vous dispenser de fournir des informations sur l'alignement. Les entreprises peuvent également déclarer partiellement l'alignement pour montrer les progrès accomplis, ce qui permet d'attirer des financements de transition. Pour les banques, les calculs du ratio d'actifs verts sont simplifiés et les contrôles DNSH allégés.

La voie est désormais plus libre pour les petits importateurs. Un seuil annuel d'environ 50 tonnes signifie qu'environ 90% d'importateurs sont exemptés, tout en maintenant la couverture des émissions au-dessus de 99% pour les secteurs lourds tels que l'acier, l'aluminium, le ciment et les engrais.

Pour InvestEU, il faut s'attendre à moins de rapports et à un allègement des tâches administratives pour tous les acteurs de la chaîne. Les petites transactions évitent complètement les KPI supplémentaires. Les fonds hérités du passé, tels que l'EFSI et InnovFin, sont regroupés dans un seul et même pot, libérant ainsi une somme estimée à 50 milliards d'euros pour de nouveaux projets.

Ne considérez pas cela comme une occasion de faire une pause. Profitez de ce répit pour nettoyer et consolider les données existantes, automatiser les contrôles de validation et renforcer vos contrôles ESG. Revérifiez votre analyse de matérialité et mettez à jour vos systèmes pour un marquage XBRL plus fluide et plus rapide.

Même si les règles s'assouplissent, les équipes intelligentes mettront ce temps à profit pour construire un moteur de reporting fiable, efficace et prêt à tout. Les investisseurs et les régulateurs sont en train d'observer ce qui se passe, et les premiers seront ceux qui agiront, pas ceux qui attendront.

CSRD n'est pas un cas isolé. Les régulateurs de tous les grands marchés transforment les discussions volontaires sur l'ESG en règles strictes et comparables. Si vous opérez au-delà des frontières, vous devez avoir une vue d'ensemble.

| Cadre de travail | Où s'applique-t-elle | Principaux points d'attention | Statut actuel |

| CSRD / ESRS | UE, et entreprises non européennes réalisant un chiffre d'affaires significatif dans l'UE | Double matérialité, marquage XBRL obligatoire | Mise en place progressive à partir de 2024 |

| ISSB S1 et S2 | Adopté par quinze juridictions, vingt-et-une autres en consultation | Risque de qualité, importance financière | Les premiers dépôts débutent en 2026 sur les marchés pionniers |

| Règle de la SEC sur le climat | Sociétés publiques cotées aux États-Unis | Risques climatiques, émissions de type 1 et 2, assurance limitée | La règle finale est attendue pour 2025, la déclaration commence en 2027 pour les grands déclarant |

| Californie SB 261 | Entreprises dont le chiffre d'affaires est supérieur à 500 millions USD et qui exercent leurs activités en Californie | Divulgation bisannuelle des risques climatiques, qualitative et quantitative | Premiers rapports attendus en 2026 |

| Exigences de divulgation en matière de développement durable au Royaume-Uni (SDR) | Sociétés cotées en bourse au Royaume-Uni et grandes entreprises privées | Indicateurs de climat et de nature alignés sur l'ISSB | Phase de consultation, qui devrait débuter en 2026 |

Un système de reporting fragmentaire ne fait que gonfler le nombre d'heures d'audit et augmenter le coût du capital. La solution la plus intelligente consiste à créer une source unique de vérité pour les données ESG. Cartographiez chaque mesure une fois, puis marquez-la et exportez-la pour le CSRD, l'ISSB, la règle climatique de la SEC, la loi californienne SB 261 ou le SDR britannique. Pas de travail en double.

C'est cette approche à partir d'un seul jeu de données que nous mettons en œuvre à Innowise. Vous obtenez de nombreux rapports conformes à partir des mêmes données propres, sans avoir à vous démener chaque fois qu'un autre régulateur durcit ses règles.

Le CSRD demande aux entreprises de rassembler tous les éléments, de la consommation d'énergie aux mesures de sécurité du personnel, souvent pour des dizaines d'entités et de zones géographiques. Pour la plupart des équipes, la recherche de ces chiffres à la main est synonyme de délais non respectés et de rapports entachés d'erreurs. C'est là que le AI et l'automatisation font une réelle différence.

AI n'est pas une panacée, mais pour les rapports CSRD et ESG, il est déjà devenu indispensable. Les équipes qui s'appuient sur ces outils réduisent les erreurs, accélèrent leur cycle et consacrent plus de temps à l'analyse qu'aux feuilles de calcul.

La conformité à la norme CSRD montre que vous êtes sérieux en matière de transparence et de résilience. Les données de développement durable vérifiées et étiquetées en XBRL renforcent la confiance des investisseurs, débloquent des financements écologiques et consolident les partenariats avec les fournisseurs. Votre rapport devient la preuve que vous dirigez une entreprise prête pour l'avenir.

Voici votre dernière liste de contrôle pour la préparation du CSRD. Utilisez-la pour vous assurer que rien ne vous échappe :

Partout dans le monde, les régulateurs adoptent des règles obligatoires en matière de développement durable. En préparant le terrain dès maintenant, vous évitez les paniques de dernière minute et vous vous préparez à tout changement futur. Lancez votre sprint CSRD cette semaine. Fixez votre architecture de données, organisez des ateliers sur la matérialité et rédigez votre premier rapport. Une action précoce transforme la conformité en un avantage stratégique.

Responsable du développement durable

Stanislav apporte une réflexion concrète sur la durabilité dans le domaine de la technologie. Il aide ses clients à dépasser les cases à cocher et à obtenir des résultats concrets, qu'il s'agisse d'optimiser l'infrastructure, de réduire les déchets ou de créer des produits numériques en tenant compte de leur impact.

Votre message a été envoyé.

Nous traiterons votre demande et vous contacterons dès que possible.

En vous inscrivant, vous acceptez notre Politique de confidentialitéy compris l'utilisation de cookies et le transfert de vos informations personnelles.