Your message has been sent.

We’ll process your request and contact you back as soon as possible.

The form has been successfully submitted.

Please find further information in your mailbox.

In a world where businesses strive to digitize and online shopping experiences become more and more popular, more and more people switch from cash to digital payments worldwide. Today, consumers expect a high level of convenience in managing their digital assets, seeking financial services to ease their daily struggles. In the article below, we explore the phenomenon of digital wallet development and give tips on delivering a mobile wallet app that inevitably resonates with the target audience and brings solid revenue to stakeholders.

After Covid-19 hit, companies were forced to adapt to the new business normal instantly. A recent statistic reveals that online wallets accounted for 44.5% of e-commerce payments and 25.7% of POS sales in 2020, right in the midst of a pandemic. Meanwhile, Statista reports that the total volume of world digital transactions will reach $12.27 trillion by 2025, showing a remarkable 12.01% boost compared to the previous year. Because of their accessibility, ease of use, and security, mobile wallets are poised to become the primary means of payment, with 4 billion active users around the globe to date.

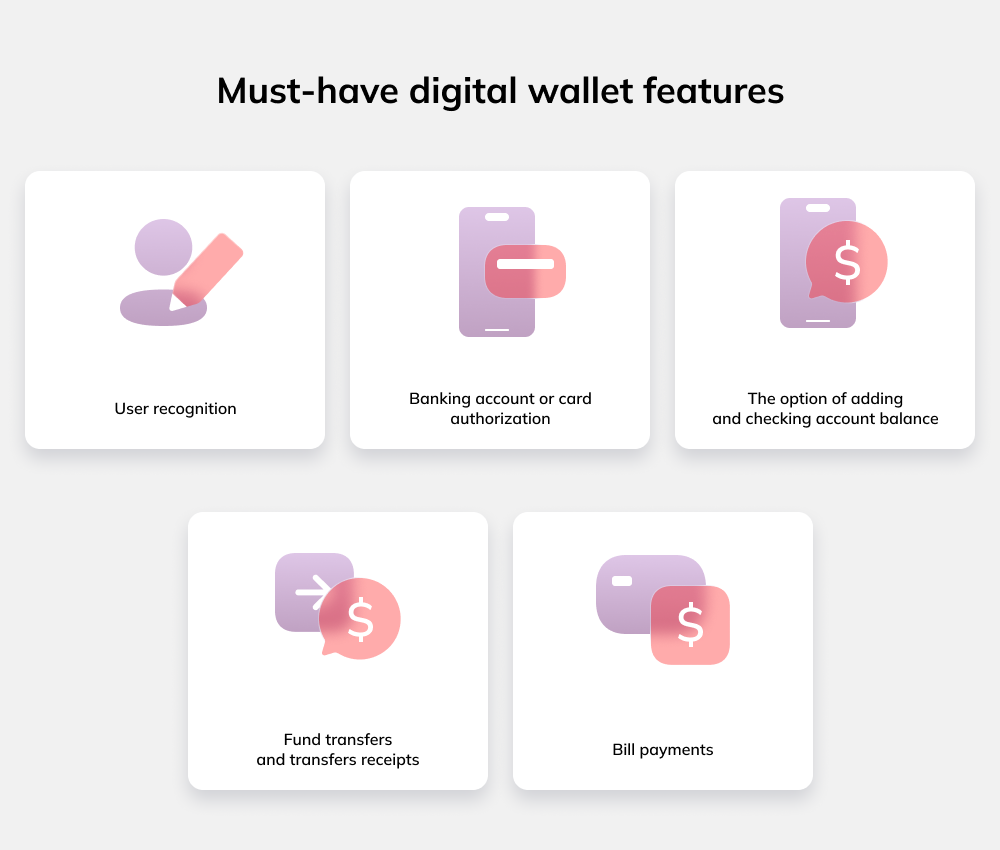

Essentially, e-wallets serve the same purpose as debit and credit cards, except that they are fully digital and do not require plastic carriers to be used. For rapid online transactions with a PC or smartphone, they combine payment acceptance gateways and secure storage.

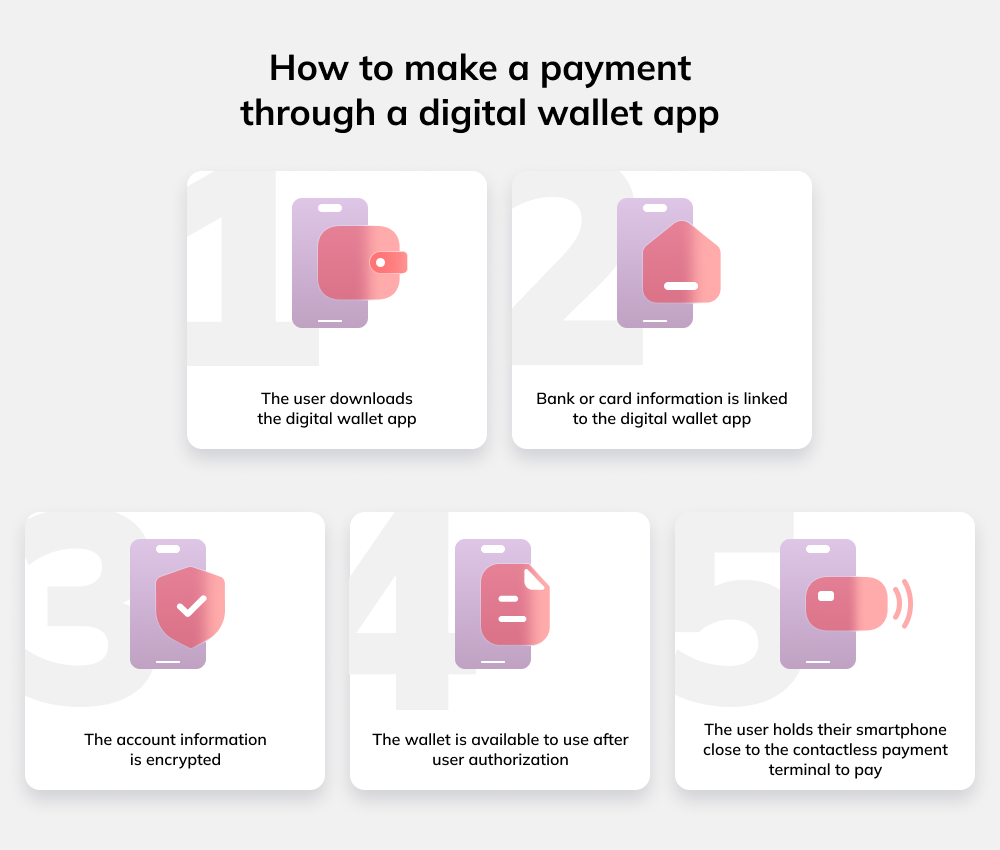

In theory, the principles that govern the functionality of e-wallets appear simple, but in practice, smooth contactless transactions entail more than just front-end and server-side interactions. In essence, performing a single payment operation involves well-coordinated work between digital apps, hardware devices, an NFC mode and security features to ensure immense user-friendliness and guarantee the safety of funds.

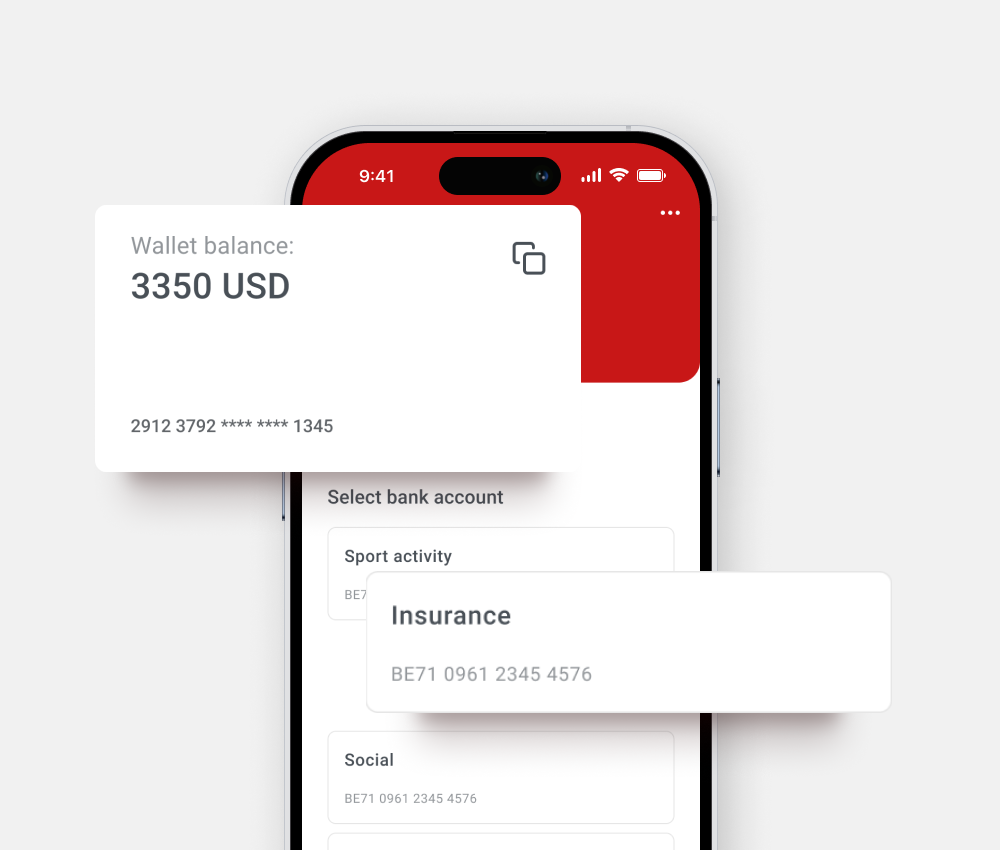

To leave no space for controversy, let’s take a look at the basic electronic wallet’s flow. For e-payments to be legal, users must download a mobile app and link their credit card to the app. After the user is verified, the digital wallet software independently encrypts all payment details while users hold their smartphones near the contactless terminal to conduct payments.

However, in some cases, linking a card to the app is not mandatory since the payment provider is responsible for data transfer security, thus eliminating the need for in-app integration. Alternatively, the wallet can be replenished from user accounts through banking APIs when the bank initiates the payment and redirects the user to the proprietary confirmation page, bypassing the need to download a mobile app.

Nowadays, ApplePay, Samsung Pay, Google Pay, PayPal, AliPay, Venmo, and others are some of the most popular e-wallets on the market.

We have differentiated e-wallets based on a variety of characteristics to assist you in identifying the most popular and in-demand ones.

Based on the target audience, digital wallets fall into three categories

Closed wallets are forged by companies that sell products or render services. They can only be used to purchase items directly from the wallet’s issuer. While money from returns and refunds is stored in the e-wallet, many companies earn significant interest on the transactions within the closed wallet.

This option allows more freedom for users since they are entitled to complete digital transactions at pre-identified locations and stores. To accept payments from these wallets, mobile app owners must contract with the wallet issuer, officially agree with the terms and conditions, and outline mutual responsibilities.

Open wallets, as the name suggests, are issued by banks and other financial organizations for mass usage and are accepted by most retailers without restriction, facilitating contactless in-store and online payments.

As for the goals, e-wallets can be general or specific, allowing for

E-wallets help people manage their finances by providing advanced analytics on incomes, expenses, and budgets.

These apps are compatible with debit and credit cards and are accessible on a variety of devices, and enable instant money transfers to pay for utility bills, communication fees, subscriptions, etc.

With this option, users can transmit money to friends or relatives abroad or purchase goods/services in a few clicks without having to depend on a bank branch or third-party financial institution.

These e-wallet apps allow people to safely store and exchange their cryptocurrencies with no censorship from governmental authorities.

Building a comprehensive mobile wallet app is impossible without employing the technologies that form the core of wireless functionality.

With a smartphone camera or e-wallet’s scanning system, a customer accesses these codes to initiate a payment. Once users scan the QR code, they can use personal accounts to purchase goods and pay for services.

Near Field Communication (NFC) is a contactless payment technology that uses electromagnetic signals to exchange data and conduct money transactions between smartphones and payment devices in close proximity.

This mobile payment system works based on pre-chip magnetic stripe technology supported by a terminal that does not require a swipe. When users swipe the stripe, it generates a magnetic signal that initiates a contactless payment operation.

This is another convenient option to provide data exchange via proximity for peer-to-peer payment operations within a certain distance (reaching 70 meters on average).

Developing a turnkey digital wallet solution is reasonable and crucial if your business involves online shopping. However, bold reassuring plans to build a top-notch mobile wallet app may be thrown off by a couple of pitfalls. For your project to succeed, keep in mind the challenges that must be considered to mitigate the risk of failure.

The security of mobile app wallets must be sufficient to mitigate the slightest risk of hacking or security issues. Fraud damages the vendor’s reputation and leads to substantial financial losses, frequently leading to class actions and lawsuits.

Though mobile wallet apps are spreading exponentially, many people still distrust digital solutions for fear of losing their virtual assets. Businesses must embrace the digital awareness that is sweeping the globe and explain the basics of e-wallets’ usage and their potential benefits.

Vendors should set a fine example of mass digitation, attracting clients with the advantages of contactless payments.

Digital wallet app development should comply with KYC requirements and AML standards to ensure people’s trust in the vendor’s reliability.

As the development process never stops abruptly, it is never enough to deploy a solution and forget about post-launch support – you need to continually ensure trouble-free performance across multiple devices, operating systems, and platforms.

For a company to remain competitive, it’s crucial to adopt technologies that offer enhanced user experiences, including fast sign-up, easy document uploading, QR code payment accessibility, etc.

Digital wallet development presents a number of challenges. Taking into account these challenges can significantly improve developers’ chances of success and convince people to switch to electronic wallets.

Understandably, electronic wallets are naturally associated with fintech and banking, where money exchange is involved. Being the core of online shopping, this sector provides a wide range of fintech e-wallet capabilities and furnishes customers with contactless transactions. Nonetheless, people use digital wallets for remittances in a variety of fields, including

In this case, users exploit e-wallets for online shopping or as an addition to already existing mobile apps. With these applications, merchants can store essential sales information and benefit from loyalty cards, bonuses, rewards, and coupons.

As big players in the financial sector, these companies oftentimes integrate different payment capabilities from various financial institutions into a single mobile wallet.

Telecom entails the transmission of information via electromagnetic systems over a large distance, so it employs NFC or MST technologies to link data with financial flows.

Want your digital wallet app to reach the widest audience?

Start your cross-platform development today for a unified user experience on any device.

Innowise renders full-cycle custom software development services, equipping clients with mobile solutions that engine business performance. Here are some recent contactless e-payment examples that demonstrate our expertise.

A couple of months ago, our mobile team developed a native iOS and Android application serving as a digital wallet for instant payments. After registration and verification in the app, users get access to the digital wallet. Tourists can use bank cards to replenish their accounts, while residents can transfer money from their bank accounts. Users can request payment (e.g., to split a restaurant bill), pay using QR codes, and make money transfers to another account by email or mobile phone number. The app provides information about account balances and stores the history of payments. To protect confidential data, we integrated a security system (TLS 1.2, SSL Pinning, check for rooted devices) and used PIN code validation and data encryption.

Recently, our project team built a secure ID scanner and a digital wallet app that helps verify digital identities and ensure secure transactions. The Android application is a mobile digital wallet with an ID scanner to scan, store, and verify IDs, bank cards, mobile passports, driver’s licenses, health records, social security cards, and more. The solution saves all user’s electronic documents within one software environment and lets users store personal cards and credentials with the help of a smartphone. The mobile digital wallet is compliant with all KYC and AML regulations, ensuring strict security with no risk of breaches.

Digital wallets provide convenient options for paying bills, buying household goods, transferring money, and many other things. Although top-tier e-wallet app development requires joint efforts of a skilled project team backed by a reasonable budget and industry-specific expertise, building a mobile app solution can become a game-changer to bypass competitors and drive business performance.

Innowise, as a digital wallet app development company, has a proven record of building state-of-the-art digital solutions of any complexity and scale. Dedicated to delivering products of unmatched quality, our talented software engineers are overachievers who are ready to put in the extra effort to deliver disruptive solutions that bring value to customers and inspire them to come back with new challenges.

Rate this article:

4.8/5 (45 reviews)

Your message has been sent.

We’ll process your request and contact you back as soon as possible.

By signing up you agree to our Privacy Policy, including the use of cookies and transfer of your personal information.