Votre message a été envoyé.

Nous traiterons votre demande et vous contacterons dès que possible.

Le formulaire a été soumis avec succès.

Vous trouverez de plus amples informations dans votre boîte aux lettres.

Sélection de la langue

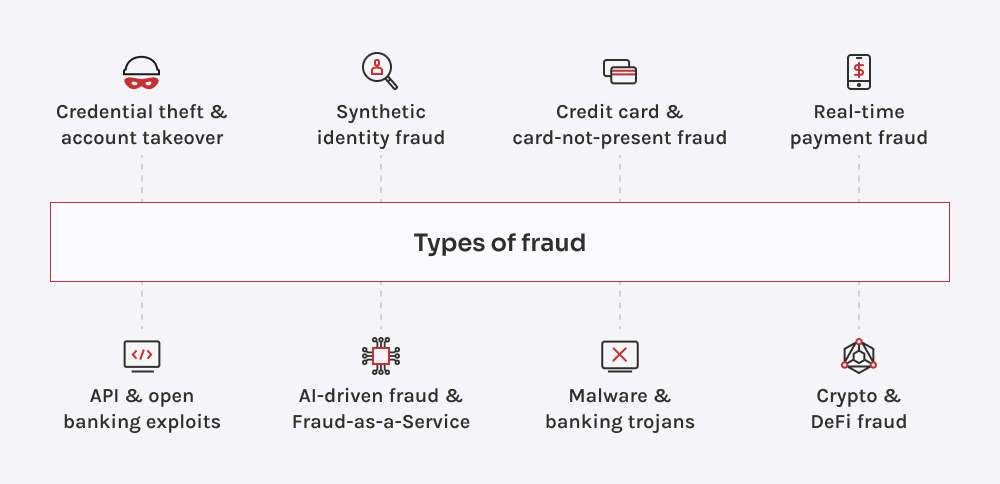

On ne peut pas lutter contre ce que l'on ne comprend pas parfaitement. Et si la fraude évolue constamment, il ne faut pas oublier que certains des plus vieux trucs du livre sont toujours d'actualité. Nous avons mûri, mais eux aussi se sont adaptés. Ainsi, avant de nous plonger dans la prévention, examinons les techniques de fraude les plus courantes qui menacent les banques et les FinTechs aujourd'hui et pourquoi une détection de la fraude solide et adaptative dans les services financiers est plus importante que jamais.

Le vol d'informations d'identification et l'abus de confiance se produisent lorsque des fraudeurs utilisent des informations d'identification volées pour se connecter à des comptes d'utilisateurs. Ils utilisent des astuces telles que l'hameçonnage assisté par ordinateur, le bourrage d'informations d'identification et les logiciels malveillants pour déjouer les mesures de sécurité. Des tactiques plus avancées comme le détournement de session, les attaques de type "man-in-the-middle" (MitM) et l'échange de cartes SIM leur permettent d'intercepter les codes d'authentification et de vider les comptes avant que quiconque ne s'en aperçoive.

Les fraudeurs mélangent de vraies et de fausses données personnelles - souvent en utilisant l'IA - pour créer des identités qui n'appartiennent en réalité à personne. Ces profils synthétiques passent à travers les contrôles de sécurité, permettant aux criminels d'ouvrir des comptes bancaires, de contracter des prêts et de blanchir de l'argent. Sans victime réelle pour signaler la fraude, l'activité frauduleuse passe souvent inaperçue jusqu'à ce qu'il soit trop tard. La détection de ces activités nécessite une IA sophistiquée et un solide système de gestion des fraudes dans le secteur bancaire.

Avec les systèmes de paiement instantané, les fraudeurs exploitent la rapidité et l'irréversibilité des transactions pour déplacer des fonds volés avant d'être détectés. Parmi les tactiques les plus courantes, citons la fraude par paiement poussé autorisé (APP) et les réseaux de mules qui dispersent rapidement l'argent illicite. Une fois que l'argent est parti, il n'y a pas de rétrofacturation, et les banques ont besoin d'une surveillance avancée de la fraude bancaire pour détecter les menaces avant qu'elles ne s'aggravent.

Les fraudeurs s'emparent des données des cartes par écrémage, fuite de données et hameçonnage, et les utilisent pour effectuer des achats en ligne douteux sans avoir besoin de carte physique. Ils réalisent des escroqueries telles que la fraude par rétrofacturation, le bourrage d'informations d'identification et les attaques menées par des robots, accumulant les frais avant que quiconque ne s'en aperçoive. Lorsque les informations de cartes volées inondent le dark web, les banques et les commerçants doivent faire face aux retombées.

Alors que les banques et les entreprises fintech s'appuient de plus en plus sur des API bancaires ouvertes, les fraudeurs cherchent des failles de sécurité pour voler des données et détourner des transactions. Une authentification faible, des API mal configurées et des points de terminaison exposés permettent aux attaquants de manipuler des comptes, d'initier des paiements non autorisés ou de récupérer des données financières sensibles. Les intégrations de tiers étant plus nombreuses que jamais, un seul maillon faible peut ouvrir la porte à une fraude à grande échelle.

Les fraudeurs utilisent des logiciels malveillants et des chevaux de Troie bancaires pour s'introduire dans les comptes, voler les informations d'identification et perturber les transactions. Ils se propagent par le biais de courriels de phishing, de fausses applications et d'extensions de navigateur douteuses, donnant aux attaquants un accès complet aux sessions bancaires. Certains trojans sont si avancés qu'ils peuvent même contourner l'authentification multifactorielle (MFA), ce qui en fait un cauchemar pour les banques et les utilisateurs.

L'IA aide les criminels à automatiser les escroqueries, à contourner les contrôles de sécurité et à générer de fausses voix et de fausses vidéos pour tromper les banques et les clients. Parallèlement, le FaaS a fait de la cybercriminalité une activité commerciale, avec des kits de phishing prêts à l'emploi, des outils de credential stuffing et des bots pilotés par l'IA disponibles à la location sur le dark web. Cela permet même aux fraudeurs peu qualifiés de lancer des attaques avancées, ce qui rend la fraude financière plus difficile à attraper et à stopper.

Alors que les banques et les FinTechs plongent dans la cryptographie, la fraude évolue avec elles. Nous ne parlons pas seulement de l'arrachage occasionnel de tapis - les attaquants tirent parti des failles des contrats intelligents, des prêts flash et des astuces entre chaînes pour déplacer des actifs volés avant que quiconque ne s'en aperçoive. Avec des transactions rapides et anonymes, la pression sur les institutions pour détecter et répondre en temps réel est plus forte que jamais.

La fraude n'est pas toujours bruyante, évidente ou facile à détecter - elle peut être subtile, adaptable et se faufile souvent là où personne ne regarde. C'est pourquoi la détection moderne de la fraude dans le secteur bancaire ne se limite pas à repérer les signaux d'alarme. Il s'agit de savoir comment les fraudeurs pensent, où les systèmes sont faibles et quand il faut agir. Alors, comment les meilleurs systèmes parviennent-ils à rester dans la course ? Voyons cela de plus près.

La détection des fraudes ne se résume pas à une solution magique - il s'agit de superposer les bonnes technologies pour repérer les fraudes avant qu'elles ne se propagent. Maintenant que nous avons examiné le fonctionnement des différentes méthodes de détection, explorons la technologie qui les alimente dans des environnements bancaires réels.

| Technologie | Comment cela fonctionne-t-il ? | Caractéristiques principales | Solutions populaires |

| Systèmes de gestion des fraudes (SGF) | Des plateformes centralisées qui regroupent les données relatives à la fraude, analysent les transactions et déclenchent des alertes en temps réel. | Suivi des transactions, gestion des cas et évaluation des risques en temps réel | NICE Actimize, FICO Falcon, SAS Fraud Management |

| AI & ML | Détecte les activités frauduleuses en analysant les modèles, les anomalies et les changements de comportement. | Analyse prédictive, détection des anomalies, modèles d'apprentissage adaptatifs | Feedzai, Darktrace, IBM Trusteer, DataVisor. |

| Blockchain | Prévient la fraude en fournissant des enregistrements de transactions immuables et une vérification décentralisée de l'identité. | Sécurité cryptographique, contrats intelligents, registres inviolables | Trust Stamp, Evernym, IBM Blockchain Fraud Prevention (en anglais) |

| Authentification biométrique et basée sur le risque (RBA) | Utilise la biométrie physique et comportementale pour vérifier les identités et évaluer les risques de manière dynamique. | Scanner d'empreintes digitales, reconnaissance faciale, biométrie comportementale, évaluation dynamique des risques | BioCatch, Nuance Gatekeeper, Jumio, Onfido |

| Intelligence des appareils et empreintes digitales | Identifie les utilisateurs frauduleux en analysant les caractéristiques de l'appareil, la géolocalisation et les schémas de connexion. | Suivi des adresses IP, liaison des appareils, détection des anomalies | ThreatMetrix, iovation, FingerprintJS |

| Détection d'identité synthétique | L'IA permet de détecter les identités fabriquées qui combinent des données réelles et fausses dans le cadre de systèmes de fraude. | Regroupement d'identités, reconnaissance de formes pilotée par l'IA, détection de documents falsifiés | Socure, Sift, Experian CrossCore |

| Détection de la fraude basée sur les graphes | Cartographie des relations entre les comptes, les dispositifs et les transactions afin de découvrir les réseaux de fraude et les passeurs d'argent. | Analyse des réseaux sociaux, analyse des liens entre entités, détection des réseaux de fraude | Quantexa, Linkurious, GraphAware |

| Surveillance du web sombre | Analyse des forums clandestins, des places de marché et des bases de données fuitées pour y trouver des informations d'identification compromises et des activités frauduleuses. | Intelligence des menaces alimentée par l'IA, alertes de fuites de données d'identification, surveillance en temps réel | Recorded Future, SpyCloud, CybelAngel |

"La plus grande erreur consiste à considérer la fraude comme un problème post-incident - détecter, réagir, répéter. Mais lorsqu'une alerte est déclenchée, le mal est souvent fait. Une véritable protection passe par la mise en place de systèmes qui rendent la fraude quasiment impossible dès le départ. Chez Innowise, nous vous aidons à découvrir les vulnérabilités cachées et à affiner votre stratégie avant que la fraude n'ait la moindre chance de s'infiltrer."

Delivery Manager dans la Fintech

Attraper la fraude, c'est bien. L'arrêter avant qu'elle ne commence ? C'est encore mieux. La véritable prévention de la fraude dans le secteur bancaire commence bien avant qu'une transaction ne soit signalée - elle commence au niveau de l'accès, de l'intention et du risque. Et il faut une stratégie solide pour relier ces points. Voici comment les équipes avant-gardistes gardent une longueur d'avance.

L'évolution constante des lois telles que KYC, AML et PSD2 fait qu'il est difficile de rester en conformité tout en prévenant la fraude. Les entreprises doivent mettre en œuvre des solutions de conformité flexibles et automatisées pour s'adapter rapidement et répondre aux exigences réglementaires.

Une sécurité renforcée est essentielle, mais trop d'étapes d'authentification peuvent frustrer les clients réels et les faire fuir. La clé consiste à utiliser une authentification intelligente, basée sur les risques, qui n'ajoute des couches supplémentaires que lorsque quelque chose semble anormal.

Investir dans la prévention avancée de la fraude peut s'avérer difficile avec des budgets serrés et des équipes réduites. Donner la priorité à l'automatisation pilotée par l'IA et aux solutions évolutives permet de maximiser la protection sans dépenser trop.

Les paiements transfrontaliers s'accompagnent de risques de fraude plus élevés en raison des différentes réglementations, des défis liés aux devises et de l'évolution des tactiques de fraude. L'utilisation d'une surveillance pilotée par l'IA et de contrôles de la fraude spécifiques à chaque région permet de détecter les menaces sans ralentir les transactions.

Le GDPR et le CCPA limitent la manière dont les données relatives à la fraude peuvent être partagées, même entre des systèmes de confiance. C'est pourquoi de nombreuses institutions s'appuient désormais sur la gestion sécurisée des données pour protéger les données sensibles tout en permettant une détection sûre et conforme des fraudes.

La fraude ne vient pas toujours de l'extérieur ; les initiés peuvent abuser de l'accès à des fins personnelles ou être de connivence avec des criminels externes. La formation régulière des employés, la surveillance des activités en temps réel et les contrôles d'accès stricts basés sur les rôles contribuent à la lutte contre la fraude réduire le risque de fraude.

Les fraudeurs ont toujours une longueur d'avance, utilisant l'IA, les deepfakes et les identités synthétiques pour contourner la sécurité. Rester proactif avec une détection des menaces basée sur l'IA et des mises à jour continues des modèles de fraude permet de maintenir des défenses solides.

Les paiements en temps réel, les crypto-monnaies et les portefeuilles numériques créent des failles de sécurité avant que les réglementations ne les rattrapent. La mise en œuvre d'outils de prévention de la fraude avec un suivi en temps réel et des contrôles de risque adaptatifs permet de garder une longueur d'avance sur les nouvelles menaces.

Nous connaissons les outils qui valent la peine d'être utilisés et savons comment les faire fonctionner pour vous. Avec une expertise approfondie dans des plateformes comme Samsub et SDK.finance, nous aidons à transformer d'excellentes plateformes en solutions de gestion de la fraude transparentes et évolutives pour les banques et les FinTechs.

L'année 2025 met une chose au clair : l'avenir de la prévention de la fraude est axé sur la collaboration, l'adaptation et le temps réel. Il ne s'agit plus de réagir après coup, mais d'anticiper le mouvement avant qu'il ne se produise. Pour les fintechs et les banques, cela signifie aligner la technologie, les équipes et les partenaires autour de stratégies toujours en apprentissage, toujours en évolution et toujours avec une longueur d'avance.

Les fonctions de sécurité proactives gagnent du terrain, faisant passer la prévention de la fraude des alertes passives à l'action en temps réel. Des outils tels que ANZ's "digital padlock" permettent aux utilisateurs de verrouiller les comptes instantanément, stoppant ainsi la fraude avant qu'elle ne s'aggrave. Au fur et à mesure de l'adoption, de plus en plus d'entreprises intégreront des contrôles déclenchés par l'utilisateur dans les applications et les plateformes afin que les clients fassent partie intégrante du système de défense.

La collaboration gagne du terrain, les banques, les FinTechs et même les opérateurs télécoms commençant à partager. des signaux de fraude en temps réel grâce à des technologies sécurisées et préservant la vie privée, telles que l'apprentissage fédéré. Ces réseaux sont encore émergents, mais ils remodèlent la manière dont la fraude est détectée, en transformant des informations isolées en une défense collective. Au fur et à mesure de leur adoption, les entreprises les utiliseront pour combler plus rapidement les lacunes, arrêter plus tôt les attaques coordonnées et faire de la lutte contre la fraude un travail d'équipe.

Soyons honnêtes : la fraude ne va nulle part. Elle évolue, devient plus audacieuse et apprend aussi vite que nous. La question est la suivante : vos systèmes s'adaptent-ils ou se contentent-ils de réagir ? De Systèmes de détection de la fraude alimentés par l'IA à l'identité décentralisée et à l'intelligence partagée, les outils existent. Mais leur qualité dépend de la stratégie qui les sous-tend. Si vous voulez vraiment garder une longueur d'avance, il est temps d'arrêter de penser en silos et de commencer à construire la prévention de la fraude comme une partie vivante et évolutive de votre entreprise.

Votre message a été envoyé.

Nous traiterons votre demande et vous contacterons dès que possible.

En vous inscrivant, vous acceptez notre Politique de confidentialitéy compris l'utilisation de cookies et le transfert de vos informations personnelles.