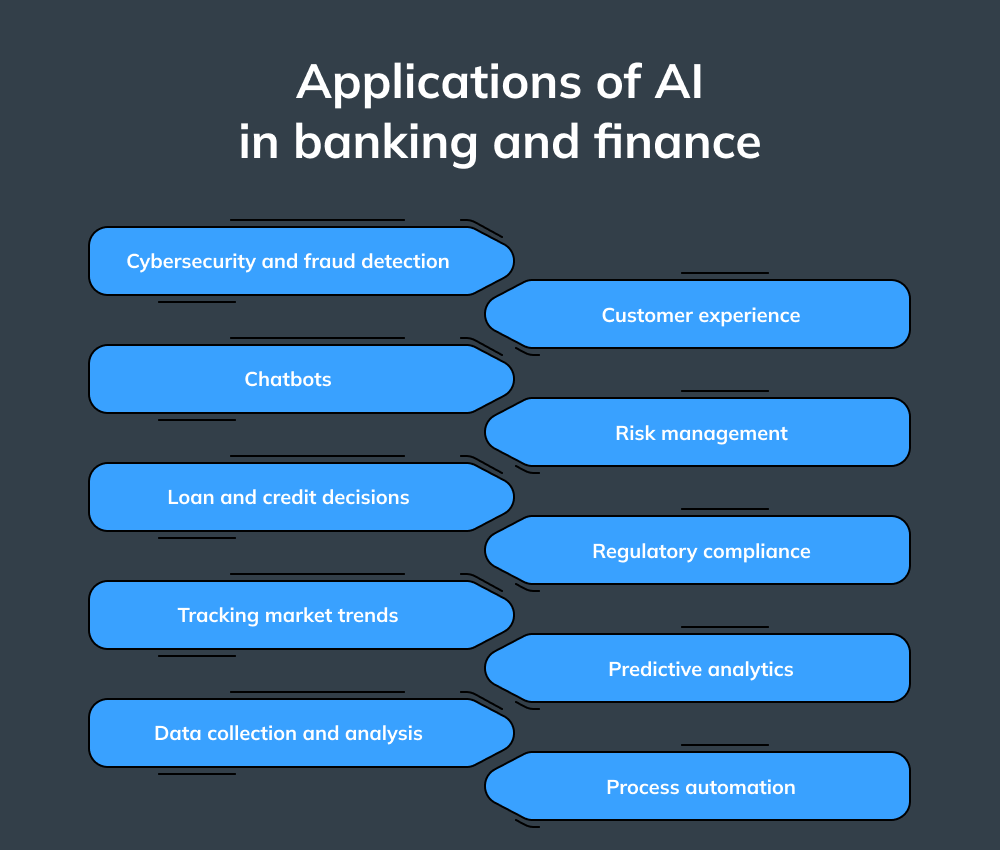

Aplicaciones de la IA en banca y finanzas

La IA se ha entretejido en el tejido cotidiano de nuestras vidas y ha transformado sectores de una forma que hace unos años solo podíamos imaginar. Negar su importancia sería miope: el sector bancario y financiero en particular ha experimentado un enorme cambio gracias a las innovaciones FinTech, aportando una gran cantidad de beneficios tanto a las partes interesadas como a los clientes.

Ciberseguridad y detección del fraude

Cada día, millones de transacciones fluyen a través del sistema bancario: la gente paga facturas, deposita dinero, retira fondos, cobra cheques y mucho más. Entre bastidores, los bancos están en una carrera constante para adelantarse a los ciberdelincuentes, intensificando sus esfuerzos de seguridad para proteger las operaciones y los activos y detener las actividades fraudulentas antes de que tengan siquiera la oportunidad de producirse.La IA es ahora un actor clave en este juego de altas apuestas. Los bancos pueden utilizar el potencial de la inteligencia artificial para mejorar los pagos digitales, detectar vulnerabilidades del software e identificar comportamientos sospechosos de los clientes, reduciendo al mismo tiempo el riesgo de estafas. El aprendizaje automático -un subconjunto de la IA- ayuda a detectar y prevenir acciones ilegales como el phishing por correo electrónico, el fraude con tarjetas de crédito y móviles, el robo de identidad y las reclamaciones de seguros falsas.Por ejemplo, el banco danés Danske Bank actualizó recientemente su obsoleto software de detección de fraudes con modernos algoritmos de IA. Gracias a la capacidad de ML para analizar transacciones pasadas (piense en información personal, datos, dirección IP, ubicación, etc.), el banco vio un aumento de 50% en la precisión de la detección de fraudes y una reducción de 60% en falsos positivos. Dado que los bancos son los principales objetivos de los piratas informáticos, la adopción generalizada de ML y AI es crucial. Estas tecnologías ayudan a las organizaciones financieras a responder rápidamente a las amenazas digitales, reforzando sus defensas contra los ciberataques antes de que pongan en peligro los sistemas internos, los empleados o los clientes.Chatbots

El uso de chatbots en banca es uno de los ejemplos más sencillos de aplicación de la IA. Una vez desplegados, estarán disponibles las 24 horas del día, a diferencia del personal humano con horarios fijos y necesidad de descansos regulares. Los chatbots no se limitan a responder a las consultas con respuestas únicas: aprenden de las interacciones con los clientes y acumulan conocimientos que les permiten predecir las necesidades de los usuarios y adaptar sus respuestas en consecuencia. Al integrar chatbots con IA en las aplicaciones bancarias, los gestores pueden estar seguros de que sus clientes reciben atención personalizada las 24 horas del día, los 7 días de la semana, con productos y servicios adaptados a sus necesidades individuales.Un ejemplo de chatbot exitoso se puede ver en la forma de Erica: un asistente virtual impulsado por IA del Bank of America. Desde 2019, Erica ha gestionado más de 50 millones de solicitudes de clientes, desde ayudarles a reducir la deuda de sus tarjetas de crédito hasta actualizar la seguridad de las mismas.Decisiones sobre préstamos y créditos

Hoy en día, los bancos emplean una amplia gama de herramientas inteligentes para mejorar la exactitud, precisión y rentabilidad de sus decisiones sobre préstamos y créditos. El software bancario convencional suele quedarse corto, plagado de errores, inexactitudes en los historiales de transacciones y clasificaciones erróneas de los acreedores. Las organizaciones financieras necesitan vigilar de cerca los historiales crediticios y las referencias de los clientes a la hora de conceder créditos y evaluar la solvencia de personas o empresas. Los sistemas basados en IA analizan los patrones de comportamiento de los clientes para tomar decisiones basadas en datos relativos a la solvencia, alertando rápidamente a los bancos de cualquier actividad sospechosa o de riesgo.Experiencia del cliente

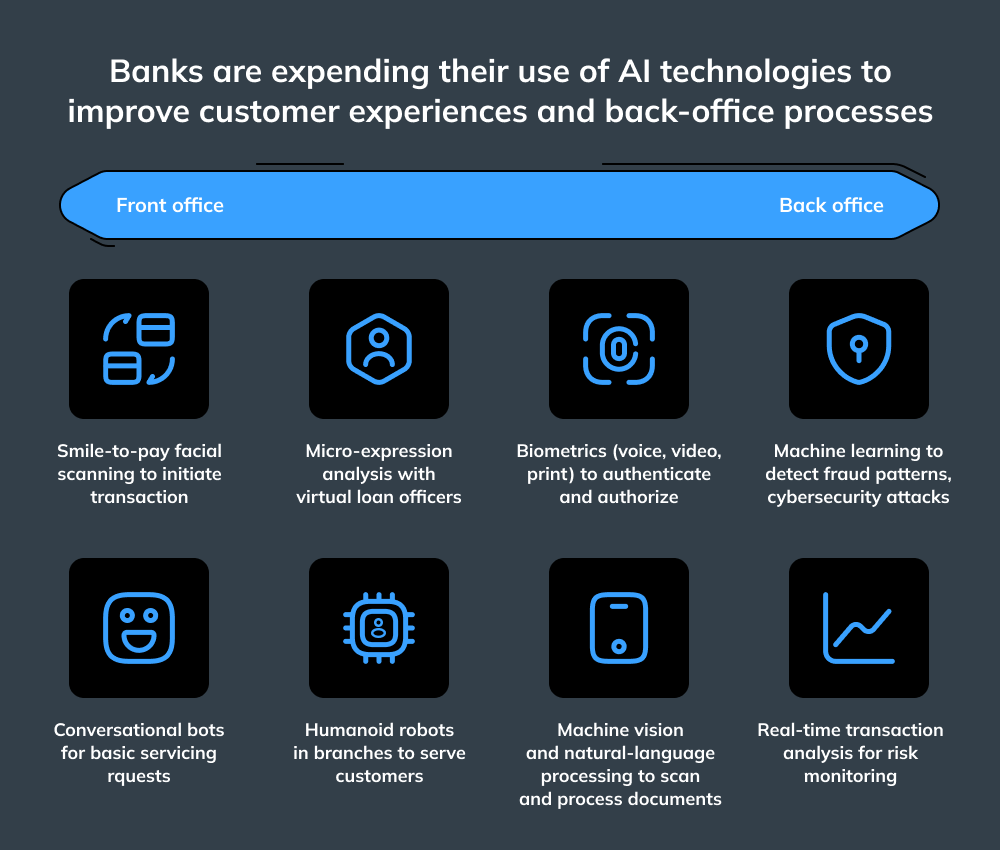

Los clientes esperan una experiencia de usuario intuitiva y sin complicaciones a la hora de gestionar sus aplicaciones bancarias. Gracias a la comodidad de los cajeros automáticos, ya no es necesario acudir a una sucursal bancaria para realizar operaciones sencillas, como ingresos y reintegros.Hoy en día, con una población más conocedora de la tecnología, los bancos necesitan innovar continuamente para ofrecer soluciones de pago digitales rápidas y seguras. La IA ayuda a reducir el tiempo necesario para registrar la información KYC y erradicar errores, agiliza la comercialización de productos y aborda de forma proactiva los problemas previos al lanzamiento antes de que surjan.Por si fuera poco, solicitar un préstamo personal nunca ha sido tan fácil. Los clientes ya no tienen que pasar por el engorro de las solicitudes manuales: La IA y el ML en FinTech reducen drásticamente los tiempos de aprobación, capturando datos precisos y sin errores relativos a las cuentas de los clientes.Gestión de riesgos

Las oscilaciones monetarias, las convulsiones políticas, las catástrofes naturales y los conflictos armados pueden sacudir los sistemas financiero y bancario. En tiempos turbulentos, tomar decisiones de inversión acertadas es crucial para mantenerse a flote y evitar pérdidas financieras. Aquí es donde entra en juego la IA: al proporcionar una visión general útil de los acontecimientos actuales, pronosticar las tendencias futuras y predecir lo que nos espera, la IA ayuda a los inversores a navegar por aguas inciertas con confianza. La IA también puede ayudar a determinar si un cliente podrá o no devolver un préstamo analizando patrones de comportamiento, historial crediticio y datos personales disponibles.Cumplimiento de la normativa

La tecnología financiera es uno de los sectores más regulados de la economía mundial. Los gobiernos desempeñan un importante papel como principales guardianes, vigilando y supervisando a los bancos para evitar delitos financieros, blanqueo de capitales y evasión fiscal.Los requisitos y normas legales cambian con frecuencia, lo que significa que los bancos necesitan mantener departamentos bien informados y ágiles dedicados a investigar y aplicar una legislación financiera en constante evolución. Cuando se hace manualmente, este proceso es largo y costoso. Entra la IA: utilizando el poder del aprendizaje profundo y la PNL), los sistemas de IA pueden analizar rápidamente las nuevas regulaciones y evaluar los requisitos de cumplimiento, asegurándose de que las organizaciones cumplan todas las leyes externas, así como las políticas internas. Aunque la IA no sustituye a un analista de cumplimiento humano cualificado, puede señalar aspectos críticos o ambiguos de la normativa y proteger a la empresa frente a los riesgos legislativos.Análisis predictivo

Utilizar la IA para el análisis predictivo es algo así como contar con un asistente muy intuitivo capaz de detectar tendencias y correlaciones que los humanos o la tecnología convencional suelen pasar por alto. La IA se utiliza ampliamente en el análisis del lenguaje natural y la semántica de propósito general, gracias a su capacidad para detectar rápidamente patrones específicos y correlaciones de datos. Se trata de un cambio de juego para el sector bancario: el análisis predictivo ayuda a las instituciones financieras a definir oportunidades de venta sin explotar, ofrecer métricas basadas en datos y revelar perspectivas específicas del sector que pueden aumentar significativamente los ingresos.¿Por qué el sector bancario debería adoptar AI?

El mundo de la banca está cambiando rápidamente hacia modelos centrados en el cliente que pretenden satisfacer sus deseos, necesidades y expectativas. Los clientes de hoy en día quieren que sus bancos estén disponibles 24 horas al día, 7 días a la semana, y que les ofrezcan herramientas y funciones innovadoras que les permitan disfrutar de su experiencia bancaria sin complicaciones. Para satisfacer estas expectativas, los bancos deben abordar primero los retos internos, como los sistemas de software heredados, los silos de datos fragmentados, los presupuestos limitados y la mala calidad de los activos. Una vez superados estos obstáculos, los bancos estarán un paso más cerca de adoptar la IA para sus problemas cotidianos.La IA no sólo garantiza una ciberseguridad inigualable: también hace que los servicios financieros sean más cómodos y ahorren tiempo tanto a los clientes como a los empleados.

Retos para la adopción generalizada de AI en las finanzas y la banca

Ni que decir tiene que la IA viene acompañada de un paquete de innumerables ventajas, pero su adopción generalizada se ve obstaculizada por diversos problemas, como las lagunas de credibilidad y los riesgos de seguridad que se ciernen sobre ella. Una estrategia holística y un enfoque integral de la IA y el aprendizaje automático en las finanzas pueden disminuir significativamente estos riesgos, aumentando la probabilidad de éxito y las ganancias financieras que vienen con él. A medida que los responsables de la toma de decisiones navegan por el apasionante mundo de la IA en las finanzas, pueden encontrarse con una serie de obstáculos comunes, que se describen a continuación.

Seguridad de los datos

La IA recopila, almacena y maneja enormes cantidades de información personal sensible, lo que significa que es imperativo que las instituciones financieras establezcan medidas de protección para evitar la violación de datos y el acceso no autorizado. Los bancos deben dar prioridad a los sistemas de protección de datos blindados cuando manejen grandes volúmenes de información relacionada con la IA, con el fin de eliminar cualquier riesgo y mantener segura la información confidencial.Falta de datos de calidad

La insuficiente calidad de los datos plantea un gran reto a las empresas FinTech. Sin datos bien organizados, la aplicación de conocimientos a situaciones de la vida real es casi imposible si no se corresponden con la realidad actual. Además, los datos que difieren del formato legible por máquina pueden dar lugar a comportamientos impredecibles en los modelos de IA.Los bancos que deseen adoptar la inteligencia artificial deben modificar -y, si es necesario, revisar- sus políticas de datos e introducir más orden en los flujos de datos.Cuestiones de explicabilidad

Como los programas basados en IA eliminan los errores y ahorran tiempo, se emplean mucho en los procedimientos de toma de decisiones. Por desgracia, pueden tener sesgos derivados de errores de juicio humanos anteriores. Esto puede poner en peligro la reputación del banco si pequeñas discrepancias en la IA se agravan y causan problemas a gran escala. Todos los datos implicados en los escenarios de IA deben ser claros y transparentes, sin dejar ningún espacio a posibles discrepancias.Cómo puede Innowise acelerar su viaje hacia la IA