Votre message a été envoyé.

Nous traiterons votre demande et vous contacterons dès que possible.

Le formulaire a été soumis avec succès.

Vous trouverez de plus amples informations dans votre boîte aux lettres.

Sélection de la langue

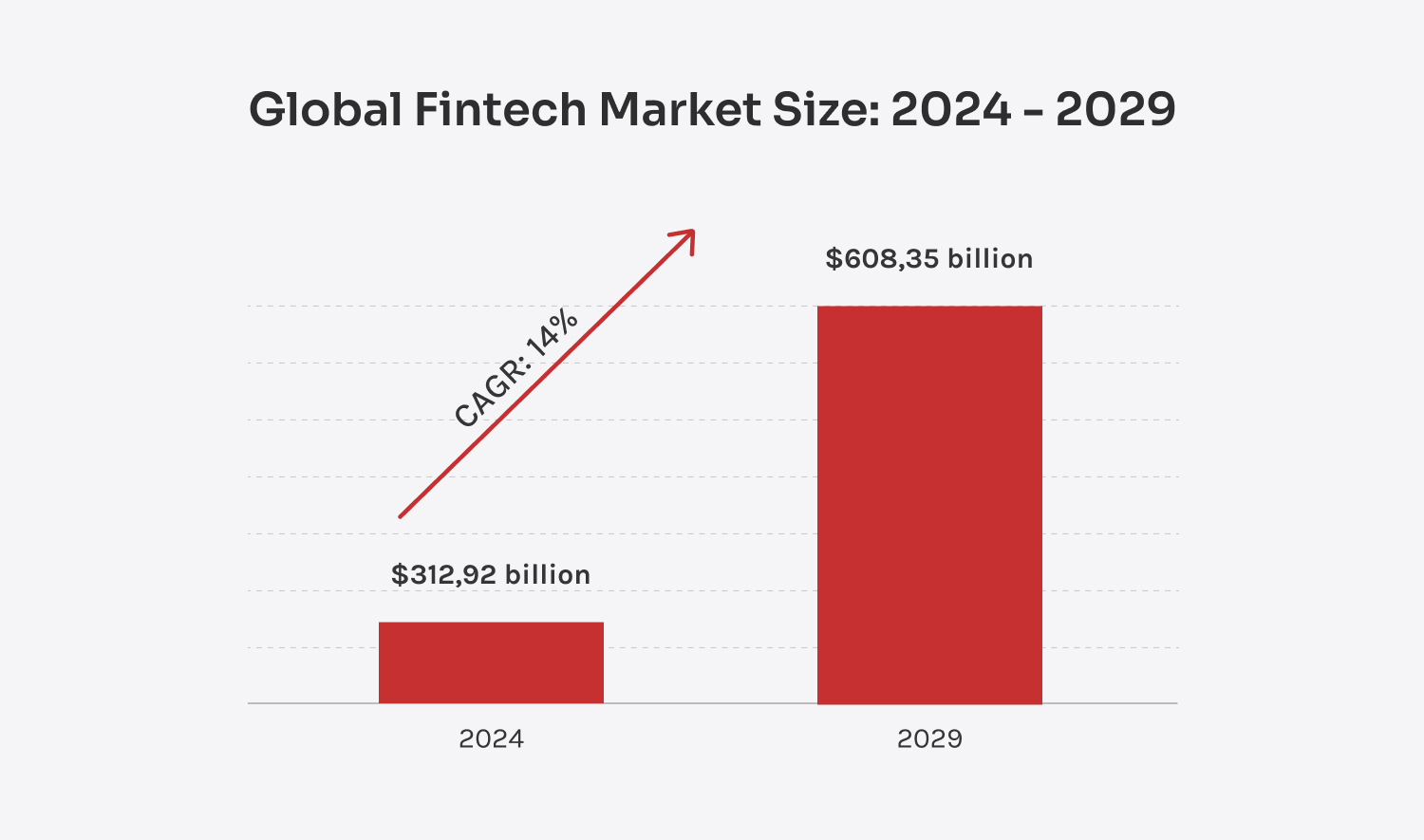

La poussée vers la numérisation, la demande croissante d'inclusion financière et les progrès technologiques rapides, ainsi que l'évolution des préférences des consommateurs pour les services bancaires numériques, indiquent tous une chose : l'adoption des FinTech n'est plus facultative. Ce n'est qu'une question de temps avant que les entreprises ne doivent l'adopter sous peine d'être distancées. Et les chiffres parlent d'eux-mêmes - selon Mordor Intelligence, le marché des FinTech est estimé à $312,92 milliards en 2024 et pourrait atteindre $608,35 milliards d'ici 2029, avec un TCAC de plus de 14%. Cela signifie que l'industrie des applications FinTech est en plein essor et qu'elle n'est pas près de ralentir !

Si vous êtes ici, c'est que vous faites sans doute partie de ces avant-gardistes qui cherchent à développer et à transformer leur entreprise à l'aide d'applications FinTech. C'est pourquoi nous avons rassemblé tous les détails que vous devez connaître sur les FinTech. coûts de développement de l'application.

There’s no better time than now! At Innowise, we know how to get it done right at a cost that works for you.

Banking apps aren’t just nice-to-haves anymore — they're tools people rely on daily, if not hourly. From fast and secure payments to smooth mobile experiences and 24/7 support, these apps need to be reliable and built to handle everything your customers need, anytime and anywhere. We create banking apps that are not only powerful but also designed to keep your customers coming back, boosting loyalty and engagement with every interaction.

Today’s digital-savvy users want more than just to send or receive money — they want to easily manage, budget, track, and plan their finances. The personal finance software market is booming, expected to hit $4.2 billion by 2032. At Innowise, we build personal finance apps that truly live up to the "personal" part. They're customized to fit real customer needs and flexible enough to grow as those needs change.

InsurTech is all about making things simple and earning your customers' trust. So, how do you pull that off? Well, you could build a super user-friendly app where policyholders can easily access insurance options. Or you could make things easier for your agents — helping them streamline their routine tasks so they can focus on the important stuff that really drives results. Either way, we've got you covered!

Applications d'investissement let users trade stocks from the comfort of their couch. You might be thinking, "Sure, lots of apps offer that." But what if we told you that your app could integrate advanced features like GenAI to analyze market trends and user risk tolerance and offer personalized advice? Sounds more exciting, right? Our investment apps are designed to help users make the most of their money, turning investing into a simple and rewarding experience.

Banking apps aren’t just nice-to-haves anymore — they're tools people rely on daily, if not hourly. From fast and secure payments to smooth mobile experiences and 24/7 support, these apps need to be reliable and built to handle everything your customers need, anytime and anywhere. We create banking apps that are not only powerful but also designed to keep your customers coming back, boosting loyalty and engagement with every interaction.

Today’s digital-savvy users want more than just to send or receive money — they want to easily manage, budget, track, and plan their finances. The personal finance software market is booming, expected to hit $4.2 billion by 2032. At Innowise, we build personal finance apps that truly live up to the "personal" part. They're customized to fit real customer needs and flexible enough to grow as those needs change.

InsurTech is all about making things simple and earning your customers' trust. So, how do you pull that off? Well, you could build a super user-friendly app where policyholders can easily access insurance options. Or you could make things easier for your agents — helping them streamline their routine tasks so they can focus on the important stuff that really drives results. Either way, we've got you covered!

Investment apps let users trade stocks from the comfort of their couch. You might be thinking, "Sure, lots of apps offer that." But what if we told you that your app could integrate advanced features like GenAI to analyze market trends and user risk tolerance and offer personalized advice? Sounds more exciting, right? Our investment apps are designed to help users make the most of their money, turning investing into a simple and rewarding experience.

Le développement d'une application FinTech peut comporter de nombreuses parties mobiles. C'est là qu'Innowise intervient - nous nous efforçons de vous simplifier la tâche. Au lieu de traiter avec de multiples fournisseurs de services, vous pouvez compter sur nous pour vous fournir un service complet.

Vous avez déjà une vision de votre future application FinTech ?

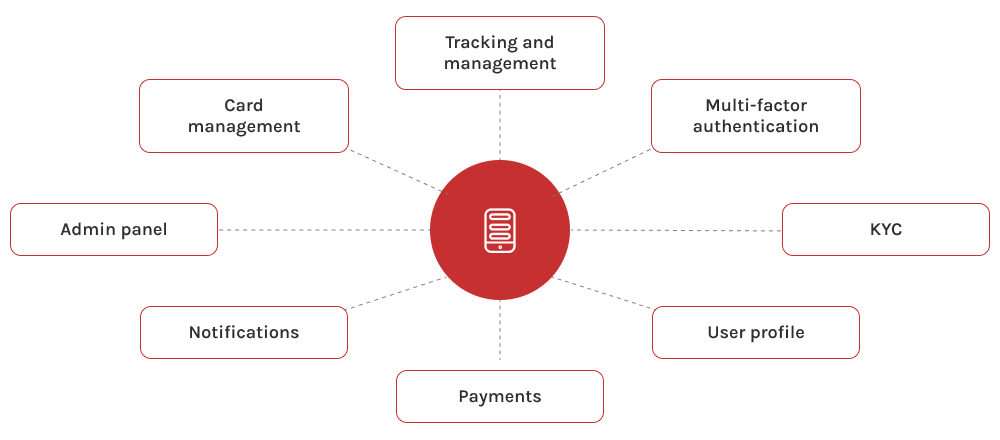

Selon SDK.finance, a FinTech software provider focused on banking and payment infrastructure, many must-have FinTech features impact development costs mainly through backend architecture, ledger logic, and reconciliation workflows rather than user interface complexity, which is why these elements play a key role in overall fintech app development cost.

Nous vous aiderons à prendre des mesures intelligentes et à créer une solution qui génère réellement des bénéfices.

Exigences relatives aux produits

UI/UX interactif

Localisation du partenaire de développement

Temps nécessaire au développement de l'application

Maintenance de l'application

Technologies avancées utilisées

Outils et langages utilisés

Caractéristiques intégrées

Siarhei Sukhadolski

Expert FinTech chez Innowise

Nous y voilà ! Après avoir plongé dans les caractéristiques essentielles et les considérations de coût du développement d'applications FinTech, examinons le fonctionnement du processus de développement dans son ensemble.

Siarhei Sukhadolski

Expert FinTech chez Innowise

Cela dépend vraiment de la complexité de l'application - cela peut prendre de 3 à 12 mois, voire plus. Bien entendu, le développement des fonctionnalités les plus avancées prendra plus de temps, mais plus votre application sera bien pensée et construite avec soin, moins vous rencontrerez de problèmes par la suite.

Une application de base peut vous coûter entre $50 000 et $100 000, mais si vous recherchez des fonctionnalités plus avancées, le prix peut facilement augmenter. Tout dépend également de votre décision d'embaucher des développeurs en interne, d'externaliser le travail ou d'opter pour un mélange des deux avec des équipes renforcées.

Avec les bons experts et des processus transparents, les coûts cachés sont peu probables. Toutefois, l'ajout de nouvelles fonctionnalités au fil du temps peut faire grimper le prix. C'est pourquoi nous proposons une planification et une budgétisation solides dès le départ, afin de vous éviter toute surprise en cours de route.

La sécurité est essentielle dans le développement d'applications FinTech, car ces applications gèrent des données financières sensibles. La nécessité de disposer de dispositifs de sécurité solides peut faire grimper le budget. Les failles de sécurité sont coûteuses, non seulement en termes d'argent, mais aussi en termes de confiance des utilisateurs.

Expert FinTech

Siarhei dirige notre orientation FinTech avec une connaissance approfondie de l'industrie et une vision claire de la direction que prend la finance numérique. Il aide les clients à naviguer dans les réglementations complexes et les choix techniques, en façonnant des solutions qui ne sont pas seulement sécurisées - mais construites pour la croissance.

Votre message a été envoyé.

Nous traiterons votre demande et vous contacterons dès que possible.

En vous inscrivant, vous acceptez notre Politique de confidentialitéy compris l'utilisation de cookies et le transfert de vos informations personnelles.