Your message has been sent.

We’ll process your request and contact you back as soon as possible.

The form has been successfully submitted.

Please find further information in your mailbox.

According to the Digital Banking Platform Global Market Report, there will be a substantial expansion in the size of the digital banking market, from $6.68 billion in 2023 to $7.49 billion in 2024, reflecting a staggering compound annual growth rate of 12.0%. With the ubiquitous demand for convenient banking on the go, the challenge of becoming a digital-first fintech vendor to meet tech-savvy clients’ expectations has become increasingly significant. Following lockdowns and COVID-era restrictions, people expect brick-and-mortar banks to embrace more agility, allowing them to conduct financial transactions from the comfort of their homes without the burden of visiting a bank branch.

A decade ago, the lack of a substantial investment — somewhere in the range of $30-50 million — would have been a formidable barrier for any institution aspiring to automate its banking services fully and step onto the bank digital transformation path. However, the landscape has shifted dramatically nowadays, thanks to the advent of open-source technology that changed the paradigm for good. Recently, the open-source revolution has democratized the process drastically. It enables both budding startups and mature enterprises to construct a fully operational digital bank piece by piece using solutions available in the market in a budget-friendly manner.

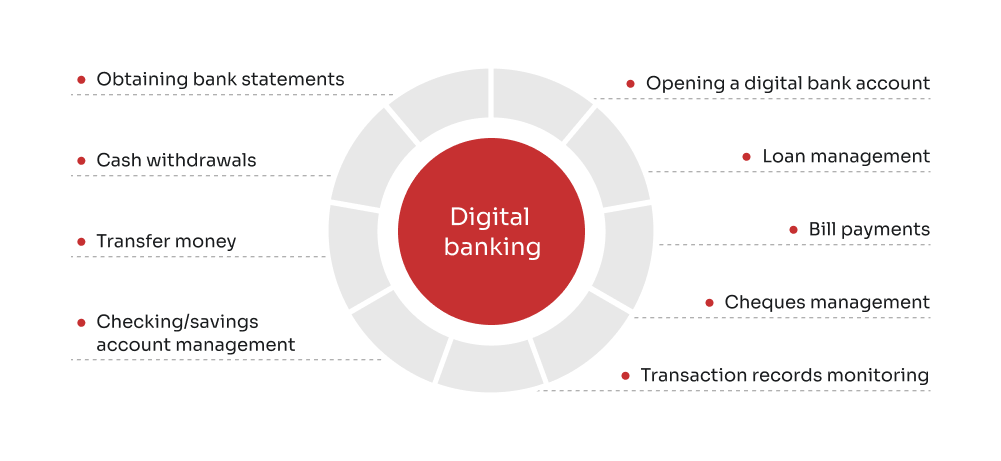

In essence, digital banking implies digitizing all traditional banking products, processes, operations, and activities to serve clients through online channels. Digital banking facilitates customers to access a range of banking services seamlessly via their laptops, smartphones, and tablets, from account creation and onboarding to conducting payments and applying for loans anywhere, anytime.

Today, digital banking platforms are utilized by a diverse and extensive user base, with over 10,000 commercial bank businesses worldwide, IBISWorld reports. Broad adoption of open-source platforms reflects the flexibility, robustness, and relevance of open-source digital core banking systems in various market conditions and regulatory environments, backed by continuous improvements and the evolution of the global community of developers.

Alexander Nemtsov

Delivery manager & FinTech expert at Innowise

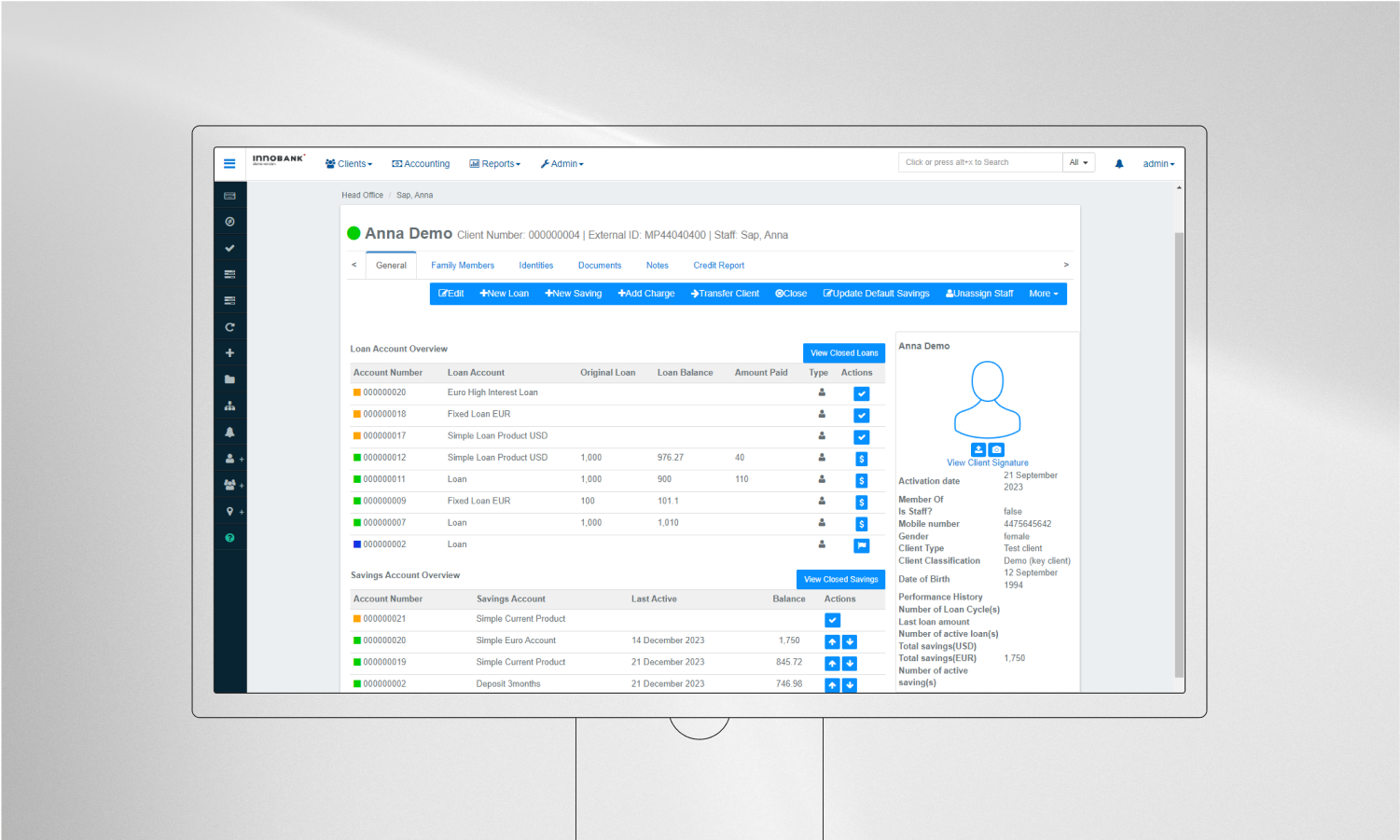

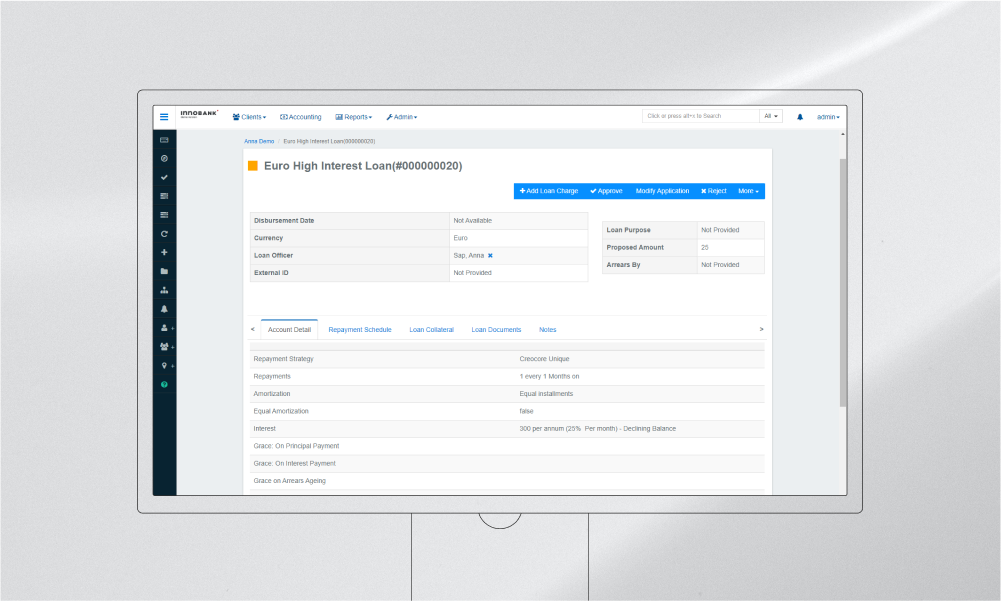

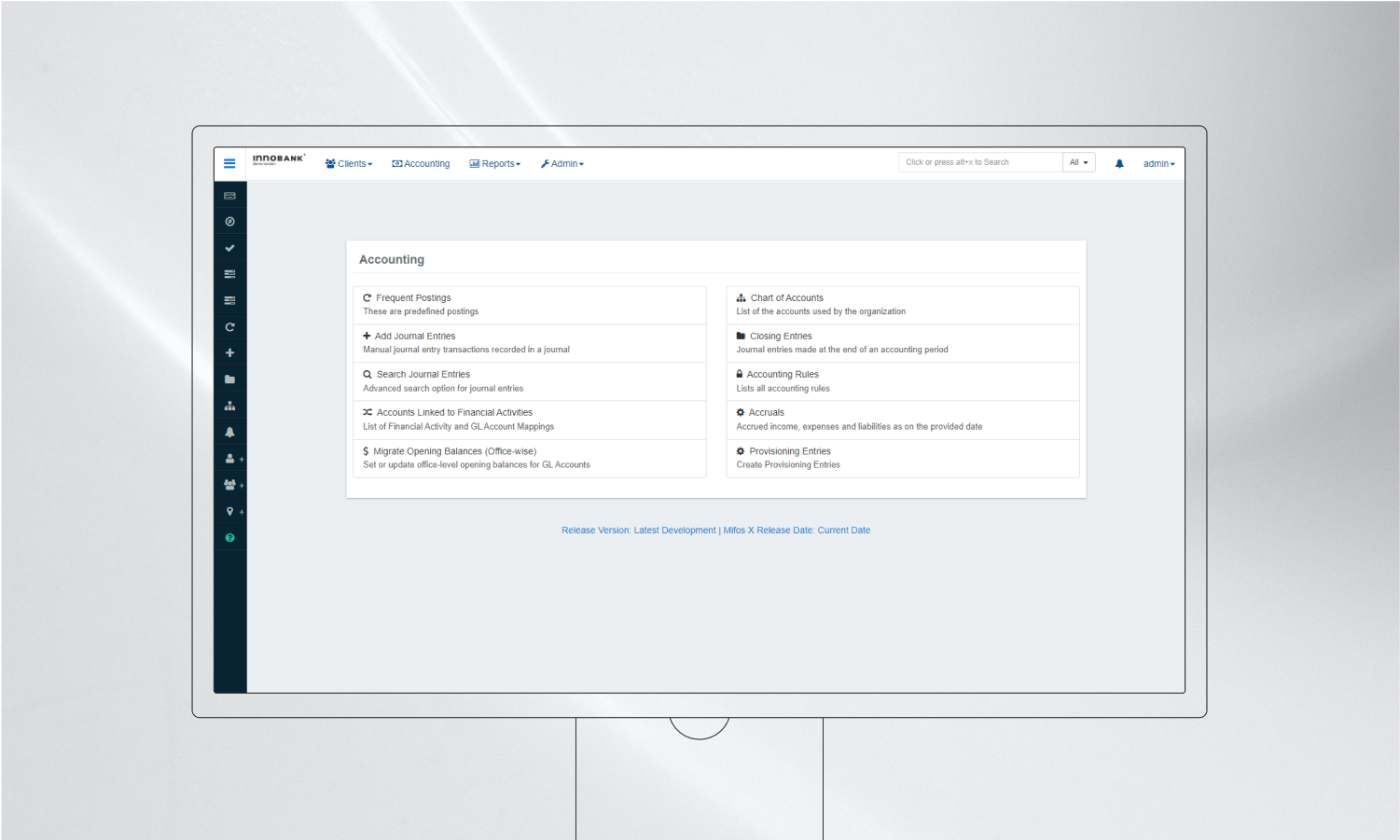

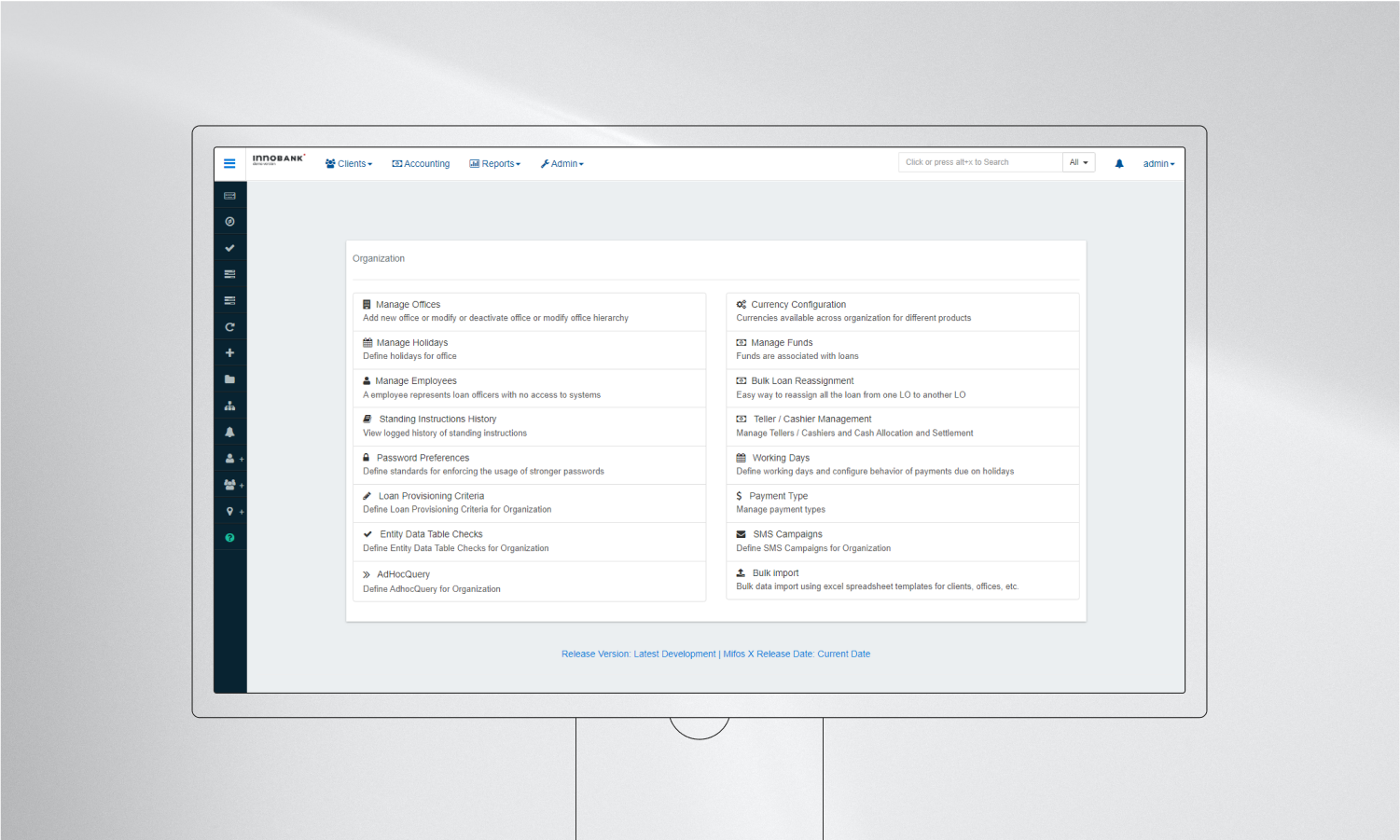

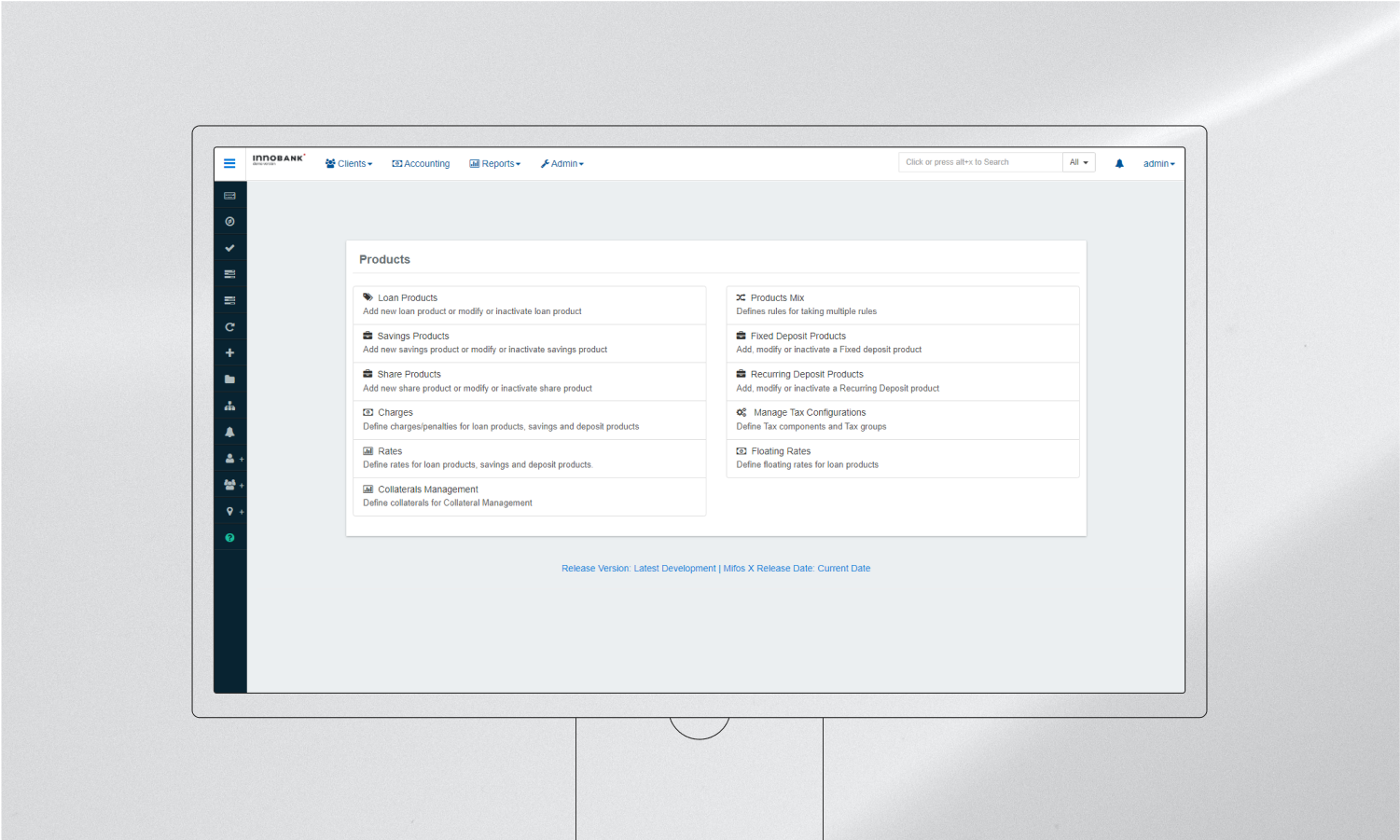

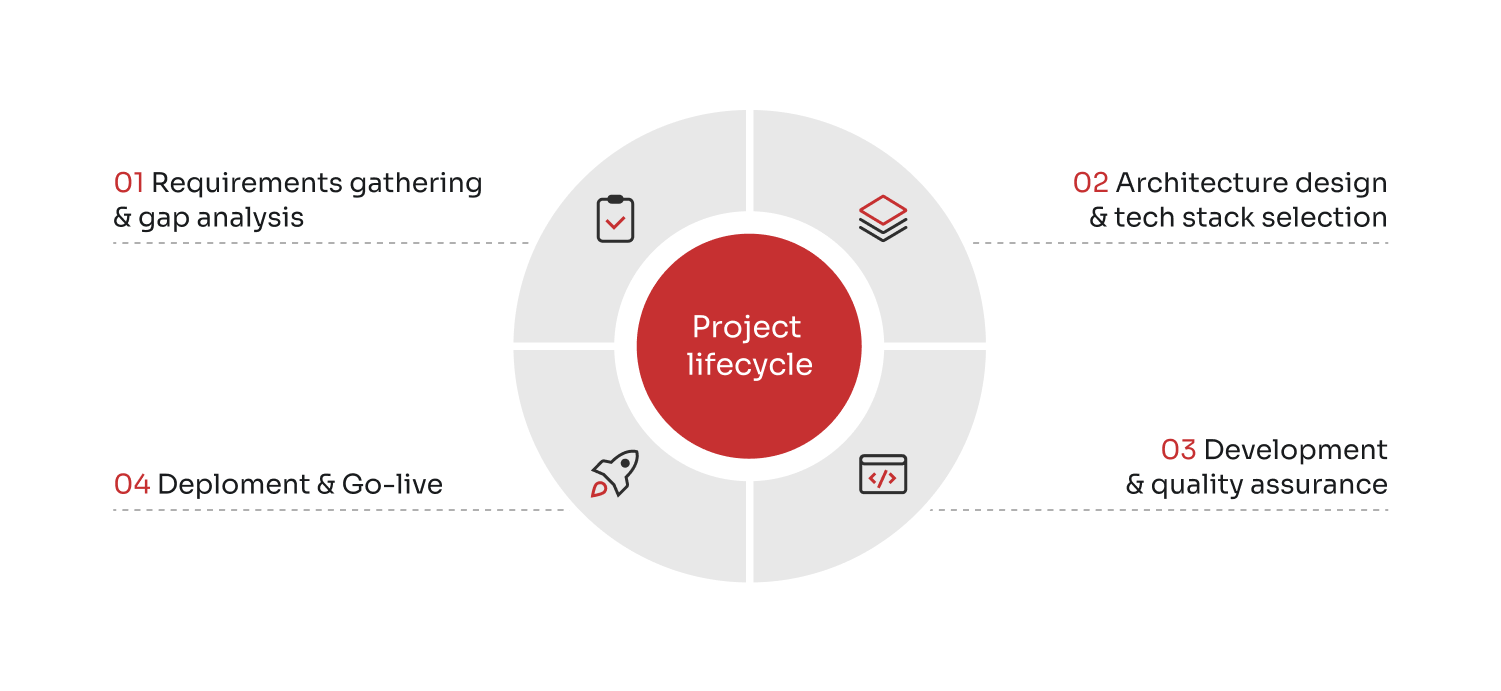

Developing a new core banking system involved a structured project lifecycle, ensuring the end product was tailored to meet specific business needs and objectives.

01

02

03

04

Financial institutions operate under strict regulatory environments, which vary significantly from country to country. When developing a digital bank, it is crucial to ensure that the system complies with varying legal frameworks, reporting standards, and compliance protocols, eliminating the slightest risk of costly penalties and trials in case of violations.

The journey of implementing a core banking system using open-source technologies, exemplified through the lens of Innobank, has fundamentally altered the banking landscape. Previously, the development of a digital bank from scratch was a privilege reserved for wealthy and large-scale banking institutions. It required significant capital, resources, and technological infrastructure, often making it an impossible challenge for smaller players in the financial sector. However, the current landscape tells a different story – one where even a startup can aspire to and successfully launch a digital bank. The democratization of technology, led by open-source platforms like Innobank, has leveled the playing field, making it possible for organizations of all sizes to venture into digital banking with more confidence and fewer resources.

Innowise, with 17+ years of experience in the fintech domain, builds sophisticated digital banking solutions, excelling in areas where other outsourcing vendors show signs of hesitation. From bank API integrations to configuring core banking system components, we put in the aggregate experience of 1600+ accomplished specialists to present digital solutions that reshape the fintech horizon and open new business opportunities. The skills and experience we bring to the development of financial technology solutions extend beyond simply creating software as we cement financial diversity and inclusion. Opt for us, and let’s start great things together.

Rate this article:

4.8/5 (45 reviews)

Your message has been sent.

We’ll process your request and contact you back as soon as possible.

By signing up you agree to our Privacy Policy, including the use of cookies and transfer of your personal information.