Uw bericht is verzonden.

We verwerken je aanvraag en nemen zo snel mogelijk contact met je op.

Het formulier is succesvol verzonden.

Meer informatie vindt u in uw mailbox.

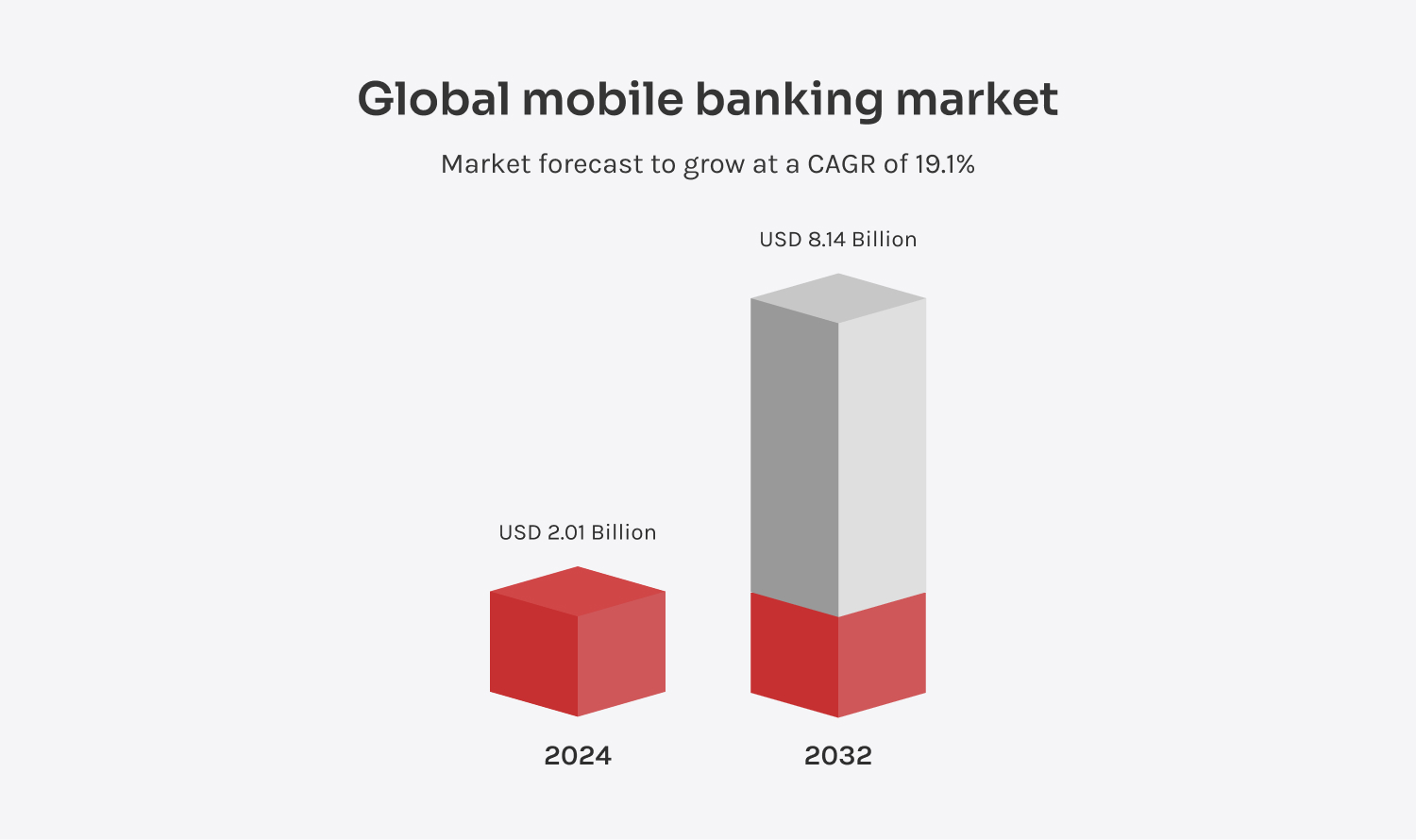

Mobiele bankieren-apps zijn tegenwoordig onze levensaderen. Moet je je saldo controleren? Een rekening betalen? Een lening aanvragen? Daar is een app voor. De markt voor mobiel bankieren groeit niet alleen - hij groeit explosief. Tegen 2032 zal het sprong van $2,01 miljard in 2024 naar $8,14 miljard met een jaarlijkse groei van 19,10%. Dat zijn een heleboel mensen die verwachten dat hun apps perfect werken elke keer dat ze op hun scherm tikken.

Maar hier zit het addertje onder het gras - banken zitten vast in een lastig parket. Ze moeten meegaan met de laatste technische trends, maar ze kunnen geen enkele crash of hapering riskeren. Eén hik en het vertrouwen van de klant is verloren.

Hoe houden banken hun apps innovatief en toch betrouwbaar? Het geheim is het testen van apps voor mobiel bankieren - de held achter de schermen die ervoor zorgt dat alles vlekkeloos werkt. Benieuwd hoe het allemaal in zijn werk gaat? Laten we erin duiken!

Siarhei Sukhadolski

FinTech Expert & Head of Competence Center

Bij Innowise begrijpen we het: uw app voor mobiel bankieren is het gezicht van uw merk en de sleutel om meer gebruikers voor u te winnen. Van gedetailleerde controles tot diepgaande evaluaties, wij zorgen ervoor dat je app vlekkeloos presteert en een blijvende indruk achterlaat.

Functioneel testen zorgt ervoor dat je bank-app werkt zoals bedoeld - of het nu gaat om het afhandelen van transacties, het verwerken van betalingen of het beheren van rekeningen. We testen praktijkscenario's om eventuele haperingen op te sporen en te verhelpen, zodat je app een betrouwbare ervaring biedt.

Uw bankieren-app is altijd in ontwikkeling - bugs worden verholpen, upgrades worden uitgerold en prestaties worden verbeterd. Onze regressietests zorgen ervoor dat deze veranderingen niet ten koste gaan van wat al werkt, zodat uw app stabiel blijft en altijd klaar is voor gebruikers.

Met beveiligingstests voor bankapps versterken we je app tegen potentiële bedreigingen door kwetsbaarheden op te sporen met penetratietests, encryptienormen te beoordelen en veilige verificatiemethoden te valideren.

Ons team voert stress- en belastingstests uit om knelpunten op te sporen, de snelheid te verhogen en ervoor te zorgen dat je app voor mobiel bankieren snel blijft, veel verkeer aankan, transacties snel verwerkt en soepel werkt - zelfs onder zware belasting.

Compliantietests zorgen ervoor dat je bank-app voldoet aan alle regels en normen van de sector, zoals GDPR, PCI DSS of lokale bankwetten. Dit is essentieel om boetes te voorkomen, gebruikersgegevens veilig te houden en het vertrouwen van klanten te verdienen.

Automatiseringstests maken het controleren van je bankieren-app een stuk eenvoudiger door vooraf gescripte tests uit te voeren voor zaken als regressie, functionaliteit en prestaties. Het vermindert handmatig werk, versnelt het testen en houdt alles consistent.

Ons team test API's - de motoren achter de kernfuncties van uw bankieren-app - streng om te controleren of elke API werkt zoals bedoeld. De focus ligt op het testen van de functionaliteit en betrouwbaarheid van de API zelf, onafhankelijk van andere componenten.

In een bankieren-app draait alles om nauwkeurige en betrouwbare gegevens - of het nu gaat om gebruikersgegevens, transactiegegevens of rekeningsaldi. Ons team controleert invoer, databasebewerkingen en uitvoer zorgvuldig om fouten te voorkomen en de integriteit te behouden.

Integratietesten zorgen ervoor dat alle onderdelen van je bankieren-app perfect samenwerken. Het draait allemaal om het opsporen van problemen wanneer dingen met elkaar worden verbonden, zoals een betalings-API die saldi niet bijwerkt of meldingen verstuurt.

Ons team test je app op allerlei apparaten, platforms, schermformaten en opstellingen om fouten in de lay-out, vertragingen of gebroken functies op te sporen, zodat je app er goed uitziet en perfect werkt, waar hij ook wordt gebruikt.

We controleren functies zoals schermlezers, toetsenbordnavigatie, kleurcontrast en tekstgrootte aan de hand van toegankelijkheidsnormen zoals WCAG om ervoor te zorgen dat je app voor iedereen inclusief en gebruiksvriendelijk is.

Bruikbaarheidstests richten zich op hoe gemakkelijk en intuïtief uw app voor mobiel bankieren te gebruiken is. Het evalueert de navigatie, workflows en het algehele ontwerp om pijnpunten zoals verwarrende lay-outs of moeilijk te vinden functies te identificeren.

UAT is de laatste controle voor de lancering, waarbij echte gebruikers uw bankieren-app testen om te bevestigen dat deze voldoet aan hun verwachtingen en bedrijfsvereisten. De focus ligt op de bevestiging dat de app klaar is voor lancering, zowel technisch als vanuit het perspectief van de gebruiker.

30+

experts in bankieren en financiële diensten

27+

zakelijke klanten

35+

ervaren QA-engineers

105+

succesvolle testprojecten in de banksector

Our ISTQB Gold Partner status confirms our commitment to world-class software testing standards at company scale, supporting both regulation-heavy and agile environments.

We got here by developing versatile QA expertise — from test management to automation — so we’ve ensured you’re fully covered.

Het testen van een mobiele bankieren-app is een proces van begin tot eind waarbij elke fase van belang is. Het is als het in elkaar zetten van een puzzel; elk stukje is belangrijk om het geheel soepel te laten verlopen. Laten we eens kijken hoe het proces in elkaar steekt.

Met platforms voor online bankieren kunnen gebruikers rekeningen controleren, geld versturen en hun financiën regelen wanneer ze maar willen. We testen op veilige aanmeldingen, realtime updates, soepele transacties en compatibiliteit tussen apparaten om ervoor te zorgen dat alles vlekkeloos werkt.

Mobiel bankieren apps plaatsen financiële diensten in de zakken van gebruikers, met de nadruk op toegankelijkheid en gebruiksgemak. Onze tests zorgen voor kritieke functies zoals biometrische logins, pushmeldingen en mobiele factoren zoals soepele navigatie en snelle laadtijden.

E-wallets maken het makkelijk om geld te sturen, contactloos te betalen of rekeningen te delen met vrienden. Als we e-wallets testen, kijken we naar alles wat ze veilig en gebruiksvriendelijk maakt, zoals sterke encryptie, bescherming tegen fraude en synchronisatie tussen apparaten.

Zakelijke bankieren apps zijn speciaal ontworpen voor bedrijven en stroomlijnen taken zoals salarisadministratie, bulkbetalingen en het beheren van rekeninghiërarchieën. We richten ons op het testen van hun vermogen om zware transactiebelastingen te verwerken, veilige toegang voor meerdere gebruikers te ondersteunen en mee te groeien met je bedrijf.

Dergelijke apps werken uitsluitend op digitale platforms en vereisen meer dan alleen basistests. We concentreren ons op het probleemloos aanmaken van accounts, robuuste beveiligingsprotocollen, vlekkeloze integratie met API's van derden en nauwkeurige transactieverwerking in realtime.

Beleggingsapps brengen de kracht van handelen en portefeuillebeheer binnen handbereik van gebruikers. Om ervoor te zorgen dat deze apps werken, richten we ons op het testen van de nauwkeurigheid van gegevens, integratie met handels-API's en stabiliteit onder het zware verkeer dat gepaard gaat met pieken en dalen op de markt.

P2P-apps maken het versturen van geld net zo eenvoudig als een paar tikken. Onze tests zijn gericht op het verifiëren van de nauwkeurigheid van transacties, veilige gebruikersverificatie, het valideren van soepele grensoverschrijdende overboekingen en naleving van de betalingsvoorschriften.

Andrew Artyukhovsky

Hoofd QA bij Innowise

Mobiel bankieren apps ontwikkelen zich snel en het testen moet gelijke tred houden met de toenemende eisen voor snelheid, veiligheid en betrouwbaarheid. Naarmate de technologie zich verder ontwikkelt, zal de manier waarop we deze apps testen drastisch veranderen, gedreven door een aantal Spannende trends die de toekomst van mobiel bankieren vormgeven.

AI en ML zijn game-changers voor het testen van apps voor mobiel bankieren. Geautomatiseerde testcreatie, zelfherstellende scripts en slimmere testprioritering halen het repetitieve werk van het bord van QA-teams. Dit betekent meer tijd om edge cases aan te pakken en lastige problemen op te lossen. ML maakt het ook eenvoudiger om problemen op te sporen die er echt toe doen, zoals betalingsfouten, beveiligingsrisico's en aanmeldingsproblemen, zodat apps altijd in topvorm zijn.

Omdat apps voor mobiel bankieren meer gevoelige gegevens dan ooit verwerken, zullen beveiligingstests centraal staan. Van encryptie en veilige API's tot het opsporen van kwetsbaarheden voordat hackers dat doen, het veilig houden van apps wordt een topprioriteit. Penetratietesten en realtime beveiligingscontroles helpen apps om bedreigingen voor te blijven en het vertrouwen van gebruikers intact te houden.

Bij het testen van apps voor mobiel bankieren gaat het erom vertrouwen op te bouwen, dingen veilig te houden en ervoor te zorgen dat alles soepel verloopt. Slimme controles zijn cruciaal voor elk onderdeel van de app. Het draait allemaal om het voldoen aan de hoge verwachtingen van zowel gebruikers als toezichthouders, terwijl de financiële integriteit behouden blijft en compliance wordt nageleefd - allemaal om gebruikers een naadloze, betrouwbare ervaring te bieden.

Testen is een must voor apps voor mobiel bankieren omdat ze omgaan met gevoelige informatie en echt geld - één kleine bug kan alles verknoeien. Het zorgt ervoor dat de app veilig is, soepel werkt en gebruikers tevreden en stressvrij houdt.

Het lastige aan het testen van apps voor mobiel bankieren is om alles in evenwicht te houden: strenge beveiliging, vlekkeloze transacties, compatibiliteit met meerdere apparaten en strikte naleving, terwijl de app toch eenvoudig en prettig is voor gebruikers.

We zorgen ervoor dat de app werkt op zowel Android als iOS door platformonafhankelijke testtools te gebruiken, tests uit te voeren op echte apparaten en emulators en functionaliteit, prestaties en compatibiliteit specifiek voor elk besturingssysteem te valideren.

De duur van het testen van apps voor mobiel bankieren hangt af van de complexiteit, functies en vereisten van de app. Gemiddeld kan het enkele weken duren voor eenvoudige apps tot enkele maanden voor complexe apps met geavanceerde functionaliteiten en strenge compliance-eisen.

Uw bericht is verzonden.

We verwerken je aanvraag en nemen zo snel mogelijk contact met je op.

Door u aan te melden gaat u akkoord met onze Privacybeleidmet inbegrip van het gebruik van cookies en de overdracht van uw persoonlijke gegevens.