Uw bericht is verzonden.

We verwerken je aanvraag en nemen zo snel mogelijk contact met je op.

Het formulier is succesvol verzonden.

Meer informatie vindt u in uw mailbox.

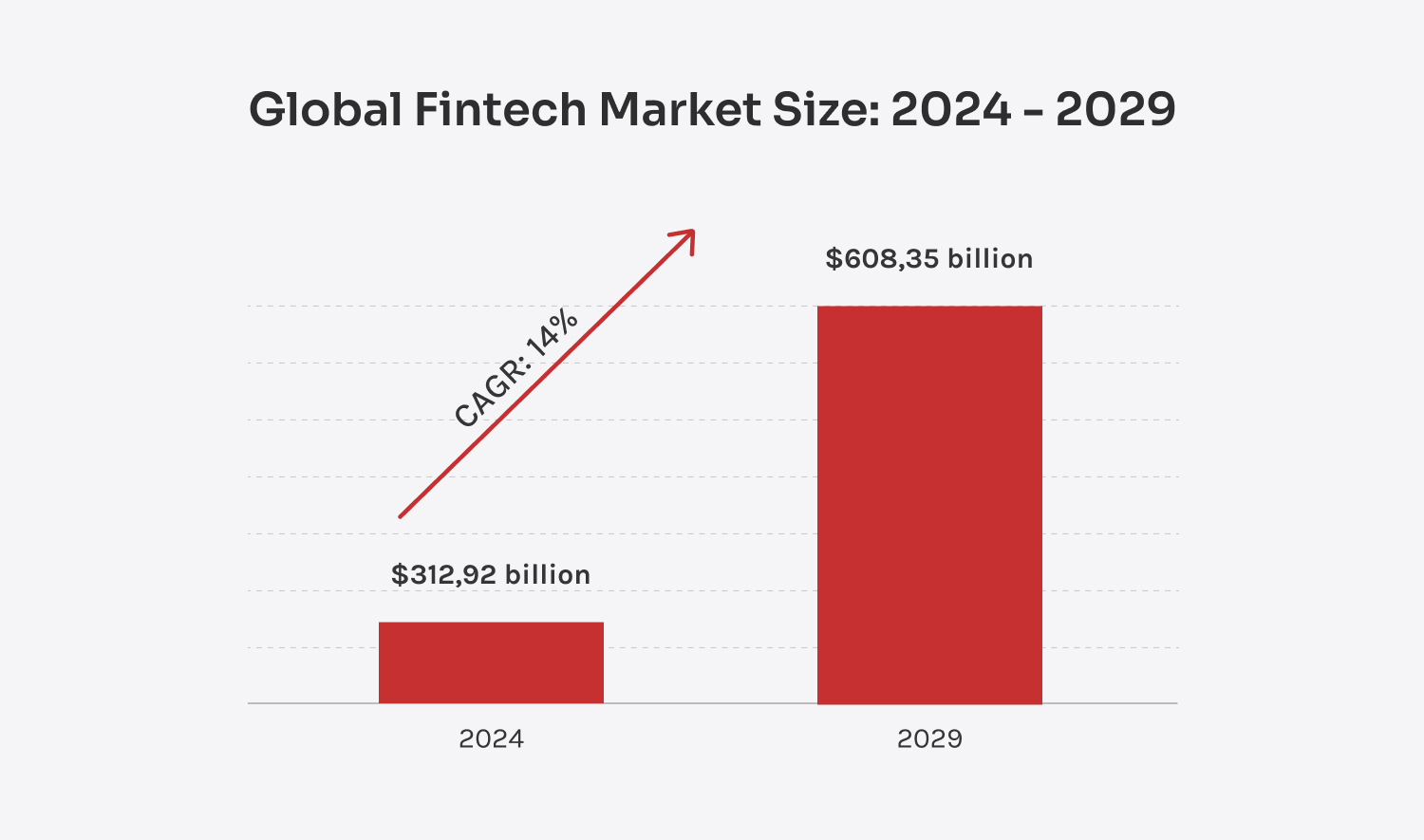

De drang naar digitalisering, de groeiende vraag naar financiële inclusie en de snelle technologische vooruitgang, samen met de verschuivende voorkeuren van consumenten voor digitaal bankieren, wijzen allemaal op één ding: de overstap naar FinTech is niet langer optioneel. Het is slechts een kwestie van tijd voordat bedrijven het moeten omarmen of het risico lopen achterop te raken. En de cijfers spreken voor zich - volgens Mordor Intelligence wordt de FinTech markt geschat op $312,92 miljard in 2024 en zou deze kunnen groeien tot $608,35 miljard in 2029, met een CAGR van meer dan 14%. Dit betekent dat de FinTech app industrie in opkomst is en niet snel zal vertragen!

Als u hier bent, bent u waarschijnlijk een van die vooruitdenkers die op zoek zijn naar mogelijkheden om uw bedrijf te laten groeien en transformeren met FinTech apps. Daarom hebben we alle details die u moet weten over FinTech op een rijtje gezet van de kosten voor app-ontwikkeling.

Bancaire apps zijn niet meer alleen een leuk hebbedingetje - het zijn tools waar mensen dagelijks op vertrouwen, zo niet zo niet elk uur. Van snelle en veilige betalingen tot soepele mobiele ervaringen en 24/7 ondersteuning, deze apps moeten betrouwbaar zijn en alles aankunnen wat uw klanten nodig hebben, altijd en overal. Wij maken apps voor banken die niet alleen krachtig zijn, maar ook ontworpen zijn om uw klanten terug te laten komen, zodat ze loyaler en meer betrokken worden bij elke interactie. elke interactie.

De digitale gebruikers van vandaag willen meer dan alleen geld sturen of ontvangen. gemakkelijk hun financiën beheren, budgetteren, bijhouden en plannen. De markt voor software voor persoonlijke financiën is booming en zal naar verwachting $4,2 miljard tegen 2032. Bij Innowise maken we apps voor persoonlijke financiën die het "persoonlijke" deel echt waarmaken. deel. Ze zijn aangepast aan de werkelijke behoeften van de klant en flexibel genoeg om mee te groeien als die behoeften veranderen.

Bij InsurTech draait alles om dingen eenvoudig maken en het vertrouwen van je klanten verdienen. Dus, hoe krijg je dat voor elkaar? Nou, je zou een super gebruiksvriendelijke app kunnen bouwen waar polishouders gemakkelijk toegang hebben tot verzekeringsopties. Of je kunt het je agenten makkelijker maken - door ze te helpen hun routinetaken te stroomlijnen zodat ze zich kunnen richten op de belangrijke dingen die echt resultaat opleveren. Hoe dan ook, wij zorgen ervoor!

Investeringsapps laat gebruikers vanuit hun luie stoel handelen in aandelen. Misschien denk je denken, "Natuurlijk, veel apps bieden dat." Maar wat als we je vertellen dat je app geavanceerde functies zoals GenAI kan integreren om markttrends en risicotolerantie van gebruikers te analyseren en persoonlijk advies kan geven? functies zoals GenAI kan integreren om markttrends en de risicotolerantie van gebruikers te analyseren en persoonlijk advies te geven? Klinkt spannender, toch? Onze beleggingsapps zijn ontworpen om gebruikers te helpen het meeste uit hun geld te halen. een eenvoudige en lonende ervaring te maken.

Bancaire apps zijn niet meer alleen een leuk hebbedingetje - het zijn tools waar mensen dagelijks op vertrouwen, zo niet zo niet elk uur. Van snelle en veilige betalingen tot soepele mobiele ervaringen en 24/7 ondersteuning, deze apps moeten betrouwbaar zijn en alles aankunnen wat uw klanten nodig hebben, altijd en overal. Wij maken apps voor banken die niet alleen krachtig zijn, maar ook ontworpen zijn om uw klanten terug te laten komen, zodat ze loyaler en meer betrokken worden bij elke interactie. elke interactie.

De digitale gebruikers van vandaag willen meer dan alleen geld sturen of ontvangen. gemakkelijk hun financiën beheren, budgetteren, bijhouden en plannen. De markt voor software voor persoonlijke financiën is booming en zal naar verwachting $4,2 miljard tegen 2032. Bij Innowise maken we apps voor persoonlijke financiën die het "persoonlijke" deel echt waarmaken. deel. Ze zijn aangepast aan de werkelijke behoeften van de klant en flexibel genoeg om mee te groeien als die behoeften veranderen.

Bij InsurTech draait alles om dingen eenvoudig maken en het vertrouwen van je klanten verdienen. Dus, hoe krijg je dat voor elkaar? Nou, je zou een super gebruiksvriendelijke app kunnen bouwen waar polishouders gemakkelijk toegang hebben tot verzekeringsopties. Of je kunt het je agenten makkelijker maken - door ze te helpen hun routinetaken te stroomlijnen zodat ze zich kunnen richten op de belangrijke dingen die echt resultaat opleveren. Hoe dan ook, wij zorgen ervoor!

Met beleggingsapps kunnen gebruikers vanuit hun luie stoel handelen in aandelen. Je denkt misschien denken: "Natuurlijk, veel apps bieden dat." Maar wat als we je vertellen dat je app geavanceerde functies zoals GenAI kan integreren om markttrends en risicotolerantie van gebruikers te analyseren en persoonlijk advies kan geven? functies zoals GenAI kan integreren om markttrends en de risicotolerantie van gebruikers te analyseren en persoonlijk advies te geven? Klinkt spannender, toch? Onze beleggingsapps zijn ontworpen om gebruikers te helpen het meeste uit hun geld te halen. een eenvoudige en lonende ervaring te maken.

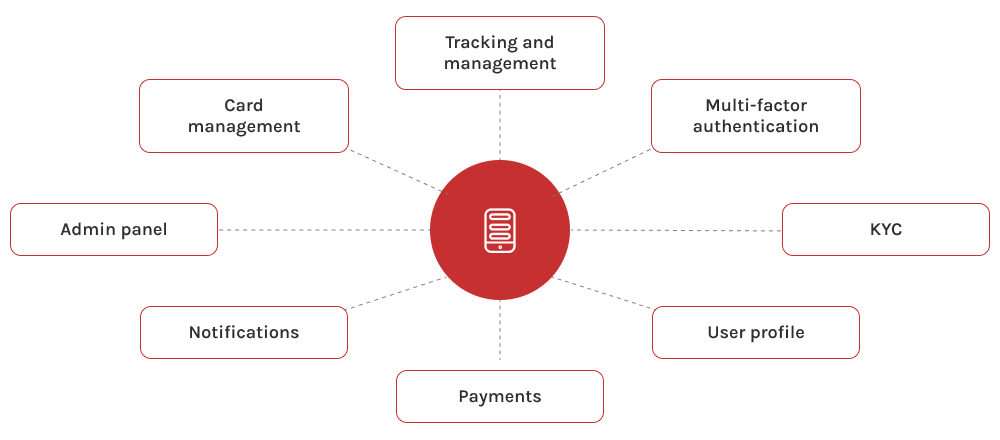

FinTech app ontwikkeling kan veel bewegende delen met zich meebrengen. Daar komt Innowise om de hoek kijken - wij willen het voor u eenvoudig houden. In plaats van met meerdere dienstverleners te maken te hebben, kunt u op ons vertrouwen dat wij een volledige service leveren.

Nu is het tijd om Innowise in te schakelen en je app klaar te maken om de markt op te schudden!

Productvereisten

Interactieve UI/UX

Locatie van de ontwikkelingspartner

Benodigde tijd voor app-ontwikkeling

App onderhoud

Gebruikte geavanceerde technologieën

Gebruikte gereedschappen en talen

Geïntegreerde functies

Siarhei Sukhadolski

FinTech-expert bij Innowise

Hier zijn we dan! Na een duik in de essentiële kenmerken en kostenoverwegingen van de ontwikkeling van FinTech apps, laten we eens kijken hoe het hele ontwikkelingsproces in zijn werk gaat.

Siarhei Sukhadolski

FinTech-expert bij Innowise

Het hangt er echt vanaf hoe complex de app is - het kan 3 tot 12 maanden of zelfs langer duren. Natuurlijk kost het meer tijd om geavanceerdere functies te ontwikkelen, maar hoe beter doordacht en zorgvuldig gebouwd je app is, hoe minder problemen je later zult tegenkomen.

Een basis-app kan ongeveer $50.000 tot $100.000 kosten, maar als je op zoek bent naar meer geavanceerde functies, kan de prijs gemakkelijk omhoog gaan. Het hangt er ook vanaf of je besluit om in-house ontwikkelaars in te huren, het werk uit te besteden of te kiezen voor een mix van beide met augmented teams.

Met de juiste experts en transparante processen zijn verborgen kosten onwaarschijnlijk. Maar als je na verloop van tijd meer functies toevoegt, kan de prijs stijgen. Daarom bieden we een degelijke planning en budgettering vanaf het allereerste begin, zodat je later niet voor verrassingen komt te staan.

Beveiliging is essentieel bij de ontwikkeling van FinTech apps omdat deze apps gevoelige financiële gegevens verwerken. De behoefte aan sterke beveiligingsfuncties kan het budget verhogen. Maar dit is geen gebied waar je kunt bezuinigen - beveiligingslekken zijn kostbaar, niet alleen in geld, maar ook in het vertrouwen van de gebruiker.

Uw bericht is verzonden.

We verwerken je aanvraag en nemen zo snel mogelijk contact met je op.

Door u aan te melden gaat u akkoord met onze Privacybeleidmet inbegrip van het gebruik van cookies en de overdracht van uw persoonlijke gegevens.