Su mensaje ha sido enviado.

Procesaremos su solicitud y nos pondremos en contacto con usted lo antes posible.

El formulario se ha enviado correctamente.

Encontrará más información en su buzón.

Seleccionar idioma

Como responsable de Sostenibilidad, me lo preguntan mucho: "¿Cuál es la diferencia entre ESG y sostenibilidad?". Es una gran pregunta porque, aunque están estrechamente relacionados, sirven a diferentes propósitos y no son intercambiables.

La sostenibilidad es la idea general: el compromiso a largo plazo de una empresa con prácticas responsables que equilibren el cuidado del medio ambiente, el bienestar social y el crecimiento económico. Se trata de construir un futuro en el que las empresas prosperen sin comprometer al planeta ni a la sociedad.

La gestión medioambiental, social y de gobierno corporativo (ESG) es un marco específico utilizado para medir y evaluar el rendimiento de una empresa en estos ámbitos. Se centra en parámetros como las emisiones de carbono, el compromiso con la comunidad y las prácticas de gobernanza, y ofrece a las partes interesadas una forma clara de evaluar el impacto.

En este artículo, le guiaré a través del debate entre ESG y sostenibilidad: en qué se diferencian estos conceptos, por qué son importantes y cómo las empresas pueden aprovechar ambos para impulsar un cambio significativo y duradero.

crecimiento anual de las inversiones climáticas de 2019 a 2022

Fuente: McKinsey SostenibilidadEn 2027, la compensación estará vinculada al impacto de la tecnología sostenible

Fuente: Gartnerlas empresas integran la ASG en sus procesos de gestión de riesgos

Fuente: RivelLa sostenibilidad siempre ha consistido en hacer más próspero el futuro: satisfacer las necesidades de hoy sin agotar los recursos de mañana. Sus raíces son profundas, empezando por la inversión socialmente responsable (ISR) en los años setenta, cuando los inversores empezaron a alinear sus carteras con sus valores. En la década de 1980, la responsabilidad social de las empresas (RSE) estaba en pleno apogeo, animando a las empresas a retribuir al planeta y operar de forma ética. Pero, aunque la RSC puso el balón en movimiento, a menudo carecía de las herramientas necesarias para medir el impacto real.

Todo cambió a principios de la década de 2000. El informe "Who Cares Wins" acuñó oficialmente el término ESG (environmental, social, and governance), marcando un cambio hacia métricas mensurables y marcos estructurados. Al mismo tiempo, organizaciones como la Global Reporting Initiative (GRI) y los Objetivos de Desarrollo del Milenio de la ONU sentaron las bases de lo que sería la ASG: un plan práctico y orientado a la acción para empresas e inversores.

ESG puso de relieve la conservación del medio ambiente, destacando cuestiones como las emisiones de carbono y el uso de recursos en su pilar medioambiental. El componente social se centra en los derechos laborales, la diversidad y el impacto en la comunidad, mientras que la gobernanza hace hincapié en la transparencia y la rendición de cuentas. Juntos, estos pilares medioambiental, social y de gobernanza forman una trifecta que ahora guía a las empresas de todo el mundo.

En la actualidad, la ASG es una prioridad mundial. Las empresas están tomando medidas y los inversores exigen resultados. Desde sus primeros días como una idea de nicho hasta su papel actual como punto de inflexión, la ASG trata de la responsabilidad, el impacto y de marcar una diferencia real.

Atraer inversiones ecológicas con buenos resultados en materia de ASG.

Reconozcámoslo: ESG y sostenibilidad ya no son sólo términos de moda. Son los pilares sobre los que las empresas mantienen su relevancia y se ganan la confianza. La forma en que trabajamos, los recursos que utilizamos y el impacto que dejamos están bajo la lupa de todo el mundo. Los 17 Objetivos de Desarrollo Sostenible (ODS) de las Naciones Unidas, desde la lucha contra la pobreza hasta la lucha contra el cambio climático, nos ofrecen una hoja de ruta clara para el futuro. ¿Y adivinen qué? Las empresas desempeñan un papel protagonista en este viaje.

La sostenibilidad es una forma de vida, no una idea pasajera. Reducir las emisiones (acción por el clima, ODS 13) o crear oportunidades justas (trabajo digno y crecimiento económico, ODS 8) no sólo ayuda al planeta, sino que también mejora su cuenta de resultados. Clientes, inversores y empleados buscan empresas que respalden sus palabras con hechos, y si usted no está a bordo, ya se está quedando atrás.

Pero no se trata sólo de seguir siendo competitivos. Normativas como la Directiva sobre Informes de Sostenibilidad Corporativa (CSRD) están subiendo el listón. A partir de 2025, las grandes empresas de la UE que cumplan dos de los tres criterios (más de 250 empleados, ingresos superiores a 40 millones de euros o activos superiores a 20 millones de euros) tendrán que informar sobre su impacto ambiental y social.

Puede parecer una montaña que hay que escalar: recopilar datos, determinar la cadena de valor y establecer sistemas puede resultar abrumador. Pero aquí está el lado positivo: las empresas que adopten la sostenibilidad hoy serán las que lideren el grupo mañana. Piense en una mejor gestión del riesgo, en una mayor confianza con las partes interesadas y en adelantarse a los acontecimientos en un mundo que cambia a gran velocidad.

Este cuadro ofrece una visión clara de los tipos de empresas sujetas a la normativa ASG y sus respectivos plazos de notificación.

| Grupo | Criterios | Año de referencia | Plazo de presentación |

| Organizaciones que anteriormente estaban sujetas al NFRD | >500 empleados, 50 millones de euros de facturación, 25 millones de euros de activos | 2024 | 2025 |

| Grandes empresas | >250 empleados, 50 millones de euros de facturación, 25 millones de euros de activos | 2025 | 2026 |

| PYME | Más de 10 empleados, 900.000 euros de facturación, 450.000 euros de activos | 2026 | 2027 |

| Empresas no europeas | 150 millones de euros de ingresos en la UE a través de filiales/sucursales | 2028 | 2029 |

Hoy en día, la sostenibilidad no es opcional: las empresas deben respaldar sus afirmaciones con datos sólidos e informes claros. En primera línea están la Directiva sobre Informes de Sostenibilidad Corporativa (CSRD) y las Normas Europeas para la Elaboración de Informes de Sostenibilidad (ESRS). Estos marcos establecen las normas para que las empresas de la Unión Europea informen sobre los impactos ambientales, sociales y de gobernanza (ASG), tratando la sostenibilidad con el mismo rigor que la información financiera.

Jozef Síkela, ex ministro de Industria y Comercio de la República Checa, explicó que la CSRD se diseñó para impulsar la responsabilidad real: "Las nuevas normas harán que más empresas rindan cuentas de su impacto en la sociedad y las orientarán hacia una economía que beneficie a las personas y al medio ambiente. Los datos sobre la huella ambiental y social estarán a disposición pública de cualquier persona interesada en esta huella. Al mismo tiempo, los nuevos requisitos ampliados se adaptan a distintos tamaños de empresa y les proporcionan un periodo de transición suficiente para prepararse para los nuevos requisitos."

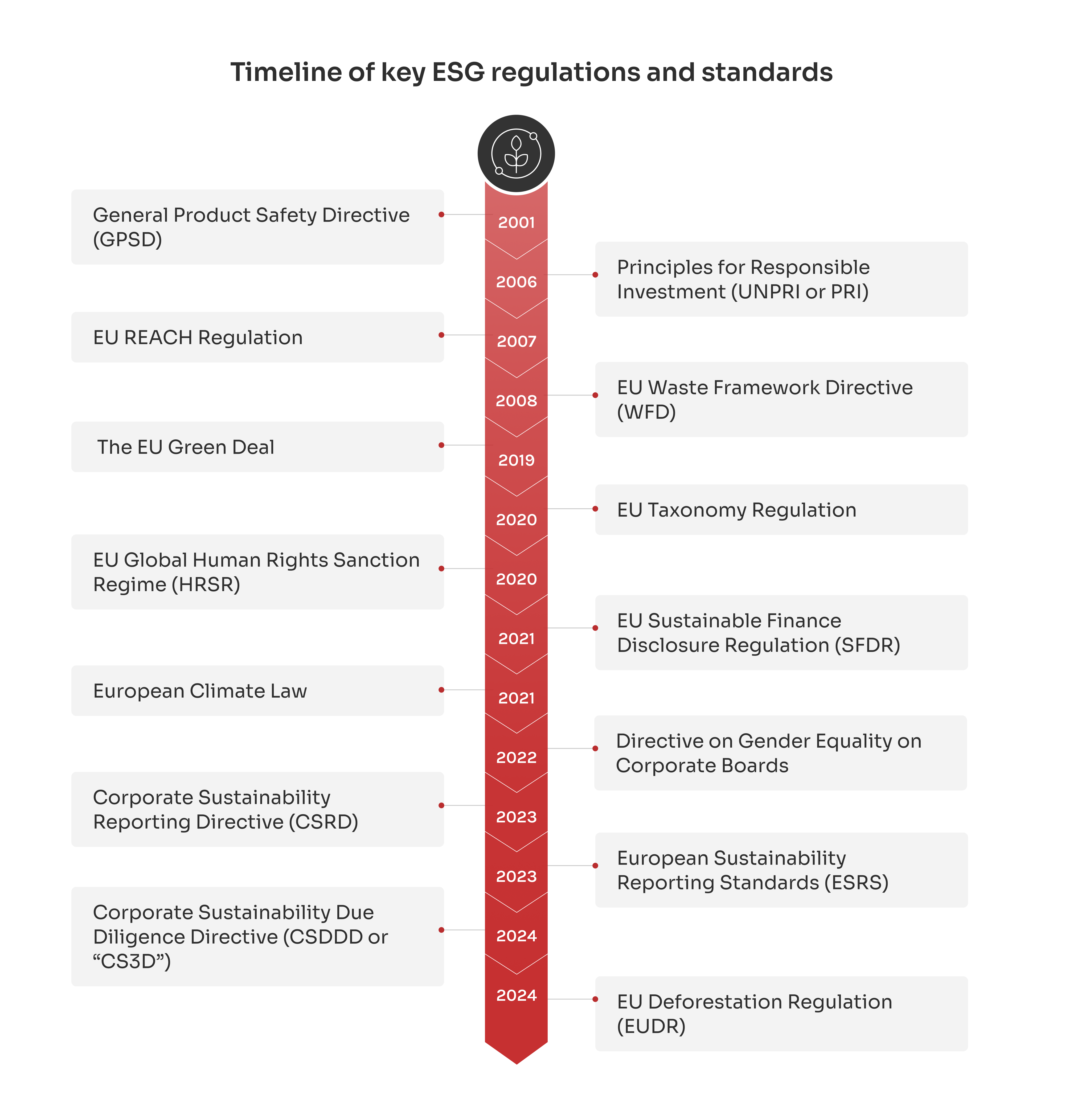

Pero estos marcos no surgen de forma aislada. Se basan en normativas anteriores de la UE que sientan las bases del actual ecosistema global de sostenibilidad. A continuación expondré las principales normativas que han configurado el panorama actual de la ASG y sus implicaciones para las empresas que operan en el mercado europeo.

La DSGP establece normas estrictas de seguridad para los productos vendidos en la UE. Las empresas deben probar y verificar que sus productos cumplen estas normas antes de llegar a los consumidores. Si un producto plantea un riesgo, las empresas deben tomar medidas para solucionar el problema o retirarlo del mercado.

El PRI, respaldado por las Naciones Unidas, es una iniciativa mundial que promueve la inversión responsable. Proporciona un marco para integrar los factores ASG en las decisiones de inversión, ayudando a las instituciones financieras a alinearse con los objetivos de sostenibilidad.

La CDSD empuja a las empresas a responsabilizarse de toda su cadena de valor. Exige a las empresas que identifiquen, prevengan y aborden las repercusiones negativas sobre los derechos humanos y el medio ambiente, no sólo en sus operaciones, sino también entre sus proveedores y socios.

La Directiva Marco de Residuos (DMR) desplaza el centro de atención de la gestión de residuos a su reducción. La directiva promueve el reciclaje y la reutilización, animando a las empresas a pensar en términos de principios de economía circular.

El Pacto Verde de la UE establece un plan para reducir las emisiones y conseguir que Europa sea climáticamente neutra en 2050. Fomenta las energías limpias, la industria verde y las políticas económicas que protegen el medio ambiente al tiempo que impulsan la innovación.

El Reglamento sobre Taxonomía de la UE actúa como libro de normas ecológicas de la UE. Define lo que se considera una actividad sostenible y ayuda a los inversores a identificar los proyectos auténticamente ecológicos. Así se combate el "lavado verde" y se garantiza la autenticidad de las inversiones sostenibles.

El HRSR proporciona a la UE un marco jurídico para sancionar a las personas y organizaciones implicadas en graves violaciones de los derechos humanos. Esta política pone de relieve que la sostenibilidad va más allá del medio ambiente: incluye proteger a las personas de la explotación y la injusticia.

El SFDR se dirige al sector financiero y exige a las empresas que revelen cómo integran los riesgos de sostenibilidad en sus decisiones de inversión. Garantiza que los fondos etiquetados como "verdes" sean realmente sostenibles, aumentando la transparencia para los inversores.

La Ley hace de la neutralidad climática para 2050 un requisito legal, no sólo un objetivo. Obliga a las instituciones de la UE y a los Estados miembros a rendir cuentas, con objetivos intermedios para seguir los avances y cumplir los compromisos climáticos.

Para 2026, se espera que las empresas que cotizan en bolsa en la UE tengan al menos 40% de los puestos de director no ejecutivo ocupados por el género menos representado, lo que impulsará mejores resultados empresariales.

El CSRD eleva la información sobre sostenibilidad al mismo nivel que la información financiera, exigiendo a las empresas que revelen información detallada sobre su impacto medioambiental y social, y cómo los riesgos de sostenibilidad podrían afectar a sus resultados.

El ESRS establece normas claras sobre la forma en que las empresas comunican los datos medioambientales, sociales y de gobernanza (ESG). Crea un enfoque normalizado que facilita la comparación de los esfuerzos de sostenibilidad entre sectores.

El Reglamento sobre registro, evaluación, autorización y restricción de sustancias y preparados químicos lleva más lejos la responsabilidad de las empresas. Obliga a las empresas a gestionar las sustancias químicas que producen y utilizan, centrándose en las repercusiones para el medio ambiente y la salud humana.

La EUDR exige a las empresas que importan productos como soja, carne de vacuno y aceite de palma que demuestren que están libres de deforestación, lo que refuerza el compromiso de la UE con la biodiversidad y las cadenas de suministro sostenibles.

Cuando hablamos del aspecto medioambiental de ESG, es fácil centrarse únicamente en la huella de carbono. Pero va mucho más allá. Se trata de cómo gestionamos los recursos que utilizamos, reducimos los residuos y protegemos la biodiversidad. Este pilar empuja a las empresas a pensar de forma crítica sobre todo su impacto medioambiental, desde la energía que alimenta sus operaciones hasta los materiales que obtienen y cómo los desechan.

Por ejemplo, la gestión de recursos. ¿Utiliza el agua, la energía y las materias primas de forma eficiente, o hay margen para recortar y ahorrar? La reducción de residuos es otro aspecto clave. Cada gramo de residuo que no va a parar a un vertedero es bueno para el planeta y estupendo para reducir costes. Y luego está la biodiversidad, algo que las empresas están empezando a comprender. Proteger los ecosistemas tiene que ver con la salud a largo plazo de las cadenas de suministro y las comunidades que dependen de ellas.

Pensar más allá del carbono es el verdadero liderazgo. Las empresas que lo hacen marcan la pauta para un futuro verdaderamente sostenible.

El pilar "social" de ESG tiene que ver con las personas. Se trata de cómo las empresas tratan a sus empleados, respetan los derechos humanos y contribuyen a las comunidades a las que sirven. Este pilar nos reta a mirar hacia dentro y plantearnos algunas preguntas difíciles. ¿Se trata a los trabajadores con justicia y se les paga equitativamente? ¿Las condiciones de trabajo seguras se dan por supuestas o se tienen en cuenta a posteriori?

Pero esto no acaba en el lugar de trabajo. Los derechos humanos son importantes en toda la cadena de valor, desde los proveedores con los que trabaja hasta los clientes a los que sirve. Y no nos olvidemos del impacto en la comunidad. ¿Está creando empleo, apoyando iniciativas locales y ayudando a las comunidades a prosperar?

El pilar social nos recuerda que las empresas no existen en el vacío. Las empresas que dan prioridad a las personas -ya sea su propia plantilla o la comunidad en general- están construyendo organizaciones más fuertes y resistentes.

Puede que el pilar de la "gobernanza" no acapare titulares como la reducción de las emisiones de carbono o los programas comunitarios, pero es la columna vertebral de la ASG. Aquí es donde las empresas muestran su compromiso de hacer lo correcto, cada día. Se trata de transparencia, ética y liderazgo.

Empecemos por la transparencia. ¿Sabe cómo se toman las decisiones, cómo se gasta el dinero y cómo se gestionan los riesgos? Luego está la ética. ¿Los líderes hacen realmente lo que dicen cuando se trata de ser honestos y responsables? La composición del consejo de administración también desempeña un papel importante. Un consejo diverso, capacitado e independiente es esencial para tomar decisiones acertadas y dirigir la empresa en la dirección correcta.

El buen gobierno es algo más que evitar escándalos o cumplir la normativa. Se trata de generar confianza entre inversores, empleados y clientes. Un liderazgo ético sólido marca la pauta de todo lo que hace una empresa, y cuando eso está en su sitio, el resto tiende a alinearse.

Dmitry Nazarevich

Director de Tecnología

Los principios medioambientales, sociales y de gobernanza (ASG) se han convertido en fundamentales para la creación de valor a largo plazo en las empresas. Empresas que integran ESG en sus estrategias centrales están viendo beneficios tangibles, desde eficiencia operativa y ahorro de costes hasta relaciones más sólidas con las partes interesadas y ventajas competitivas en el mercado.

Mira IKEA consiguieron reducir su huella climática en 5% en solo un año y la friolera de 28% desde 2016. Cómo lo han conseguido? Duplicando el uso de energías renovables, replanteándose los materiales y racionalizando la producción. Pero no se trata solo del medio ambiente: IKEA también apuesta por el compromiso con la comunidad.

Solo en Europa, IKEA llevó a cabo más de 40 actividades locales, desde proyectos de voluntariado y biodiversidad hasta programas educativos e iniciativas de economía circular. Ya sea donando ordenadores portátiles a estudiantes en Indonesia o apoyando hogares infantiles en Brasil, IKEA se asegura de que su impacto vaya más allá de la cuenta de resultados.

Luego está Microsoft demostrando que la sostenibilidad no es solo cosa de marcas ecológicas. En 2023, utilizarán más de 19,8 gigavatios de energía renovable en 21 países. También están abordando el uso del agua de forma directa, diseñando centros de datos que no necesitan agua para la refrigeración. Además, han evitado que más de 18.500 toneladas métricas de residuos acaben en vertederos y están presionando a sus proveedores para que no generen 100% de carbono en 2030. No se trata sólo de buenas relaciones públicas, sino de un negocio inteligente que ahorra recursos y prepara sus operaciones para el futuro.

Y no podemos olvidar Unilever. Han apostado por el abastecimiento sostenible, con 97,5% de materias primas clave como el aceite de palma y la soja procedentes de proveedores libres de deforestación. Han reducido el uso de plástico virgen en 18% desde 2019 y están invirtiendo mucho en envases reciclables. A los consumidores les encanta, a los inversores también, y está dando sus frutos en fidelidad a la marca y crecimiento del mercado.

| Desafío | Edición | ¿Cómo abordarlo? |

| Diferentes normas de información | A menudo, las empresas se enfrentan a marcos ESG que se solapan, como GRI, SASB y CSRD, lo que crea lagunas en la presentación de informes y trabajo adicional. | Es útil centrarse en el marco que mejor se adapte a su sector y región. La consolidación de datos con herramientas de información ESG puede simplificar el proceso y reducir la duplicación. |

| Seguir la evolución de la normativa | La normativa ESG evoluciona rápidamente en la UE, el Reino Unido y EE.UU., lo que convierte su cumplimiento en un reto permanente. | Contar con un equipo especializado en ASG, ya sea interno o externo, es crucial para mantenerse al día de los cambios normativos. La incorporación de sistemas de información flexibles facilita la rápida adaptación a las nuevas normativas. |

| Gestión de datos desconectados | Los datos ESG suelen estar aislados por departamentos, lo que provoca incoherencias, errores y retrasos en la presentación de informes. | Centralizar los datos ESG en una plataforma integrada puede mejorar la coherencia y la precisión. La automatización de la recopilación de datos reduce los errores manuales y ayuda a mantener la disponibilidad de los datos en tiempo real. |

| Medir el impacto ESG (medioambiental, social y de gobernanza) | A menudo es difícil relacionar las iniciativas ASG con resultados empresariales tangibles, como el ahorro de costes o el aumento de los ingresos. | Establezca objetivos ESG claros con KPI mensurables vinculados a los resultados empresariales. Incluir estas métricas en los informes financieros muestra el impacto real de los esfuerzos de sostenibilidad. |

| Definición de los riesgos ASG | Los riesgos ASG, como los relacionados con el clima o el daño a la reputación, son difíciles de definir y medir, lo que da lugar a evaluaciones de riesgo incoherentes. | Defina claramente los riesgos ASG dentro del plan de gestión de riesgos de su empresa. El análisis de escenarios ayuda a comprender los riesgos potenciales y a tomar mejores decisiones. |

| Elevados costes de la aplicación de ESG | Los programas ESG suelen requerir un gasto considerable en tecnología, formación del personal y herramientas de datos, lo que puede sobrecargar los presupuestos, especialmente en el caso de las empresas más pequeñas. | Debe centrarse en las actividades ASG que aporten más valor a su empresa. El uso de tecnologías escalables y la creación de asociaciones pueden ayudar a gestionar los costes al tiempo que se obtienen resultados sólidos. |

¿Cansado de estar al día de las cambiantes normas ESG? Deje que nos encarguemos por usted.

Como persona muy implicada en la sostenibilidad, he visto lo rápido que la ASG está pasando de ser un "detalle" a una necesidad empresarial. Lo que antes era un conjunto de iniciativas opcionales, ahora ocupa un lugar central en los consejos de administración, impulsado por las prioridades mundiales, la innovación tecnológica y las crecientes expectativas de inversores, clientes y reguladores. ¿Y ahora qué? He aquí las principales tendencias que determinarán el futuro de la sostenibilidad y la ASG.

El enfoque tradicional de "tomar-hacer-desechar" se está quedando rápidamente obsoleto. Cada vez más empresas están adoptando modelos de economía circular, centrados en minimizar los residuos y aprovechar al máximo los recursos. Esto significa diseñar productos duraderos, reparables y reciclables, y encontrar formas de reutilizar los materiales a lo largo de la cadena de suministro. No son solo las empresas las que están impulsando este cambio: los líderes gubernamentales también están reconociendo la urgencia de alejarse de la producción lineal.

Como señala Linda Gillham, consejera del gobierno local del Reino Unido, la "tomar-hacer-desechar" está en la raíz de muchos retos medioambientales y sociales. Abordarlo es esencial no sólo para construir una economía sostenible, sino también para garantizar un aire más limpio, una mejor calidad de los alimentos y del agua y una mayor equidad social.

La ASG y la sostenibilidad están cambiando la forma en que las empresas acceden al capital. La financiación ecológica va en aumento, y los inversores favorecen cada vez más a las empresas que demuestran unos buenos resultados en materia de ASG. Instrumentos como los bonos verdes, los préstamos vinculados a la sostenibilidad y los fondos de inversión centrados en la ASG se están generalizando. Las instituciones financieras también están endureciendo los requisitos, vinculando las condiciones de préstamo a resultados ASG mensurables. Para las empresas, esto significa que la sostenibilidad ya no es sólo una cuestión de responsabilidad corporativa: es una cuestión financiera, que influye en la solvencia y el atractivo de las inversiones.

Lo que antes era un objetivo ambicioso se está convirtiendo en una expectativa. Empresas de todos los sectores están fijando objetivos netos cero, con el fin de reducir las emisiones de gases de efecto invernadero lo más cerca posible de cero, compensando las emisiones restantes mediante proyectos de eliminación de carbono. Pero las partes interesadas exigen algo más que promesas: quieren transparencia, responsabilidad y progresos reales. Este cambio está empujando a las empresas a integrar la reducción de carbono en cada parte de sus operaciones, desde la gestión de la cadena de suministro hasta el diseño de productos e incluso las políticas de desplazamiento de los empleados. La presión es cada vez mayor, y las empresas que no actúan corren el riesgo de quedarse rezagadas tanto competitiva como reputacionalmente.

La tecnología está desempeñando un papel fundamental en el avance de los esfuerzos de ESG, haciendo que los datos de sostenibilidad sean más transparentes, fiables y procesables.

La ASG y la sostenibilidad se están convirtiendo rápidamente en elementos imprescindibles para las empresas de todo el mundo. Ya no se trata de si las empresas informarán sobre sus esfuerzos de sostenibilidad, sino de cuándo lo harán. Muy pronto, los informes transparentes y basados en datos serán la norma. Aunque algunas empresas siguen intentando parecer sostenibles sin tomar medidas reales (hola, greenwashing), las que realmente destacarán serán las que ofrezcan resultados medibles y significativos.

En Innowise, no estamos aquí para promesas vacías, estamos aquí para obtener resultados. Hemos creado una sólida práctica de ESG y sostenibilidad, respaldada por historias de éxito reales. Ya sea ayudando a las empresas a navegar por los informes ESG o desarrollando soluciones ecológicas como sistemas ERP y CRM orientados a la sostenibilidad, nuestro objetivo es hacer que la sostenibilidad forme parte del ADN empresarial. ¿Nuestro objetivo? Ayudar a las empresas a ir más allá de las palabras y crear un cambio positivo y duradero que realmente marque la diferencia.

Su mensaje ha sido enviado.

Procesaremos su solicitud y nos pondremos en contacto con usted lo antes posible.

Al registrarse, acepta nuestra Política de privacidadincluyendo el uso de cookies y la transferencia de su información personal.