Your message has been sent.

We’ll process your request and contact you back as soon as possible.

The form has been successfully submitted.

Please find further information in your mailbox.

Innowise helped build Haia, a modular AI finance OS that connects banks, crypto wallets, and investments, enabling secure, cross-chain operations without exposing private keys.

more efficient LP via Superform integration

crypto app interfaces already replaced with one

After a successful collaboration on building the Haust Network, the client entrusted us with developing their new flagship product, Haia. Built on top of the existing network, Haia takes the next step toward enabling an agentic web experience. It serves as an intelligent financial operating system that unifies banking, crypto, and DeFi in a secure, multilingual, cross-platform hub.

Working with Innowise was exactly what we needed to bring our agentic web platform for crypto and blockchain to life fast. Even though I initially doubted a large outsourcing company could match our pace, their team proved the opposite by delivering a working PoC in just 9 days. They combined strong blockchain and AI expertise with excellent integration capabilities, stayed flexible as the product evolved, and built a mobile app in record time. Innowise also contributed real product thinking, industry insight, and valuable connections, making them a reliable long-term partner.

Building an AI-powered finance OS that unifies banking, crypto, and DeFi into one secure, user-controlled hub meant overcoming both complex market dynamics and deep technical hurdles.

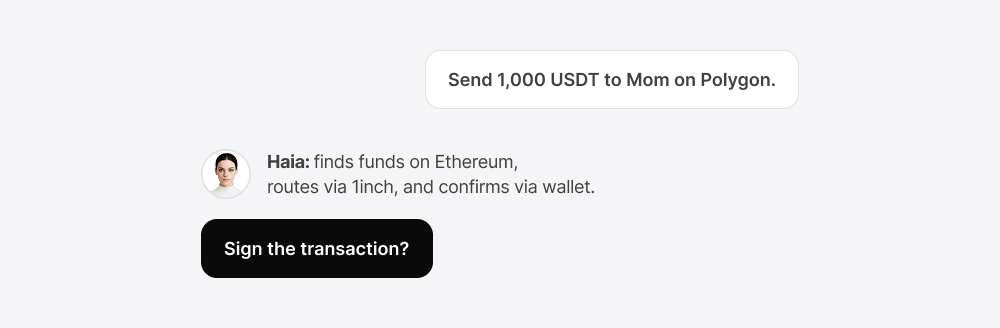

Getting Haia live wasn’t simple. The team had to solve real technical challenges, from making AI outputs deterministic and verifiable to building context-aware prompts that adapt to each user’s wallet and assets. We nailed human-in-the-loop safety, so every action is editable and transparent before it goes on-chain. What is really impressive is how natural the experience feels. You can say what you want — ‘swap 500 USDC to ETH on Base’ — and Haia handles the rest, reliably and securely. Behind the scenes, it’s a high-performance system with low latency, smart routing, and hardened infrastructure. For us, it’s a complete shift in how people interact with crypto.

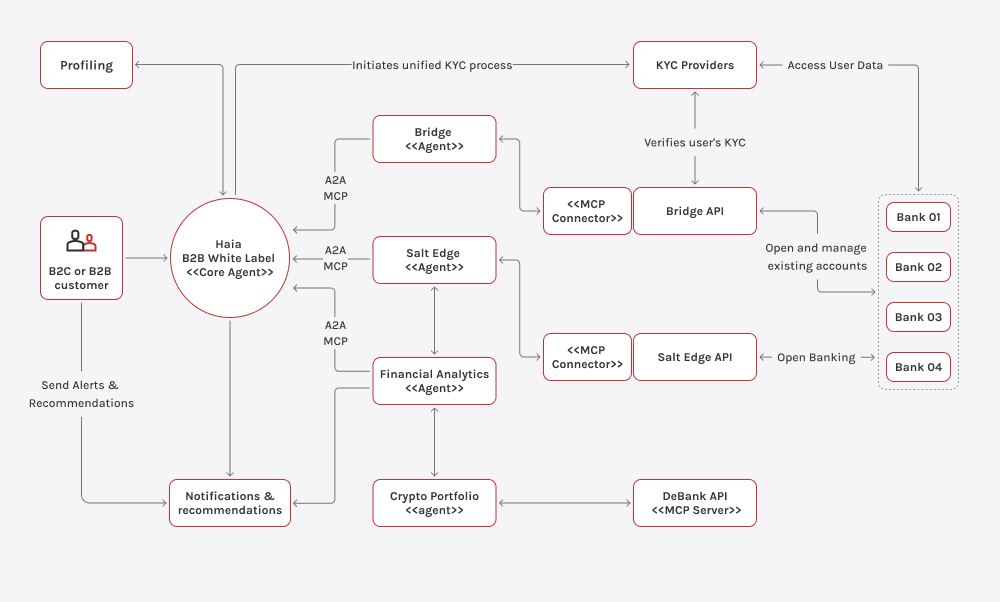

We wanted Haia to be a truly intelligent finance OS, so we designed it to function as both a product and a platform. It integrates with banks (via PSD2 and open banking APIs), all crypto wallets, and DeFi protocols, and offers users real-time visibility and tactical recommendations across all assets. Haia doesn’t store funds or keys. Every action is executed via connected apps or wallets, preserving full user custody.

Here’s what enables Haia’s core capabilities:

Haia’s frontend is a multi-platform conversational interface that converts complex financial operations into single-prompt interactions. Built on Capacitor, it works seamlessly across mobile and browser environments, including an in-wallet browser for DApps.

The interface supports the following functionality:

The abstract account logic allows Haia agents to execute logic-driven financial tasks without touching user keys or assets.

Haia can:

This is done through scoped, temporary permissions granted by the user, which are revocable at any time. No hot wallets. No shared custody. Just automation with clear boundaries.

To unify fiat and crypto into a single, intelligent interface, Haia supports deep integrations across the financial stack. Each integration was selected and implemented with performance, security, and user experience in mind.

Thanks to WalletConnect integration, Haia supports nearly all non-custodial wallets compatible with EVM blockchains, which gives users flexible, secure access without being locked into a specific provider.

The model context protocol powers Haia’s flexibility. It’s the layer that transforms Haia into a modular, agent-driven platform where every feature is a plug-in module with scoped context and isolated permissions.

Core capabilities:

MCP decouples velocity from risk. New features go live without core rewrites.

Haia was designed from the ground up with non-custodial infrastructure and on-device confirmation principles:

Users don’t need to understand bridges, gas fees, or DEX routing. Haia handles:

Haia was designed for enterprise rollouts and fintech partnerships:

Banks, wallets, and fintechs can launch their own version of Haia with governance, agents, and integrations tailored to their region or use case.

Haia simplifies the fragmented experience of interacting with Web3 tools and platforms. It's a non-custodial, modular system that connects to your existing wallet and acts as a live operating layer across all your Web3 activity. Everything happens in one conversational interface where the agent generates actions transparently, and users stay in full control. And because it’s modular, it can plug into almost any blockchain, wallet, or protocol. There’s huge potential here — not just for users, but for infrastructure teams looking for better ways to onboard, guide, and activate their ecosystems.

Haia provides a single interface for managing banking, crypto, and DeFi activity.

What users can do with Haia right now:

Your message has been sent.

We’ll process your request and contact you back as soon as possible.

By signing up you agree to our Privacy Policy, including the use of cookies and transfer of your personal information.