Your message has been sent.

We’ll process your request and contact you back as soon as possible.

The form has been successfully submitted.

Please find further information in your mailbox.

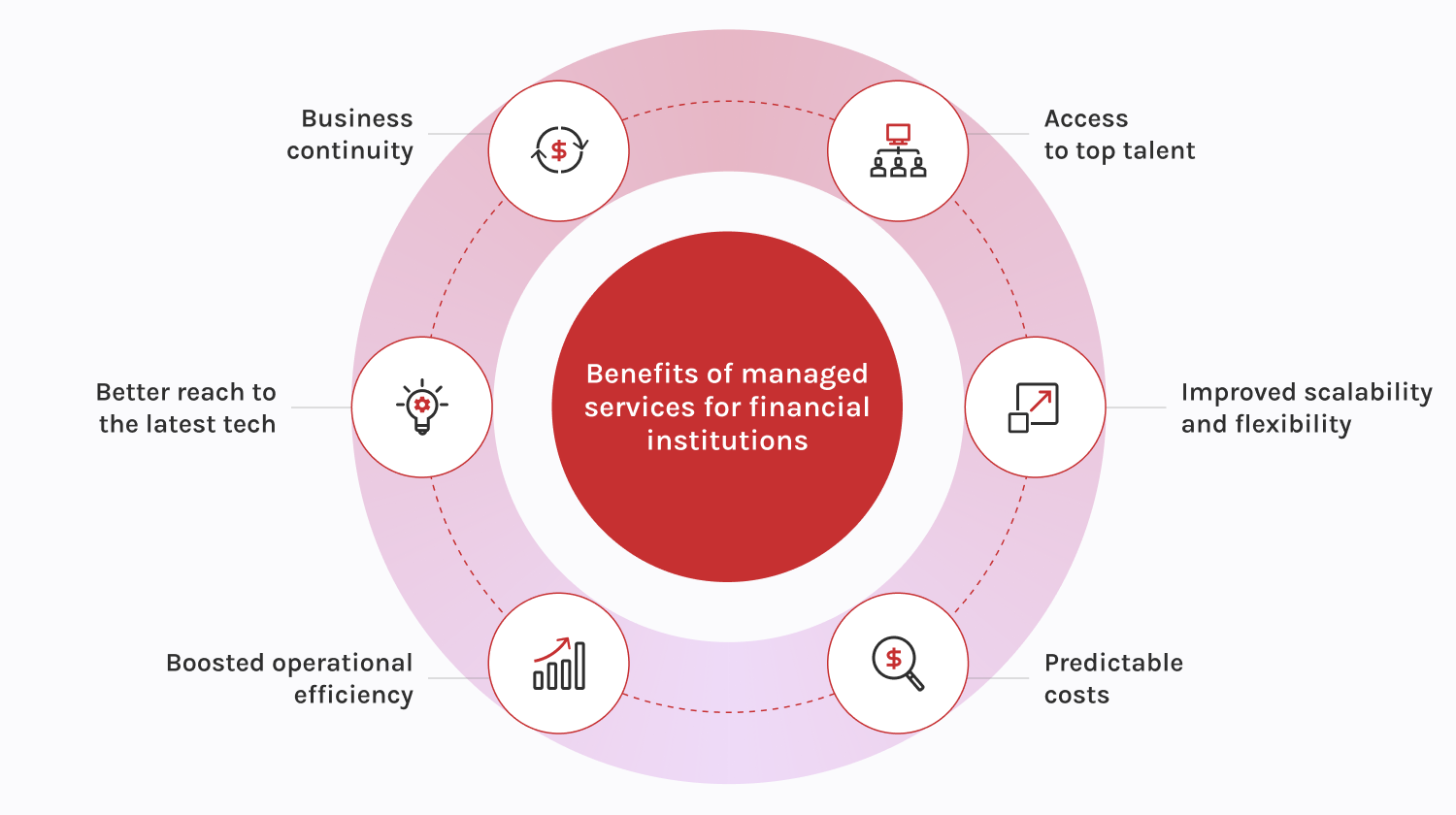

In just a few short decades, the financial world has gone through a serious tech makeover — we saw the transition from traditional banking to web-based services, the explosion of cryptocurrencies, and the rise of data analytics. While super convenient, these changes also bring major security and operational headaches.

And this is where Managed IT Service Providers (MSPs) step in. Think about it like this: when banks need to move a ton of cash, they hire armored cars because the pros handle it better. It’s the same idea with IT — MSPs are the experts that keep everything running smoothly, securely, and in line with all the strict regulations.

Stick with us, and we’ll break down the real benefits, the competitive edge you’ll gain, and exactly how managed IT services could be a game-changer for your business.

We partner with the best-in-class platforms, like SDK.Finance, Temenos, Mambu, and UiPath, and help you handle everything from implementation and integration to customization and upgrades.

Our QA process is here to thoroughly test your systems for functionality, security, and compliance. This essential step guarantees your products reach customers just as expected, with reliable performance and strong protection from threats.

We help keep your live systems running smoothly day in and day out. Once you’re up and running, we handle monitoring, managing, and fine-tuning to prevent issues, cut downtime, and keep everything performing at its best.

Our team handles it all — designing, developing, and implementing everything from core banking systems to custom software that fits your exact needs. We’re all about creating innovative, future-proof tech that keeps you on top of the wave.

Whether you’re after specialized banking software or custom financial solutions, we’ve got you covered. Our builds are flexible, scalable, and ready to grow with you, giving you the tools to stay ahead and keep things running as your needs evolve.

We track and document every change to your IT setup, making sure updates and tweaks are properly handled. This way, your systems stay consistent, secure, and free from those pesky configuration errors.

Our managed IT services cover everything from infrastructure management to network security, disaster recovery, and compliance with industry regulations. We handle the heavy lifting so you can focus on your core business while staying protected and fully operational.

Our team’s got your back with fast, reliable support for any tech issues so your staff can fix problems quickly and stay on track. Whether it’s troubleshooting, system updates, or just answering IT questions, we’re here to keep you online at all times.

From securely organizing and storing your data to using advanced analytics to gain insights, we make sure you get the most out of your information. We help you use data as a powerful tool to streamline day-to-day operations and spot new growth opportunities.

We help financial institutions handle even the toughest challenges by teaming up with the best platforms, so you get tailored solutions, right on time, and at a fair price. What makes our partnerships so powerful is how they blend flexibility, security, and smart tech.

With SDK.Finance, we get fintech products and digital payment solutions up and running fast, adapting to whatever’s needed along the way.

Temenos is our go-to for rock-solid core banking and wealth management, keeping everything in check with strict compliance.

Mambu, with its cloud-based, modular setup, lets us scale financial services at lightning speed.

And then there’s UiPath — thanks to its AI automation, we can automate repetitive tasks, boost accuracy, and cut costs.

Siarhei Sukhadolski

FinTech Expert at Innowise

Implementing managed IT services can feel a bit daunting, especially if you’re new to it or used to your usual workflows. We totally get it! That’s why we’ve put together a list of tried-and-true steps to help you navigate it with confidence and hit the right targets.

Managed services for financial institutions are more than just an extra set of hands — they’re a smart move to help you thrive, adapt, and stay ahead of the pack. It’s the secret sauce that separates the leaders from the ones struggling to keep up. No matter how much the industry changes, one thing’s for sure: managed IT services give you the backup you need to keep tech on track and your business running.

Your message has been sent.

We’ll process your request and contact you back as soon as possible.

By signing up you agree to our Privacy Policy, including the use of cookies and transfer of your personal information.