Ditt meddelande har skickats.

Vi behandlar din begäran och återkommer till dig så snart som möjligt.

Formuläret har skickats in framgångsrikt.

Ytterligare information finns i din brevlåda.

Om du är i bankverksamhet, känner du redan av trycket från alla håll: tillsynsmyndigheter, investerare och kunder förväntar sig alla konkreta åtgärder i miljöfrågor och sociala frågor. Hållbar bankverksamhet har gått från att vara en PR-aktivitet vid sidan om till att bli en icke förhandlingsbar pelare i verksamheten, som håller den relevant och motståndskraftig.

För varje kvartal blir insatserna allt högre. Nya redovisningsregler hamnar på ditt bord. Kapitalförvaltare kräver bevis på genuin hantering av klimatrisker, inte grönmålning. Företagskunder förväntar sig att bankerna ska stödja sina egna ESG-mål. Till och med vanliga kunder röstar nu med sina plånböcker.

Att väva in hållbarhet i sin kärnstrategi är naturligtvis allt annat än enkelt. Data lagras ofta i silos, gamla system stretar emot nya krav och komplexiteten kan kännas skrämmande. Men så här ligger det till: kostnaden för passivitet är långt större än utmaningen med omvandling. Att hamna på efterkälken innebär missade möjligheter, intensiv granskning och urholkat kundförtroende.

I den här artikeln ska jag visa dig exakt varför hållbarhet måste vara en central del av din banks framtid. Vi kommer att gå rakt på sak, utforska de tekniker som gör det möjligt och ta itu med de verkliga hinder som står i vägen för dig. Låt oss dyka in!

"Sluta skruva på bankernas hållbarhet i sista minuten. Koppla in det i varje kreditbeslut och produktplan. Det är så du minskar risken, ökar tillväxten och överträffar marknaden, eftersom tillsynsmyndigheter, investerare och kunder verkligen inte väntar."

I det här avsnittet kommer jag att utforska grunderna i hållbar bankverksamhet: vad det egentligen innebär, hur ESG vävs in i varje beslut och förändrar den dagliga verksamheten, hur det skiljer sig från traditionella modeller och vilka regler som driver på denna förändring.

Hållbar bankverksamhet innebär att man fattar beslut med ESG-kriterier (miljö, sociala frågor och bolagsstyrning) i centrum. I stället för att bara jaga snabba vinster sätter hållbara banker upp stora, långsiktiga mål. De strävar efter att minska föroreningarna från de företag som de finansierar, skydda naturresurser, garantera rättvisa arbetsvillkor och bedriva en transparent verksamhet. För att göra detta ändrar de hur de arbetar, vilka lån de ger och var de investerar.

Och det är inte bara prat. En nyligen genomförd undersökning visade att över 90% av världens största institutionella investerare ta hänsyn till ESG när de placerar sina pengar. Om stora investerare bryr sig om ESG måste bankerna också göra det. Annars kommer de att gå miste om det kapitalet.

Så hur ser det här ut i praktiken? Låt oss säga att en bank finansierar en stor vindkraftspark i stället för ett kolkraftverk, eller erbjuder mikrolån till småföretag i utsatta områden för att stödja tillväxten i lokalsamhället. Eller kanske driver banken sina egna kontor och datacenter med förnybar energi. Allt handlar om att stödja projekt och bedriva verksamhet på ett sätt som är ansvarsfullt för både människor och planeten.

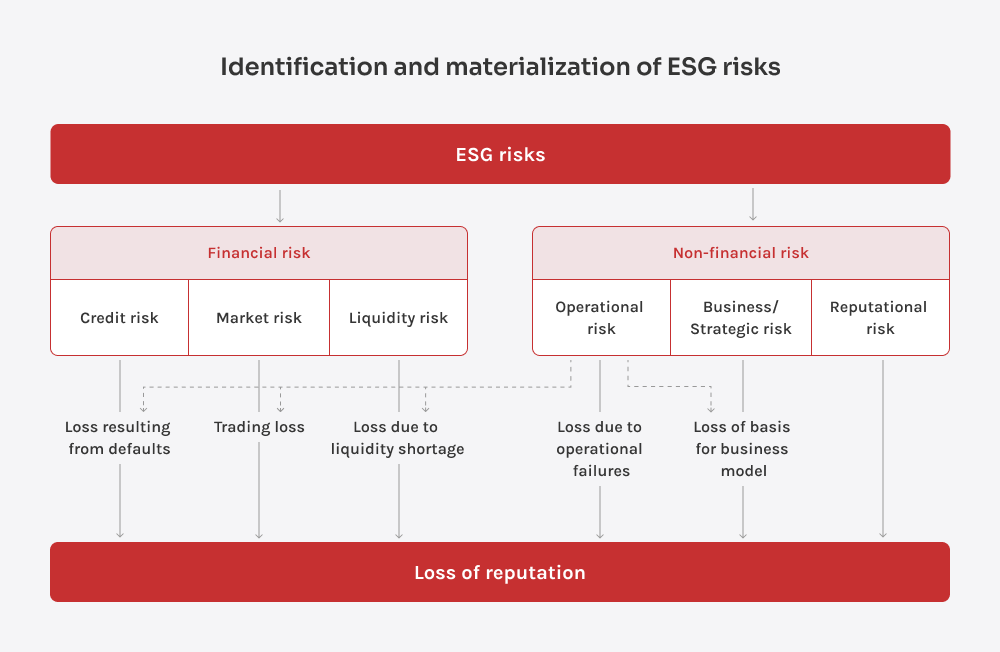

När en bank överväger ett lån eller en investering tittar den på de vanliga finansiella riskerna. Men när det gäller hållbarhetsinriktad bankverksamhet är ESG-risker och -möjligheter i fokus. Frågor som "Hjälper den här verksamheten miljön?" eller "Behandlar den sina anställda rättvist?" är centrala i varje beslut.

Detta tillvägagångssätt ger verkliga resultat. År 2024 kommer den globala utgivning av hållbara obligationer översteg en biljon dollar, vilket bekräftar att investerarna är sugna på gröna tillgångar och hjälper bankerna att sänka sina finansieringskostnader när de levererar på hållbarhetsområdet.

Bankerna själva är också på väg att förändras. Enligt Deloittes undersökning om hållbarhetsrapportering 2024, 58% av de finansiella företagen har nu en hållbarhetschef. Över hälften har också anställt särskilda ESG-rapporteringsteam för att följa upp deras miljömässiga och sociala påverkan.

Men det är inte lätt att hålla jämna steg med de nya reglerna. Ribban höjs hela tiden. Färre banker använder ESG-regler i sina lånebeslut nu (67% år 2024 jämfört med 72% året innan), delvis på grund av att de nya kraven är krävande och kräver mer kvalificerad personal.

Riskhantering är en del av dragningen. Deloitte uppskattar att enbart amerikanska banker står inför $1,7 biljoner i låneexponering till sektorer som riskerar att drabbas av förlust av biologisk mångfald och andra miljöhot. Dessa kanske inte syns i traditionella finansiella modeller, men de kan plötsligt orsaka stora förluster. Å andra sidan finns det en enorm möjlighet. PwC förutspår att år 2025 kommer cirka en tredjedel av alla globala förvaltade tillgångar (cirka $53 biljoner kronor) kommer att investeras med ESG i åtanke.

I den finansiella sektorn idag, ESG-kriterier formar alla viktiga beslut, från att utforma nya produkter till att godkänna lån och investeringar. Det är inte längre bara ett grönt sidoprojekt, utan en central del av hur banker hanterar risker, lägger upp strategier och mäter framgång. Här är en snabb ögonblicksbild från kafferasten av hur varje ESG-pelare ser ut i praktiken.

Tänk på "E" som ett scorecard för din banks påverkan på planeten: varje ton koldioxid, varje kilowatt, varje skrot av avfall räknas. Banker som tar den här pelaren på allvar bakar in koldioxid i låneräntorna, styr kunderna mot grön teknik och driver filialer och servrar med förnybar energi.

"S" mäter hur du ställer upp för människor - personal, kunder, leverantörer och lokalsamhällen. Det handlar om rättvis lön, säkert arbete, tydliga villkor och verkligt stöd från lokalsamhället. Genom att knyta lånevillkoren till mål för levnadslön eller finansiera mikrolån till småföretag bygger du upp förtroende, minskar antalet betalningsinställelser och håller insättningarna stabila när marknaderna vacklar.

"G" är hur banken styrs från toppen. Tänk tydligt ledarskap, gedigna revisioner, strikta interna kontroller och bonusar som belönar långsiktiga resultat. God styrning innebär att besluten är transparenta, att ansvarsskyldigheten är inbyggd och att bankens rykte och kapitalkostnad förblir starka och stabila.

Hållbar bankverksamhet är en term som vi hör hela tiden, men jag har märkt att den fortfarande känns abstrakt för många människor. Så när någon frågar mig vad som skiljer en hållbarhetsfokuserad bank från en traditionell bank försöker jag förtydliga svaret genom att fokusera på fyra nyckelfaktorer: syfte, risk, tidshorisont och daglig verksamhet. Och här ska jag visa hur var och en av dem innebär att vi går från "business as usual" till miljövänlig bankverksamhet.

Har du fortfarande svårt att visualisera exakt hur dessa olika tillvägagångssätt fungerar? För att ge dig en tydlig, obestridlig bild av skillnaderna har jag sammanställt allt i en snabb jämförelse sida vid sida:

| Funktion | Traditionell bankverksamhet | Hållbar bankverksamhet |

| Huvudmål | Maximera den kortsiktiga vinsten och öka balansomslutningen snabbt | Balansera finansiell avkastning med positiva miljömässiga och sociala resultat över tid |

| Riskkontroller | Kreditvärdighet, räntor och marknadsvolatilitet | Lägger till klimatrisker, resursbrist och social påverkan i lånebesluten |

| Planeringsfönster | 1-3 år | 10+ år |

| Energi & effektivitet | Standardnätkraft, enstaka uppgraderingar | Mål för att minska energianvändningen i datacenter varje år, uppgraderingar av filialer, smarta kontroller |

| Verksamhet | Pappersutdrag, fysiska formulär, minimal återvinning | Digital kommunikation, e-signaturer, program för återvinning och kompostering på kontoret |

| Teknik | IT-system (ibland äldre), processer inom filialen | Fullständigt digitala plattformar, mobilbank, e-KYC |

| Fokus på utlåning | Traditionella projekt, liten screening för koldioxidutsläpp | Gröna lån för förnybar energi, elbilar och energieffektivitet. Ofta till förmånliga räntor |

| Rapportering | Årliga finansiella rapporter, få icke-finansiella detaljer | Integrerade ESG-rapporter med tydliga mätetal för koldioxidutsläpp, inkludering och bolagsstyrning |

| Incitament | Omsättningsbaserade bonusar | Belöningar kopplade till ESG-milstolpar |

Låt oss vara tydliga: hela den här övergången till hållbar bankverksamhet sker inte bara på grund av någon plötslig grön goodwill. Regelboken håller på att förändras, och det snabbt. Globala tillsynsmyndigheter ser nu finanssektorn som ett verktyg i frontlinjen för att hantera klimatförändringar och social ojämlikhet, och de ökar trycket. De har bytt ut artiga knuffar mot fasta tidsfrister och verkliga konsekvenser.

Därefter kommer jag att gå igenom några av de tunga regleringar och riktlinjer som sätter takten.

Tänk på EU:s gröna giv som Europas plan för att bli den första klimatneutrala kontinenten 2050. Det är en ekonomisk strategi som syftar till att omdirigera biljontals euro till hållbara investeringar. Och bankerna förväntas naturligtvis vara de viktigaste kanalerna för detta kapital. Ambitionen är enorm, det är det ingen som tvivlar på. Den stora frågan som jag hör (och uppriktigt sagt ställer mig själv) är om EU kan leverera i den omfattning och hastighet som utlovas, eller om saker och ting kommer att fastna i byråkrati och krångel.

SFDR är Europas anti-greenwashing-filter. Det innebär i princip att alla finansiella aktörer, från kapitalförvaltare till rådgivare, måste standardisera hur de identifierar och redovisar ESG-risker och negativ påverkan. Du måste förklara vad du gör eller planerar att göra och sedan publicera det i ditt prospekt, i periodiska rapporter och på din webbplats.

En sak att veta: SFDR är inte samma sak som EU:s taxonomi, men de går hand i hand. Taxonomin definierar vad som verkligen är grönt, medan SFDR ser till att du är uppriktig om hur dina produkter står sig mot dessa definitioner.

Den EU:s taxonomi är EU:s försök att dra en tydlig gräns mellan vad som verkligen är grönt och vad som bara låter grönt. Jag vill se det som en mästerlig ordbok för hållbar finansiering, ett detaljerat klassificeringssystem som anger vilka ekonomiska aktiviteter som räknas som miljömässigt hållbara.

För att få den officiella gröna märkningen måste en verksamhet bidra till minst ett av sex miljömål: begränsning av klimatförändringar, anpassning till klimatförändringar, hållbar användning och skydd av vatten och marina resurser, övergång till en cirkulär ekonomi, förebyggande och begränsning av föroreningar samt skydd och återställande av biologisk mångfald och ekosystem. Lika viktigt är att den inte får orsaka betydande skada för något av de andra målen.

I praktiken kan ett vindkraftsprojekt se grönt ut vid första anblicken, men om det byggs i ett skyddat naturområde och stör lokala ekosystem kan det misslyckas med testet "inte orsaka någon betydande skada".

Så, med alla dessa nya regler som staplas på hög och ambitiösa globala mål på bordet, hur ska en bank klara av att bedriva hållbar bankverksamhet i den verkliga världen? De kan inte bara improvisera. De behöver ett ramverk för hållbar bankverksamhet, en spelbok som omvandlar mål på hög nivå till dagliga beslut. Så här har jag sett hur de bäst skötta bankerna fyller på sin verktygslåda:

Lägg ihop alla dessa verktyg och du får en skarp bank- och hållbarhetsstrategi för att säkra klimatrelaterade finansiella risker, utnyttja nya hållbara intäktsströmmar och leda utvecklingen mot en ekonomi med låga koldioxidutsläpp.

Okej, vi har gått igenom varför hållbar bankverksamhet inte är förhandlingsbart och tittat på de ständigt skiftande reglerna. Nu ska vi ta itu med den praktiska sidan: hur hanterar bankerna all denna komplexitet i stor skala? Spoilervarning: det sker inte med hjälp av ett berg av kalkylblad. Att integrera hållbarhet i varje hörn av verksamheten kräver seriös teknisk eldkraft.

I det här avsnittet går jag igenom de grundläggande plattformar och verktyg som driver modern hållbar bankverksamhet.

Låt oss säga det rakt ut: att navigera bland datakrav, transparensstandarder och avancerade riskmodeller för hållbar finansiering utan smart teknik är som att styra en supertanker med en kanotpaddel. Här är de pelare som jag har sett banker luta sig mot:

När det gäller ESG drunknar bankerna i data - koldioxidavtryck, leverantörsgranskningar, dynamiska kartor över översvämningszoner, allt möjligt. Inget mänskligt team kan bearbeta allt detta tillräckligt snabbt eller exakt. Det är just där AI kommer in i bilden.

AI hjälper bankerna att ta sig igenom detta överväldigande brus. Den analyserar komplexa data för att optimera energianvändningen i bankens filialer och kontor och stresstestar utlåning mot sofistikerade klimatmodeller som förutspår framtida översvämningszoner eller risker för skogsbränder. Vi ser också nya kraftfulla tillämpningar, särskilt när det gäller generativ AI. Det kan t.ex. hjälpa banker att utforma innovativa gröna finansiella produkter eller anpassa hållbarhetsrådgivningen så att den passar varje kunds unika behov och mål.

Ta JPMorgan Kapitalförvaltning, till exempel. De använder AI och maskininlärning för att söka igenom stora mängder data från över 14 000 företag över hela världen. Deras system skannar och bearbetar företagsrapporter, lagstadgade ansökningar och nyheter. Denna AI-drivna lösning identifierar sedan exakt företag som aktivt bidrar till klimatlösningar, vilket gör det möjligt för JPMAM att bygga portföljer med hög övertygelse som är ekonomiskt sunda och miljöanpassade.

Men här är haken: AI är bara så bra som de data den matas med. Och ärligt talat är det fortfarande en av de största huvudvärkarna för hela finansbranschen att få fram konsekventa, tillförlitliga och jämförbara ESG-data.

Ett av de svåraste hindren för hållbar finansiering är förtroende. Hur kan investerare, tillsynsmyndigheter och kunder vara säkra på att pengar som öronmärkts för gröna eller sociala projekt verkligen håller vad de lovar? Blockchain erbjuder en lösning: en delad, oföränderlig liggare som spårar varje euro, kilowatt eller koldioxidkredit från källa till sänka.

Till exempel, Standard Chartereds pilotprojekt med Mastercard, Mox Bank och Libeara inom ramen för HKMA:s Fintech Supervisory Sandbox. De tokeniserade koldioxidkrediter och insättningar, vilket visar hur blockchain kan effektivisera handeln med koldioxidkrediter, förkorta avvecklingstiderna och leverera spårbarhet från början till slut för krediter som säljs av projekt på tillväxtmarknader.

Blockchain är naturligtvis ingen trollstav. Den behöver sund styrning, interoperabla standarder och verklig integration med befintliga banksystem. Men för användningsfall som att verifiera intäkter från gröna obligationer eller låsa koldioxidkrediters livscykler är dess potential att utrota grönmålning och bygga upp ett bergfast förtroende enorm.

Att flytta bankers kärninfrastruktur och appar till det publika molnet är en av de mest effektiva hållbarhetsåtgärder som en bank kan vidta. Att flytta lokala arbetsbelastningar till ett modernt, delat moln innebär i stort sett att man minskar den direkta energianvändningen och koldioxidutsläppen. Och uppriktigt sagt uppnår hyperscale-leverantörer som AWS, Azure och Google Cloud energi- och kylningseffektivitet som inget internt datacenter kan replikera.

Titta bara på BBVA. Genom att rulla ut Salesforce Net Zero Cloud globalt har de automatiserat insamlingen och analysen av miljödata. Lösningen ger dem insyn i realtid i energianvändning och koldioxidutsläpp på dussintals platser, så att de snabbt kan upptäcka ineffektivitet och vidta åtgärder.

Det viktigaste är naturligtvis att välja en leverantör med verifierbara åtaganden för förnybar energi. Annars lägger du helt enkelt ut utsläppen på entreprenad, inte eliminerar dem.

Låt oss vara ärliga och säga att bankerna fortfarande är överbelastade med repetitiva, manuella uppgifter: sammanställa ESG-rapporter, kopiera data mellan system, stämma av rapporter. Det är tråkigt, felbenäget och en enorm tidsförlust. Det är därför RPA kommer in i bilden. Dessa mjukvarubotar automatiserar rutinmässiga arbetsflöden så att människor kan sluta agera som mellanhänder mellan kalkylblad.

Ur hållbarhetssynpunkt spelar RPA en större roll än det kan verka. För det första minskar pappersanvändningen och digitala processer effektiviseras, vilket innebär att färre resurser går åt till att flytta runt data. För det andra hanterar robotar uppgifter snabbare och mer effektivt, så att du inte slösar bort datorkraft på uppblåsta arbetsflöden. Och dessutom frigör det tid för analytikerna att fokusera på strategi, scenariomodellering och ESG-riskutvärdering istället för att jaga förra månadens koldioxidrapport.

Vårt team, till exempel, samarbetade med en stor amerikansk bank att automatisera sina SOX- och ITGC-kontroller med hjälp av WorkFusion RPA och OCR. Tidigare tillbringade deras efterlevnadsteam dussintals timmar varje vecka med att manuellt extrahera data. Efter att ha implementerat våra robotar sparades 64 arbetstimmar varje vecka, effektiviteten i efterlevnaden förbättrades två gånger och antalet utskrivna rapporter minskade avsevärt. De frigjorda timmarna gjorde det möjligt för banken att omfördela specialister för att förfina ESG-riskmodeller och driva initiativ för grön finansiering.

RPA är naturligtvis inte en patentlösning för att integrera ESG i hela företaget. Det är ett sätt att ta itu med lågt hängande frukter. Verklig hållbarhet inom banksektorn kräver högkvalitativa data, kulturella förändringar och integrering av RPA i ett bredare tekniskt ekosystem. Men som en del av en bredare teknikstack ger RPA omedelbara vinster i form av både effektivitet och resursminskning.

Okej, du har de här kraftfulla teknikerna under huven, men kunderna känner det genom de appar och portaler som de faktiskt använder. Så här gör grön finansteknik att hållbara banktjänster fungerar för riktiga människor:

När jag hjälper en bank att omvandla hållbarhetsambitioner till praktisk handling börjar jag alltid med att lägga fram fem steg som inte får missas. Om du hoppar över dessa riskerar dina gröna mål att bli lite mer än PR-buller.

Det går absolut inte att improvisera här. Jag har sett banker ta fram glansiga hållbarhetsdokument som samlar damm i C-suiten. Säkerställ i stället ett stenhårt stöd från VD och styrelse och sätt sedan upp knivskarpa mål. Till exempel att minska filialens energianvändning med 20% fram till 2027 eller att nå $500 miljoner i gröna lån fram till 2030.

Det som mäts blir förvaltat, så publicera framsteg öppet. Din strategi måste vara en levande plan, inte en statisk PDF, så utveckla den i takt med att regler, data och marknadsdynamik förändras. Och om du behöver extra muskler kan experter ESG-rådgivning kan hjälpa till att skapa en strategi som fungerar för din bank.

Sann stringens innebär att ESG-insikter vävs in direkt i det finansiella beslutsfattandet. Jag har sett ett kreditteam avstå från ett lån till en tillverkningsanläggning eftersom platsen flaggades som en framtida översvämningszon med hög risk. En traditionell kreditbedömning, som enbart fokuserar på finansiella aspekter, skulle helt ha missat denna kritiska, klimatdrivna sårbarhet.

Det är den nya standarden. Utbilda era kredithandläggare i att göra kontroller av klimatresiliens och social påverkan vid sidan av kreditbetygen. Pressa investeringsteamen att väga styrningsrisker lika tungt som avkastningen på investerat kapital. För i slutändan är ESG-risker finansiella risker.

Utöver att hantera nedåtrisker ligger den verkliga möjligheten i att bygga och skala upp produkter som drar dina kunder och din bank mot en grönare och mer rättvis ekonomi. Det här handlar inte om sidoaffärer längre. Tänk dig vanliga gröna obligationer som finansierar vindkraftsparker och solcellsparker, hållbarhetskopplade lån som sänker din ränta med räntepunkter när du når överenskomna ESG-mål (tro mig, inget motiverar som billigare lån) eller miljöfokuserade investeringsportföljer för kunder som kräver påverkan vid sidan av avkastningen.

Men akta er. Greenwashing avslöjas på några sekunder nuförtiden. Om du sätter ett grönt klistermärke på en produkt utan tydliga kriterier, tredjepartsverifierade effektmått och helt transparent rapportering, kommer du att förlora mycket mer trovärdighet än du någonsin kommer att vinna i volym.

Vid första anblicken kanske det här låter som backoffice-grejer, men i själva verket är automatisering avgörande för om du ska kunna uppfylla dina hållbarhetslöften. Varje klumpig manuell process, varje kalkylblad som lappas ihop i sista minuten och varje timme som slösas bort på att jaga data minskar din banks förmåga att nå ESG-målen. Rapportering av regelefterlevnad och riskhantering är de främsta syndarna. Försök att jonglera med dem och det slutar med misstag, utbrändhet, missade deadlines och skenande kostnader.

Det är här smart automatisering gör sig förtjänt av sin plats. Tänk RPA-robotar som hämtar och validerar energianvändningsdata på några sekunder, AI-motorer som flaggar för avvikelser i dina ESG-rapporter och enhetliga arbetsflöden som håller alla intressenter på samma sida. Resultatet? Rena, felsäkra data, blixtsnabba lagstadgade ansökningar och dina bästa talanger som fokuserar på strategi, inte datainmatning.

Så här ligger det till: du kan inte minska din banks miljöpåverkan om du inte mäter den först. Välmenande hållbarhetslöften faller ofta platt utan en tydlig baslinje. Det absolut första steget är att få ett järngrepp om ditt koldioxidavtryck.

För banker innebär det att man måste gå längre än bara direkta utsläpp (Scope 1) och den energi man köper (Scope 2). Den verkliga kicken är Scope 3: finansierade utsläpp som är kopplade till era lån, investeringar och andra aktiviteter nedströms. Enligt min erfarenhet är det här som saker och ting snabbt blir komplicerade, och ärligt talat är de flesta äldre system helt enkelt inte byggda för att spåra dessa saker ordentligt.

Det är här specialiserade verktyg för koldioxidbedömning kommer in i bilden. De bästa verktygen samlar in data från alla delar av verksamheten, sammanställer siffrorna enligt GHG-protokollets standarder och visar på optimala möjligheter att minska utsläppen. Jag har arbetat med kunder som integrerar dessa system direkt i sina bankplattformar för att omvandla statiska årsrapporter till en levande, utvecklande instrumentpanel som visar exakt var du står och vart du är på väg.

Till exempel i projekt som Automatiserad insamling av miljödata, kan du se att även de mest avancerade verktygen inte räcker till utan solid, organiserad data.

Mitt råd: välj verktyg på ett klokt sätt, organisera dina data noggrant och använd dessa insikter för att åstadkomma mätbara förändringar. Det är den enda vägen från vaga mål till verifierbara framsteg.

Låt oss byta fokus från vad du vinner på hållbarhet till vad du kan förlora om du ignorerar det. Förra årets rekordstora översvämningar i Mellanvästern gjorde en sak tydlig: klimatrisker är en brutal finansiell verklighet. När vattennivåerna steg drabbades regionala banker av serviceavbrott och antalet betalningsinställelser ökade nästan över en natt. För banker som enbart förlitar sig på traditionella riskmodeller var effekterna både plötsliga och allvarliga.

Klimatrelaterade risker inom banksektorn kan delas in i två huvudgrupper. Fysiska risker är de mer uppenbara. De är kopplade till saker som översvämningar, skogsbränder eller värmeböljor som direkt kan skada din infrastruktur eller avbryta din verksamhet. Omställningsrisker är mer subtila men lika viktiga. De kommer från det globala skiftet mot en ekonomi med låga koldioxidutsläpp. Nya regleringar, förändrat kundbeteende och till och med ryktespress. Om din utlåningsportfölj lutar sig för tungt mot föråldrade branscher kan det drabba dig hårt.

Mot bakgrund av dessa dubbla hot väver framtidsinriktade banker in hållbarhet i sina riskramverk. Detta innebär:

Lönsamheten är tydlig. Banker som aktivt hanterar hållbarhetsrisker minskar inte bara oväntade förluster utan förbättrar också sitt rykte och får en påtaglig konkurrensfördel.

Budskapet kunde inte vara skarpare: agera nu eller se klyftan vidgas. Allvarligt talat: varje månad skärper tillsynsmyndigheter sina standarder, investerare skärper sina ESG-analyser och kunder flyttar sin lojalitet till banker som är ledande i klimatfrågan.

Om du redan har börjat med hållbar finansiering eller ESG-rapportering har du ett försprång. Använd dessa tidiga framgångar som en startplatta. Skala upp dina ansträngningar till kreditgranskningar, riskmodeller och produktdesign så att du inte behöver skynda dig för att komma ikapp när nästa regel om offentliggörande släpps.

Behöver du ett bollplank för att se hur nära dina nuvarande processer är en verklig hållbarhetsintegrering? Låt oss prata om det. Tillsammans kan vi göra hållbara bankmetoder till en verklig fördel.

Chef för hållbarhetsavdelningen

Stanislav tar hållbarhet inom tech till den verkliga världen. Han hjälper kunderna att gå från kryssrutor till faktiska resultat — oavsett om det handlar om att optimera infrastruktur, minska avfall eller bygga digitala produkter med påverkan i åtanke.

Ditt meddelande har skickats.

Vi behandlar din begäran och återkommer till dig så snart som möjligt.

Genom att registrera dig godkänner du vår Integritetspolicy, inklusive användning av cookies och överföring av din personliga information.