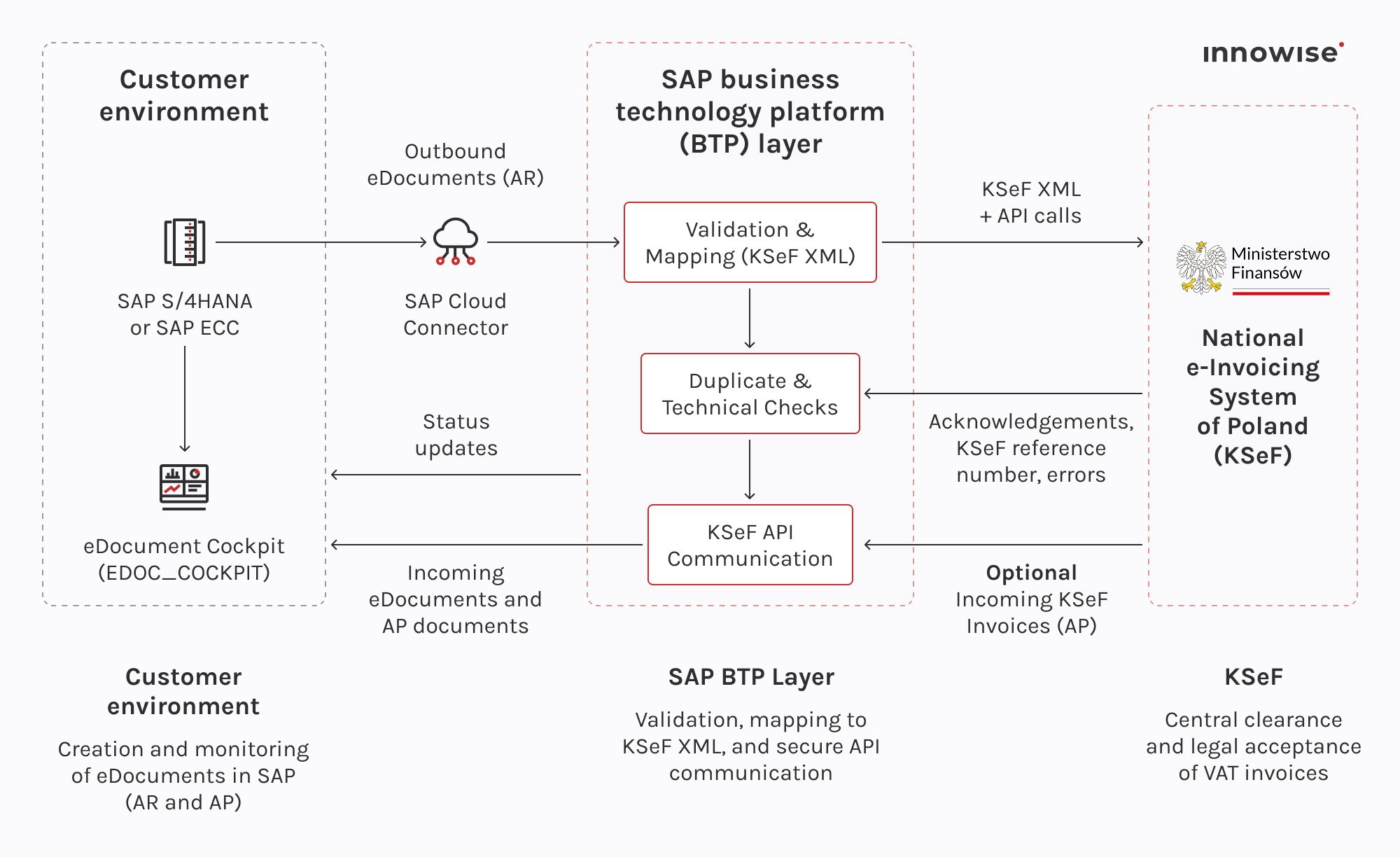

O SAP DRC é licenciado como um produto separado que é executado juntamente com o SAP S/4HANA ou ECC. Mantém o eDocument Cockpit e as regras dentro do seu ERP, enquanto o SAP BTP trata da comunicação com as autoridades fiscais na nuvem, normalmente através de um modelo de subscrição ligado ao volume de documentos.

A sua mensagem foi enviada.

Processaremos o seu pedido e contactá-lo-emos logo que possível.