Please leave your contacts, we will send you our overview by email

I consent to process my personal data in order to send personalized marketing materials in accordance with the Privacy Policy. By confirming the submission, you agree to receive marketing materials

Thank you!

The form has been successfully submitted.

Please find further information in your mailbox.

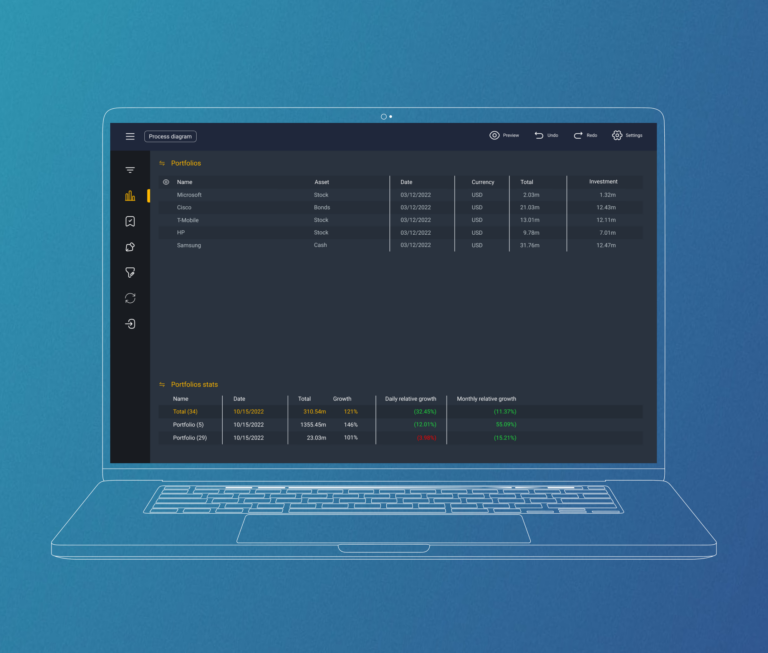

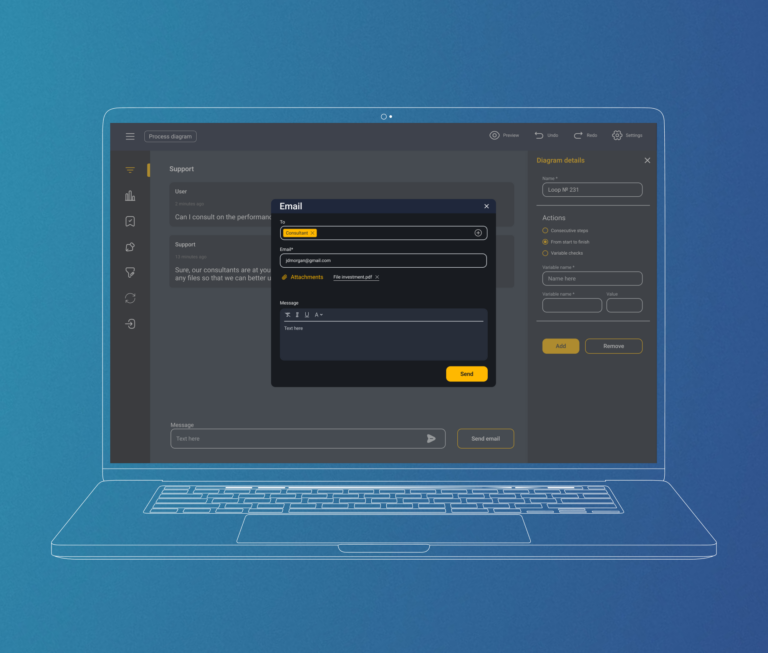

From banking platforms to crypto exchanges, we build high-performance finance software that powers critical operations, manages risk, and supports growth 24/7.

Services & solutions

Services & solutions

About us

Fintech

Banking

Trading

Insurance

Blockchain

en English

From banking platforms to crypto exchanges, we build high-performance finance software that powers critical operations, manages risk, and supports growth 24/7.

Services & solutions