Your message has been sent.

We’ll process your request and contact you back as soon as possible.

The form has been successfully submitted.

Please find further information in your mailbox.

Let’s be honest — banks aren’t blind to the physical world. They’ve had ATMs, branch footfall counters, smart vaults, even geolocation data for years. The problem? That data rarely talks to the systems that matter. It sits in silos, reacts too slowly, or never reaches decision-makers at all.

This is where the Internet of Things (IoT) quietly rewrites the rules. Not with shiny gadgets, but with context that actually connects data points. Smart ATMs that detect tampering before it happens. Hyper-personalized offers triggered the moment a customer enters a partner store. IoT isn’t about more devices. It’s about turning the physical world into a data layer banks can finally use.

In this post, I’ll go beyond the buzzwords and look at where IoT is already reshaping operations, customer experience, and risk in banking — and where the next competitive edge might quietly emerge.

Before we unpack what’s possible with IoT in banking industry, let’s get clear on what it really is and why it suddenly matters more than it did five years ago.

IoT in banking — the use of connected sensors and systems to gather real-world data — at its core is not about the devices. It’s about a new layer of real-time, physical-world data that can inform digital decisions. Think of it less as “technology” and more as a strategic signal infrastructure.

Banks have always been data-rich, but historically, that data has been transactional, behavioral, and retrospective. What IoT introduces is something fundamentally different: situational awareness. It brings time, place, movement, presence, and even environment into the logic stack. And for an industry that makes money on timing and trust, that’s not a small shift.

This is important because the digital systems banks have optimized over the past decade — CRMs, core banking platforms, fraud engines — were built to respond to inputs from clicks, taps, and numbers. They weren’t built to ingest and act on sensor streams, location signals, or environmental triggers.

Now they can. Thanks to advancements in edge computing, 5G, and API-first architectures, IoT data can finally be fast, integrated, and meaningful instead of isolated, delayed, and noisy.

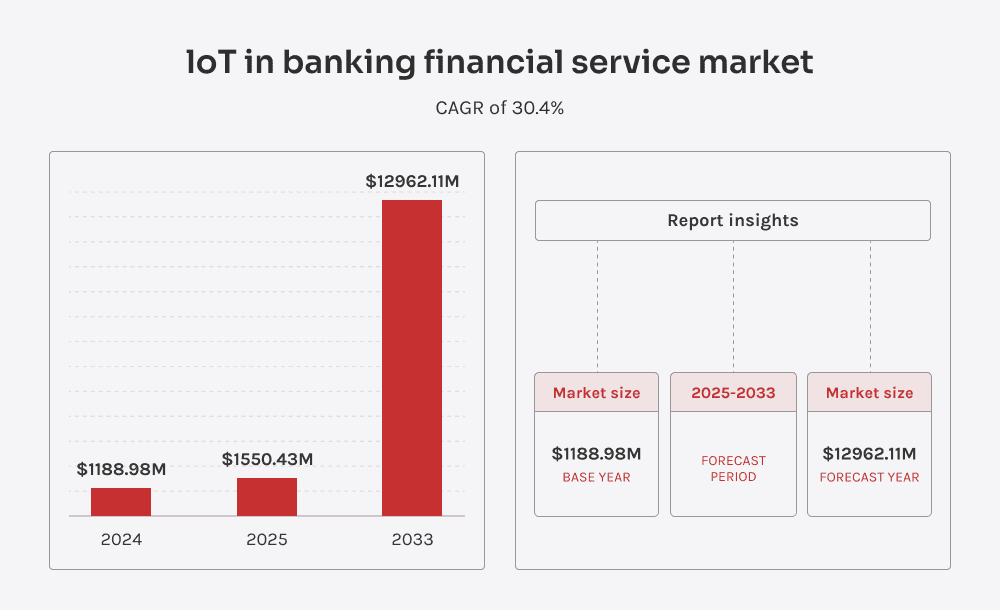

And the investment reflects that shift. The IoT in banking and financial services market was valued at $1.19 billion in 2024, and it’s projected to grow at an astonishing 30.4% annually, reaching nearly $13 billion by 2033. That’s not experimentation — that’s infrastructure being built at scale.

So now that we’ve cleared up what IoT in banking actually is, there’s another area that doesn’t always get the clarity it deserves: the strategic benefits. Not just surface-level “efficiencies” or tech-for-tech’s-sake improvements, but the kind of outcomes that actually move the needle for your business.

A static profile can’t capture what a customer needs in the moment — but IoT can. Whether it’s detecting movement near a branch or behavior in a partner store, physical-world signals now feed into real-time personalization engines. The result? Better targeting, higher engagement rates, and a dramatic drop in irrelevant offers.

Why heat an empty branch or send cash to an ATM that’s half full? IoT enables dynamic adjustments to everything from staffing to utilities to delivery schedules. This leads to leaner operations, reduced energy costs, and fewer logistics headaches, especially across large networks.

Break-fix maintenance is expensive, slow, and disruptive. With connected ATMs, safes, and service equipment reporting stress and anomalies in real time, banks can move to condition-based and predictive maintenance. That means fewer outages, lower repair costs, and longer asset life.

Traditional security systems miss real-time threats like skimming or tampering until it’s too late. IoT devices detect abnormal vibrations, unauthorized access, or forced entry attempts immediately. This shift cuts response time dramatically, reduces fraud losses, and strengthens physical trust in self-service channels.

Sustainability goals can’t be hit using estimates and spreadsheets. IoT captures actual resource consumption — down to the kilowatt and minute of usage. Banks get precise data to optimize branch operations, reduce emissions, and cut waste, turning ESG into a measurable advantage.

Location, device behavior, motion — IoT introduces new dimensions into risk scoring that traditional systems ignore. When these signals flow into fraud engines or compliance checks, they reduce false positives, accelerate legitimate approvals, and improve investigation precision. Fewer wrongly-blocked users, faster onboarding, better audit trails.

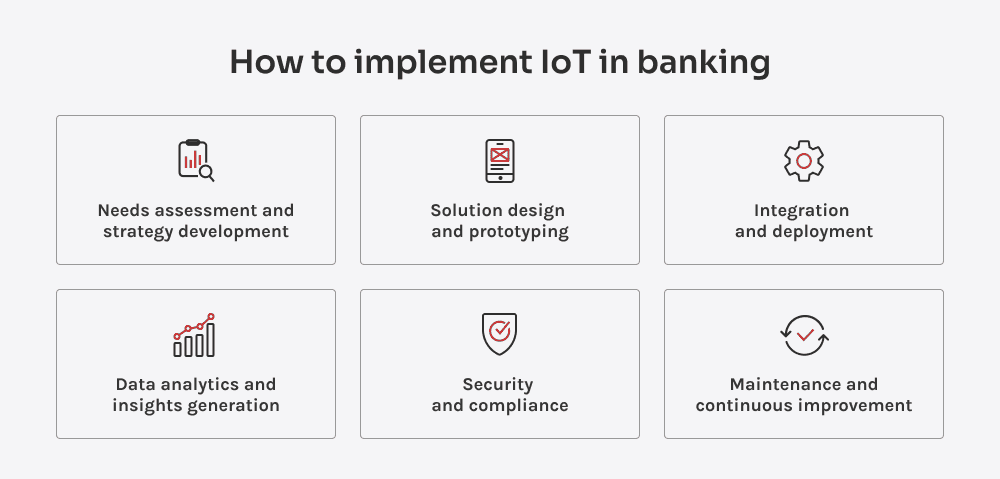

Now that you’ve seen what IoT can truly deliver, let’s talk execution. Below are the key stages of implementation, each with critical focus areas to get right. These aren’t one-size-fits-all steps; every bank needs its own blueprint. But one thing is constant: successful IoT execution demands expertise. Having the right partner by your side isn’t optional — it’s a must.

Every IoT initiative must start with a clear business goal tied to measurable KPIs. This stage aligns IT, operations, compliance, and CX to define use cases and ownership. Without strategic clarity here, even a technically sound solution will fall flat.

This phase is about architecting how data flows from edge devices through APIs into your core systems. Prototypes should test end-to-end logic, not just device performance. Cloud vs. edge decisions, latency, and interoperability are key technical factors at this stage.

True integration means syncing IoT data with legacy cores, fraud systems, CRMs, and compliance engines. Event-driven architectures and stream-processing tools like Kafka are essential for real-time responsiveness. Deployment must include load testing, network segmentation, and rollback plans.

Sensor data is meaningless until processed in real time and connected to business logic. Stream analytics platforms (e.g., Flink, Azure Stream Analytics) enable real-time insights, anomaly detection, and contextual triggers. If insights aren’t operationalized, it’s just digital noise.

IoT demands Zero Trust architecture from edge to cloud — device identity, encrypted channels, and secure OTA updates are the baseline. Integration with existing SIEM tools ensures threat visibility. Regulatory frameworks like GDPR and PSD2 require full auditability of IoT-generated data.

IoT systems degrade fast — firmware, sensors, and data pipelines all need care. Banks must track device health, push OTA updates, and retrain ML models as environments change. Continuous monitoring ensures sustained performance and ROI.

IoT is quietly powering real change across banking and finance, transforming how institutions operate, serve, and respond in the physical world. Below are some of the most impactful ways banks are already putting IoT to work across their operations and customer experiences.

Modern ATMs are equipped with biometric authentication, tamper sensors, and device-level telemetry. They detect suspicious activity in real time, report maintenance needs, and enhance self-service security — all without human intervention.

Sensors track foot traffic, queue lengths, and customer movement to optimize staffing, digital signage, and environmental controls. This turns branches into dynamic environments that respond to real-time demand, not static schedules.

Wearables provide behavioral and contextual data like movement patterns or payment timing that enrich customer profiles. Banks use these insights for real-time personalization, passive authentication, or wellness-linked financial products.

Bluetooth beacons and GPS-enabled apps let banks detect customer presence in branches or partner locations. This enables localized promotions, priority queueing, and personalized service as soon as someone walks through the door.

You’ve seen where IoT is making an impact across banking and finance. Now let’s look at how it’s being implemented on the ground. Below, I’ve outlined tech already in use across banks and financial institutions. Each one plays a distinct role in making physical infrastructure smarter, more secure, and far more responsive.

IoT-connected ATMs report real-time device status, detect tampering, and optimize cash management through predictive refill alerts. You’ll often find them in high-traffic or remote areas where minimizing downtime is critical.

Used in-branch and in partner retail locations, these terminals handle contactless transactions and sync behavioral data across customer profiles. They’re particularly effective in co-branded retail spaces where banks want to extend services beyond traditional branches.

Smartwatches, rings, and fitness trackers allow for frictionless payments, while also capturing context-rich behavioral signals. This tech typically comes into play during mobile-first experiences, like transit systems or quick-service retail.

These IoT-enabled cards rotate their CVV codes based on time or usage rules, significantly reducing card-not-present fraud. They’re designed for secure e-commerce and subscription-based payments where static credentials are most vulnerable.

Context-aware engines verify transactions based on physical factors like device proximity, geolocation, or biometric input. STV is often applied in mobile banking apps or at the point of sale to enable real-time, risk-based authentication.

The system reorganizes queue orders, alerts staff, and adjusts digital signage as needed. These systems are commonly used in larger branches or flagship locations to improve service flow and reduce perceived wait times.

In-branch connectivity platforms track customer movement, enable geofenced content delivery, and support mobile-based service routing. They support location-aware interactions, such as guiding a customer to the right desk or triggering relevant app notifications.

IoT sensors monitor lighting, HVAC, and equipment usage based on occupancy and branch activity, then automatically adjust system behavior. Most often, these systems run behind the scenes across entire branch networks to meet both budget and ESG targets.

Connected displays update in real time based on branch conditions, promotions, or customer segments currently on-site. You’ll see them in entryways, waiting areas, or near ATMs, adapting content based on time of day or current traffic.

Smart cameras, IoT-based access control, and sensor-driven threat detection work together to secure both customers and infrastructure. These technologies are integral to vaults, server rooms, and 24/7 ATM vestibules where real-time alerts are critical.

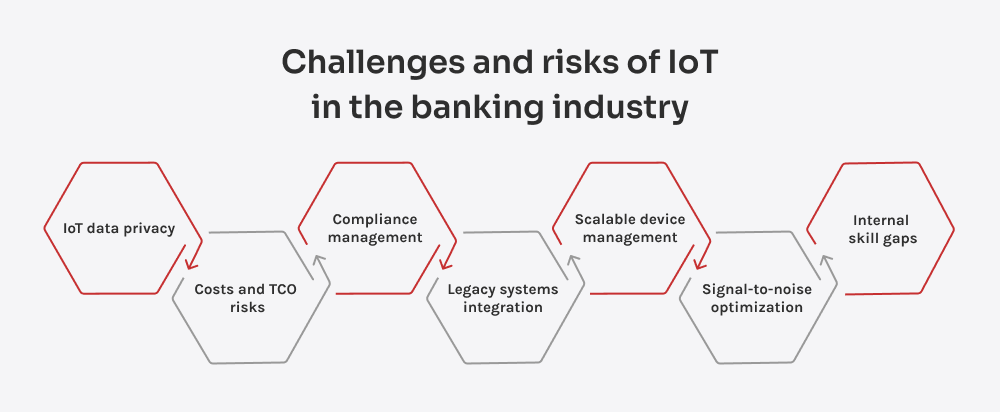

All of the above may sound pretty inspiring — and it is. But like any meaningful transformation, implementing IoT comes with its own set of challenges. These aren’t dealbreakers, but they do require careful planning and the right tech strategy. Below, I’ve outlined the most common risks, along with practical ways to navigate them.

IoT introduces vulnerabilities across the stack — from unsecured edge devices to weak encryption in transit. Any exposure of PII or transaction data is a major risk. Adopting Zero Trust, enforcing TLS encryption, and integrating IoT with SIEM tools helps secure data end-to-end.

IoT costs don’t stop at deployment. Device maintenance, bandwidth, software updates, and vendor dependencies can inflate total cost of ownership. It is important to plan for TCO early, use modular hardware, and support OTA firmware updates to stay flexible and cost-efficient.

IoT data flows challenge traditional models of ownership, storage, and processing. Regulations like GDPR and PSD2 demand full control over sensor data, even from ATMs or beacons. Banks need governance frameworks with clear rules for minimization, consent, and geographic data control.

Most core systems weren’t built for real-time, high-volume IoT data. Poor integration causes delays, data silos, and workflow breakdowns. Event-driven architecture, API gateways, and decoupled middleware help bridge the gap without heavy disruption.

At scale, sensor drift, battery failures, and outdated firmware become operational risks. Without monitoring, IoT networks degrade fast. To overcome this, investing in observability tools, automated health checks, and fleet-wide OTA update capabilities is crucial.

Older or less-optimized systems can be flooded with unfiltered IoT data, slowing down analytics and increasing false positives. Edge computing, stream filtering, and business-rule-driven capture help by pre-processing data at the source, so only relevant information is transmitted or stored.

IoT success requires alignment across IT, ops, compliance, and strategy — yet most banks lack teams with that full spectrum of expertise. Skills gaps and siloed ownership stall projects. Upskilling, IoT-focused DevOps, and making IoT part of broader digital transformation are key to scaling it effectively.

Wondering what’s next for IoT? That’s a timely question, as the trend moves toward deeper integration, blurred lines between technologies, and more real-world intelligence. So let’s take a look at what’s around the corner for IoT in banking and finance, and how it’s likely to shape the near future.

The next evolution of IoT in banking won’t just collect data — it will process and act on it at the edge. Devices will run lightweight AI models to detect anomalies, predict needs, and trigger micro-decisions instantly, without routing everything to the cloud. This enables faster fraud detection, adaptive branch environments, and context-aware customer service.

As IoT expands beyond branch walls, banks will need to integrate with third-party platforms to remain relevant. Expect APIs and open finance standards to bridge the gap between financial services and real-world touchpoints. IoT will become a key interface between banking systems and the daily lives of customers.

We’re moving toward systems that don’t just sense context, but act on it autonomously. IoT combined with ML will drive real-time approvals, dynamic pricing, fraud response, and personalized offers without waiting for human intervention. The result: faster decisions, reduced operational load, and a more adaptive customer experience.

As banks gather more context-rich data from physical environments, pressure will grow to handle it responsibly. The future of IoT will require granular consent management and privacy-preserving analytics, while tech like differential privacy and zero-knowledge proofs may become part of the financial data stack.

Regulators and stakeholders are pushing banks to prove their ESG commitments, and IoT offers the data to back it up. From tracking energy use in branches to optimizing travel and equipment cycles, sensor data will feed into real-time ESG reporting and compliance dashboards. Sustainability will move from principle to practice, powered by embedded IoT.

Banks are shifting from hardware ownership to service-based models where IoT capabilities are consumed on demand. IoT-as-a-Service allows faster scaling, easier upgrades, and predictable OPEX instead of heavy upfront CAPEX. This model will open the door to more agile experimentation and tighter alignment with cloud-native banking strategies.

So now that I’ve walked you through the key pillars of IoT in banking, you might be asking yourself how to make it work for your business. If you’re not using IoT yet, this is the moment to consider it. And if you are, it’s worth asking whether you’re truly getting the most out of it.

Either way, the smartest place to start is with a clear assessment of where you stand and what the real opportunity is. At Innowise, we’re here to provide expert guidance and help you turn your IoT initiatives into measurable business value.

Siarhei leads our FinTech direction with deep industry knowledge and a clear view of where digital finance is heading. He helps clients navigate complex regulations and technical choices, shaping solutions that are not just secure — but built for growth.

Your message has been sent.

We’ll process your request and contact you back as soon as possible.

By signing up you agree to our Privacy Policy, including the use of cookies and transfer of your personal information.