Your message has been sent.

We’ll process your request and contact you back as soon as possible.

The form has been successfully submitted.

Please find further information in your mailbox.

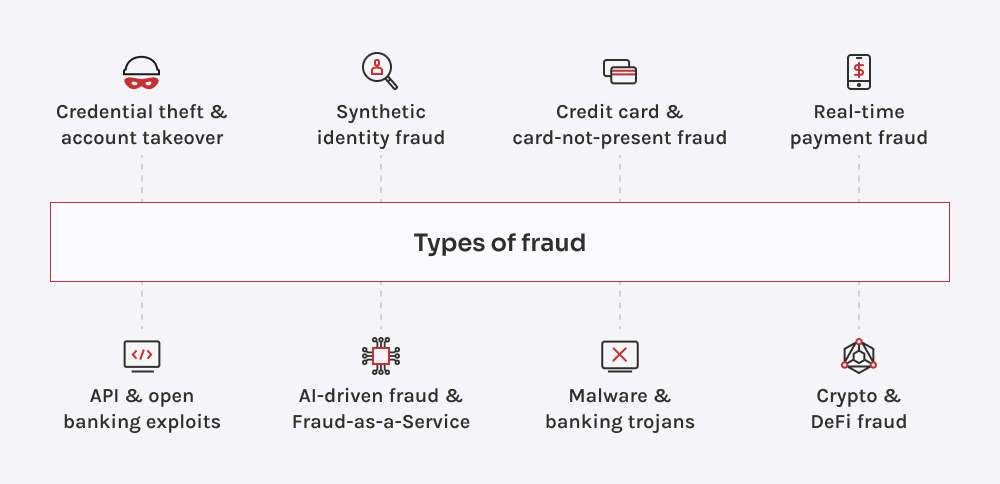

You can’t fight what you don’t fully understand. And while fraud is constantly evolving, let’s not forget some of the oldest tricks in the book are still in play. We’ve matured, but they’ve adapted too. So, before we dive into prevention, let’s look at the most common fraud techniques threatening banks and FinTechs today and why strong, adaptive fraud detection in financial services matters more than ever.

Credential theft and ATO happen when fraudsters use stolen credentials to log into user accounts. They use tricks like AI-powered phishing, credential stuffing, and malware to sneak past security. More advanced tactics like session hijacking, man-in-the-middle (MitM) attacks, and SIM swapping let them intercept authentication codes and drain accounts before anyone notices.

Fraudsters mix real and fake personal data — often using AI — to create identities that don’t actually belong to anyone. These synthetic profiles slip through security checks, allowing criminals to open bank accounts, take out loans, and launder money. Without a real victim to report the fraud, fraudulent activity often goes undetected until it’s too late. Detecting this requires sophisticated AI and a strong fraud management system in banking.

With instant payment systems, fraudsters exploit the speed and irreversibility of transactions to move stolen funds before detection. Common tactics include authorized push payment (APP) fraud and mule networks that rapidly disperse illicit money. Once the money’s gone, there’s no chargeback, and banks need advanced banking fraud monitoring to catch threats before they escalate.

Fraudsters swipe card details through skimming, data leaks, and phishing, and use them for shady online purchases where no physical card is needed. They pull off scams like chargeback fraud, credential stuffing, and bot-driven attacks, racking up charges before anyone catches on. With stolen card info flooding the dark web, banks and merchants are left dealing with the fallout.

As banks and fintech businesses rely more on open banking APIs, fraudsters look for security gaps to steal data and hijack transactions. Weak authentication, misconfigured APIs, and exposed endpoints let attackers manipulate accounts, initiate unauthorized payments, or scrape sensitive financial data. With more third-party integrations than ever, a single weak link can open the door to large-scale fraud.

Fraudsters use malware and banking trojans to sneak into accounts, steal credentials, and mess with transactions. They spread through phishing emails, fake apps, and shady browser extensions, giving attackers full access to banking sessions. Some trojans are so advanced that they can even bypass multi-factor authentication (MFA), which makes them a nightmare for banks and users alike.

AI helps criminals automate scams, bypass security checks, and generate deepfake voices and videos to trick banks and customers. Meanwhile, FaaS has turned cybercrime into a business, with ready-made phishing kits, credential stuffing tools, and AI-driven bots available for rent on the dark web. This lets even low-skill fraudsters launch advanced attacks, making financial fraud harder to catch and stop.

As banks and FinTechs dive into crypto, fraud is evolving with them. We’re not just talking about the occasional rug pull — attackers are leveraging smart contract flaws, flash loans, and cross-chain tricks to move stolen assets before anyone notices. With transactions happening fast and anonymously, the pressure on institutions to detect and respond in real time is higher than ever.

Fraud isn’t always loud, obvious, or easy to catch — it can be subtle, adaptive, and often slips through where no one’s looking. That’s why modern fraud detection in banking isn’t just about spotting red flags. It’s about knowing how fraudsters think, where systems get weak, and when to act. So, how do the best systems stay in the game? Let’s take a closer look.

Fraud detection isn’t about one magic solution — it’s about layering the right technologies to spot fraud before it spreads. Now that we’ve looked at how different detection methods work, let’s explore the tech that powers them in real-world banking environments.

| Technology | How it works | Key features | Popular solutions |

| Fraud management systems (FMS) | Centralized platforms that aggregate fraud data, analyze transactions, and trigger alerts in real time | Transaction monitoring, case management, and real-time risk scoring | NICE Actimize, FICO Falcon, SAS Fraud Management |

| AI & ML | Detects fraudulent activity by analyzing patterns, anomalies, and behavioral shifts | Predictive analytics, anomaly detection, adaptive learning models | Feedzai, Darktrace, IBM Trusteer, DataVisor. |

| Blockchain | Prevents fraud by providing immutable transaction records and decentralized identity verification | Cryptographic security, smart contracts, tamper-proof ledgers | Trust Stamp, Evernym, IBM Blockchain Fraud Prevention |

| Biometric & risk-based authentication (RBA) | Uses physical and behavioral biometrics to verify identities and assess risk dynamically | Fingerprint scanning, facial recognition, behavioral biometrics, dynamic risk scoring | BioCatch, Nuance Gatekeeper, Jumio, Onfido |

| Device intelligence & fingerprinting | Identifies fraudulent users by analyzing device characteristics, geolocation, and connection patterns | IP tracking, device binding, anomaly detection | ThreatMetrix, iovation, FingerprintJS |

| Synthetic identity detection | Uses AI to detect fabricated identities that combine real and fake data for fraud schemes | Identity clustering, AI-driven pattern recognition, document forgery detection | Socure, Sift, Experian CrossCore |

| Graph-based fraud detection | Maps relationships between accounts, devices, and transactions to uncover fraud rings and money mules | Social network analysis, entity link analysis, fraud ring detection | Quantexa, Linkurious, GraphAware |

| Dark web monitoring | Scans underground forums, marketplaces, and leaked databases for compromised credentials and fraud activity | AI-powered threat intelligence, credential leak alerts, real-time monitoring | Recorded Future, SpyCloud, CybelAngel |

“The biggest misconception is treating fraud as a post-incident issue — detect, react, repeat. But by the time an alert fires, the damage is often done. Real protection means building systems that make fraud nearly impossible from the start. At Innowise, we help uncover hidden vulnerabilities and fine-tune your strategy before fraud ever has a chance to slip through.”

Delivery Manager in Fintech

Catching fraud is good. Stopping it before it starts? Even better. True fraud prevention in the banking industry begins long before a transaction is flagged — it starts at access, intent, and risk. And it takes a solid strategy to connect those dots. Here’s how forward-thinking teams stay ahead.

Constantly changing laws like KYC, AML, and PSD2 make it challenging to stay compliant while preventing fraud. Businesses must implement flexible, automated compliance solutions to adapt quickly and meet regulatory demands.

Tight security is crucial, but too many authentication steps can frustrate real customers and drive them away. The key is using smart, risk-based authentication that adds extra layers only when something seems off.

Investing in advanced fraud prevention can be tough with tight budgets and small teams. Prioritizing AI-driven automation and scalable solutions helps maximize protection without overspending.

Cross-border payments come with higher fraud risks due to different regulations, currency challenges, and evolving fraud tactics. Using AI-driven monitoring and region-specific fraud controls helps detect threats without slowing transactions.

GDPR and CCPA limit how fraud data can be shared, even across trusted systems. That’s why many institutions now rely on secure data management to protect sensitive data while enabling safe, compliant fraud detection.

Fraud doesn’t always come from the outside; insiders can misuse access for personal gain or collude with external criminals. Regular employee training, real-time activity monitoring, and strict role-based access controls help reduce the fraud risk.

Fraudsters are always a step ahead, using AI, deepfakes, and synthetic identities to bypass security. Staying proactive with AI-driven threat detection and continuous fraud model updates helps keep defenses strong.

Real-time payments, crypto, and digital wallets create security gaps before regulations catch up. Implementing fraud prevention tools with real-time monitoring and adaptive risk controls helps stay ahead of new threats.

We know the tools worth using and how to make them work for you. With deep expertise in platforms like Samsub and SDK.finance, we help turn great platforms into seamless, scalable fraud management solutions for banks and FinTechs alike.

2025 is making one thing clear: the future of fraud prevention is collaborative, adaptive, and real-time. It’s no longer about reacting after the fact—it’s about anticipating the move before it happens. For fintechs and banks, that means aligning tech, teams, and partners around strategies that are always learning, always evolving, and always one step ahead.

Proactive security features are gaining ground, shifting fraud prevention from passive alerts to real-time action. Tools like ANZ’s “digital padlock” let users lock accounts instantly, stopping fraud before it escalates. As adoption grows, more businesses will embed user-triggered controls into apps and platforms to make customers part of the defense system.

Collaboration is gaining momentum, with banks, FinTechs, and even telcos beginning to share real-time fraud signals through secure, privacy-preserving tech like federated learning. These networks are still emerging, but they’re reshaping how fraud is detected, turning isolated insights into collective defense. As adoption grows, businesses will use them to close gaps faster, stop coordinated attacks sooner, and make fraud response a team effort.

Let’s be honest — fraud isn’t going anywhere. It’s evolving, getting bolder, and learning just as fast as we are. The question is: are your systems adapting, or are they just reacting? From AI-powered fraud detection systems to decentralized identity and shared intelligence, the tools are out there. But they’re only as good as the strategy behind them. If you’re serious about staying ahead, it’s time to stop thinking in silos and start building fraud prevention as a living, evolving part of your business.

Your message has been sent.

We’ll process your request and contact you back as soon as possible.

By signing up you agree to our Privacy Policy, including the use of cookies and transfer of your personal information.