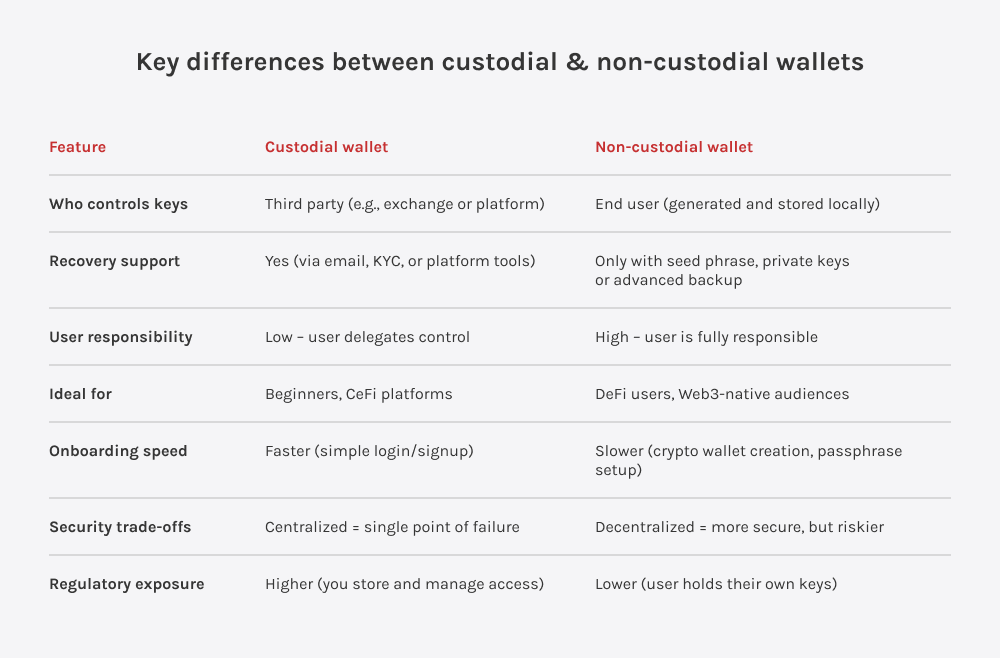

Let users unlock the app with biometrics or a PIN, and manage access to their cryptocurrency wallet by importing or exporting private keys or seed phrases, since in a non-custodial setup, the key is the account.

Your message has been sent.

We’ll process your request and contact you back as soon as possible.