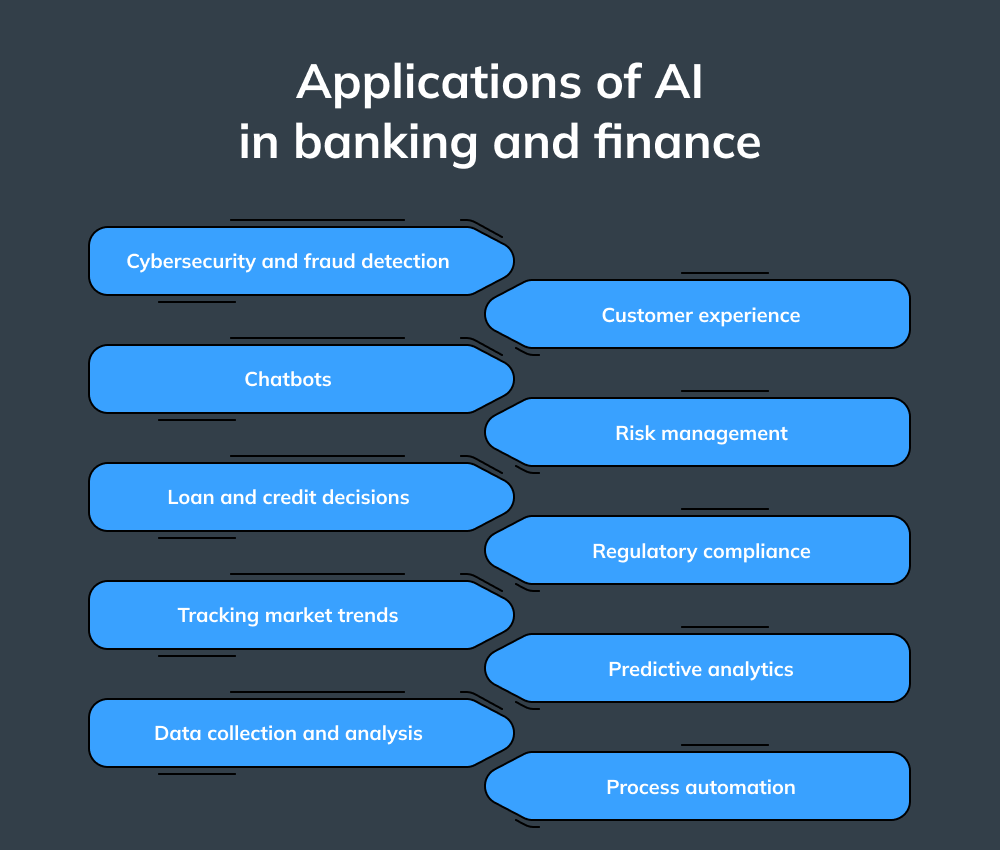

Anvendelser av kunstig intelligens i bank- og finanssektoren

Kunstig intelligens har blitt en del av hverdagen vår - og har forvandlet bransjer på måter vi bare kunne forestille oss for noen få år siden. Det ville være korttenkt å benekte betydningen av kunstig intelligens: Særlig bank- og finanssektoren har gjennomgått store endringer takket være FinTech-innovasjoner, som har gitt en rekke fordeler for både interessenter og kunder.

Cybersikkerhet og avdekking av svindel

Hver dag strømmer millioner av transaksjoner gjennom banksystemet: folk betaler regninger, setter inn penger, tar ut penger, løser inn sjekker og mye mer. Bak kulissene er bankene i et konstant kappløp for å holde seg i forkant av nettkriminelle - de øker sikkerhetsinnsatsen for å beskytte driften og eiendelene sine og for å stoppe svindelforsøk før de i det hele tatt har en sjanse til å skje.

Kunstig intelligens er nå en nøkkelspiller i dette spillet med høy innsats. Bankene kan bruke potensialet i kunstig intelligens til å forbedre digitale betalinger, oppdage sårbarheter i programvaren, identifisere mistenkelig kundeatferd og samtidig redusere risikoen for svindel. Maskinlæring - en delmengde av kunstig intelligens - bidrar til å oppdage og forhindre ulovlige handlinger som phishing via e-post, kredittkort- og mobilsvindel, identitetstyveri og falske forsikringskrav.

Ta Danske Bank i Danmark, som nylig oppdaterte sin foreldede programvare for svindeloppdagelse med moderne AI-algoritmer. Takket være MLs evne til å analysere tidligere transaksjoner (tenk personlig informasjon, data, IP-adresse, lokasjon og så videre), opplevde banken en 50% økning i nøyaktigheten i oppdagelsen av svindel og en 60% reduksjon i falske positiver. Banker er et yndet mål for hackere, og derfor er det avgjørende at ML og AI tas i bruk i stor skala. Disse teknologiene hjelper finansinstitusjoner med å reagere raskt på digitale trusler, og styrker forsvaret mot cyberangrep før de går ut over interne systemer, ansatte eller kunder.

Chatbots

Bruk av chatboter i bankvesenet er et av de enkleste eksemplene på implementering av kunstig intelligens. Når de er tatt i bruk, vil de være tilgjengelige døgnet rundt, i motsetning til menneskelige ansatte med faste timeplaner og behov for regelmessige pauser. Chatbots svarer ikke bare på spørsmål med svar som passer for alle: De lærer av kundeinteraksjoner og bygger opp en mengde kunnskap som gjør at de kan forutsi brukernes behov og skreddersy svarene deretter. Ved å integrere AI-drevne chatboter i bankapper kan ledere være sikre på at kundene deres får personlig kundestøtte døgnet rundt, med produkter og tjenester som er tilpasset individuelle behov.

Et eksempel på en vellykket chatbot er Erica: en AI-drevet virtuell assistent fra Bank of America. Siden 2019 har Erica håndtert over 50 millioner kundeforespørsler - fra å hjelpe kunder med å redusere kredittkortgjelden til å oppdatere kortsikkerheten.

Låne- og kredittbeslutninger

Bankene bruker i dag et bredt spekter av intelligente verktøy for å forbedre nøyaktigheten, presisjonen og lønnsomheten i sine låne- og kredittbeslutninger. Konvensjonell bankprogramvare kommer ofte til kort, og er plaget av feil, unøyaktigheter i transaksjonshistorikken og feilklassifiseringer av kreditorer. Finansinstitusjoner må følge nøye med på kreditthistorikk og kundereferanser når de gir kreditt og vurderer soliditeten til enkeltpersoner eller selskaper. AI-baserte systemer analyserer kundenes atferdsmønstre for å ta datadrevne beslutninger om kredittverdighet, og varsler bankene umiddelbart om mistenkelige eller risikofylte aktiviteter.

Kundeopplevelse

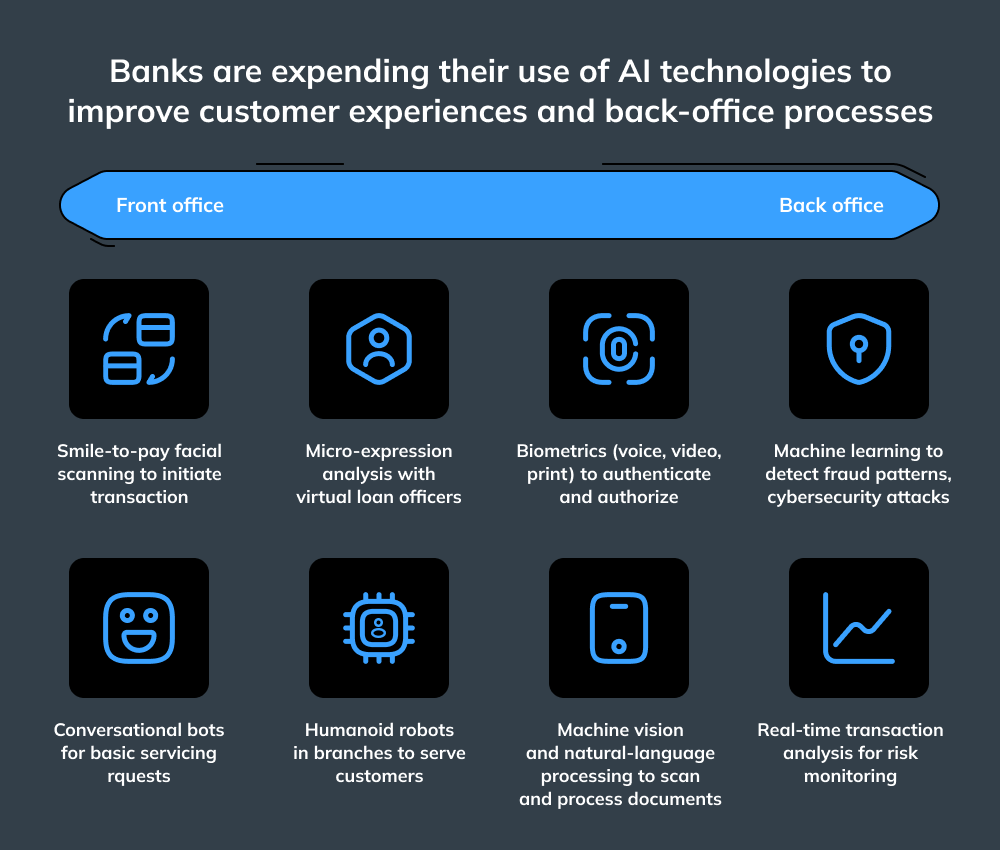

Kundene forventer en intuitiv og enkel brukeropplevelse når de skal administrere bankappene sine. De dagene da det var nødvendig å besøke en bankfilial for enkle transaksjoner som innskudd og uttak, er forbi, takket være de praktiske minibankene.

I dag - med en mer teknologikyndig befolkning - må bankene kontinuerlig innovere for å kunne tilby raske og sikre digitale betalingsløsninger. Kunstig intelligens bidrar til å redusere tiden det tar å registrere KYC-informasjon og eliminere feil, effektiviserer rask time-to-market for produkter og løser proaktivt problemer før lansering før de oppstår.

Som om ikke det var nok, har det aldri vært enklere å søke om et privatlån. Kundene trenger ikke lenger å gå gjennom bryderiet med manuelle søknader: AI og ML i FinTech reduserer innvilgelsestiden og innhenter presise og feilfrie data om kundenes kontoer.

Risikostyring

Valutasvingninger, politiske omveltninger, naturkatastrofer og væpnede konflikter kan alle sende sjokkbølger gjennom finans- og banksystemene. I turbulente tider er det avgjørende å ta kloke investeringsbeslutninger for å holde seg flytende og unngå økonomiske tap. Det er her AI kommer inn i bildet: Ved å gi en nyttig oversikt over aktuelle hendelser, forutse fremtidige trender og spå hva som ligger foran oss, kan AI hjelpe investorer med å navigere trygt i usikre farvann. AI kan også bidra til å avgjøre om en kunde vil være i stand til å betale tilbake et lån eller ikke, ved å analysere atferdsmønstre, kreditthistorikk og tilgjengelige personopplysninger.

Overholdelse av regelverk

Fintech skiller seg ut som en av de mest gjennomregulerte sektorene i den globale økonomien. Myndighetene spiller en viktig rolle som de viktigste vaktbikkjene - de overvåker og fører tilsyn med bankene for å forhindre økonomisk kriminalitet, hvitvasking av penger og skatteunndragelse.

Lovkrav og standarder endres ofte - noe som betyr at bankene må ha velinformerte og smidige avdelinger som er dedikert til å undersøke og implementere den stadig skiftende finanslovgivningen. Når denne prosessen gjøres manuelt, er den både tidkrevende og kostbar. Nå kommer AI inn i bildet: Ved hjelp av dyp læring og NLP kan AI-systemer raskt analysere nye forskrifter og vurdere samsvarskrav, slik at organisasjoner oppfyller alle eksterne lover så vel som interne retningslinjer. Selv om kunstig intelligens ikke kan erstatte en dyktig, menneskelig compliance-analytiker, kan den avdekke kritiske eller tvetydige aspekter ved regelverket og beskytte selskapet mot lovgivningsrisiko.

Prediktiv analyse

Å bruke kunstig intelligens til prediktiv analyse er litt som å ha en svært intuitiv assistent som kan finne trender og sammenhenger som mennesker eller konvensjonell teknologi ofte overser. AI er mye brukt i naturlig språkanalyse og generell semantikk, takket være evnen til raskt å oppdage spesifikke mønstre og datakorrelasjoner. Dette er en gamechanger for banksektoren: Prediktive analyser hjelper finansinstitusjoner med å definere uutnyttede salgsmuligheter, levere datadrevne beregninger og avdekke bransjespesifikk innsikt som kan øke inntektene betydelig.

Hvorfor bør banksektoren ta i bruk kunstig intelligens?

Bankverdenen er i rask endring i retning av kundesentrerte modeller som tar sikte på å oppfylle alle kunders ønsker, behov og forventninger. Dagens kunder vil at bankene skal være tilgjengelige døgnet rundt og tilby innovative verktøy og funksjoner som gjør bankopplevelsen problemfri. For å innfri disse forventningene må bankene først takle interne utfordringer, som gamle programvaresystemer, fragmenterte datasiloer, begrensede budsjetter og dårlig kvalitet på eiendelene. Når disse hindringene er overvunnet, er bankene ett skritt nærmere å ta i bruk kunstig intelligens for å løse hverdagsproblemene sine.

AI sørger ikke bare for uovertruffen cybersikkerhet: Det gjør også finansielle tjenester mer praktiske og tidsbesparende for både kunder og ansatte.

Utfordringer ved bredere bruk av kunstig intelligens i finans- og banksektoren

Det sier seg selv at AI kommer med en rekke fordeler, men utbredelsen av AI hindres av en rekke problemer, blant annet manglende troverdighet og sikkerhetsrisiko. En helhetlig strategi og en omfattende tilnærming til AI og maskinlæring i finanssektoren kan redusere disse risikoene betydelig, og dermed øke sannsynligheten for suksess og de økonomiske gevinstene som følger med. Når beslutningstakere navigerer i den spennende verdenen av kunstig intelligens i finans, kan de støte på en rekke vanlige hindringer, som er skissert nedenfor.

Datasikkerhet

AI samler inn, lagrer og håndterer enorme mengder sensitiv personlig informasjon - noe som betyr at det er viktig for finansinstitusjoner å etablere beskyttelsestiltak for å forhindre datainnbrudd og uautorisert tilgang. Bankene bør prioritere vanntette databeskyttelsessystemer når de håndterer store mengder AI-relatert informasjon, for å eliminere enhver risiko og holde konfidensiell informasjon sikker.

Mangel på kvalitetsdata

Utilstrekkelig datakvalitet utgjør en stor utfordring for FinTech-selskaper. Uten velorganiserte data er det nesten umulig å anvende innsikten på virkelige situasjoner hvis den ikke samsvarer med dagens virkelighet. I tillegg kan data som avviker fra det maskinlesbare formatet, føre til uforutsigbar atferd i AI-modeller. Banker som ønsker å ta i bruk kunstig intelligens, bør endre - og om nødvendig revidere - datapolicyene sine og innføre mer orden i datastrømmene.

Spørsmål om forklarbarhet

Siden AI-basert programvare luker ut feil og sparer tid, er de mye brukt i beslutningsprosesser. Dessverre kan de ha skjevheter som stammer fra tidligere menneskelige feilvurderinger. Det kan bety at bankens omdømme kan være i fare hvis mindre avvik i AI eskalerer og forårsaker store problemer. Alle data som er involvert i AI-scenarioer, bør være tydelige og transparente, slik at det ikke er rom for potensielle avvik.

Hvordan Innowise kan akselerere AI-reisen din