Your message has been sent.

We’ll process your request and contact you back as soon as possible.

The form has been successfully submitted.

Please find further information in your mailbox.

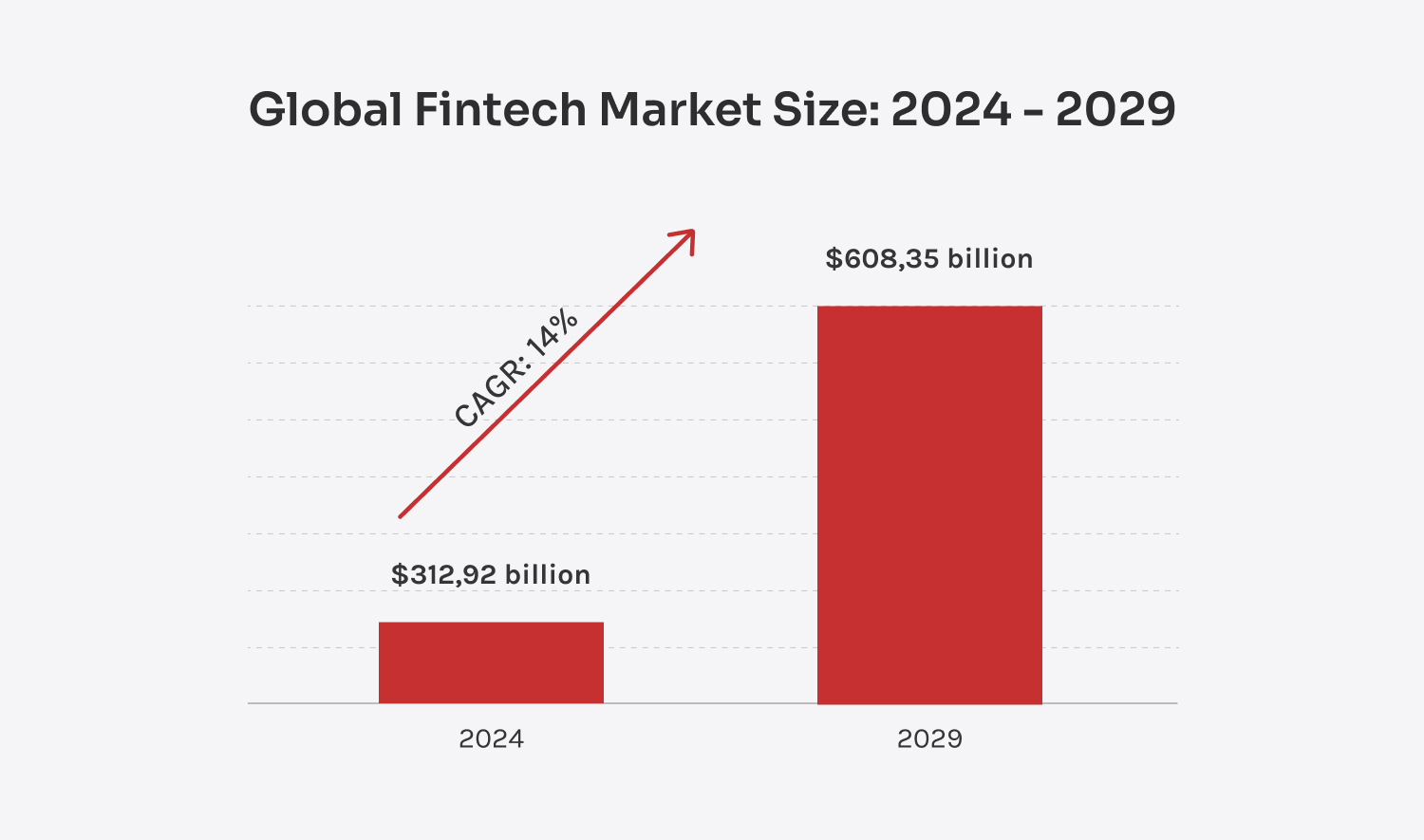

The push towards digitalization, growing demand for financial inclusion, and rapid tech advancements, along with shifting consumer preferences for digital banking, all point to one thing: adopting FinTech is no longer optional. It’s only a matter of time before businesses must embrace it or risk falling behind. And the numbers speak for themselves — according to Mordor Intelligence, the FinTech market is estimated to be $312.92 billion in 2024 and could grow to $608.35 billion by 2029, with a CAGR of over 14%. What this means is that the FinTech app industry is on the rise and isn’t slowing down anytime soon!

If you’re here, you’re likely one of those forward-thinkers looking to grow and transform your business with FinTech apps. That’s why we’ve put together all the details you need to know about FinTech app development costs.

There’s no better time than now! At Innowise, we know how to get it done right at a cost that works for you.

Banking apps aren’t just nice-to-haves anymore — they're tools people rely on daily, if not hourly. From fast and secure payments to smooth mobile experiences and 24/7 support, these apps need to be reliable and built to handle everything your customers need, anytime and anywhere. We create banking apps that are not only powerful but also designed to keep your customers coming back, boosting loyalty and engagement with every interaction.

Today’s digital-savvy users want more than just to send or receive money — they want to easily manage, budget, track, and plan their finances. The personal finance software market is booming, expected to hit $4.2 billion by 2032. At Innowise, we build personal finance apps that truly live up to the "personal" part. They're customized to fit real customer needs and flexible enough to grow as those needs change.

InsurTech is all about making things simple and earning your customers' trust. So, how do you pull that off? Well, you could build a super user-friendly app where policyholders can easily access insurance options. Or you could make things easier for your agents — helping them streamline their routine tasks so they can focus on the important stuff that really drives results. Either way, we've got you covered!

Investment apps let users trade stocks from the comfort of their couch. You might be thinking, "Sure, lots of apps offer that." But what if we told you that your app could integrate advanced features like GenAI to analyze market trends and user risk tolerance and offer personalized advice? Sounds more exciting, right? Our investment apps are designed to help users make the most of their money, turning investing into a simple and rewarding experience.

Banking apps aren’t just nice-to-haves anymore — they're tools people rely on daily, if not hourly. From fast and secure payments to smooth mobile experiences and 24/7 support, these apps need to be reliable and built to handle everything your customers need, anytime and anywhere. We create banking apps that are not only powerful but also designed to keep your customers coming back, boosting loyalty and engagement with every interaction.

Today’s digital-savvy users want more than just to send or receive money — they want to easily manage, budget, track, and plan their finances. The personal finance software market is booming, expected to hit $4.2 billion by 2032. At Innowise, we build personal finance apps that truly live up to the "personal" part. They're customized to fit real customer needs and flexible enough to grow as those needs change.

InsurTech is all about making things simple and earning your customers' trust. So, how do you pull that off? Well, you could build a super user-friendly app where policyholders can easily access insurance options. Or you could make things easier for your agents — helping them streamline their routine tasks so they can focus on the important stuff that really drives results. Either way, we've got you covered!

Investment apps let users trade stocks from the comfort of their couch. You might be thinking, "Sure, lots of apps offer that." But what if we told you that your app could integrate advanced features like GenAI to analyze market trends and user risk tolerance and offer personalized advice? Sounds more exciting, right? Our investment apps are designed to help users make the most of their money, turning investing into a simple and rewarding experience.

FinTech app development can involve a lot of moving parts. That’s where Innowise steps in — we’re all about keeping it simple for you. Instead of dealing with multiple service providers, you can rely on us to deliver a full-cycle service.

Already have a vision for your future FinTech app?

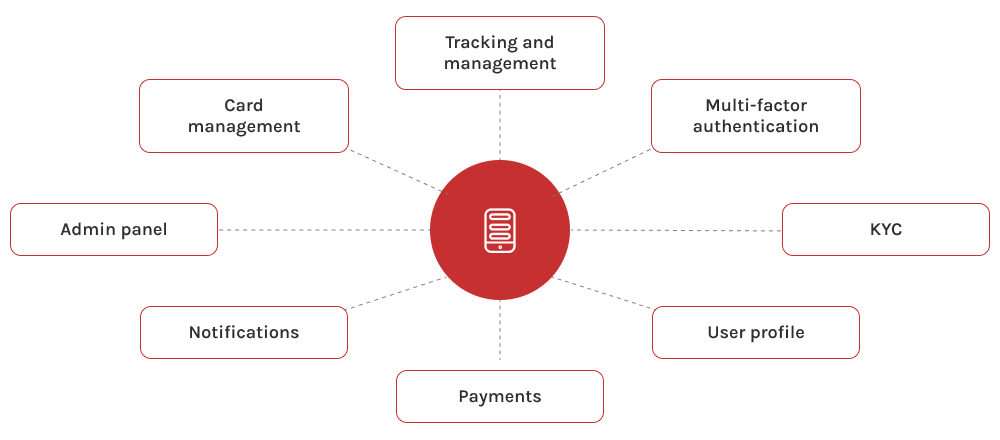

According to SDK.finance, a FinTech software provider focused on banking and payment infrastructure, many must-have FinTech features impact development costs mainly through backend architecture, ledger logic, and reconciliation workflows rather than user interface complexity, which is why these elements play a key role in overall fintech app development cost.

We’ll help you make smart moves and create a solution that really drives profits.

Product requirements

Interactive UI/UX

Location of the development partner

Time required for app development

App maintenance

Advanced technologies used

Tools and languages used

Features integrated

Siarhei Sukhadolski

FinTech Expert at Innowise

So here we are! After diving into the essential features and cost considerations of FinTech app development, let’s take a look at how the whole development process actually works.

Siarhei Sukhadolski

FinTech Expert at Innowise

It really depends on how complex the app is — it can take anywhere from 3 to 12 months or even longer. Of course, more advanced features will take more time to develop, but the better thought out and carefully built your app is, the fewer problems you’ll run into down the road.

A basic app could run you around $50,000 to $100,000, but if you’re looking for more advanced features, the price can easily go up. It also depends on whether you decide to hire in-house developers, outsource the work, or go for a mix of both with augmented teams.

With the right experts and transparent processes, hidden costs are unlikely. However, adding more features over time can increase the price. That’s why we offer solid planning and budgeting from the very start to save you from any surprises down the road.

Security is essential in FinTech app development since these apps handle sensitive financial data. The need for strong security features can raise the budget. But this isn’t an area where you can cut corners — security breaches are costly, not just in money, but in user trust as well.

FinTech Expert

Siarhei leads our FinTech direction with deep industry knowledge and a clear view of where digital finance is heading. He helps clients navigate complex regulations and technical choices, shaping solutions that are not just secure — but built for growth.

Your message has been sent.

We’ll process your request and contact you back as soon as possible.

By signing up you agree to our Privacy Policy, including the use of cookies and transfer of your personal information.