Meldingen din er sendt.

Vi behandler forespørselen din og kontakter deg så snart som mulig.

Skjemaet har blitt sendt inn.

Mer informasjon finner du i postkassen din.

I henhold til FNs kontor for narkotika og kriminalitet (UNODC), det anslås at 2-5% av verdens BNP - mellom $800 milliarder og $2 billioner - hvitvaskes hvert år. Det er en utrolig mengde svarte penger som forvrenger økonomiene, bremser utviklingen og bryter ned tilliten til det finansielle systemet. Tenk på dette i det virkelige liv - forestill deg hvor mange forsøk på hvitvasking av penger som skjer hver eneste dag. Ganske skremmende, ikke sant?

Det er her AML-transaksjonsovervåking kommer inn i bildet. Det er som å ha en finansiell vakthund på vakt døgnet rundt, som holder øye med millioner av daglige transaksjoner - overføringer, innskudd og uttak - for å snuse opp alt som er mistenkelig. Tenk på det som frontlinjen i kampen mot økonomisk kriminalitet, som jobber i sanntid (eller ganske nær) for å fange opp alt som ikke stemmer.

AML-transaksjonsovervåking er en fascinerende blanding av teknologi, strategi og årvåkenhet som det er verdt å vite mer om. Er du klar til å sette deg inn i detaljene? La oss dykke ned i det!

$17.59bn

den estimerte verdien av det globale markedet for transaksjonsovervåking av hvitvasking av penger i 2024

kilde: Fact.mr

9.4%

forventet CAGR for det globale markedet for transaksjonsovervåking av hvitvasking av penger innen 2024

kilde: Fact.mr

Når det gjelder å bekjempe økonomisk kriminalitet, er AML-transaksjonsovervåking her for å analysere hver eneste transaksjon - stor eller liten - for å fange opp alt som er mistenkelig. Hvorfor er dette så viktig? Fordi kriminelle ikke er åpenbare i sine handlinger. De bruker alle slags triks, som smurfing, for å dele opp store beløp i små, harmløst utseende transaksjoner for å fly under radaren. AML-systemer utnytter ML for å identifisere uvanlige transaksjonsmønstre, AI-drevet atferdsanalyse for å finne aktiviteter som avviker fra en kundes normale profil, og sofistikerte regelbaserte motorer for å flagge transaksjoner som bryter med lovbestemte terskelverdier.

I tillegg til de tradisjonelle finanssystemene har kryptovalutaer gjort arbeidet med hvitvasking av penger enda mer komplisert. Kryptovalutaenes anonymitet og desentraliserte natur gjør dem til et praktisk verktøy for kriminelle som ønsker å hvitvaske penger eller finansiere ulovlige aktiviteter uten å bli oppdaget. Tradisjonelle AML-metoder, som kundesjekker og rapportering av mistenkelig aktivitet, har problemer med å holde tritt på dette området. Det er derfor effektiv transaksjonsovervåking med avanserte verktøy som blokkjedeanalyse og -overvåking er så viktig - det bidrar til å identifisere og stoppe ulovlig aktivitet, og tilpasser seg den skiftende dynamikken i den digitale finansverdenen.

Et godt system for overvåking av AML-transaksjoner analyserer transaksjonsmønstre, lokasjoner, forretningstyper og mer for å skape detaljerte risikoprofiler. Disse profilene bidrar til å identifisere potensiell eksponering for økonomisk kriminalitet og justere overvåkingen basert på hver kundes samlede risikonivå.

Systemet må kunne tilpasses regel- og scenariokonfigurasjoner. Det må ikke bare kunne håndtere standardmønstre og -krav, men også gi deg mulighet til å tilpasse ting for å holde deg oppdatert på endringer i regelverk, bransjetrender og nye svindeltaktikker.

Ettersom det hele tiden dukker opp oppdateringer av regler, rapporteringskrav og risikofaktorer, må et solid system for overvåking av hvitvaskingstransaksjoner ha innebygde verktøy som automatisk holder tritt med disse endringene.

Systemet bør håndtere både sanntidsovervåking og løpende overvåking. Sanntidsovervåking holder deg oppdatert med umiddelbare varsler om mistenkelig aktivitet, mens løpende overvåking ser på det større bildet og oppdager trender og mønstre over tid.

Et solid system for overvåking av hvitvaskingstransaksjoner består av automatisering og avansert analyse. Automatisering tar seg av overvåkingsprosessen og generering av rapporter om mistenkelige transaksjoner (STR), mens avansert analyse dykker ned i dataene for å oppdage mønstre, trender og røde flagg.

Overvåkingssystemet bør bruke avansert kunstig intelligens for å skjerpe deteksjonen og redusere antallet falske positiver. AI-algoritmer gjør overvåkingen raskere og mer pålitelig, ettersom de kan oppdage vanskelige mønstre og avvik som tradisjonelle metoder kan overse.

Et system for overvåking av hvitvaskingstransaksjoner bør være skalerbart og holde tritt med økende transaksjonsvolumer og kompleksitet. Det bør også integreres effektivt med det eksisterende IT-økosystemet for å sikre en jevn dataflyt og prosessautomatisering.

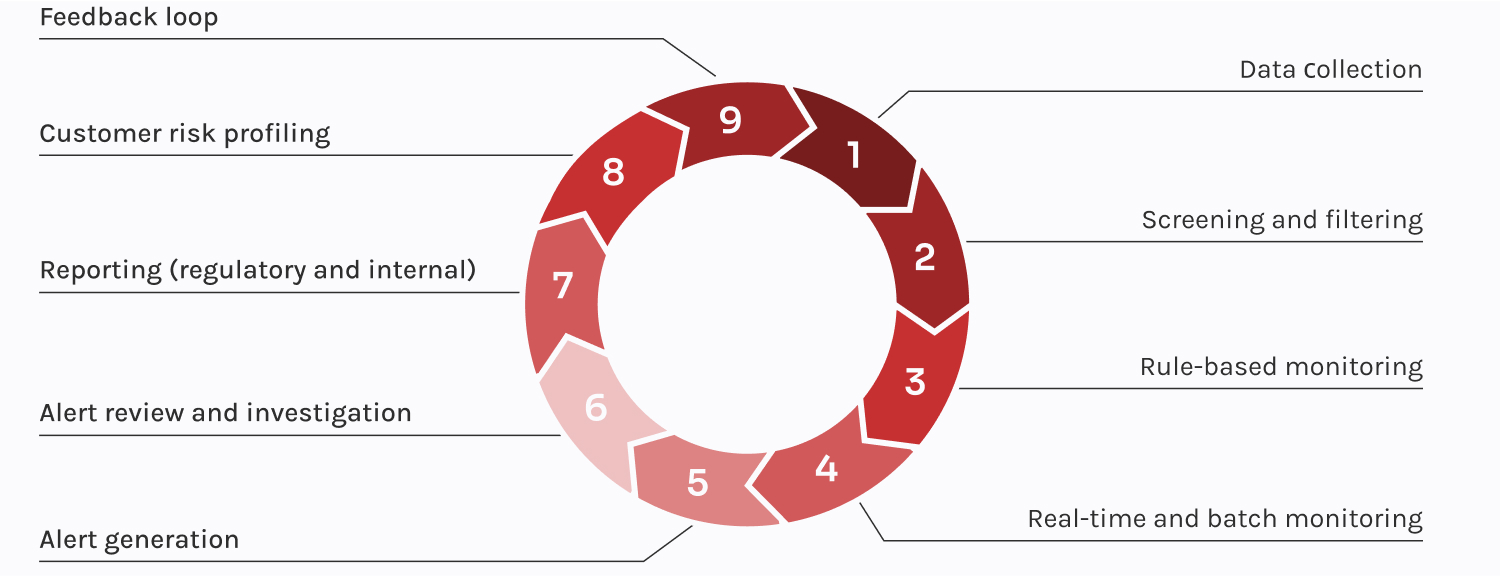

Nå som vi har gjennomgått det grunnleggende om solide systemer for overvåking av hvitvaskingstransaksjoner og de røde flaggene vi bør se etter, kan vi trekke forhenget til side og se hvordan det hele fungerer. Her er en trinnvis gjennomgang av hva som skjer bak kulissene.

Dzianis Kryvitski

Leveransesjef i Fintech

AML-transaksjonsovervåking er et kraftig verktøy i kampen mot økonomisk kriminalitet som har en positiv innvirkning på alle aspekter av en virksomhet. Til sammen skaper fordelene et sterkere og sikrere økosystem som beskytter virksomheten og bygger tillit.

Bedrifter må følge mange forskrifter om AML, CTF og bekjempelse av økonomisk svindel. Et godt system for overvåking av AML-transaksjoner hjelper deg med å oppdage mistenkelig aktivitet tidlig og sende inn rapporter i tide, slik at du unngår bøter, kostbare revisjoner og potensielle restriksjoner på virksomheten.

Overvåking av AML-transaksjoner bidrar til å vurdere eksponeringen for ulike former for økonomisk kriminalitet og iverksette proaktive tiltak for å redusere disse risikoene. Dette er en viktig del av en bredere risikostyringsstrategi som bidrar til å styrke virksomhetens generelle finansielle stabilitet og motstandsdyktighet.

Tillit er avgjørende i økonomiske relasjoner, og hvis en virksomhet ikke kan oppdage mistenkelige aktiviteter, kan den raskt miste denne tilliten. Overvåking av AML-transaksjoner hjelper deg med å bygge opp et image som en pålitelig partner, pleie kundelojaliteten og unngå kostbare konsekvenser for omdømmet.

Et solid system for overvåking av AML-transaksjoner håndterer tonnevis av data automatisk, noe som reduserer antall feil og sparer deg for å kaste bort tid på falske positiver. Det lar teamet ditt fokusere på de virkelige truslene og forhindrer betydelig ressursbruk.

AML-transaksjonsovervåking bidrar til å beskytte kundene mot identitetstyveri, uautoriserte transaksjoner og andre former for økonomisk svindel. Det skaper en tryggere opplevelse for kundene og viser at du er opptatt av å beskytte deres økonomiske velferd.

Overvåking av AML-transaksjoner bidrar til å holde bankens økonomi stabil ved å flagge høyrisikotransaksjoner og beskytte kapitalen. Det bidrar til å forhindre forstyrrelser i kontantstrømmen som følge av frosne eiendeler, bøter eller driftsforsinkelser.

Den enorme mengden daglige transaksjoner gjør bankene til et sentralt mål for hvitvasking av penger. Kriminelle deler opp store summer, dirigerer midler gjennom komplekse overføringer eller skjuler ulovlige penger ved hjelp av falske handelsavtaler. AML-løsninger for banker oppdager raskt disse faresignalene, sikrer etterlevelse og beskytter den økonomiske integriteten.

Med sitt høye tempo, store transaksjonsvolum og minimale dokumentasjon er pengeoverføringstjenester en magnet for økonomisk kriminalitet. AML-verktøy griper inn for å fange opp uregelmessige mønstre, som små, gjentatte overføringer eller betalinger til høyrisikoområder, og flagger dem for videre etterforskning.

Formues- og investeringsforvaltningsselskaper håndterer komplekse porteføljer, noe som gjør dem til mål for økonomisk kriminalitet. AML-transaksjonsovervåking flagger investeringer knyttet til høyrisikojurisdiksjoner og oppdager uregelmessigheter i porteføljen for å beskytte kundemidler og firmaets omdømme.

Lån kan være en smart måte å hvitvaske penger på - kriminelle bruker forfalskede dokumenter, oppblåste kredittpoeng eller tvilsomme tilbakebetalingsmønstre for å kanalisere ulovlige midler. AML-overvåking hjelper långivere med å luke ut falske profiler og flagge lån knyttet til høyrisikosektorer.

Valutabørser er arnesteder for hvitvasking, der kriminelle bruker raske handler til å hvitvaske svarte penger. AML-systemer sporer handelsmønstre, fanger opp mistenkelige fondsbevegelser og flagger kontoer som prøver å unngå å bli oppdaget med små, hyppige handler.

Kriminelle bruker kryptovalutaplattformer på grunn av hastigheten og anonymiteten, og blander midler på tvers av flere lommebøker for å skjule sporene sine. AML-verktøy analyserer blokkjedeaktivitet, flagger uvanlig lommebokatferd og sjekker lommebøker mot sanksjonslister for å stoppe svindel.

Meglerhusene står overfor risikoer knyttet til hvitvasking av penger forkledd som verdipapirhandel eller markedsmanipulasjon. Kriminelle kan flytte midler mellom kontoer, handle med illikvide aktiva eller blåse opp aksjekurser. AML-systemer fanger opp uvanlig handelsatferd og blokkerer ulovlige aktiviteter før de eskalerer.

Forsikringspoliser er et uventet, men effektivt hvitvaskingsverktøy for kriminelle. Overfinansierte poliser, tidlig oppsigelse for å få rene utbetalinger og falske krav er vanlige taktikker. AML-verktøy oppdager uregelmessige premiebetalinger, tidlig kansellering og krav knyttet til mistenkelige enheter eller personer.

Advokatfirmaer er ikke immune - escrow-tjenester og klientrettigheter kan misbrukes til å skjule ulovlige midler. AML-systemer identifiserer uvanlig høye escrow-innskudd, sporer hyppige eierskifter i avtaler og hjelper advokatfirmaer med å overholde regelverket uten at det går på bekostning av klientenes tillit.

For å håndtere hvitvasking av penger på en effektiv måte kan ikke AML bare ta igjen det tapte - de må ligge i forkant. Fremtidens transaksjonsovervåking vil bli definert av proaktive, integrerte tilnærminger som er utformet for å takle utfordringene knyttet til stadig mer sofistikert økonomisk kriminalitet.

Etterretningsstyrt risikostyring

Dynamisk styring av kundenes livssyklus

Konvergens av overvåkingsfunksjoner

Integrert infrastruktur for data og teknologi

Proaktiv og samarbeidsvillig FIU

Integrerte AML-operasjoner

Bekjempelse av økonomisk kriminalitet er en evig kamp. Selv om vi har lært mye og utviklet solide løsninger for overvåking av hvitvaskingstransaksjoner, må vi være fleksible, proaktive og ha en helhetlig tilnærming for å holde oss i forkant. Det er den eneste måten å holde virksomheten trygg, transaksjonene dine sikre og kundene dine beskyttet.

Screening av betalinger er en engangsprosess før en transaksjon som sjekker betalinger opp mot historiske risikodatabaser. Transaksjonsovervåking er derimot en kontinuerlig prosess som også analyserer aktiviteter etter en transaksjon for å avdekke mer mistenkelig atferd.

KYC er nøkkelen til å oppdage høyrisikokunder, for eksempel de som er knyttet til sanksjoner, politisk eksponerte personer (PEP-er) eller lyssky bransjer. Det forhindrer også identitetstyveri og syntetisk svindel ved å hindre kriminelle i å bruke stjålne eller falske identiteter til å utnytte finansielle systemer.

Hvert land har sitt eget regelverk for hvitvasking av penger, for eksempel BSA og USA PATRIOT Act i USA eller 5AMLD og 6AMLD i EU. Hovedkravene er imidlertid de samme: risikobasert overvåking, kundekontroll og rapportering av mistenkelige aktiviteter til de relevante myndighetene.

Systemer for overvåking av hvitvaskingstransaksjoner må oppdateres jevnlig for å holde tritt med utviklingen innen økonomisk kriminalitet. Beste praksis anbefaler at disse systemene gjennomgås og oppdateres minst én gang i året eller når det skjer vesentlige endringer, for eksempel nye forskrifter, nye risikoer eller endringer i kundeatferd.

Meldingen din er sendt.

Vi behandler forespørselen din og kontakter deg så snart som mulig.

Ved å registrere deg godtar du vår Retningslinjer for personvern, inkludert bruk av informasjonskapsler og overføring av dine personopplysninger.