Meldingen din er sendt.

Vi behandler forespørselen din og kontakter deg så snart som mulig.

Skjemaet har blitt sendt inn.

Mer informasjon finner du i postkassen din.

Økonomiledere spør ofte om CSRD virkelig betyr noe. Mitt svar er Absolutt, det betyr mer enn noensinne. Direktivet om rapportering om samfunnsansvar har erstattet frivillige brosjyrer om samfunnsansvar med et bindende regelverk for rapportering om bærekraft i hele EU.

Direktivet dekker allerede regnskapsåret 2024 for den første bølgen av selskaper som omfattes av direktivet, og de første CSRD-rapportene må offentliggjøres i 2025. Tilsynsmyndighetene anslår at rundt 50 000 organisasjoner vil omfattes av CSRD. Dette tallet inkluderer nå også multinasjonale selskaper utenfor EU, så snart de når en omsetningsterskel på 150 millioner euro.

I denne trinn-for-trinn-veiledningen går jeg gjennom opprinnelsen til CSRD, vi presenterer de viktigste kravene og klargjør hvem som må etterleve kravene og når. Du får et praktisk veikart for beredskap og rapportering, en oversikt over kommende endringer i regelverket, innsikt i hvordan du tar i bruk AI for ESG-informasjon, og strategier for å gjøre etterlevelse til en strategisk fordel.

CSRD står for Corporate Sustainability Reporting Directive. Det gjør rapportering om bærekraft til et lovpålagt krav i hele EU. Hvis organisasjonen din oppfyller to av disse tre terskelverdiene - 250 ansatte, 50 millioner euro i omsetning eller 25 millioner euro i eiendeler - er du omfattet. Direktivet gjelder også for børsnoterte små og mellomstore bedrifter, banker, forsikringsselskaper og alle konsern utenfor EU som genererer en omsetning på over 150 millioner euro i EU.

Rapporteringen rulles ut i fire trinn:

CSRD krever seriøs offentliggjøring. Selskapene må rapportere i henhold til de europeiske standardene for bærekraftsrapportering (ESRS). De 12 ESRS-standardene (2 tverrgående, 5 miljømessige, 4 sosiale og 1 for selskapsstyring) krever hundrevis av spesifikke datapunkter, for eksempel Scope 1-, 2- og 3-utslipp i henhold til ESRS E1 for klima, som er skreddersydd for din vesentlighetsvurdering. Rapportene må være digitalt merket i ESEF-format, noe som betyr at de må være maskinlesbare med XBRL-koder i en XHTML-fil. I tillegg må du ha begrenset sikkerhet for FY 2024-rapporter, med krav om rimelig sikkerhet innen 2028.

CSRD har juridiske tenner. Manglende overholdelse kan føre til bøter og, enda verre, kan svekke investorenes tillit raskere enn noen straff. Så begynn å bygge robuste revisjonsspor nå for å forberede deg.

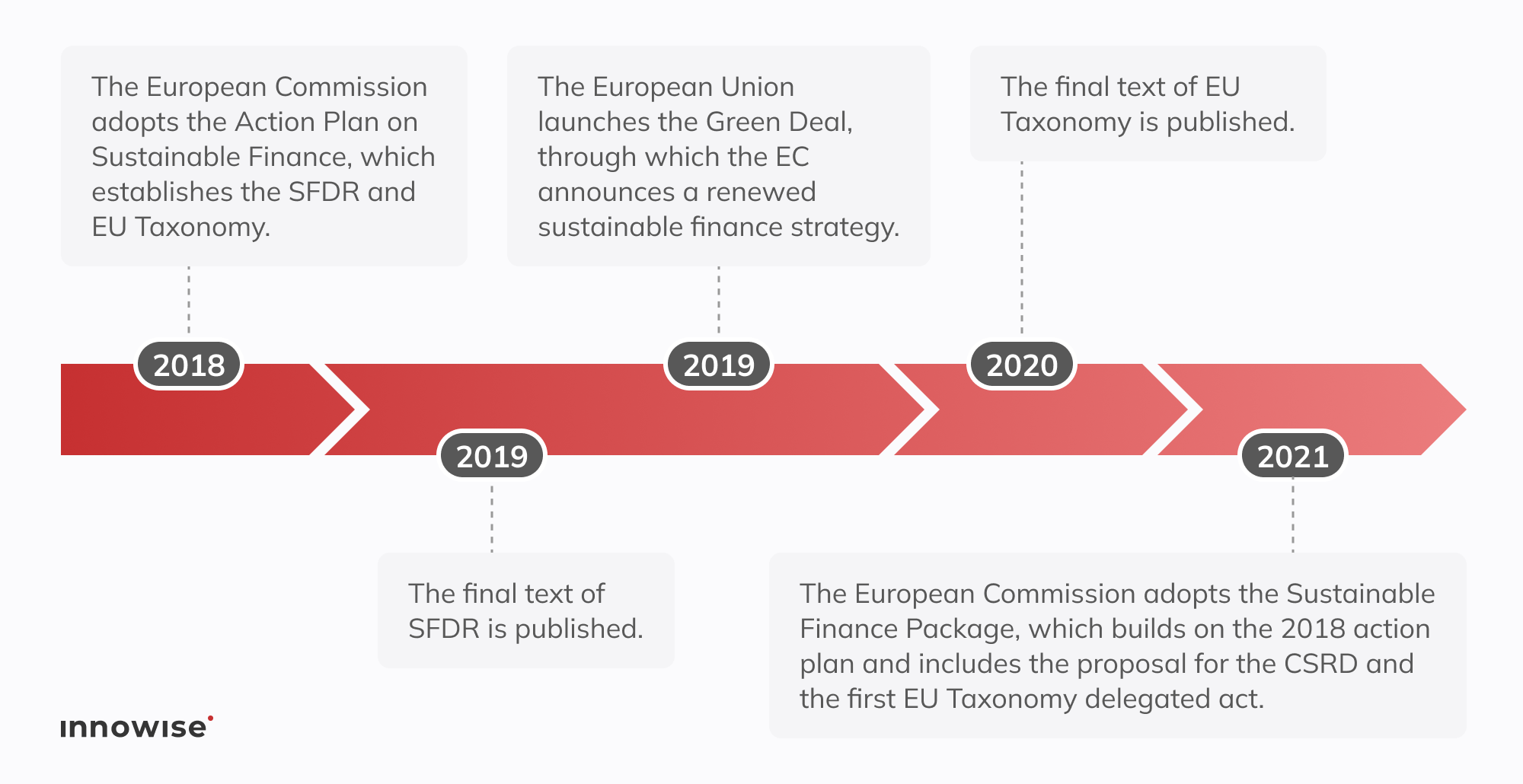

Tilbake i 2014, direktivet om ikke-finansiell rapportering (NFRD) omfattet rundt 11 700 virksomheter av allmenn interesse. Intensjonen var god, men reglene lot selskapene velge sine egne formater, utelate data og droppe enhver form for forsikring. Resultatet føltes inkonsekvent og vanskelig å sammenligne.

Lovgiverne ble stilt overfor større krav fra investorer, målene i EUs Green Deal og en bølge av grønnvaskingsskandaler. I 2015 ble for eksempel Dieselgate-utslippsjuksskandalen hos Volkswagen avslørte hvordan overdrevne miljøpåstander kan skjule alvorlige misligheter. I slutten av 2022 erstattet de NFRD med CSRD, som forankrer bærekraftsrapporteringen i EUs bredere klima- og samfunnsmål.

CSRD tar utgangspunkt i NFRDs fundament og styrker det på tre viktige måter:

Etter denne historikken går vi rett på de viktigste målene og prinsippene bak CSRD.

CSRD skisserer hva som utgjør god ESG-rapportering hvis du ønsker å drive virksomhet i EU uten komplikasjoner. Kjernen i direktivet er klare mål og noen grunnregler som alle selskaper må respektere. Her er det som virkelig betyr noe.

Tenk på CSRD som EUs kraftsenter for bærekraftsdata. Det står ikke alene. Tallene du oppgir i henhold til CSRD, flyter inn i EUs taksonomi, som krever rapporter om andelen taksonomi-tilpassede aktiviteter (f.eks. inntekter, CapEx, OpEx i henhold til artikkel 8 i taksonomiforordningen).

De samme tallene ligger til grunn for SFDR-rapporteringen og vil underbygge CSDDD-samsvar. Med andre ord: Hvis du er omfattet av CSRD, jobber du automatisk mot taksonomireglene, og CSRD-rapporten blir den primære datakilden som kapitalforvalterne henter inn i SFDR-malene sine.

Investorene er sultne på ESG-data de kan stole på. Nesten ni av ti institusjonelle investorer sier at de lener seg mer på ESG-informasjon. Likevel mener fire av fem at dataene fortsatt er mangelfulle når det gjelder vesentlighet og konsistens.

CSRD strekker seg langt utover den lille gruppen selskaper som var omfattet av det gamle direktivet. Nå omfatter det titusenvis av enheter. Enten du er innenfor eller utenfor EU, er det størrelsen og omsetningen din i EU som avgjør om du må rapportere. Nedenfor har jeg satt sammen en praktisk sjekkliste for å se om virksomheten din er omfattet.

Et EU-selskap blir underlagt CSRD hvis det krysser av i minst to av disse boksene på to balansedatoer på rad.

ansatte i gjennomsnitt

i netto omsetning

totale eiendeler

Hvis du oppfyller to av dem, må du rapportere. Et ingeniørfirma med 300 ansatte og 28 millioner euro i eiendeler, men bare 40 millioner euro i omsetning, må for eksempel likevel rapportere. Fordi det oppfyller kravene til ansatte og eiendeler.

Også børsnoterte små og mellomstore bedrifter på et EU-regulert marked er omfattet, med unntak av mikroforetak (færre enn 10 ansatte, 0,7 millioner euro i omsetning eller 0,35 millioner euro i eiendeler), som er unntatt i henhold til artikkel 19a i regnskapsdirektivet.

Hvis bedriften din er basert i EU og overskrider størrelsestersklene, gjelder CSRD automatisk. Ingen spesielle betingelser, ingen løsninger. Du er omfattet.

Det er her mange firmaer gjør feil: CSRD når langt utenfor EUs grenser. Hvis du driver et morselskap utenfor EU, er det to kontroller som avgjør om du blir tatt:

Et kanadisk programvareselskap omsetter for eksempel for 200 millioner euro i EU gjennom en filial i Dublin, og tjener 45 millioner euro. De har kanskje aldri tenkt på EU-rapportering før. Men i henhold til CSRD må de nå levere en fullstendig bærekraftsrapport for sin virksomhet i EU.

Og en siste hake. Selv om EU en dag kan godta bærekraftstandarder fra land utenfor EU som likeverdige, har det ikke skjedd ennå. Så hvis du er dekket, er ESRS-ene utgangspunktet. Ingen snarveier for øyeblikket.

CSRD kommer ikke til å treffe alle over natten. Utrullingen strekker seg fra 2024 til 2029, hovedsakelig avhengig av om du allerede var omfattet av det gamle direktivet om ikke-finansiell rapportering eller hvor stor virksomheten din er.

Slik forklarer jeg det til kunder som ønsker å få klarhet i når den første rapporten lander på økonomidirektørens bord:

Hvis du allerede var underlagt NFRD (tenk på børsnoterte selskaper i EU med mer enn 500 ansatte), vil du sende inn din første CSRD-rapport neste år. Ingen endringer her.

Denne var planlagt for børsnoterte små og mellomstore bedrifter, men den er flyttet til regnskapsåret 2028 (rapporter i 2029). Du kan fortsatt velge valgfri utsettelse, noe som vil føre til at du rapporterer i 2029.

Denne gjelder for morselskaper utenfor EU med en omsetning på over 150 millioner euro i EU og et datterselskap eller en filial som kvalifiserer. Startskuddet går nå i regnskapsåret 2028 (rapporter skal leveres i 2029). Denne tidslinjen forblir uendret i henhold til gjeldende regler.

| Bølge | Hvem rapporterer | Opprinnelig innleveringsår | Nytt innleveringsår |

| Bølge 1 (regnskapsår 24) | NFRD-enheter (500+ ansatte) | 2025 | 2025 |

| Bølge 2 (25. regnskapsår) | Store EU-foretak | 2026 | 2028 |

| Bølge 3 (regnskapsår 26) | Børsnoterte små og mellomstore bedrifter (opt-out for å utsette ytterligere) | 2027 | 2029 |

| Bølge 4 (28. regnskapsår) | Omfattede morselskaper utenfor EU | 2029 | 2029 |

Når tidsfristene forskyves, er det fristende å utsette forberedelsene. Så hvis du ikke er under det opprinnelige NFRD-omfanget, har tidslinjen din bare forskjøvet seg, men forberedelsesarbeidet forsvinner ikke. Jeg foreslår alltid at kundene bruker den ekstra tiden fornuftig. Ta tak i datahullene nå, test kvalitetssikringsprosessen tidlig, og unngå panikk i siste liten når den nye tidsfristen kommer.

Rapporteringskravene i CSRD er detaljerte og spesifikke, og de er laget for å tåle en revisors mikroskop. Du må rapportere eksakte datapunkter som dekker miljømessige, sosiale og styringsmessige faktorer, og underbygge dem med bevis som kan godkjennes av uavhengige revisorer. I tillegg må alle data merkes digitalt, slik at tilsynsmyndigheter og investorer kan hente dem rett inn i systemene sine.

I avsnittene nedenfor går jeg gjennom hva du må dekke under hver søyle: miljø, sosiale forhold og selskapsstyring.

Under CSRD følger du ESRS-standardene, som er gruppert i tre pilarer. Tenk på dem som en sjekkliste for full etterlevelse.

Ikke vent til siste liten med å finne ut av dette. De fleste rapporteringshullene jeg ser, skyldes manglende leverandørdata, uklar kartlegging av verdikjeden eller tynn dokumentasjon om klimamål. Hvis denne listen føles uoverkommelig, er det lurt å få hjelp av et ERP- eller bærekraftskonsulentteam som har vært gjennom noen rapporteringssykluser.

CSRD krever dobbel vesentlighet. Du må vise både hvordan bedriften påvirker mennesker og planeten, og hvordan bærekraftspørsmål påvirker kontantstrømmen og bedriftens verdi.

Du beskriver fotavtrykket du etterlater deg. Det betyr konkrete tall om karbonutslipp, vannforbruk, mangfold i arbeidsstyrken, aktsomhetsvurderinger knyttet til menneskerettigheter og mer. Hvis du for eksempel driver en fabrikk i en region med vannmangel, bør du rapportere uttaksmengder, dele resultater fra konsultasjoner med lokalsamfunnet og fremheve investeringer i systemer for resirkulering av vann. Disse tallene viser tilsynsmyndigheter og lokalbefolkningen nøyaktig hvordan virksomheten din påvirker livene deres.

Du kartlegger hvordan bærekraftsfaktorer påvirker bunnlinjen din. Tenk på klimadrevet risiko i leverandørkjeden, kostnader ved ekstremvær, endringer i regelverk eller endrede investorkrav. For eksempel vil en detaljist som kjøper fra leverandører i flomsoner, kvantifisere potensielle forsendelsesforsinkelser, modellere ekstra logistikkostnader og forklare hvordan diversifisering av leverandørene sikrer fremtidig kontantstrøm.

Min erfaring er at de beste CSRD-rapportene starter med en strukturert dobbel vesentlighetsvurdering. Intervju viktige interessenter, kartlegg risikoer på et varmekart, få styrets godkjenning, og du vil vite hva som hører hjemme i den endelige rapporten, og hva som skal forbli på det interne dashbordet.

Tenk på CSRD som din "go-to playbook" for bærekraftsrapportering i EU tenk på CSRD som din "EU ESG playbook" som samler det beste fra de globale standardene, slik at du bare trenger å rapportere én gang.

Du får en oversiktlig liste over måleparametere, narrative instruksjoner og en XBRL-taksonomi. Ved første rapport arkiverer du i XHTML med innebygde XBRL-tagger, slik at maskiner kan hente dataene dine.

GRI fokuserer på påvirkningen på interessenter og den ytre siden av dobbel vesentlighet. CSRD speiler denne tilnærmingen når du viser hvordan aktivitetene dine påvirker mennesker og planeten.

IFRS S1 og S2 gir deg en taksonomi for risikoopplysninger. Disse scenariene kan du plugge rett inn i CSRDs seksjon for finansiell vesentlighet.

SASB tilbyr disse sektor-KPI-ene under ISSB-paraplyen nå. Du kan knytte dem direkte til ESRS-emner, slik at du unngår dobbeltarbeid. Her ser du hvordan de er satt opp:

| Rammeverk | Mandat | Hovedfokus | Hvordan det passer inn i CSRD |

| ESRS | Obligatorisk EU | Detaljerte beregninger | Full taksonomi og XBRL-tagging for alle CSRD-opplysninger |

| GRI | Frivillig | Påvirkning av interessenter | Veileder deg i hvordan du påvirker den doble vesentlighetssiden |

| IFRS-ISSB | Ferdigstilt | Investorrisiko | Tilpasser risikotaksonomien til finansielle vesentlighetsbehov |

| SASB | Frivillig | KPI-er for bransjen | Direkte mapping til ESRS-emner for å effektivisere rapporteringen |

Hvis du først utarbeider CSRD-rapporten og deretter tagger hvert datapunkt mot andre rammeverk, kan du potensielt redusere dobbeltarbeid med opptil 40%, avhengig av oppsettet ditt.

Du vil raskt lære at overholdelse av CSRD krever store ressurser i form av budsjett, tid og teamarbeid på tvers av økonomi, bærekraft, IT og innkjøp. Hvis du bommer på ett trinn, kollapser tidslinjen, noe som frustrerer revisorer, tilsynsmyndigheter og investorer. Her er fire hindringer du vil møte, og hvordan du kan overkomme dem.

Utslippstallene dine ligger i økonomisystemet. Mangfoldsstatistikken ligger i HR. Leverandørrisikoen gjemmer seg i regneark for innkjøp. Så lenge du ikke samler alt dette på ett sted, vil du slite med å tagge data for XBRL og tilfredsstille revisorer. Sett opp en sentral ESG-datasjø som kobles til ERP-, HRIS- og leverandørplattformene via API-er. Legg til valideringsregler slik at teamet ditt oppdager manglende eller merkelige tall lenge før revisjonsdagen.

Spesialiserte programvarelisenser, XBRL-konverteringstjenester, revisjonshonorarer og ekstra analytikere kan overvelde budsjettet. Faseinndel utrullingen ved å rangere forretningsenhetene etter vesentlighet og risiko, og fordel deretter implementeringen over to regnskapsår. Dette jevner ut kontantstrømmene og gir teamene pusterom til å lære seg hvert trinn uten en gigantisk forhåndsregning.

Dere driver kanskje allerede solide bærekraftsprosjekter, men hvis de ikke samsvarer med ESRS-datapunktene, vil revisorene umiddelbart oppdage hullene. Gjennomfør en fokusert todagers workshop med lederne for bærekraft, økonomi, jus og IT. Sammen lager dere en CSRD-tilpasningsmatrise som knytter hvert strategiske mål til ESRS-kravene og utpeker en tydelig dataeier. Matrisen fungerer også som prosjektplan og sjekkliste for revisjon.

CSRD er ikke valgfritt. Hvis du slurver med bærekraftsrapporteringen, risikerer du store bøter, søksmål, utestengelse og varig skade på omdømmet. Mange team behandler dette som ekstrapoeng og ender opp med å betale for det senere. La oss se hva som gjelder og hvordan du unngår problemer.

Jeg har satt sammen en liten sjekkliste for å gjøre CSRD-rapporteringen til en fast rutine i stedet for et tungt løft. Hvis du tar tak i hvert trinn i riktig rekkefølge, vil du gå fra panikk i siste øyeblikk til forutsigbar fremgang. Revisorer vil ikke finne overraskelser, tilsynsmyndighetene holder seg unna, og investorene vil se en jevn fremdrift.

Hvert EU-medlem har sine egne tilpasninger. Gjør en rask gjennomgang av de lokale reglene nå, slik at du ikke støter på skjulte krav senere. Denne tidlige sjekken holder budsjettet og tidslinjen på rett spor.

Snakk med interessenter, plott inn risikoer på et varmekart, og knytt hver enkelt risiko til den tilhørende ESRS-standarden. Dette fokuset gjør at rapporten blir slank og fokusert på det som virkelig betyr noe.

Skriv direkte i European Single Electronic Format (XHTML med innebygde XBRL-koder). La smart programvare tagge mens du går. Ingen smertefull omformatering senere.

Begrenset sikkerhet trer i kraft for regnskapsåret 2024, og rimelig sikkerhet i 2028. Bygg bevisspor nå, og skjerp kontrollene mens arbeidsmengden fortsatt er overkommelig.

CSRD-frister bør ikke føles som tikkende bomber. Hos Innowise har vi utviklet en smidig, repeterbar prosess som gjør CSRD-samsvar til en strategisk motor. Vår tilnærming følger ESRS-veiledningen fra European Financial Reporting Advisory Group, inkludert de siste oppdateringene av spørsmål og svar, slik at du trygt kan oppfylle alle standarder.

Vårt femtrinns veikart inneholder klare milepæler og gir deg pålitelige data på hvert trinn. Vi erstatter gjetning med struktur og gir deg innsikt du kan bruke til å skape vekst. Gå fra usikkerhet til selvtillit, ett beviselig steg om gangen.

Altfor mange bedrifter oppdager hullene i CSRD først når fristen for innlevering nærmer seg. Det er da kostnadene øker, og feilene slipper gjennom. Det er smartere å foreta en beredskapssjekk på forhånd og gjøre overraskelser om til en plan som kan iverksettes.

Vår diagnostiske sprint gjør akkurat det. Vi starter med et dypdykk i retningslinjene og bærekraftsfilene dine. Deretter gjennomfører vi workshops med interessenter for å kartlegge hva investorer, ansatte, kunder og tilsynsmyndigheter er mest opptatt av. Kjernen er en dobbel Materiality Assessment (et must i henhold til ESRS 1), som kartlegger hvor bedriften din påvirker bærekraft og hvor disse problemene påvirker bunnlinjen.

Når vi er ferdige, går du derfra med tre ting du kan gjøre noe med med en gang:

Når du har et tydelig kart, kan du beskytte budsjettene, prioritere og holde kontroll på rapporteringssyklusen.

God CSRD-rapportering lever og dør av solide data. Det holder ikke å lete manuelt etter tall i regneark eller jakte på e-poster fra leverandører. Opplysningene dine må tåle å bli gransket på revisjonsnivå.

Ekspertene våre løser dette ved å sette opp en cloud ESG-datasjø: ett sted for alt. Vi henter live-data fra ERP-, HRIS- og IoT-systemene dine. Utslipp, energibruk, sikkerhet for arbeidsstokken, hva som helst. API-tilkoblinger sørger for at dataflyten er nøyaktig og i sanntid. Smarte valideringsregler sjekker dataene dine for hull eller røde flagg etter hvert som de kommer inn, slik at du kan løse problemer før de vokser seg store.

En innebygd XBRL-mapper tagger hvert nummer for digital arkivering. Denne tilnærmingen sparer tid, reduserer manuelle feil og støtter CSRDs overgang fra begrenset til rimelig sikkerhet i årene som kommer. I tillegg etterlater hver oppføring et revisjonsspor som økonomiteamet ditt vil takke deg for når eksterne revisorer banker på døren.

Nå som data- og valideringsmotoren er i gang, er det på tide å flette CSRD-innsikten inn i forretningsplanene.

Først kartlegger vi de eksisterende ESG- eller GRI-målene dine i forhold til ESRS-kravene, slik at du bygger videre på det du allerede har påbegynt, og ikke finner opp hjulet på nytt. Deretter integrerer teamet vårt disse målene i OKR-ene dine, og hvis det passer, kobler vi dem til lederinsentiver.

Til slutt har vi laget et samlet dashbord som viser finans- og ESG-data side om side. På den måten får du én oversikt som ledelsen kan bruke til å styre strategien, håndtere risiko og snakke med markedet med fakta.

Nå som CSRD er vevd inn i kjernestrategien, blir den første rapporten startrampen. Regelverket vil utvikle seg, interessentenes forventninger vil endre seg, og dataene dine må være oppdaterte. Slik sørger teamet vårt for at rapporteringsmotoren går som smurt:

Etterlevelse holder bare når medarbeiderne dine forstår hva som er i endring og hvorfor det er viktig. Derfor investerer vi i de interne teamene dine fra starten av. Opplæringen vår dekker alt fra ESRS-krav til offentliggjøring og XBRL-merking til revisjonsspor og digitale sikringsprosesser. Vi veileder økonomi-, bærekraft- og IT-teamene dine gjennom live-demonstrasjoner, praktiske øvelser og skreddersydde spørsmål og svar-økter, slik at de vet nøyaktig hvordan de skal håndtere hver rapporteringssyklus.

Med riktig opplæring får medarbeiderne dine ferdighetene de trenger for å håndtere compliance på en trygg måte år etter år, i stedet for bare å stresse når fristen går ut. Teamene jobber raskere, feilene blir færre, og kunnskapen forsvinner ikke når en person går videre.

Ved å behandle CSRD som en levende prosess i stedet for et engangsprosjekt, beskytter du omdømmet ditt, holder investorene trygge og gjør compliance til en kontinuerlig strategisk verdi.

"CSRD krever presisjon, og det starter med dataene. Hos Innowise gjør vi hver enkelt måling om til forretningsinnsikt, slik at rapporteringen vår fungerer som en reell ressurs for både ledere og investorer."

Støvet har lagt seg over forenklingen av CSRD. Den 26. februar 2025 reduserte EUs Omnibus I-pakke omfanget, forlenget tidsfrister og utsatte sektorspesifikke ESRS-standarder på ubestemt tid. Selskaper bør bruke frivillige standarder som SASB eller GRIs sektorveiledninger for å håndtere sektorspesifikk rapportering frem til ESRS-oppdateringene blir utgitt. Det som ikke har endret seg, er forventningen om at store selskaper som fortsatt er omfattet, skal levere rene, verifiserbare data.

Denne virkeligheten gir deg to klare muligheter. Du kan ta en pause og vente på mer lettelse, for så å komme i skvis senere hvis tidsfristene ikke holder. Eller du kan presse på, bygge opp data- og styringsmusklene dine nå, og oppnå troverdighet hos investorene ved å prise inn ESG-resultater tidlig.

Jeg foreslår den andre tilnærmingen. Hos Innowise kombinerer vi regelverksoppdateringer i sanntid med en fleksibel dataarkitektur. På den måten kan du overholde regelverket i dag og enkelt omstille deg når Brussel gjør sitt neste trekk.

Hvis du må balansere CSRD-frister og budsjettbegrensninger, er EUs nye Omnibus I-pakke gir deg bare litt pusterom og noen smarte kostnadskutt hvis du vet hvordan du skal bruke dem. Denne pakken handler om å redusere byråkratiet, samtidig som målene i den grønne given holdes intakte. Den omformer CSRD, CSDDD, deler av EUs taksonomi, CBAM og InvestEU-reglene med et løfte om å redusere de administrative byrdene med minst 25 prosent for store bedrifter og 35 prosent for små og mellomstore bedrifter, kort sagt: mer fokus på det som betyr noe, mindre papirarbeid som kaster bort tid.

La oss nå se hva det betyr for teamet ditt, og hvordan du kan bruke disse endringene til din fordel.

Selskaper i "bølge 2" og "bølge 3" får to ekstra år. Hvis du skulle levere CSRD-rapporten din i 2026 eller 2027, flyttes fristen til 2028 eller 2029. Startdatoen for CSDDD flyttes også, til juli 2028. Omfanget strammes også inn: Bare store foretak med mer enn 1000 ansatte og en omsetning på minst 50 millioner euro (eller en balanse på 25 millioner euro) er fortsatt fullt ut omfattet.

Du trenger nå opptil 70% færre datapunkter. Hvis mindre enn 10% av aktivitetene dine kvalifiserer, kan du hoppe over opplysninger om tilpasning. Selskaper kan også delvis rapportere om tilpasning for å vise fremgang, noe som bidrar til å tiltrekke seg overgangsfinansiering. Bankene får enklere beregninger av Green Asset Ratio og lettere DNSH-kontroller.

Små importører har nå en klarere vei å gå. En årlig terskel på rundt 50 tonn betyr at rundt 90% av importørene er fritatt, samtidig som de tunge sektorene som stål, aluminium, sement og gjødsel fortsatt er dekket av utslipp over 99%.

For InvestEU kan du forvente færre rapporter og mindre administrasjon for alle i kjeden. Små avtaler unngår helt ekstra KPI-er. Eldre fond som EFSI og InnovFin samles i én pott, noe som frigjør anslagsvis 50 milliarder euro til nye prosjekter.

Ikke se på dette som en mulighet til å ta en pause. Bruk pusterommet til å rydde opp i og konsolidere eldre data, automatisere valideringskontroller og skjerpe ESG-kontrollene. Dobbeltsjekk vesentlighetsanalysen og oppgrader systemene dine for smidigere og raskere XBRL-tagging.

Selv om reglene lempes på, vil smarte team bruke denne tiden til å bygge en rapporteringsmotor som er pålitelig, effektiv og klar for alt. Investorer og tilsynsmyndigheter følger med nå, og de som ligger i front vil være de som handler, ikke de som venter.

CSRD er ikke noe særtilfelle. Tilsynsmyndigheter på alle større markeder er i ferd med å gjøre frivillig ESG-snakk om til harde, sammenlignbare regler. Hvis du driver virksomhet på tvers av landegrensene, må du se hele bildet.

| Rammeverk | Hvor det gjelder | Hovedfokus | Nåværende status |

| CSRD / ESRS | EU, samt selskaper utenfor EU med betydelig omsetning i EU | Dobbel vesentlighet, obligatorisk XBRL-merking | Innfasing av data fra 2024 |

| ISSB S1 og S2 | Vedtatt av femten jurisdiksjoner, ytterligere tjueen i samråd | Investorrisiko, finansiell vesentlighet | De første innleveringene starter i 2026 i markeder som er tidlig ute |

| Amerikanske SECs klimaregel | Børsnoterte selskaper i USA | Klimarisiko, Scope 1- og Scope 2-utslipp, begrenset sikkerhet | Endelig regel forventes i 2025, rapportering begynner i 2027 for store selskaper |

| California SB 261 | Selskaper med mer enn 500 millioner USD i omsetning som driver virksomhet i California | Toårig rapportering om klimarisiko, kvalitativ og kvantitativ | De første rapportene skal leveres i 2026 |

| Storbritannias krav til rapportering om bærekraft (SDR) | Børsnoterte og store private selskaper i Storbritannia | ISSB-justerte klima- og naturmålinger | Høringsfase, trolig oppstart i 2026 |

Et fragmentert rapporteringsoppsett fører bare til flere revisjonstimer og høyere kapitalkostnader. Det smarteste er å bygge opp én enkelt sannhetskilde for ESG-data. Kartlegg hvert enkelt nøkkeltall én gang, og merk og eksporter det deretter til CSRD, ISSB, SECs klimaregel, California SB 261 eller Storbritannias SDR. Ingen dobbeltarbeid.

Det er denne tilnærmingen med ett datasett vi lanserer på Innowise. Du får mange kompatible rapporter fra de samme rene dataene, uten å måtte stresse hver gang en annen tilsynsmyndighet skjerper reglene.

CSRD ber bedrifter om å samle alt fra energiforbruk til sikkerhetsmålinger for arbeidsstyrken, ofte på tvers av dusinvis av enheter og geografiske områder. For de fleste team er det å jakte på disse tallene for hånd en oppskrift på overskredne tidsfrister og feilutsatte rapporter. Det er her AI og automatisering nå utgjør en reell forskjell.

AI er ikke et universalmiddel, men for CSRD- og ESG-rapportering har det allerede blitt et must. Team som benytter seg av disse verktøyene, reduserer antall feil, får raskere sykluser og bruker mer tid på innsikt i stedet for regneark.

CSRD-samsvar viser at du mener alvor når det gjelder åpenhet og robusthet. Reviderte, XBRL-merkede bærekraftsdata skaper tillit hos investorer, åpner for grønn finansiering og styrker leverandørpartnerskapene. Rapporten din blir et bevis på at du driver et fremtidsrettet selskap.

Her er den endelige sjekklisten for CSRD-beredskap. Bruk den for å sikre at ingenting faller mellom stolene:

Tilsynsmyndigheter over hele verden er i ferd med å innføre obligatoriske regler for bærekraft. Hvis du legger grunnlaget nå, unngår du panikk i siste liten og er godt rustet for eventuelle fremtidige endringer. Start CSRD-sprintet denne uken. Få på plass dataarkitekturen, gjennomfør workshops om vesentlighet og utarbeid den første rapporten. Tidlig handling gjør etterlevelse til en strategisk fordel.

Leder for bærekraft

Stanislav tenker praktisk når det gjelder bærekraft i teknologibransjen. Han hjelper kundene med å gå fra avkrysningsbokser til faktiske resultater — enten det dreier seg om å optimalisere infrastrukturen, redusere avfall eller bygge digitale produkter med tanke på påvirkning.

Meldingen din er sendt.

Vi behandler forespørselen din og kontakter deg så snart som mulig.

Ved å registrere deg godtar du vår Retningslinjer for personvern, inkludert bruk av informasjonskapsler og overføring av dine personopplysninger.