Meldingen din er sendt.

Vi behandler forespørselen din og kontakter deg så snart som mulig.

Skjemaet har blitt sendt inn.

Mer informasjon finner du i postkassen din.

Som leder for bærekraftsavdelingen får jeg ofte dette spørsmålet: "Hva er forskjellen mellom ESG og bærekraft?" Det er et godt spørsmål, for selv om de er nært knyttet til hverandre, tjener de ulike formål og kan ikke byttes ut med hverandre.

Bærekraft er det store bildet - et selskaps langsiktige forpliktelse til ansvarlig praksis som balanserer miljøhensyn, sosial velferd og økonomisk vekst. Det handler om å bygge en fremtid der virksomheter trives uten at det går på bekostning av planeten eller samfunnet.

ESG (Environmental, Social and Governance) er et spesifikt rammeverk som brukes til å måle og evaluere hvor godt et selskap presterer på disse områdene. Det fokuserer på parametere som karbonutslipp, samfunnsengasjement og styringspraksis, og gir interessenter en tydelig måte å vurdere effekten på.

I denne artikkelen går jeg gjennom debatten om ESG og bærekraft - hvordan disse begrepene skiller seg fra hverandre, hvorfor de er viktige, og hvordan bedrifter kan utnytte begge for å skape meningsfulle, varige endringer.

årlig vekst i klimainvesteringer fra 2019 til 2022

Kilde: McKinsey BærekraftKompensasjon vil være knyttet til bærekraftig teknologi innen 2027

Kilde: Gartnerselskaper integrerer ESG i risikostyringsprosessene sine

Kilde: RivelBærekraft har alltid handlet om å gjøre fremtiden mer velstående - å møte dagens behov uten å bruke opp morgendagens ressurser. Det har dype røtter, og det begynte med sosialt ansvarlige investeringer (SRI) på 1970-tallet, da investorer begynte å tilpasse porteføljene sine etter egne verdier. På 1980-tallet var CSR (Corporate Social Responsibility) i full gang, og selskapene ble oppfordret til å gi noe tilbake til planeten og drive etisk forsvarlig. Men selv om CSR fikk ballen til å rulle, manglet det ofte de nødvendige verktøyene for å måle den reelle effekten.

Alt dette endret seg på begynnelsen av 2000-tallet. Rapporten "Who Cares Wins" lanserte offisielt begrepet ESG (environmental, social, and governance), og markerte et skifte i retning av målbare parametere og strukturerte rammeverk. Omtrent samtidig la organisasjoner som Global Reporting Initiative (GRI) og FNs tusenårsmål grunnlaget for det ESG skulle bli: en praktisk, handlingsorientert plan for bedrifter og investorer.

ESG satte søkelyset på miljøvern, og tok opp spørsmål som karbonutslipp og ressursbruk under miljøsøylen. Den sosiale komponenten fokuserte på arbeidstakerrettigheter, mangfold og samfunnspåvirkning, mens selskapsstyring vektla åpenhet og ansvarlighet. Til sammen utgjør disse tre pilarene - miljø, sosiale forhold og selskapsstyring - en treenighet som nå er retningsgivende for selskaper over hele verden.

I dag er ESG en global prioritet. Bedrifter tar grep, og investorer krever resultater. Fra å være en nisjeidé i sin spede begynnelse til å bli et vendepunkt i dag, handler ESG om ansvarlighet, gjennomslagskraft og om å gjøre en reell forskjell.

Tiltrekke seg grønne investeringer med sterke ESG-resultater.

ESG og bærekraft er ikke bare trendy begreper lenger. De er byggesteinene for hvordan virksomheter holder seg relevante og gjør seg fortjent til tillit. Måten vi jobber på, ressursene vi bruker, og påvirkningen vi etterlater oss, er under et globalt mikroskop. FNs 17 mål for bærekraftig utvikling (SDG-er), som omfatter alt fra å bekjempe fattigdom til å håndtere klimaendringene, gir oss et tydelig veikart for fremtiden. Og gjett hva? Næringslivet spiller en hovedrolle på denne reisen.

Saken er at bærekraft er en livsstil, ikke en forbigående idé. Å redusere utslippene (tenk klimatiltak, bærekraftsmål 13) eller skape rettferdige muligheter (anstendig arbeid og økonomisk vekst, bærekraftsmål 8) hjelper ikke bare planeten, det øker også bunnlinjen din. Kunder, investorer og ansatte ser etter selskaper som setter handling bak ordene, og hvis du ikke er med på laget, er du allerede på etterskudd.

Men dette handler ikke bare om å holde seg konkurransedyktig. Reguleringer som CSRD-direktivet (Corporate Sustainability Reporting Directive) hever listen. Fra og med 2025 må store EU-baserte selskaper som oppfyller to av tre kriterier - mer enn 250 ansatte, inntekter på over 40 millioner euro eller eiendeler på over 20 millioner euro - rapportere om sin miljømessige og sosiale påvirkning.

Det kan høres ut som et fjell å bestige - det kan føles overveldende å samle inn data, finne ut av verdikjeden og sette opp systemer. Men her er det positive: De selskapene som omfavner bærekraft i dag, vil være de som leder an i morgen. Tenk på bedre risikostyring, sterkere tillit hos interessentene og muligheten til å ligge i forkant i en verden som endrer seg raskt.

Denne tabellen gir en oversiktlig oversikt over hvilke typer selskaper som er underlagt ESG-regelverket, og hvilke rapporteringsfrister som gjelder for dem.

| Gruppe | Kriterier | Rapporteringsår | Frist for innsending |

| Organisasjoner som tidligere var underlagt NFRD | >500 ansatte, 50 millioner euro i omsetning, 25 millioner euro i eiendeler | 2024 | 2025 |

| Store bedrifter | >250 ansatte, 50 millioner euro i omsetning, 25 millioner euro i eiendeler | 2025 | 2026 |

| Små og mellomstore bedrifter | 10+ ansatte, 900 000 euro i omsetning, 450 000 euro i eiendeler | 2026 | 2027 |

| Ikke-europeiske selskaper | 150 millioner euro i EU-inntekter via datterselskaper/filialer | 2028 | 2029 |

I dag er ikke bærekraft valgfritt - selskaper må underbygge sine påstander med solide data og tydelig rapportering. I spissen for dette står Corporate Sustainability Reporting Directive (CSRD) og European Sustainability Reporting Standards (ESRS). Disse rammeverkene fastsetter reglene for hvordan selskaper i EU skal rapportere om miljømessige, sosiale og styringsmessige forhold (ESG), og behandler bærekraft med samme strenghet som finansiell rapportering.

Jozef Síkela, tidligere industri- og handelsminister i Tsjekkia, forklarte at CSRD ble utviklet for å skape reell ansvarlighet: "De nye reglene vil gjøre flere virksomheter ansvarlige for sin innvirkning på samfunnet og lede dem i retning av en økonomi som er til fordel for mennesker og miljø. Data om miljø- og samfunnsmessig fotavtrykk vil være offentlig tilgjengelig for alle som er interessert i dette fotavtrykket. Samtidig er de nye utvidede kravene skreddersydd for ulike selskapsstørrelser og gir dem en tilstrekkelig overgangsperiode til å forberede seg på de nye kravene."

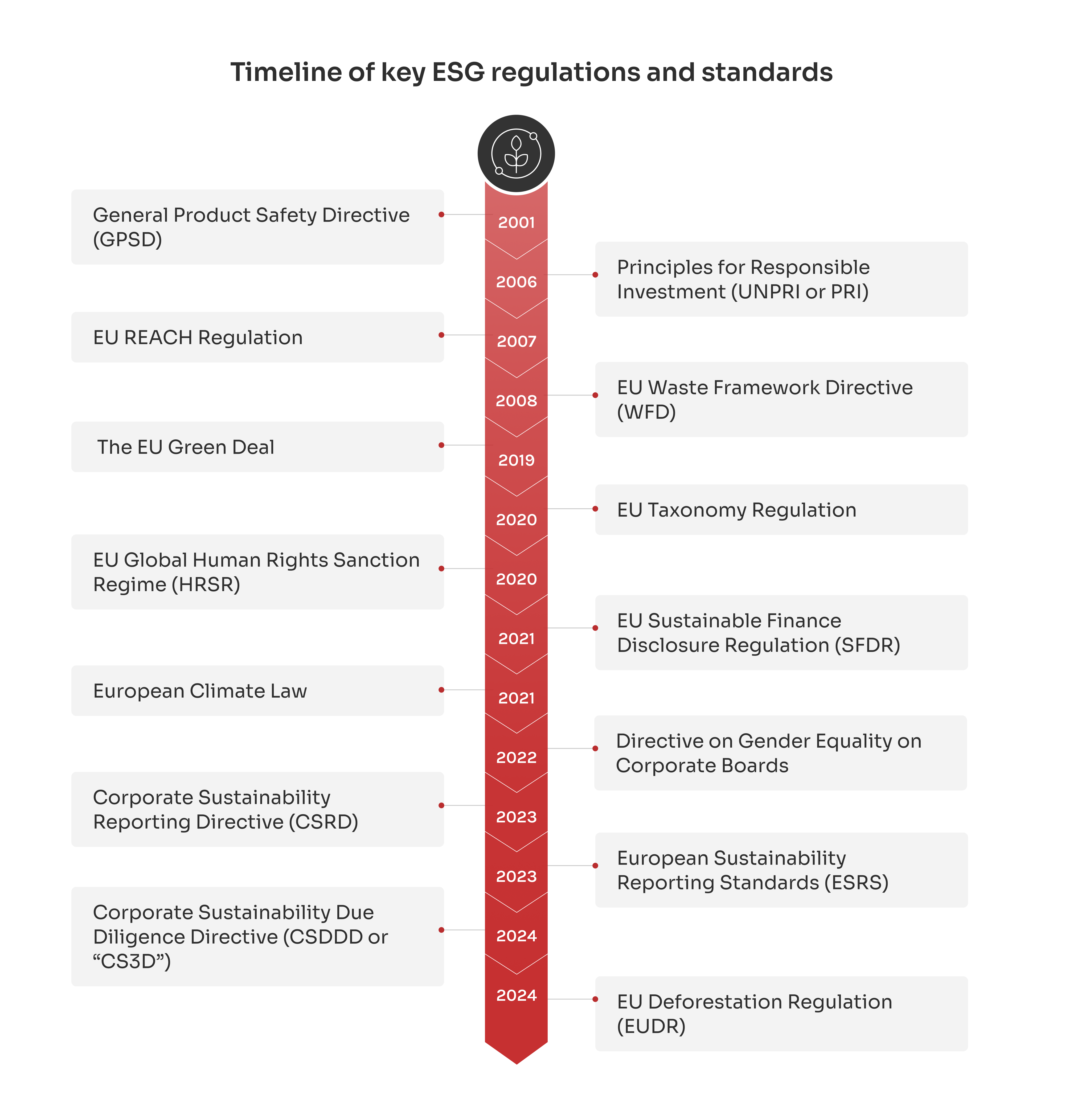

Men disse rammeverkene oppstår ikke isolert. De bygger på tidligere EU-regelverk som har lagt grunnlaget for dagens omfattende økosystem for bærekraft. I fortsettelsen vil jeg skissere de viktigste reguleringene som har formet dagens ESG-landskap, og hvilke konsekvenser de har for virksomheter som opererer på det europeiske markedet.

GPSD fastsetter strenge sikkerhetsregler for produkter som selges i EU. Selskapene må teste og verifisere at produktene deres oppfyller disse standardene før de når ut til forbrukerne. Hvis et produkt utgjør en risiko, må bedriftene iverksette tiltak for å løse problemet eller fjerne det fra markedet.

PRI, som støttes av FN, er et globalt initiativ for å fremme ansvarlige investeringer. PRI tilbyr et rammeverk for integrering av ESG-faktorer i investeringsbeslutninger, noe som hjelper finansinstitusjoner med å innrette seg etter bærekraftsmålene.

CSDDD pålegger selskaper å ta ansvar for hele verdikjeden sin. Den krever at bedrifter identifiserer, forebygger og håndterer negative konsekvenser for menneskerettigheter og miljø - ikke bare i virksomheten, men hos alle leverandører og samarbeidspartnere.

Rammedirektivet for avfall (WFD) flytter fokus fra avfallshåndtering til avfallsreduksjon. Direktivet fremmer resirkulering og gjenbruk, og oppfordrer selskaper til å tenke i termer av sirkulærøkonomiske prinsipper.

EUs grønne giv inneholder en plan for å redusere utslippene og gjøre Europa klimanøytralt innen 2050. Den fremmer ren energi, grønn industri og en økonomisk politikk som beskytter miljøet og samtidig fremmer innovasjon.

EUs taksonomiforordning fungerer som EUs grønne regelbok. Den definerer hva som regnes som en bærekraftig aktivitet, og hjelper investorer med å identifisere genuint grønne prosjekter. Dette bekjemper grønnvasking og sikrer at bærekraftige investeringer er autentiske.

HRSR gir EU et juridisk rammeverk for å sanksjonere enkeltpersoner og organisasjoner som er involvert i alvorlige brudd på menneskerettighetene. Denne policyen understreker at bærekraft ikke bare handler om miljø, men også om å beskytte mennesker mot utnyttelse og urettferdighet.

SFDR retter seg mot finanssektoren og krever at selskaper offentliggjør hvordan de integrerer bærekraftsrisiko i investeringsbeslutninger. Det sikrer at fond som betegnes som "grønne", virkelig er bærekraftige, noe som øker åpenheten for investorene.

Loven gjør klimanøytralitet innen 2050 til et juridisk krav, ikke bare et mål. Den holder EU-institusjonene og medlemslandene ansvarlige, med delmål for å spore fremdriften og opprettholde klimaforpliktelsene.

Innen 2026 forventes det at minst 40% av de børsnoterte selskapene i EU skal ha minst 40% av de underrepresenterte kjønnene som styremedlemmer, noe som vil føre til bedre forretningsresultater.

CSRD løfter bærekraftsrapporteringen opp på samme nivå som finansiell rapportering, og krever at selskaper offentliggjør detaljert informasjon om sin miljømessige og sosiale påvirkning, og hvordan bærekraftsrisikoer kan påvirke bunnlinjen.

ESRS setter klare regler for hvordan selskaper skal rapportere data om miljø, sosiale forhold og selskapsstyring (ESG). Det skaper en standardisert tilnærming som gjør det enklere å sammenligne bærekraftsarbeidet på tvers av bransjer.

Forordningen om registrering, vurdering, godkjenning og begrensning av kjemikalier (Registration, Evaluation, Authorisation, and Restriction of Chemicals) tar bedriftenes ansvar enda lenger. Den pålegger selskaper å håndtere kjemikaliene de produserer og bruker, med fokus på miljø- og helsekonsekvenser.

EUDR krever at selskaper som importerer produkter som soya, storfekjøtt og palmeolje, må bevise at de er avskogingsfrie, noe som styrker EUs engasjement for biologisk mangfold og bærekraftige leverandørkjeder.

Når vi snakker om miljøaspektet ved ESG, er det lett å fokusere kun på karbonfotavtrykk. Men det går langt utover det. Det handler om hvordan vi forvalter ressursene vi bruker, reduserer avfall og beskytter det biologiske mangfoldet. Denne pilaren får bedrifter til å tenke kritisk på hele miljøpåvirkningen - fra energien som driver virksomheten til materialene de kjøper inn og hvordan de avhender dem.

Ta ressursforvaltning, for eksempel. Bruker dere vann, energi og råvarer effektivt, eller er det rom for å kutte ned og spare? Avfallsreduksjon er et annet viktig område. Hvert eneste gram avfall som ikke havner på søppelfyllingen, er bra for planeten og bidrar til å redusere kostnadene. Og så har vi det biologiske mangfoldet - noe bedrifter bare så vidt har begynt å få øynene opp for. Å beskytte økosystemene handler om den langsiktige helsen til leverandørkjedene og lokalsamfunnene som er avhengige av dem.

Det er ved å tenke lenger enn karbonutslipp at ekte lederskap skjer. Selskaper som gjør dette, setter standarden for en virkelig bærekraftig fremtid.

Den "sosiale" pilaren i ESG handler om mennesker. Det handler om hvordan virksomheter behandler sine ansatte, respekterer menneskerettighetene og bidrar til lokalsamfunnene de tjener. Denne pilaren utfordrer oss til å se innover og stille noen vanskelige spørsmål. Behandles arbeiderne rettferdig og får de rettferdig betalt? Er trygge arbeidsforhold en selvfølge eller en ettertanke?

Men det stopper ikke på arbeidsplassen. Menneskerettigheter er viktige i hele verdikjeden, fra leverandørene du samarbeider med, til kundene du betjener. Og la oss ikke glemme påvirkningen på lokalsamfunnet. Skaper du arbeidsplasser, støtter du lokale initiativer og bidrar til at lokalsamfunnene trives?

Den sosiale pilaren minner oss om at virksomheter ikke eksisterer i et vakuum. Bedrifter som prioriterer mennesker - enten det er deres egne ansatte eller samfunnet for øvrig - bygger sterkere og mer motstandsdyktige organisasjoner.

"Governance"-pilarene skaper kanskje ikke overskrifter på samme måte som karbonreduksjon eller samfunnsprogrammer, men de utgjør ryggraden i ESG. Det er her virksomhetene viser at de forplikter seg til å gjøre det rette - hver eneste dag. Det handler om åpenhet, etikk og lederskap.

La oss begynne med åpenhet. Er dere åpne om hvordan beslutninger tas, hvordan penger brukes og hvordan risiko håndteres? Så har vi etikken. Gjør lederne faktisk det de sier når det gjelder å være ærlige og ansvarlige? Styrets sammensetning spiller også en stor rolle her. Et mangfoldig, kompetent og uavhengig styre er avgjørende for å kunne ta gode beslutninger og styre selskapet i riktig retning.

God virksomhetsstyring handler om mer enn bare å unngå skandaler eller å krysse av i forskriftsbokser. Det handler om å bygge tillit blant investorer, ansatte og kunder. Et sterkt etisk lederskap setter tonen for alt en virksomhet gjør, og når dette er på plass, har resten en tendens til å falle på plass.

Dmitry Nazarevich

Teknologidirektør

ESG-prinsipper (Environmental, Social and Governance) har blitt grunnleggende for hvordan virksomheter skaper langsiktige verdier. Selskaper som integrerer ESG i kjernestrategiene sine, ser de konkrete fordeler, fra driftseffektivitet og kostnadsbesparelser til sterkere relasjoner med interessenter og konkurransefortrinn på markedet.

Se på IKEA klarte de å redusere klimafotavtrykket sitt med 5% på bare ett år, og hele 28% siden 2016. Hvordan klarte de det? Ved å doble satsingen på fornybar energi, tenke nytt når det gjelder materialer og effektivisere produksjonen. Men det handler ikke bare om miljø - IKEA er også opptatt av samfunnsengasjement.

Bare i Europa har IKEA gjennomført over 40 lokale aktiviteter, fra frivillig arbeid og prosjekter for biologisk mangfold til utdanningsprogrammer og initiativer for sirkulær økonomi. Enten det dreier seg om å donere bærbare datamaskiner til studenter i Indonesia eller støtte barnehjem i Brasil, sørger IKEA for at deres innvirkning går utover bunnlinjen.

Så er det Microsoft og beviste at bærekraft ikke bare er for miljømerker. I 2023 hadde de over 19,8 gigawatt fornybar energi i 21 land. De tar også et oppgjør med vannforbruket ved å designe datasentre som ikke trenger vann til kjøling. I tillegg har de holdt over 18 500 tonn avfall unna søppelfyllinger, og de presser leverandørene til å bli 100% karbonfrie innen 2030. Det er ikke bare god PR, det er smart forretningsvirksomhet som sparer ressurser og fremtidssikrer driften.

Og vi må ikke glemme Unilever. De har satset alt på bærekraftige innkjøp, og 97,5% av viktige råvarer som palmeolje og soya kommer fra leverandører som ikke driver med avskoging. De har redusert bruken av jomfruelig plast med 18% siden 2019, og investerer stort i resirkulerbar emballasje. Forbrukerne elsker det, investorene elsker det, og det lønner seg i form av merkelojalitet og markedsvekst.

| Utfordring | Utgave | Hvordan ta tak i det? |

| Håndtering av ulike rapporteringsstandarder | Selskaper må ofte forholde seg til overlappende ESG-rammeverk som GRI, SASB og CSRD, noe som skaper hull i rapporteringen og ekstraarbeid. | Det er nyttig å fokusere på det rammeverket som passer best for din bransje og region. Konsolidering av data med ESG-rapporteringsverktøy kan forenkle prosessen og redusere dobbeltarbeid. |

| Holde tritt med skiftende regelverk | ESG-regelverket utvikler seg raskt i EU, Storbritannia og USA, noe som gjør etterlevelse til en kontinuerlig utfordring. | Å ha et dedikert ESG-team - enten det er internt eller utkontraktert - er avgjørende for å holde seg oppdatert på endringer i regelverket. Fleksible rapporteringssystemer gjør det enklere å tilpasse seg raskt etter hvert som nye reguleringer innføres. |

| Håndtering av frakoblede data | ESG-data er ofte delt mellom ulike avdelinger, noe som fører til inkonsekvenser, feil og forsinkelser i rapporteringen. | Sentralisering av ESG-data på en integrert plattform kan bidra til bedre konsistens og nøyaktighet. Automatisering av datainnsamlingen reduserer manuelle feil og bidrar til å opprettholde datatilgjengelighet i sanntid. |

| Måling av ESG-effekt (miljø, sosiale forhold og selskapsstyring) | Det er ofte vanskelig å knytte ESG-initiativer til konkrete forretningsresultater som kostnadsbesparelser eller inntektsvekst. | Sett tydelige ESG-mål med målbare KPI-er knyttet til forretningsresultatene. Ved å inkludere disse nøkkeltallene i de finansielle rapportene viser du den reelle effekten av bærekraftsarbeidet. |

| Definere ESG-risiko | ESG-risikoer, som klimarelaterte problemer eller omdømmeskade, er vanskelige å definere og måle, noe som fører til inkonsekvente risikovurderinger. | Definer ESG-risikoer tydelig i bedriftens risikostyringsplan. Scenarioanalyser bidrar til å forstå potensielle risikoer og ta bedre beslutninger. |

| Høye kostnader ved implementering av ESG | ESG-programmer krever ofte betydelige utgifter til teknologi, opplæring av ansatte og dataverktøy, noe som kan belaste budsjettene, særlig for mindre selskaper. | Du bør fokusere på de ESG-aktivitetene som gir mest verdi for virksomheten din. Ved å bruke skalerbare teknologier og bygge partnerskap kan du styre kostnadene samtidig som du oppnår gode resultater. |

Lei av å holde tritt med stadig skiftende ESG-regler? La oss ta hånd om det for deg.

Som en som er dypt involvert i bærekraft, har jeg sett hvor raskt ESG er i ferd med å gå fra å være et "nice-to-have" til å bli en forretningsmessig nødvendighet. Det som en gang var et sett med valgfrie tiltak, står nå i sentrum i styrerommene, drevet frem av globale prioriteringer, teknologisk innovasjon og økende forventninger fra investorer, kunder og tilsynsmyndigheter. Så hva blir det neste? Her er de viktigste trendene som vil forme fremtiden for ESG og bærekraft.

Den tradisjonelle "ta, lage, kaste"-tilnærmingen er i ferd med å bli utdatert. Stadig flere selskaper går over til sirkulære økonomimodeller, som fokuserer på å minimere avfall og få mest mulig ut av ressursene. Det betyr at produkter designes med tanke på holdbarhet, reparerbarhet og resirkulerbarhet, samtidig som man finner måter å gjenbruke materialer på i hele leverandørkjeden. Det er ikke bare bedrifter som driver frem denne endringen - også myndighetene innser at det haster med å komme bort fra lineær produksjon.

Som Linda Gillham, en lokalpolitiker i Storbritannia, påpeker, er "take-make-dispose" er roten til mange miljømessige og sosiale utfordringer. Det er viktig å ta tak i den, ikke bare for å bygge en bærekraftig økonomi, men også for å sikre renere luft, bedre mat- og vannkvalitet og større sosial likhet.

ESG og bærekraft er i ferd med å endre hvordan bedrifter får tilgang til kapital. Grønn finansiering er på fremmarsj, og investorer foretrekker i økende grad selskaper som kan vise til gode ESG-resultater. Instrumenter som grønne obligasjoner, bærekraftsrelaterte lån og ESG-fokuserte investeringsfond er i ferd med å bli mainstream. Finansinstitusjonene skjerper også kravene og knytter utlånsvilkårene til målbare ESG-resultater. For bedrifter betyr dette at bærekraft ikke lenger bare er et spørsmål om samfunnsansvar - det er også et økonomisk spørsmål som påvirker kredittverdighet og investeringsattraktivitet.

Det som en gang var et ambisiøst mål, er nå i ferd med å bli en forventning. Selskaper i alle bransjer setter seg netto null-mål, med sikte på å redusere klimagassutslippene så nær null som mulig, og eventuelle gjenværende utslipp skal kompenseres gjennom karbonfjerningsprosjekter. Men interessentene krever mer enn bare løfter - de vil ha åpenhet, ansvarlighet og reell fremgang. Dette skiftet presser bedrifter til å integrere karbonreduksjon i alle deler av virksomheten, fra leverandørkjedestyring til produktdesign og til og med de ansattes retningslinjer for pendling. Presset øker, og selskaper som ikke gjør noe, risikerer å sakke akterut både konkurransemessig og omdømmemessig.

Teknologien spiller en sentral rolle i arbeidet med å fremme ESG, og gjør bærekraftsdata mer transparente, pålitelige og handlingsrettede.

ESG og bærekraft er i ferd med å bli et must for bedrifter over hele verden. Det er ikke lenger et spørsmål om selskaper vil rapportere om bærekraftsarbeidet sitt, men når. Snart vil transparent, datastøttet rapportering være normen. Selv om noen virksomheter fortsatt prøver å fremstå som bærekraftige uten å gjøre noe (grønnvasking), vil de som virkelig skiller seg ut, være de som leverer målbare og meningsfulle resultater.

Hos Innowise er vi ikke her for tomme løfter - vi er her for å skape resultater. Vi har bygget opp en sterk ESG- og bærekraftpraksis, støttet av virkelige suksesshistorier. Enten det dreier seg om å hjelpe bedrifter med å navigere i ESG-rapportering eller å utvikle grønne løsninger som bærekraftsdrevne ERP- og CRM-systemer, handler det om å gjøre bærekraft til en del av bedriftens DNA. Målet vårt? Å hjelpe bedrifter med å gå fra ord til handling og skape varige, positive endringer som virkelig gjør en forskjell.

Meldingen din er sendt.

Vi behandler forespørselen din og kontakter deg så snart som mulig.

Ved å registrere deg godtar du vår Retningslinjer for personvern, inkludert bruk av informasjonskapsler og overføring av dine personopplysninger.